剝頭皮交易策略:Scalping實例與策略

剝頭皮交易策略是一種短期交易方法,交易者的目標是從全天小幅、頻繁的價格波動中獲利。它是日內交易中節奏最快的交易方式之一,需要敏銳的決策和精準的執行。雖然剝頭皮交易通常被專業人士使用,但對於想要參與快速波動的市場並學習捕捉微小價格變化的初學者來說,也可以採用這種策略。 以下是剝頭皮交易的運作方式,以及它如何融入更廣泛的日內交易計劃,適合那些探索快速交易策略的人。

什么是剥头皮交易?有没有最好的剥头皮交易策略?

剝頭皮交易是一種超短線交易策略,目標是頻繁獲取小額利潤。與持倉數天或數週的波段交易者不同,剝頭皮交易者通常只持倉幾分鐘,甚至更短。剝頭皮交易的核心在於:回本點差成本,再額外獲取少量利潤,並不斷重複這一過程。

單筆剝頭皮交易本身獲利有限,但交易者通常每天執行大量交易。這種高頻交易行為,可以在一個交易日內累積可觀的整體收益。

部分剝頭皮交易者持倉時間不超過15秒,也有些會持倉幾分鐘。無論是哪種方式,剝頭皮交易者不建議隔夜持倉。

那麼,最好的剝頭皮交易策略是什麼?

如何進行剝頭皮交易?

小型帳戶範例:

買入:您以 1.1000 的價格開倉 0.1 手歐元/美元。槓桿為 1:10,您的保證金為 1,000 美元(控制 10,000 美元)。

行價格變動:價格上漲至 1.1050(+50 點)。

賣出:您以 1.1050 的價格平倉。

利潤計算:

0.1 手每點 = 1 美元

總獲利 = 50

毛利:1 美元 × 50 = 50 美元

淨利(扣除 5 美元往返佣金後):50 美元 - 5 美元 = 45 美元

大型帳戶範例:

買入:您以 1.1000 的價格開倉 10 手歐元/美元。使用 1:10 槓桿,您的所需保證金為 100,000 美元(控制 1,000,000 美元)。

價格變動:價格上漲至 1.1050(+50 點)。

賣出:您以 1.1050 的價格平倉。

利潤計算:

10 手每點 = 100 美元

總獲利 = 50

毛利:100 美元 × 50 = 5,000 美元

淨利潤(扣除 100 美元往返佣金後):5,000 美元 - 100 美元 = 4,900 美元

小型和大型交易者都可以從剝頭皮交易的短期價格波動中獲利,但利潤與頭寸規模和槓桿率直接相關。交易成本和風險也會隨著交易規模而改變。

然而,使用槓桿交易差價合約時,利潤和損失會被放大。雖然槓桿允許交易者以較小的初始投資控制更大的部位,但它也增加了風險——損失可能超過您的初始保證金,尤其是在快速波動的市場中。差價合約產品複雜,可能不適合所有投資者。

請確保您完全了解差價合約和槓桿的運作方式,並在交易前考慮您的風險承受能力。

那麼,最佳的剝頭皮交易策略是什麼?

新手最佳 CFD 剝頭皮交易策略

適合你的最佳剝頭皮策略,取決於你交易的金融市場種類、使用的技術分析方法、價格行為模式,以及你對風險的承受能力。為了幫助你制定正確的交易策略,接下來我們將介紹幾種最常見與有效的剝頭皮交易策略。

剝頭皮交易策略:隨機震盪指標

隨機震盪指標剝頭皮交易策略

隨機震盪指標(Stochastic Oscillator)是一種短期動量指標,可在 MT4 等外匯交易平台上使用,類似於移動平均收斂/發散指標(MACD),其是透過前一周期的收盤價來計算。

該指標由兩條線構成:一條是快速、靈敏的 %K 線,另一條是稍慢、反應較遲的 %D 線。剝頭皮交易者主要觀察這兩條線之間的變化關係,因為它們分別根據不同的時間框架來衡量市場的動能。

作為震盪指標,其數值範圍始終介於 0 到 100 之間。該指標常用來判斷**超賣(低於30)與超買(高於70)**狀態,但這並非剝頭皮交易者的使用方式。

在剝頭皮交易策略中,交易者會持倉直到兩線再次交叉並變得平緩,以等待下一個訊號。當快速線(%K)上穿慢速線(%D)時,交易者建立多頭部位並持有,直到快速線下穿慢速線後平倉。反之,當快速線下穿慢速線時建立空頭倉位,當其再次上穿時則平倉。

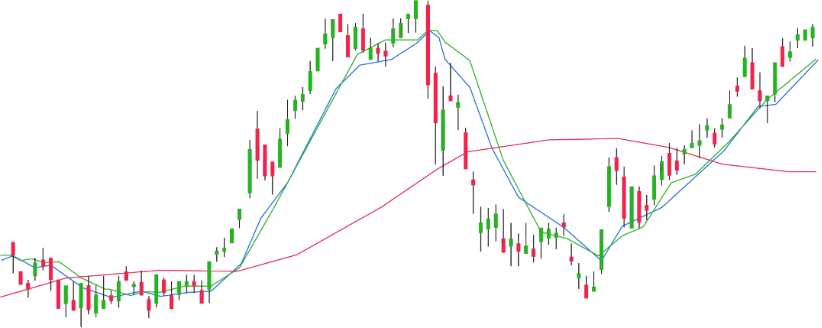

簡單移動平均線:最佳剝頭皮交易策略的有力候選者

有些剝頭皮交易者依賴簡單移動平均線(SMA),該指標通過計算過去數日的平均價格(例如:5日簡單移動平均線,對於股票交易者而言相當於一週,因為股市週末不開盤)來衡量市場趨勢的動能。

交易者會在圖表上使用兩條或三條簡單移動平均線。例如,他們會使用一條短期均線來觀察五個時間週期內的價格變化,同時也會加上一條10週期或20週期的中長期均線。

當短期均線上穿長期均線時,這通常被視為看漲訊號,剝頭皮交易者會進場尋求快速獲利;而當長期均線下穿短期均線時,則可能是開空倉的時機,預期市場會出現下跌走勢。

你可以選擇使用簡單移動平均線(SMA),也可以使用指數移動平均線(EMA),後者會給予近期價格更大的權重。由於 EMA 對價格變動更加敏感,許多剝頭皮交易者偏好使用 EMA,以便能更早掌握入場時機。

相對強弱指數(RSI)在 CFD 剝頭皮交易中的應用

相對強弱指數(RSI)是另一項衡量市場供需關係的技術指標。與隨機震盪指標類似,RSI 的數值介於 0 到 100 之間。一些交易者認為 RSI 更容易解讀,因為其線條相較於隨機指標更為平滑。當 RSI 超過 70,表示市場處於超買狀態;當 RSI 低於 30,則表示市場超賣。

如同使用隨機震盪策略一樣,當 RSI 到達另一個極端區域時,交易者應考慮立即平倉。

剝頭皮交易中的支撐與阻力位應用

剝頭皮交易策略亦可利用已建立的價格水平,這些水平往往是市場可能發生反轉的關鍵區域。當市場接近這些價位時,剝頭皮交易者可觀察技術指標或蠟燭圖形態,作為額外的交易訊號。

將這些支撐/阻力位繪製於圖表上,有助於捕捉高機率的入場點與出場時機。

TMGM - 剝頭皮交易新手的專業平台

開始剝頭皮交易之前,交易者應先做好研究,選擇一家受監管、值得信賴的經紀商,為自己的交易提供先進的資源與支援。

TMGM 提供 MetaTrader 4 與 MetaTrader 5 平台,具備強大的圖表分析功能與極速下單能力,非常適合進行剝頭皮策略。

我們與超過10家流動性提供商合作,並採用NY4 伺服器架構,確保您的每筆交易都能快速執行。

如果您想嘗試剝頭皮交易,歡迎立即前往 TMGM 官網開立帳戶,展開您的高效短線交易旅程!

今日更明智地進行交易

交易帳戶

入金

交易