POPULAR ARTICLES

- PI price action forms an Adam and Eve pattern setup, signaling a potential bullish reversal.

- Pi Network invests in OpenMind, an AI robotics startup that has raised $20 million in funding.

- Pi's community raises concerns about the network's request for volunteers to limit misinformation about the project.

Pi Network (PI) edges higher by around 1% at press time on Friday, extending the 4.64% rise from Thursday, hinting at a bullish comeback with an Adam and Eve setup on the 4-hour chart.

Optimism around PI has revived somewhat after news that Pi Network has invested in AI robotics startup OpenMind. However, the community remains on edge following the recent circular from Pi Network that requests that Pi community members, commonly referred to as Pioneers, voluntarily address the rising misinformation on public forums without any apparent compensation.

Pi Network invests in OpenMind

OpenMind, a US-based AI robotics startup, officially announced $20 million investment raise backed by Pantera Capital. The investment will work towards creating a global network to improve coordination and communication between AI-powered androids. The project has been backed by multiple names, including the Pi Network’s core team.

This marks one of Pi Network's investment ventures following the $100 million commitment made on Pi2Day on June 28. However, there has been no official release from Pi Network regarding the exact amount of the investment.

Social chatter increases amid a new circular release

Pioneers, users of the Pi Network, are on the edge with the recent circular requesting for volunteers to curb the spread of "misinformation" in the community. Jatin Gupta, a pioneer, said, “It's the project's job to do press conferences and invite media people to provide correct information,” in an X Post on Friday.

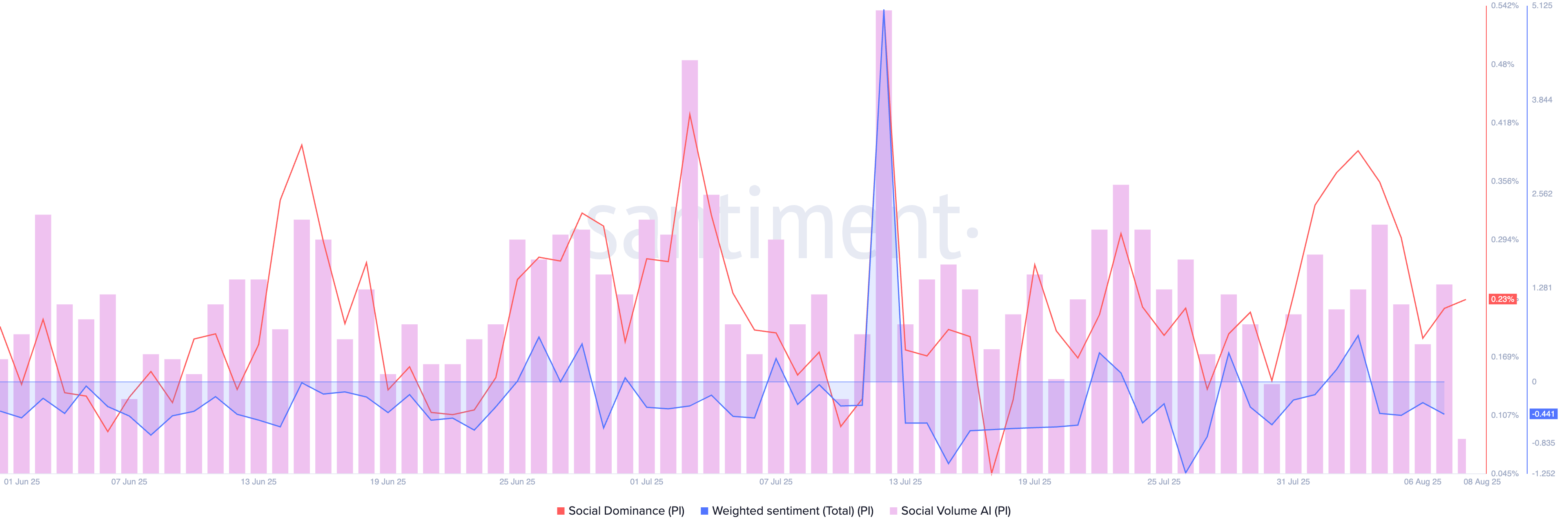

Furthermore, Gupta raised concerns about the lack of communication or marketing managers. Amid the rising chatter on the matter, Santiment shows that the social dominance score (Pi Network’s share in total crypto discussions) of Pi Network has risen to 0.23%, up from a weekly low of 0.18% on Wednesday.

Social dominance score. Source: Santiment

However, the total weighted sentiment of Pi Network stood at a bearish -0.441 on Thursday, down from -0.28 on Wednesday.

Pi Network recreates the Adam and Eve setup

Pi Network edges higher to the 50-period Exponential Moving Average (EMA) at $0.3699 on the 4-hour chart at press time on Friday. The short-term consolidation above $0.3334, which formed a weekly Adam and Eve pattern, was previously observed in early July on the same chart, resulting in a short-lived surge.

The current pattern’s upper ceiling is near $0.3700, and a decisive close above this level or the 50-period EMA could ignite a breakout rally. In such a case, the bulls could target the 100-period EMA at $0.3938.

The Moving Average Convergence Divergence (MACD) displays increasing bullish momentum as the average line and green histograms rise. Furthermore, the Relative Strength Index (RSI) shows steady growth, reaching 59 on the 4-hour chart, indicating that buying pressure is holding up.

PI/USDT daily price chart.

On the downside, if PI reverses from the upper ceiling at $0.3700, it could extend the decline to the weekly low of $0.3334.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.