BÀI VIẾT PHỔ BIẾN

- The Dow Jones treaded water on Thursday as markets await next week’s Fed rate call.

- Markets are tilting firmly into hopes for a third straight rate cut on December 10.

- Challenger job cuts data reaffirmed a slowing in the US labor market.

The Dow Jones Industrial Average (DJIA) spun in a tight circle near 48,000 on Thursday before retreating around 100 points. Equity markets are taking a break and slowing their momentum through the back half of the trading week as investors’ focus remains fully pinned on the upcoming Federal Reserve (Fed) interest rate decision slated for next week.

Fed rate cut expectations dominate

Markets remain fully committed to expecting a third straight interest rate trim from the Fed on December 10. According to the CME’s FedWatch Tool, rate traders are pricing in nearly 90% odds of a quarter-point rate cut next week. Official datasets are still lagging well behind the curve as federal agencies struggle to play catchup following the longest US federal government shutdown in history. Recent private datasets have teased that the US labor market could be crumbling further heading into the year’s end, keeping trader expectations of further rate cuts on the high side.

US data supports further rate moves

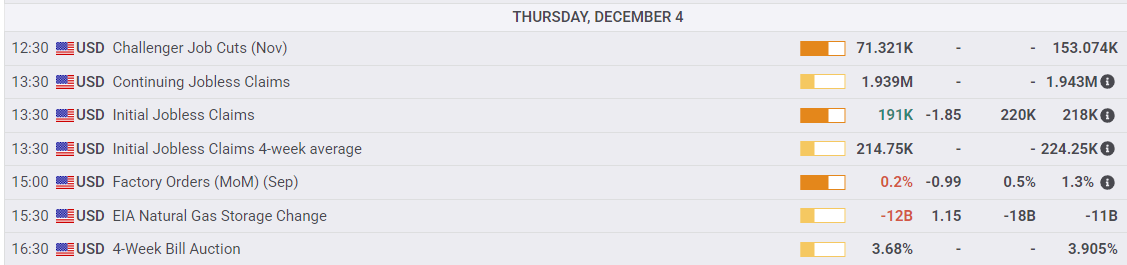

Challenger job cuts fell back in November, declining to 71.3K after the previous month’s eye-watering 153K headline figure. Still, the figures are hiding some particular gloomy clouds. November’s layoff figures are 24% higher than at the same time in 2024, and the year-to-date job cuts figure of 1.17 million stands as one of the worst non-recession years on record.

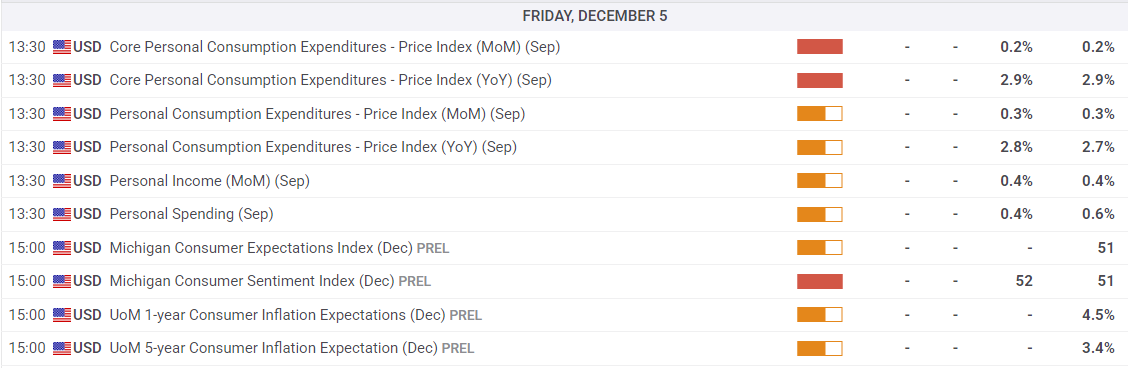

Before the Fed can gather to deliberate on interest rates, the latest Personal Consumption Expenditures Price Index (PCE) inflation report will drop on Friday. The figures are from September, and are far too backdated to be immediately relevant to the Fed’s deliberations for a December interest rate cut. However, a hard upswing, even in old data, could throw a wrench in the works for a third straight interest rate trim.

Dow Jones daily chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.