Volatility in Crypto vs Forex Market: The Reality

When comparing volatility in crypto and forex markets, the main differences are in scale and frequency. Forex markets generally move within relatively narrow ranges, while crypto markets operate continuously and often experience larger and more frequent price fluctuations. These conditions may create more trading opportunities, but they also increase potential risks and require careful risk management.

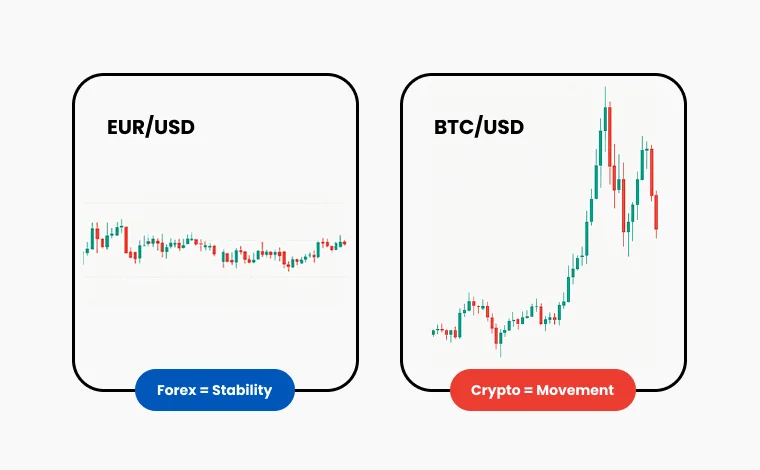

BTC/USD vs EUR/USD: Understanding the Numbers

To compare volatility levels, consider two popular pairs:

● EUR/USD, the world’s most traded forex pair, typically fluctuates around 0.5%–0.8% per day.

● BTC/USD moves around 3%–5% daily, and often more during major events.

This comparison highlights how volatility in crypto vs forex can differ by an entire magnitude, with digital assets offering far greater price movement potential.

For casual investors, such price fluctuations may seem challenging to navigate. But for traders who use disciplined crypto trading strategies, those movements represent opportunity. While price movements can create potential opportunities, they also carry risks, and outcomes depend on each trader’s approach and risk management practices.

Crypto Trading Strategies for Volatile Markets

Professional traders do not avoid volatility; they structure their trades around it. The goal is not to eliminate risk but to manage it effectively.

Here are some proven approaches for forex-style trading in crypto markets:

● Defined Risk per Trade: Limit exposure to 1–2% of total capital, regardless of direction or sentiment.

● Tight Stop-Loss and Take-Profit Levels: Crypto’s larger swings mean smaller moves can deliver stronger returns.

● Adaptive Position Sizing: Scale in or out of trades to lock in profits and control exposure.

These crypto trading strategies allow professionals to turn volatility in crypto vs forex into consistent compounding opportunities, using leverage carefully and protecting downside risk.

Forex-Style Risk Management in Crypto Trading

The difference between opportunity and disaster often comes down to risk management in crypto trading.

Top traders apply structured techniques adapted from forex vs crypto trading principles. They:

● Always set a stop-loss, even for short-term positions.

● Manage exposure with position scaling during extreme volatility.

● Track margin levels closely to avoid forced liquidation.

By applying the same level of discipline used in forex trading, traders can approach crypto markets with a structured strategy and clearer risk management. This helps them respond to market movements in a more consistent and informed manner.

Why Volatility Makes You a Better Trader

Unlike forex markets that pause on weekends, crypto trades nonstop. This constant motion forces traders to adapt quickly and sharpen their discipline.

Over time, traders who operate in volatile markets learn to:

● React logically under pressure.

● Depend on data and planning instead of emotion.

● Refine decision-making through more frequent trade setups.

Exposure to crypto market volatility can provide valuable experience in observing price behavior and testing trading strategies. For traders who understand the differences between volatility in crypto and forex markets, these fluctuations can offer insights into risk management and decision-making. Volatility is a characteristic of the market that, when approached with disciplined strategies, can help traders develop a structured and informed approach to trading across different asset classes.

Trading Volatility the TMGM Way

Volatility does not have to mean uncertainty. When approached with precision, planning, and discipline, it becomes a valuable source of opportunity.

TMGM provides advanced platforms, analytics, and CFD instruments that help traders manage volatility in crypto vs forex with confidence. Whether you are testing strategies on a demo account or building a live portfolio, TMGM offers the tools, insights, and education to help traders better understand market volatility and make informed decisions. Ready to elevate your trading strategy? Start with TMGM today.