POPULAR ARTICLES

- XRP breaks out to $3.38, supported by positive market sentiment.

- Ripple, US SEC file with the Second Circuit Court to dismiss appeals.

- XRP showcases a bullish technical picture with the MACD indicator maintaining a buy signal.

Ripple (XRP) holds near its intraday high of $3.38 on Friday, backed by a sudden increase in speculative demand after the United States (US) Securities & Exchange Commission (SEC) signaled a potential end to its five-year lawsuit.

The cross-border money remittance token shows signs of extending the rally toward its all-time high of $3.66, reached on July 18 and the following price discovery phase.

Ripple, SEC file to dismiss appeals

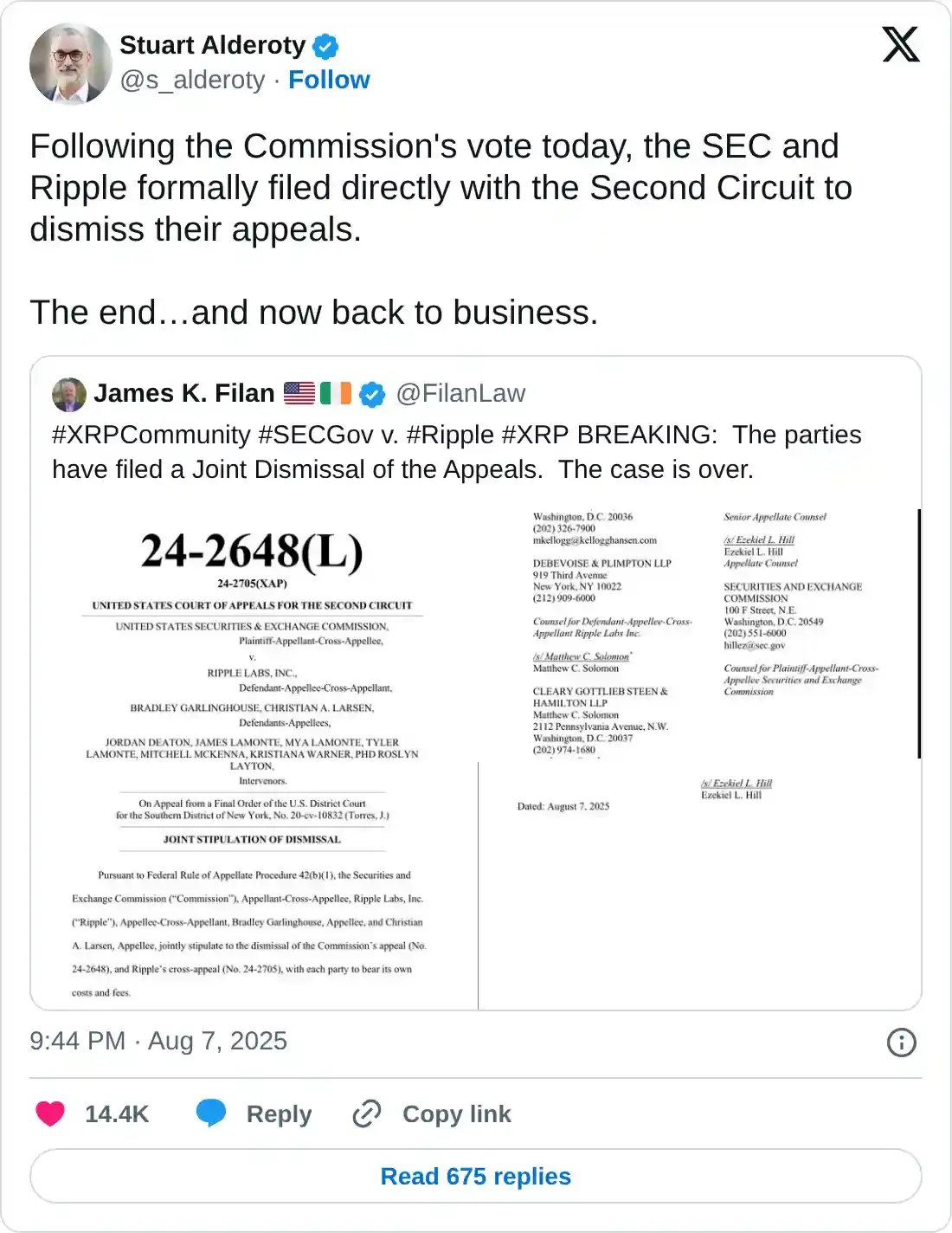

Ripple and the SEC have jointly filed directly with the Court of Appeals for the Second Circuit, requesting to dismiss their appeals.

According to the filing shared by Ripple’s Chief Legal Officer, Stuart Alderoty, each party is expected to settle its own fees and costs. The filing marks a major step toward the resolution of the legal standoff between Ripple and the regulator.

The SEC sued Ripple in 2020, alleging that the company sold unregistered securities in violation of US securities laws. A landmark ruling in 2023 found that the programmatic sale of XRP on third-party platforms like Binance and Coinbase crypto did not constitute unregistered securities. Still, the court found Ripple answerable for direct sales to institutions.

In recent months, Ripple and the SEC have explored settlement paths, especially after the blockchain startup was penalized $125 million, currently in an interest-earning escrow account.

A $50 million settlement was signed by both parties this year. However, Judge Analisa Torres of the District Court for the Southern District of New York rejected the joint motion seeking to end the lawsuit, citing an incomplete legal process.

The SEC is also expected to provide a status report to the court by August 15. However, the joint motion to the Second Circuit offers insight, suggesting that a resolution could be imminent.

Technical outlook: Can XRP sustain the uptrend?

XRP is consolidating gains at around $3.36 at the time of writing, following a rejection from an intraday high of $3.38. Interest in the token picked up the pace on Thursday, following the report regarding the joint motion with the SEC.

The Relative Strength Index (RSI), which is retreating into the bullish region after being slightly overbought at 75, indicates waning buying pressure, possibly due to profit-taking and sentiment in the broader crypto market.

Key support levels include $3.32, which was tested toward the end of July, the 50-period Exponential Moving Average (EMA) at $3.07, the 100-period EMA slightly below at $3.06 and the 200-period EMA at $2.95.

XRP/USDT 4-hour chart

On the other hand, the technical outlook could remain bullish if the Moving Average Convergence Divergence (MACD) indicator upholds a buy signal, triggered on Thursday when the blue line crossed and settled above the red signal line.

A daily close above the intraday high resistance at $3.38 could bolster the uptrend and potentially increase the chances of bulls accelerating the uptrend to the record high of $3.66 and the medium-term target of $4.00.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.