POPULAR ARTICLES

- NEAR Protocol price is retesting its key support level at $2.53 on Tuesday, if it holds could pave the way for a recovery.

- Sideline investors looking to accumulate LINK tokens could do so between $2.35 and $2.53.

- On-chain data paints a bullish outlook, with TVL rising, large whale orders, and positive funding rates, supporting upside potential.

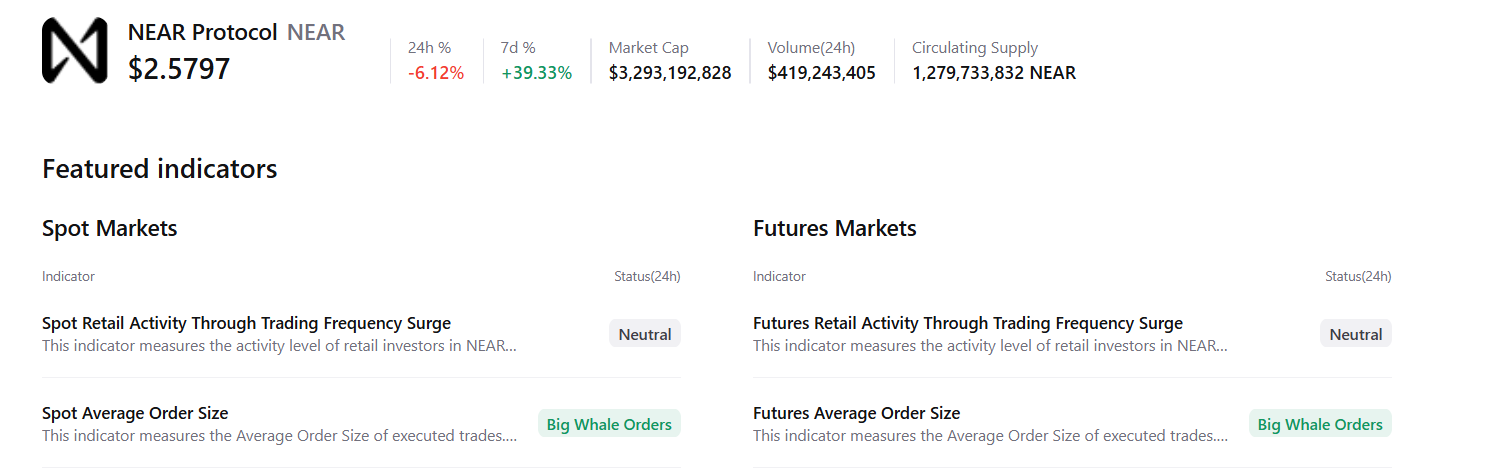

NEAR Protocol (NEAR) is retesting its key support at $2.53 at the time of writing on Wednesday; if it holds, it suggests a recovery head. Rising total value locked (TVL), increasing whale activity, and positive funding rates all point to improving market sentiment, hinting that NEAR could be gearing up for a recovery this week.

NEAR’s on-chain and derivatives data show bullish bias

Arthemis Terminal data shows that NEAR TVL increased to $182.1 million on Wednesday, up from $105.5 million on October 29, and has been steadily rising since then. Rising TVL indicates growing activity and interest in NEAR Protocol’s ecosystem, suggesting that more users are depositing or using assets on NEAR-based protocols.

-1762934545052-1762934545065.jpeg)

CryptoQuant summary data further supports a positive outlook as both spot and futures markets show large whale orders, signaling a potential rally ahead.

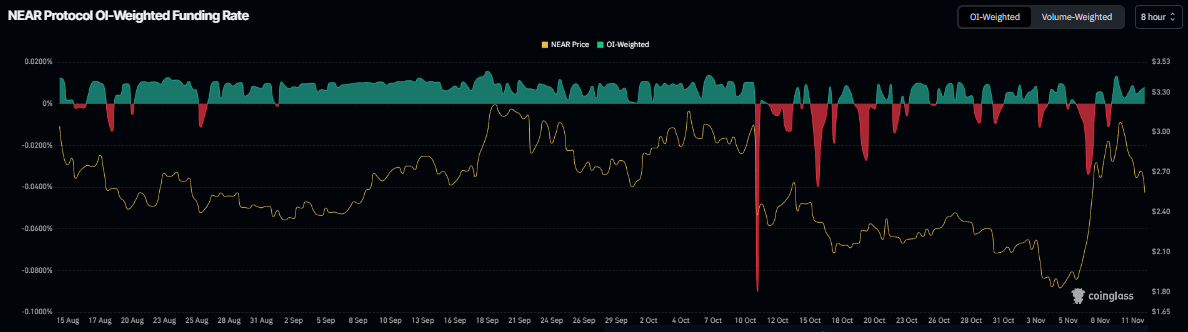

On the derivatives side, NEAR appears poised for a recovery rally, as Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of NEAR Protocol will slide further is lower than those anticipating a price increase. The metric flipped to a positive rate on Sunday and stood at 0.0079% on Wednesday, indicating that longs are paying shorts and indicating a bullish sentiment.

NEAR Protocol Price Forecast: NEAR could rally if support zones hold

NEAR Protocol price broke out of a falling wedge pattern on Friday, gaining over 11% in the following two days. However, the bullish momentum faded early this week as NEAR dropped more than 17% through Tuesday, retesting the 200-day EMA support at $2.53. At the time of writing on Wednesday, NEAR rebounds slightly, trading above $2.57.

Sideline investors looking to accumulate NEAR tokens could do so in the $2.35 and $2.53 support zones, which correspond to the weekly support and the 200-day EMA, respectively.

If NEAR finds support around the abovementioned levels, it could extend the rally toward the September 19 high of $3.34.

The Relative Strength Index (RSI) on the daily chart is 53, above the neutral 50 level, indicating bullish momentum gaining traction. The Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which remains intact, suggesting the continuation of an upward trend.

On the other hand, if NEAR faces a correction and closes below the weekly support at $2.35, it could extend the decline toward the next daily support at $1.90.