What is a Forex Trader and How to Become one?

The goal of forex trading is to profit from currency price speculation. Pairs of currencies are exchanged for one another or traded in pairs. A trader predicts the growth or decrease of one currency's value relative to another. Trade flows, as well as political, economic, and geopolitical factors that impact the supply and demand of foreign exchange, determine the value of a currency pair. Because of the everyday volatility this produces, traders may find new chances. It is the largest financial market in the world, with traders of all types buying and selling securities and currencies. These individuals carry out their activities using various methods, programs, and internet resources. Traders use trading acumen to forecast and speculate in the market. Their methods mainly rely on industry expertise and sensible trading knowledge.

What is a Forex Trader?

A forex trader is someone who buys and sells currencies in the global forex market to profit from changes in exchange rates. If you are wondering what is a forex trader, it simply refers to an individual or institution that speculates on currency movements by going long or short on different currency pairs.

Forex traders often analyze market trends, economic news, and price charts to make informed trading decisions. Their goal is to buy a currency pair when they believe its price will increase or sell it when they think the price will decrease.

The foreign exchange market operates 24 hours a day from Monday to Friday, with different global sessions creating overlapping forex market hours that give traders flexibility to trade at times that suit their lifestyle. This accessibility is one of the reasons forex trading has become increasingly popular among beginners, professionals, and large financial institutions.

How to Become a Forex Trader Step-by-Step

If you are searching for how to become a forex trader or how to be a successful forex trader, the process can be broken down into simple steps. Anyone can start, even without prior financial knowledge, as long as they are willing to learn and practice consistently.

Step 1: Begin Forex Trading Education

Before trading with real money, it is vital to understand how the forex market works. You can start by learning about currency pairs, how prices move, what influences currency values, and key concepts such as pips, leverage, spread, and margin.

Free trading guides, beginner videos, and demo accounts can help you build this foundation. TMGM provides a dedicated forex trading for beginners guide and other educational resources and academy lessons suitable for new traders.

Step 2: Choose a Reputable Forex Broker

A trusted broker gives you access to the forex market through an online trading platform. Your choice of broker affects your trading experience and the safety of funds.

When selecting a broker, consider its regulatory status, platform quality, spreads and fees, and the value of its customer support. A broker like TMGM is a globally trusted provider offering ultra-low spreads, fast execution, and platforms such as MetaTrader 4 and MetaTrader 5. You can compare these platforms in our MT4 vs MT5 guide to see which layout and tools better suit your forex trading style.

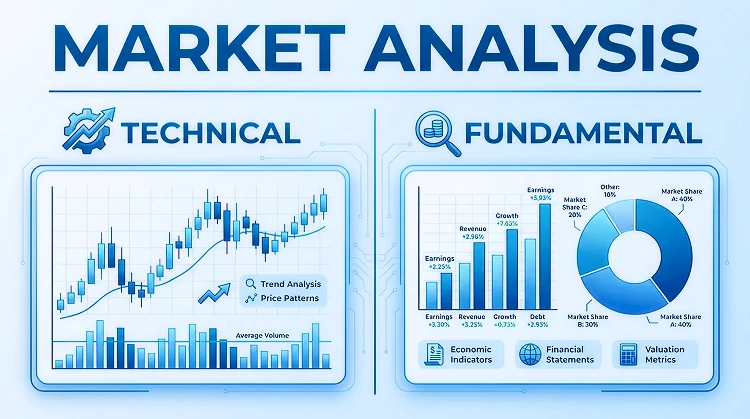

Step 3: Learn How to Analyze the Forex Market

Forex traders use two main types of analysis: technical and fundamental. Technical analysis uses price charts, patterns, and indicators, while fundamental analysis studies economic data, interest rates, and financial news. Many traders watch an economic calendar to see when important events are scheduled and to prepare for potential volatility.

Step 4: Start with a Demo Account

A demo account lets you practice trading using virtual money. This is where you develop your strategy and learn how to manage risk before investing real funds.

Step 5: Develop a Forex Trading Strategy

Your strategy should be developed to include when to enter and exit trades, how much to risk per trade, which currency pairs to trade, and which market conditions you should avoid; many traders study structured forex trading strategies for ideas they can adapt to their goals. Successful traders follow their strategy consistently rather than trading on emotions.

Step 6: Risk Management for Forex Traders

Effective risk management, including understanding concepts such as the risk-reward ratio, is key to protecting your capital. Methods such as setting stop-loss orders, risking only a small percentage of your account per trade, and avoiding overleveraging are among the most common. Developing discipline is one of the most important steps to learning how to be a successful forex trader.

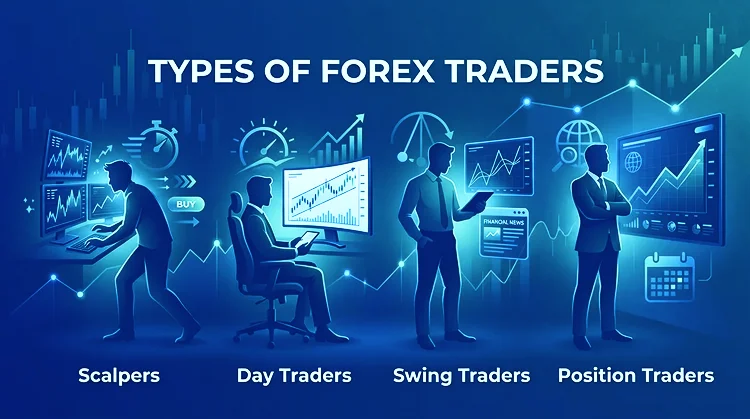

Types of Forex Traders and Trading Styles

There are several types of forex traders, and each follows a different trading approach based on time, strategy, and market analysis methods.

Fundamental Trader

A fundamental trader studies economic data such as GDP growth, employment rates, and central bank interest rate decisions. They trade based on how these factors impact currency strength.

This is common among traders who enjoy research and understanding global financial events.

Sentiment Trader

A sentiment trader analyzes the market's emotional tone. They observe whether traders are mostly buying or selling and sometimes take positions against extreme market behavior to anticipate reversals.

Sentiment traders often use indicators like volatility and trader positioning reports.

Market Timer

A market timer attempts to predict the perfect entry and exit points. This style mainly relies on technical indicators and timing patterns. While potentially profitable, it requires discipline and experience.

Day Trader

A day trader buys and sells currency pairs within the same day and does not hold trades overnight. They look for quick short-term price movements and use technical charts heavily. Many day traders follow structured forex day trading strategies to stay consistent with their plan.

Day trading suits individuals who:

Enjoy active and frequent market participation

Have time to monitor charts during trading hours

Prefer quick results rather than long waiting periods

Swing Trader

A swing trader holds positions for several days or weeks to capture medium-term price movements. Swing trading combines technical chart analysis with an understanding of broader economic trends.

This approach is suitable for traders who want trading flexibility without constant screen time.

The Richest and Most Famous Forex Traders in the World

Many beginners type queries like "who is the richest forex trader in the world", "who is the best forex trader in the world", or "forex trader salary" when they start learning, hoping to find inspiration from stories of success.

One of the well-known successful traders is George Soros, who was famous for his short position on the British Pound in 1992. Other ones include Paul Tudor Jones and Stanley Druckenmiller.

These traders emphasize discipline, research, and patience. Their success came from years of learning and refining strategies, not overnight decisions.

TMGM Emerges as Leading Choice for Modern Forex Traders

For traders seeking a comprehensive trading solution, TMGM offers a compelling technology package, support, and trading conditions across a broad range of markets including forex, indices, commodities, and metals.

Their focus on meeting the needs of different trader types, robust platform technology, and educational resources positions them as a strong choice in the competitive forex broker landscape.

The platform's commitment to continuous improvement and trader success suggests that TMGM will continue to adapt and evolve with the changing needs of the forex trading community. Whether you're a novice trader learning the basics or an experienced professional seeking advanced tools, TMGM provides the infrastructure and support needed for trading success, including practical tools such as a mobile trading app and a dedicated trading calculator.

Negocie de Forma Mais Inteligente Hoje

Frequently Asked Questions

What is a forex trader?

How to become a successful forex trader?

Who is the best forex trader in the world?

How much average forex trader earn per month?

Real

Conta

Instantaneamente