POPULAR ARTICLES

- Litecoin's supply in profit has shrunk to 57% amid partial profit-taking and loss realization.

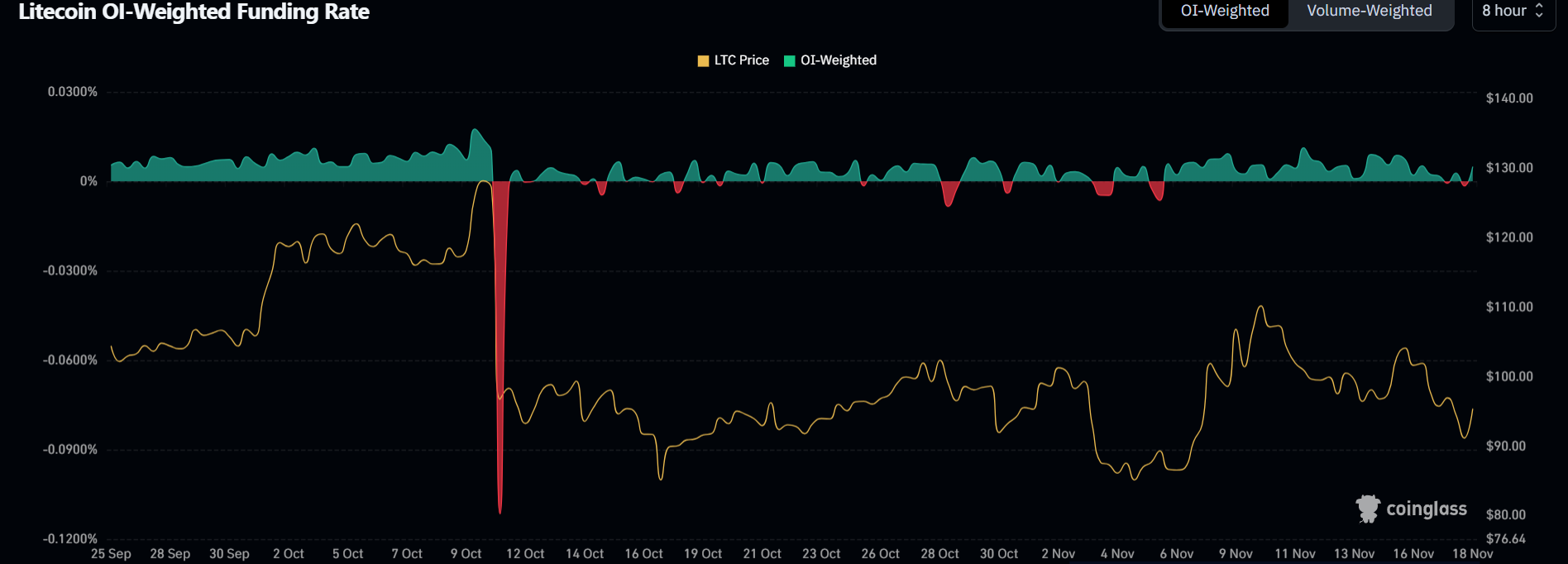

- Litecoin funding rates have flashed negative twice over the past two days, indicating rising bearish sentiment.

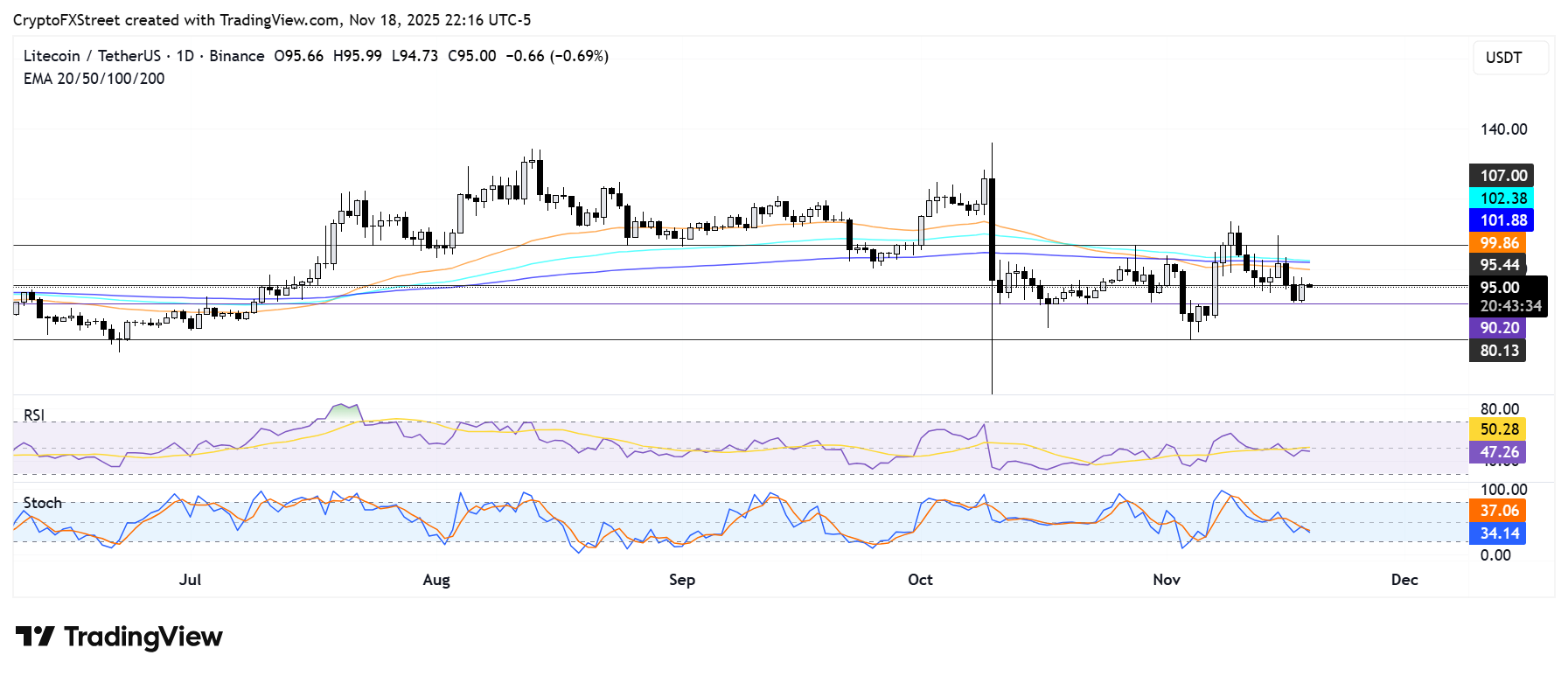

- LTC is testing the $95 key resistance after bouncing off the $90 support.

Litecoin is up 4% at the time of publication in the early Asian session on Wednesday, joining the wider crypto market in staging a brief recovery from the downtrend over the past three days. However, the fundamentals of the Bitcoin fork have remained cautiously neutral.

After the total supply of LTC coins in profit dropped to 57%, selling activity rose slightly as investors posted a combination of loss realization and profit-taking in the past few days, per Santiment data. The distribution stems mainly from investors who purchased LTC within the past two months.

[04-1763523606222-1763523606223.39.35, 19 Nov, 2025].png)

Historically, older coins often join the distribution as the supply in profit continues to decline, making the metric critical for investors to watch.

The weakness is also visible across US spot Litecoin exchange-traded funds (ETFs), which have failed to attract demand. Since their launch last October, the products have attracted only a cumulative net inflow of $7.26 million, according to SoSoValue data. The only spot Litecoin ETF available in the US is Canary's LTCC.

LTC derivatives remain subdued with flashes of negative funding rates

On the derivatives side, Litecoin funding rates have flashed negative twice in the past two days, indicating short traders are gradually gaining ground in the LTC futures market.

Funding rates are periodic payments between perpetual futures traders to keep a contract's price anchored to its underlying spot counterpart. Short traders pay longs when funding rates are negative, and vice versa when they are positive.

Meanwhile, Litecoin's open interest has recovered slightly to 5.57 million LTC but remains far from pre-October 10 leverage-flush levels of 8.80 million LTC.

Litecoin Price Forecast: LTC struggles near $95 resistance

LTC bounced off the support at $90.2 but is facing pressure near the $95.4 resistance. A rise above $95.4 will see it tackle another hurdle at the confluence of the 50-day, 100-day and 200-day Exponential Moving Averages (EMAs).

On the downside, Litecoin could fall to the $80 level if it breaks the $90.2 support.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, indicating a dominant bearish momentum.