Why a Crypto Trading Strategy is Essential in a Volatile Market

Cryptocurrencies are traded on decentralised markets, meaning they are not issued or controlled by a central authority like a government. Instead, they operate on blockchain networks. While this decentralisation removes some traditional financial constraints, cryptocurrencies remain highly volatile, influenced by:

Supply and demand dynamics

Media coverage and public sentiment

Adoption trends and institutional interest

Macroeconomic events and regulatory changes

This volatility underscores the importance of a structured trading strategy. A well-planned approach helps traders mitigate risks and make better-informed decisions, whether using leveraged instruments like CFDs or directly purchasing crypto assets through an exchange.

Mastering Crypto Strategy: Essential Trading Techniques

Trading crypto successfully requires a strategic approach. Here are five key strategies that traders rely on:

1. Moving Average Crossovers

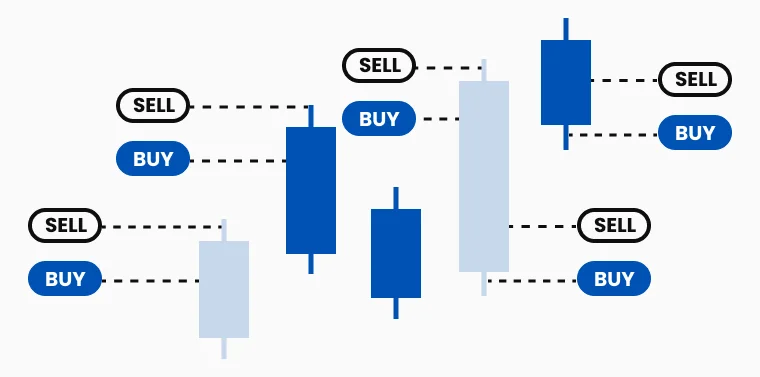

Moving averages (MAs) are lagging indicators that help traders identify trends by smoothing out price fluctuations over a specific period. A crossover occurs when a short-term moving average crosses above or below a long-term moving average, signalling potential trend shifts:

Golden Cross: When a short-term MA crosses above a long-term MA, it suggests an upward trend—often a buy signal.

Death Cross: When a short-term MA crosses below a long-term MA, it indicates a downward trend—typically a sell signal.

Traders can use these signals to enter or exit trades strategically. With TMGM’s advanced charting tools, you can easily apply moving average strategies to crypto markets.

Best For: Trend traders looking for confirmation of bullish or bearish movements.

TMGM Advantage: With TMGM’s advanced charting tools, you can easily apply moving average strategies to crypto markets.

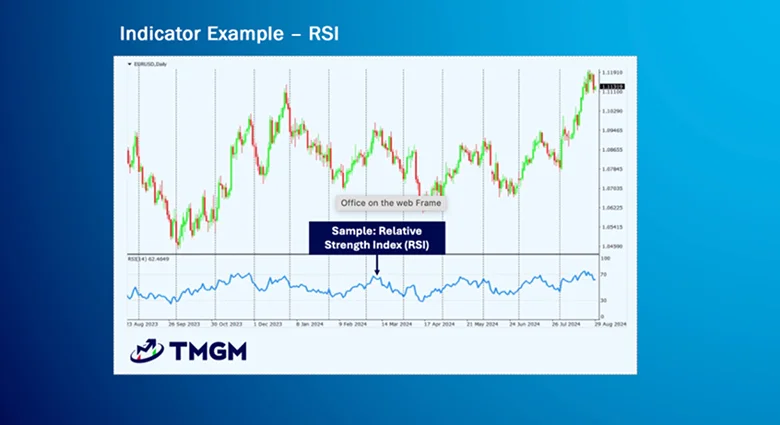

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that helps traders assess whether a cryptocurrency is overbought or oversold:

Above 70: The asset is overbought—potential sell opportunity.

Below 30: The asset is oversold—potential buy opportunity.

By identifying trends and divergences, traders can use RSI to time their entries and exits effectively. TMGM’s trading platform provides real-time RSI analysis to support your decision-making.

Best For: Traders seeking to identify reversals and momentum shifts.

TMGM Advantage: TMGM’s trading platform provides real-time RSI analysis to support your decision-making.

3. Event-Driven Trading

Market-moving events—such as regulatory announcements, partnerships, or technological upgrades—can significantly impact cryptocurrency prices. Event-driven trading involves capitalising on these shifts by:

Buying when positive news is released

Shorting when negative news emerges

This strategy requires monitoring the market, which TMGM makes easier with live market news and in-depth analysis.

Best For: Traders who follow news cycles and react quickly to market events.

TMGM Advantage: Stay informed with TMGM’s live market news and in-depth analysis.

4. Scalping

Scalping is a high-frequency trading strategy where traders enter and exit positions multiple times within a short period to profit from small price movements. This method is ideal for volatile markets, requiring:

Fast execution

Tight risk management

A keen eye on real-time price changes

With TMGM’s lightning-fast execution speeds and low-latency infrastructure, scalpers can trade efficiently without delays.

Another important trick that traders use to amplify scalping profits, is by practicing margin trading. Margin trading allows you to trade with a position way bigger than what your cash balance is, by using borrowed funds from the broker.

This is useful because in scalping, you enter and exit positions very quickly, while aiming for a small price swing. This means margin trading can amplify that profit, while the execution window is so short, it limits the downside of margin trading, keeping losses more in control compared to swing trading with margin.

Best For: Active traders looking for multiple quick trades in a single session.

TMGM Advantage: With TMGM’s lightning-fast execution speeds and low-latency infrastructure, scalpers can trade efficiently without delays.

5. Dollar Cost Averaging (DCA)

DCA is a long-term investment strategy in which traders invest a fixed amount in cryptocurrency at regular intervals, regardless of price fluctuations. This method helps reduce the impact of market volatility by averaging the entry price over time.

For example, instead of investing $10,000 in Bitcoin all at once, you could spread it over six months by investing $1,667 monthly. This reduces the risk of making a large investment at an unfavourable price.

Best For: Investors looking to reduce risk and take a long-term approach.

TMGM Advantage: TMGM offers seamless access to crypto CFD trading, backed by structured strategies to optimize your investment approach.

How to Apply Your Crypto Strategy with TMGM

Now that you understand the core crypto strategy techniques, it's time to implement them. Here’s how you can start trading crypto CFDs with TMGM:

Open an Account—Sign up with TMGM or a demo account to gain access to a world-class trading platform.

Explore the Markets – Analyse price trends, news events, and trading indicators.

Develop a Strategy – Choose a trading method that suits your risk tolerance and goals.

Use TMGM’s Tools – Leverage advanced charting, real-time data, and professional insights.

Trade with Confidence – Execute trades efficiently with TMGM’s low spreads and fast execution speeds.