Yesterday, precious metals rallied globally, with silver standing out. After finding support at the key $48 level, silver rebounded back above the $50 psychological threshold. During the U.S. session on November 10, spot silver hit $50.247/oz, up 3.99% on the day. This suggests the pullback after making new record highs may have ended, and momentum is rebuilding.

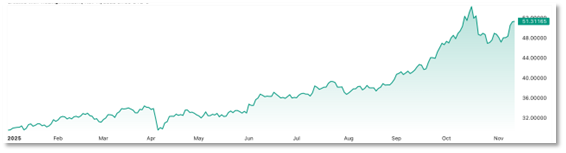

Year in review: Silver’s powerful climb

Silver delivered a stunning uptrend in 2025. From an early-year breakout above $30, prices climbed steadily—reaching a Q1 peak of $34.21 on March 28, then a 13-year high of $36.05 in early June. The rally accelerated in H2: prices broke $39 in July and pushed through $47 during August–September. On October 16 (Beijing time) silver topped $54/oz, pushing the year’s maximum gain above 90% and surpassing the record set in 1980—far outpacing this year’s much-watched gold market. Silver has become one of 2025’s brightest performers in commodities.

Why so strong?

At the core is a “financial + industrial” dual-engine driver. On the financial side, repeated record highs in gold have recalibrated valuations across precious metals, with funds viewing silver as a leveraged hedge against inflation. On the industrial side, robust demand from new energy, solar PV, and electric vehicles reinforces silver’s dual identity as both a safe-haven asset and an industrial metal.

Safe-haven demand keeps rising

Mounting U.S. debt, de-dollarization trends, escalating geopolitical tensions, and tariff-related U.S.–China trade frictions have all increased flexible safe-haven allocation to precious metals. Meanwhile, expectations for Fed rate cuts have supported silver. According to CME FedWatch, traders currently assign a 65% probability of a December rate cut, pressuring the U.S. dollar and attracting fresh buying into precious metals.

Industrial demand creates long-term value

Industrial demand provides a solid floor for prices. Li Gang, Research Director at the China Forex Investment Research Institute, notes that industrial demand’s marginal decline is slower than total demand’s, lifting its share to a record 59%—indicating industrial factors continue to lead financial factors in price influence.

A persistent supply deficit

The Silver Institute projects global silver supply to rise 1.5% in 2025 to 32,056 tonnes, while global consumption is expected to fall 1.4% to 35,716 tonnes. Even so, the annual deficit would still reach 3,659 tonnes—down 21% from 2024 but marking yet another year of shortfall.

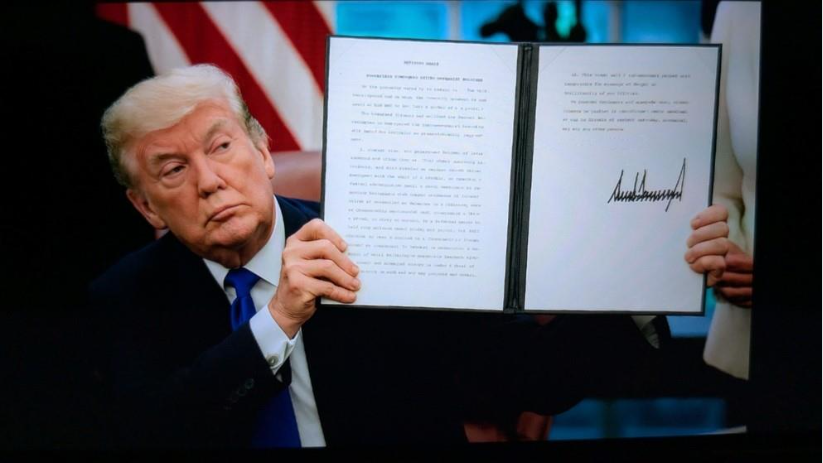

Rising status as a critical mineral

In early November 2025, the U.S. government added silver to a provisional list of critical minerals—an important step. Grouped with lithium, copper, and rare earths, silver is recognized as essential to national security and economic stability. This opens doors for strategic stockpiles, subsidy support, and faster permitting for miners.

Short-term technical view

The 50-day moving average at $46.52 continues to provide trend support and is a key level for bulls to defend. If Fed rate-cut expectations keep firming and dollar weakness persists, new momentum buying could open a path toward $54.49. That said, Li Gang cautions that after reclaiming $50/oz, silver’s technicals look overheated in the short term, posing a risk of choppy pullbacks.

Medium- to long-term outlook

A global rate-cut cycle should suppress real yields, while industrial demand keeps expanding and safe-haven flows remain intact. At the end of September, Citi raised its silver price forecast from $45.00/oz to $55.00/oz. Li Gang expects silver to grind higher within a $47–$55/oz range over the next three months. If gold holds at elevated levels, silver could follow and potentially challenge a new high near $55/oz before year-end.