Key Takeaways

A CFD broker facilitates traders’ access to the markets and executes orders via trading platforms, analytical tools, and real-time pricing feeds.

Retail traders require a broker to trade CFDs, as these instruments are not directly accessible on exchanges.

Trading costs arise from the spread or commission and from overnight financing charges when positions are held beyond the trading day.

When selecting a broker, consider regulatory compliance and client fund segregation, platform robustness, product diversity, educational resources, customer support, and transparent pricing.

Leverage amplifies both potential profits and losses, making effective risk management and high-quality trade execution critical.

What is a Broker in CFD Trading

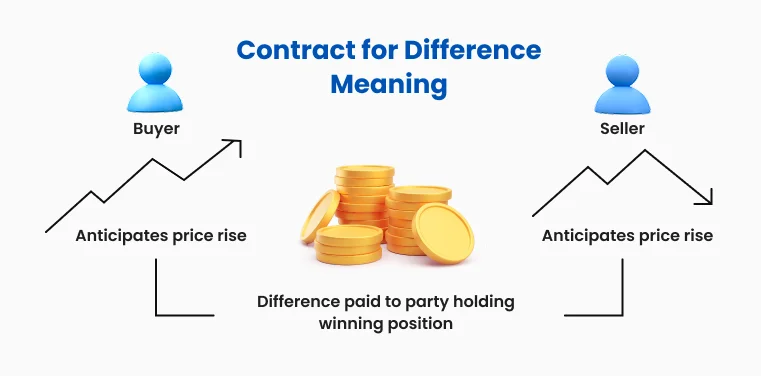

What exactly is a broker in CFD trading? This is a fundamental question every new trader should address before entering the markets. As Contract for Difference (CFD) trading grows in popularity among retail investors, understanding the role of a CFD broker becomes essential.

A broker serves as an intermediary between traders and financial markets, providing the necessary infrastructure, trading platforms, and execution tools. Without a clear grasp of what a broker is in trading, beginners may find it challenging to navigate the complexities of leveraged instruments such as CFDs.

Types of CFD Brokers

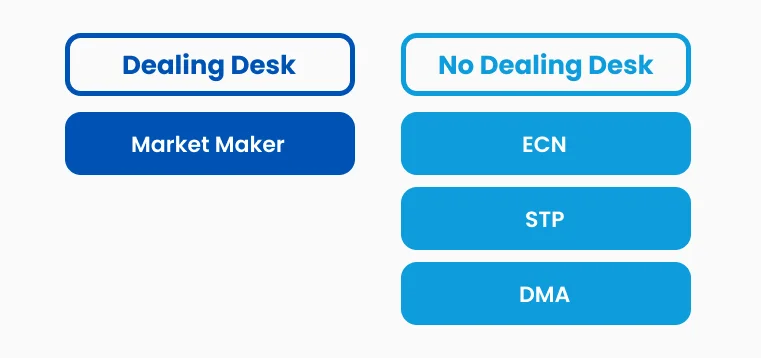

The CFD brokerage sector comprises various models. Market makers, the most prevalent type, set their own bid and ask prices, offering tight spreads and rapid execution, which suits active traders.

Electronic Communication Network (ECN) brokers link traders directly to liquidity providers, providing transparent pricing and variable spreads. Direct Market Access (DMA) brokers offer direct access to live order books and market depth, appealing to professional traders who prioritize transparency and are willing to pay higher commissions. CFD broker

Figure 1: Market makers operate as Dealing Desk (DD) brokers; ECN, DMA, and Straight Through Processing (STP) brokers are Non-Dealing Desk (NDD) brokers, meaning they connect traders directly to the interbank market rather than taking the opposite side of client trades.

What Do CFD Brokers Do?

When examining what a broker does in CFD trading, it becomes evident that CFD brokers provide trading platforms equipped with charting capabilities, technical indicators, and sophisticated order management systems.

A comprehensive CFD broker such as TMGM offers access to a broad spectrum of financial instruments, including equities, indices, commodities, forex, and cryptocurrencies, all accessible via a single trading account.

Risk management is another critical function, as brokers enforce margin requirements, stop-loss orders, and position sizing controls to assist traders in managing their exposure.

To fully understand what a broker does, it is important to recognize that their responsibilities also include ensuring regulatory compliance, abiding by financial regulations, and maintaining segregated client accounts for enhanced security.

Figure 2: What is a broker in CFD trading, and how does one operate?

How CFD Brokers Generate Revenue

A CFD broker earns revenue through multiple channels, with the spread being the primary income source for most market makers. The spread—the difference between bid and ask prices—allows brokers to profit on every executed trade.

Another revenue stream for a CFD broker is overnight financing fees, where interest charges apply to positions held overnight, based on the underlying asset’s financing costs.

Selecting a Trustworthy CFD Broker

Choosing the right CFD broker involves evaluating factors beyond just competitive spreads and commissions. Regulatory oversight is paramount, as regulated brokers adhere to stringent financial standards and maintain segregated client funds.

Traders should confirm that their broker holds licenses from reputable regulatory authorities and provides adequate investor protection mechanisms.

The distinction between broker and dealer is particularly relevant when assessing execution models, as some brokers act as dealers by taking the opposing side of client trades, whereas others operate purely as intermediaries.

Reliable customer service, comprehensive educational materials, and transparent pricing policies further differentiate professional brokers from less reputable providers.

Figure 3: Understanding the inherent risks of being a CFD broker

Risks and Responsibilities

While a CFD broker provides market access, traders must be aware of the risks inherent in leveraged trading. The distinction between broker and dealer responsibilities is critical in risk evaluation, as market maker brokers may face conflicts of interest when client losses translate into their profits.

Counterparty risk is another major consideration, as traders risk losses if their broker becomes insolvent or fails to meet its obligations.

Additionally, traders bear responsibility for understanding leverage, margin requirements, and the possibility of losses exceeding their initial capital.

Trade smarter with TMGM

Understanding what a broker is, especially in the trading context, is fundamental for a successful trading career. A CFD broker functions as a financial intermediary, providing market access, trading platforms, and essential tools while ensuring compliance with regulatory requirements.

Traders should assess a broker’s regulatory status, trading conditions, and business model, and also understand what a broker does, including how their revenue model impacts trading costs and execution quality.

Choosing a reputable and well-regulated CFD broker enables traders to manage risk effectively and maintain focus on their trading strategies. It also clarifies the difference between a broker and a dealer, supporting more informed decision-making.

For those interested in exploring CFD trading, it is advisable to test trading strategies using a TMGM demo account before committing real capital. Once familiar with the platform and trading mechanics, users can open a live trading account with TMGM, utilizing the TMGM Mobile App or desktop application.