POPULAR ARTICLES

- The Dow Jones held close to flat on Tuesday as investors brace for a government shutdown.

- Equity market momentum has drained away, but indexes are still heading for a stellar September performance.

- The latest US NFP jobs report could be delayed if the federal government can’t pass a budget.

The Dow Jones Industrial Average (DJIA) saw a sharp slowing on Tuesday, churning chart paper and holding close to flat as investors braced ahead of what is likely to be a federal government shutdown. The US has been unable to successfully push out a spending bill ahead of the deadline, sending the federal government headfirst into a spending furlough.

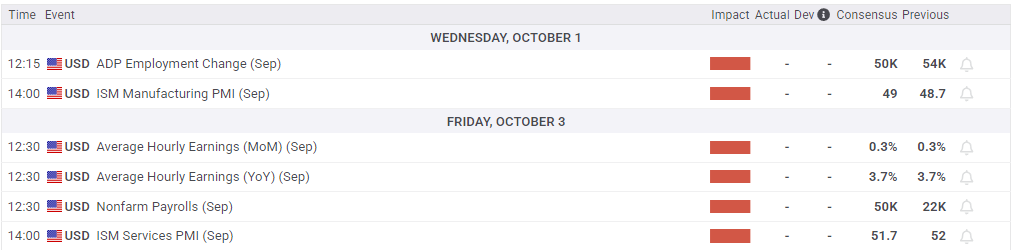

The latest Nonfarm Payrolls (NFP) jobs report, currently slated to be released on Friday, could be delayed if the US government heads into a shutdown phase. Employment figures have become a hot-button issue for investors as the Federal Reserve (Fed) grapples with using interest rates to both bolster what is now a lagging labor market and keep inflation under control.

NFP release becomes hypothetical

In the span of less than a week, President Donald Trump has rolled over from being hopeful about reaching a budget deal to acknowledging that there will likely be a shuttering of federal government operations. Trump has threatened to “do things during a shutdown that are irreversible”, including cutting benefits and axing federal worker jobs in large numbers.

The US Bureau of Labor Statistics (BLS) has already warned that a government shutdown will result in a delay or suspension of the latest NFP jobs report. The potential publication suspension comes at a time when US jobs numbers are critically important to investors, who are weighing the likelihood of additional interest rate cuts through the remainder of the year.

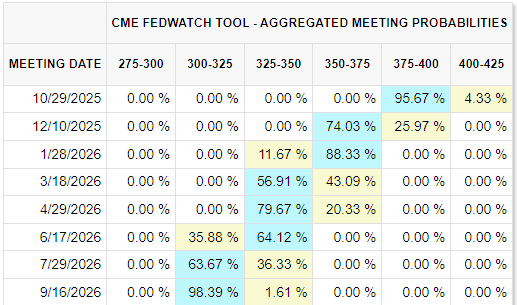

According to the CME’s FedWatch Tool, rate traders are pricing in 95% odds of a follow-up interest rate trim on October 29. However, the jury is still out on a third rate cut: Although rate markets see nearly 75% of a third-straight rate cut in December, many investors are blinking at the prospect and expect the Fed may hold in December before delivering a third cut in January.

Dow Jones daily chart

Economic Indicator

ISM Manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The indicator is obtained from a survey of manufacturing supply executives based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that factory activity is generally declining, which is seen as bearish for USD.

Read more.Next release: Wed Oct 01, 2025 14:00

Frequency: Monthly

Consensus: 49

Previous: 48.7

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) provides a reliable outlook on the state of the US manufacturing sector. A reading above 50 suggests that the business activity expanded during the survey period and vice versa. PMIs are considered to be leading indicators and could signal a shift in the economic cycle. Stronger-than-expected prints usually have a positive impact on the USD. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are watched closely as they shine a light on the labour market and inflation.