Why Gold Retains Its Value

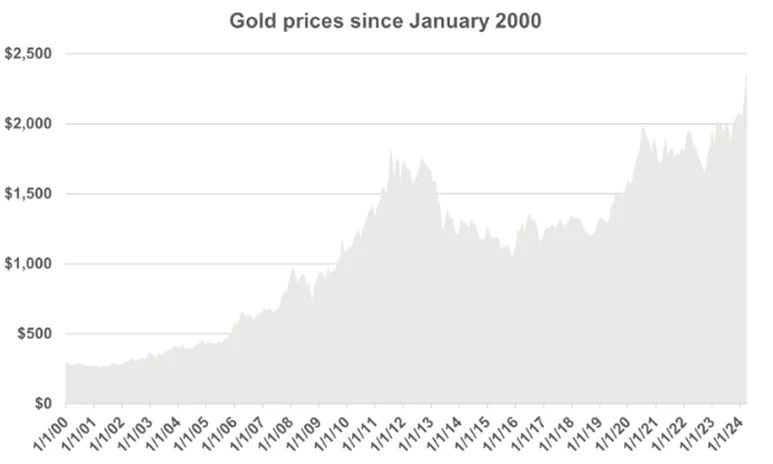

A Time-Tested Store of Value: Gold’’s reputation as a reliable store of value is grounded in centuries of financial history. Unlike fiat currencies, which are susceptible to inflation and central bank monetary policies, gold maintains intrinsic value with limited extreme volatility, making it a preferred asset during periods of economic uncertainty.

Inflation Hedge: Investors often allocate to gold to protect purchasing power, especially when inflation diminishes the real value of cash or fixed-income securities. Historically, gold has performed well in inflationary environments, offering a safeguard for portfolios.

Global Demand: Gold is a highly liquid, internationally recognized asset. Its widespread use in both industrial applications and investment portfolios ensures sustained demand, underpinning its stability as a long-term investment.

Market Drivers for Gold in 2025

Interest Rate Dynamics and Gold’’s Price Correlation: Interest rates and gold prices typically move inversely; lower interest rates increase the attractiveness of non-yielding assets like gold. In 2025, central bank interest rate decisions will be critical in shaping gold’s price path, as policymakers navigate the balance between inflation management and economic growth.

Economic and Geopolitical Risks: Gold generally performs well during periods of uncertainty, as investors seek safe-haven assets amid market volatility. Given the anticipated economic and geopolitical challenges in 2025, gold’s role as a protective asset is expected to remain significant.

Currency Movements: A depreciating US dollar often correlates with rising gold prices. Should the dollar weaken due to economic pressures, gold could see upward price momentum in 2025, becoming more accessible to international investors.

Is Gold a Viable Investment in 2025? Advantages and Disadvantages

Is Gold a Viable Investment in 2025? Advantages and Disadvantages

Advantages of Gold Investment:

Portfolio Diversification: Gold serves as a strategic asset that can hedge equity and bond exposures, particularly during market downturns.

Inflation Protection: Historically, gold has delivered returns that help offset losses from cash and fixed-income investments during inflationary periods.

Safe-Haven Demand: Gold’s value typically appreciates amid political or financial crises, making it a prudent choice for risk-averse investors.’

Disadvantages of Gold Investment:

No Yield: Gold does not generate interest or dividends, which may deter income-focused investors.

Price Volatility: While generally stable, gold prices can be volatile, especially influenced by speculative trading or short-term economic developments.

Storage and Security Expenses: Physical gold requires secure storage, adding to costs, although investment vehicles like ETFs offer exposure without the need for physical custody.

Gold Investment Vehicles

Physical Gold: Direct investment in physical gold, such as bullion and coins, provides tangible asset exposure but involves storage and security considerations.

Gold ETFs and Mutual Funds: Exchange-traded funds (ETFs) enable investors to track gold prices without owning the metal physically. These instruments offer liquidity and ease of trading but may include management fees.

Gold Mining Equities: Equity investments in gold mining companies provide indirect exposure to gold prices and potential capital appreciation, but carry operational and market risks inherent to the mining sector.

CFDs: A Contract for Difference (CFD) allows traders to speculate on price movements of gold without owning the underlying asset. When trading CFDs, investors agree to exchange the difference in gold’s price from the contract opening to closing. CFDs cover multiple asset classes, including stocks, commodities, and forex.

Is Gold Suitable for Your 2025 Investment Strategy?

Determining whether gold fits your 2025 portfolio depends on your investment objectives and risk appetite. Gold may be appropriate if you aim to diversify against macroeconomic risks, hedge inflation, or hold a safe-haven asset.’

Conversely, if your focus is on income generation or aggressive growth, gold’s lack of yield and occasional price swings might not align with your goals.’

Key Insights on Gold Investment in 2025

Positive Outlook Amid Market Volatility: Considering the economic environment and potential market instability, gold remains a compelling safe and stable asset.

Inflation Protection Potential: Gold may provide a hedge if inflation persists, helping preserve purchasing power amid currency fluctuations.

Portfolio Diversification: Incorporating gold can reduce portfolio risk and enhance long-term returns, especially if equity markets become volatile.

Flexible Investment Formats: Gold exposure can be tailored through physical holdings, CFDs, ETFs, or futures contracts, offering versatility.

Why Consider Gold in 2025

In 2025, gold may continue to be a robust choice for investors seeking stability amid economic challenges. Whether facing inflationary pressures, geopolitical tensions, or recession risks, gold has historically provided a reliable store of value when traditional assets are under strain.

Is gold a sound investment in 2025? For many investors, the answer is affirmative, especially as global economic conditions evolve.

To begin exploring gold investment opportunities, visit TMGM'’s platform for insights on trading gold and access to tools designed to help build a diversified, resilient portfolio.