BÀI VIẾT PHỔ BIẾN

- Near Protocol edges higher by 7% on Thursday, defying dominant bearish conditions in the broader crypto market.

- Near Protocol’s NEAR Intents integrates with Starknet to handle cross-chain interoperability at scale.

- Network users can swap assets from approximately 25 supported chains directly into Starknet, eliminating multi-step bridging.

Near Protocol (NEAR) is trading at $1.58 at the time of writing on Thursday amid widespread relief rebounds across the cryptocurrency market. NEAR’s intraday gains can be attributed to a key network upgrade that has paved the way for cross-chain interoperability for direct asset swaps.

NEAR Intents integrates Starknet, eliminating bridging steps

Near Protocol’s NEAR Intents platform has integrated with Starknet, a ZK execution layer scaling Ethereum, effectively bringing chain-abstracted, intent-based swaps into the ecosystem. The upgrade allows users to seamlessly transition between Starknet and the broader cryptocurrency space without having to bridge or go through a complex multi-step process.

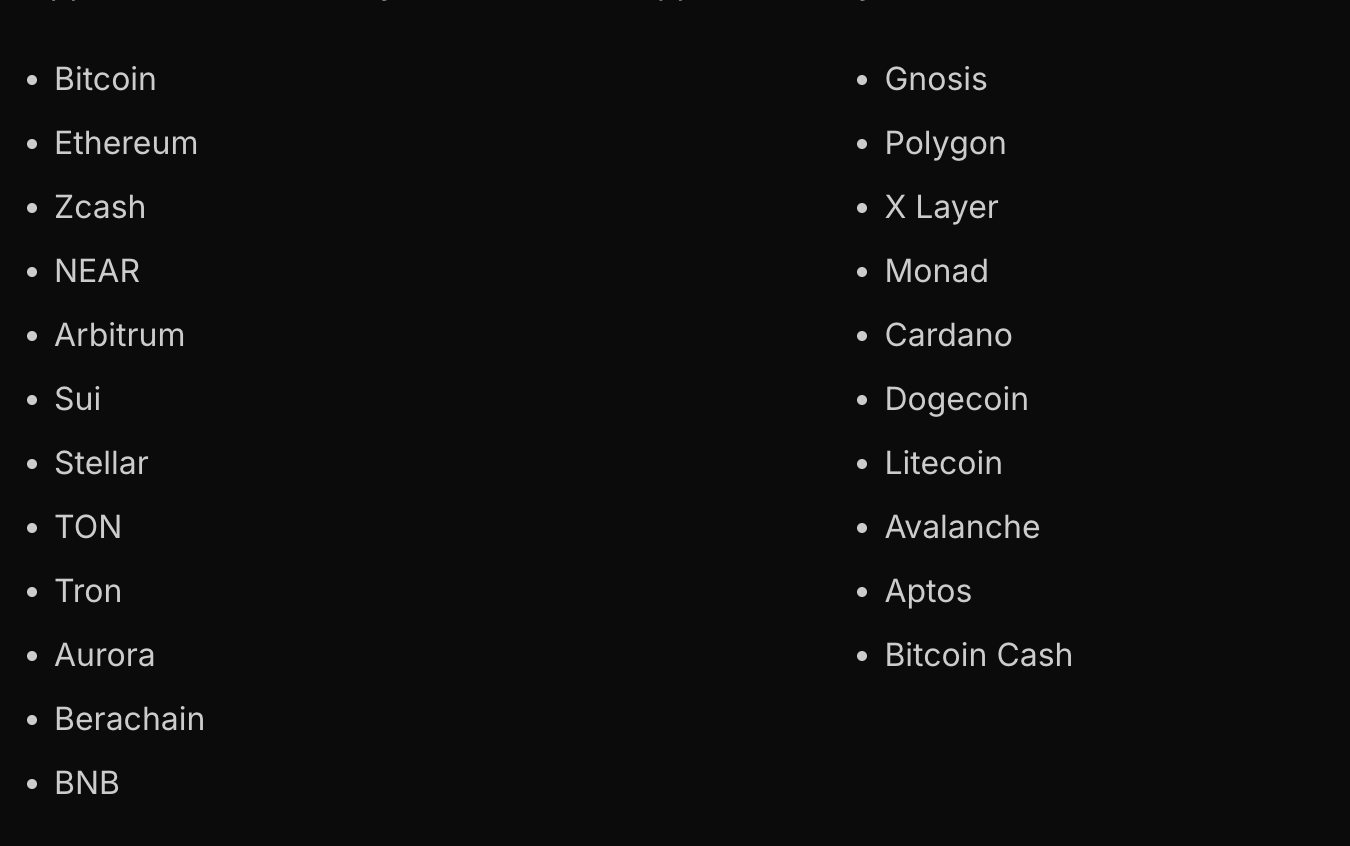

Since NEAR Intents is built on the NEAE Layer-1 blockchain, which is tailored to support cross-chain interoperability at scale, users can swap assets from approximately 25 supported blockchains directly into Starknet.

Users can also purchase Starknet (STRK) using over 100 tokens, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and more.

Near Protocol stated that “NEAR Intents achieves all this through 'chain abstraction,' which reduces the friction that arises when users are forced to navigate complex, multi-step bridging or wrap complex assets manually, resulting in fragmented user experiences.”

Technical outlook: Near edges higher amid restricted rebounds

Near Protocol rises by more than 7% to trade at $1.58 at the time of writing on Thursday. The Relative Strength Index (RSI) has sharply climbed to 38 on the daily chart, confirming a short-term momentum. However, if the RSI remains within the bearish region, recovery could be limited by the short-term supply zone at $1.80.

The Moving Average Convergence Divergence (MACD) indicator is poised to confirm a buy signal on the same chart. This signal manifests with the blue MACD line crossing above the red signal line, prompting traders to increase exposure.

Buyers should flip the 50-day Exponential Moving Average (EMA) at $1.94 into support to ascertain NEAR’s recovery potential. Failure to do so could further limit the upside and increase the odds of a correction below the short-term support at $1.45.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.