BÀI VIẾT PHỔ BIẾN

Apple’s next-generation foundational models will be built on Google’s Gemini models and cloud technologies. These models will underpin future Apple Intelligence features, including a more personalised version of Siri scheduled to roll out this year.

Apple stated that after careful evaluation, it concluded that Google’s technology provides the strongest foundation for Apple’s own core models. Apple Intelligence will continue to run on-device and on Apple’s private cloud infrastructure, while maintaining Apple’s established privacy standards.

This partnership was first reported by Bloomberg in November, and Monday’s announcement officially confirmed the arrangement.

The news comes as Google’s parent company Alphabet reached a market capitalisation of USD 4 trillion this week. The tech giant’s renewed focus on artificial intelligence has eased earlier concerns over its strategic direction and helped cement its leadership position in the fiercely competitive AI space.

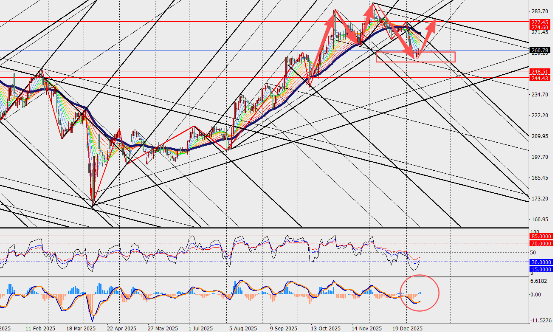

On Wednesday, Alphabet surpassed Apple in market value for the first time since 2019, becoming the world’s second most valuable company. Alphabet’s share price has risen sharply, gaining around 65% in 2025 and outperforming the other members of Wall Street’s “Magnificent Seven.” So far this year, the stock has climbed an additional 5%.

Bank of America noted that Apple is heading into its fiscal first-quarter earnings in a bullish setup, citing stronger-than-expected iPhone demand, double-digit growth in its Services segment, and multiple new product launches scheduled for later this year. The bank reiterated its “Buy” rating on Apple stock with a target price of USD 325, and said it expects Apple to beat market expectations when it reports earnings on 29 January.

iPhone demand remains resilient. Despite softer App Store sales in China, Services revenue is still expected to deliver double-digit year-on-year growth. Two key catalysts are in focus for 2026: the launch of a foldable iPhone in the autumn, and an enhanced version of Siri integrated with Gemini AI — both of which could drive a higher upgrade rate.

Market Commentary:

Apple’s recent share price underperformance has been driven mainly by concerns over rising memory costs, but this is seen as a temporary headwind. Bank of America believes the company is well positioned to offset these pressures, and notes that Apple is still under-owned in many investor portfolios — a dynamic it expects to reverse over the course of this year.