POPULAR ARTICLES

- XRP bulls tighten their grip as the price holds above the 200-day EMA support on Monday.

- The MACD remains bullish, signaling a potential continuation of the uptrend toward $3.00.

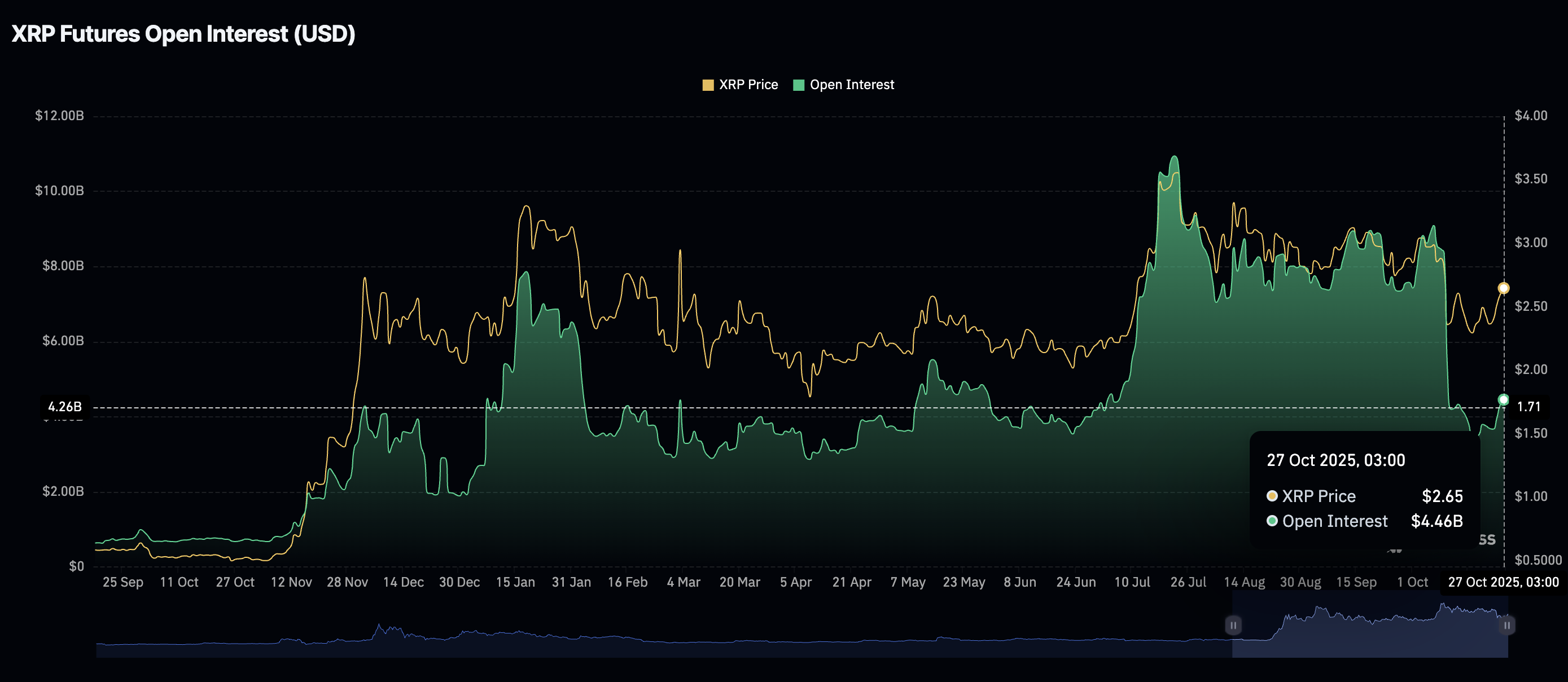

- XRP faces a weak derivatives market following a 40% drop in futures Open Interest in October.

Ripple (XRP) remains above a key support of $2.61 at the time of writing on Monday. The international money transfer token has largely been in bullish hands since Thursday, reflecting a return of positive sentiment in the broader cryptocurrency market.

A daily close above the immediate $2.61 support is required to uphold XRP’s short-term bullish picture and increase the odds of a technical breakout above the next critical hurdle at $2.68.

XRP bulls struggle amid low retail activity

Since the October 10 deleveraging event, which saw over $19 billion in crypto assets liquidated, XRP has faced weak retail demand. CoinGlass attributes this low demand to a weak derivatives market.

The XRP futures Open Interest (OI) is down approximately 40% to $4.46 billion from $7.43 billion on October 1. Although OI has improved from a monthly low of $3.49 billion, general interest in the token remains significantly suppressed compared to July, when XRP rallied to its current record high of $3.66.

Holding the price of XRP above the short-term support at $2.61 is critical for resuming the uptrend. A steady increase in OI would indicate that investors are confident that XRP can sustain its recovery and hold its accrued gains.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP testing key support

XRP is struggling to hold the 200-day Exponential Moving Average (EMA) support at $2.61, signaling potential profit-taking. The Relative Strength Index (RSI), although in the bullish region at 51, points downward, indicating easing bullish momentum.

Meanwhile, a buy signal maintained by the Moving Average Convergence Divergence (MACD) indicator since Friday encourages investors to increase risk exposure. XRP’s short-term bullish potential will remain intact as long as the blue MACD line holds above the red signal line while the indicator verbally rises.

XRP/USDT daily chart

Above the 200-day EMA support, the 50-day EMA at $2.68 is the next key hurdle, with the 100-day EMA at $2.73 likely to dampen the uptrend, particularly if investors book early profits based on sentiment in the broader cryptocurrency market.

The US Federal Reserve (Fed) is expected to release its interest rate decision on Wednesday. Market participants generally anticipate a 25-basis-point rate cut. Riskier assets like XRP and Bitcoin benefit from lower interest rates, allowing investors to diversify their portfolios.

Still, losing immediate support at $2.61 may trigger a short-term sell-off, during which the XRP price explores lower levels toward $2.18 and $1.90 in search of liquidity before another recovery attempt.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.