重點摘要:

- 微軟的持股分散於主要資產管理公司及廣泛的散戶持有者,意味著公司治理深受大型指數基金及長期投資機構的影響。

- 該公司’的流通股主要由機構投資者持有(≈71.46%),內部人士約佔6%,散戶約佔24%,提供流動性並確保利益一致,顯示出多元化的監督及穩定的資本結構。

- Vanguard、BlackRock、State Street、Fidelity及T. Rowe Price合計持有大量股份,並影響代理投票結果、董事會問責及長期策略。

- 在個人股東中,Steve Ballmer持股最多,超越Bill Gates,Satya Nadella、Brad Smith及Amy Hood則持有較小的高管股份,確保領導層與股東利益一致。

- 透過TMGM,投資者可透過差價合約(CFDs)參與微軟相關價格波動的投機,無需持有實際股票,但需注意槓桿會放大盈虧,並須嚴格風險控管。

微軟所有權結構:股東分布

微軟由Bill Gates與Paul Allen於1975年創立,迅速成為科技領域的領導者。公司快速崛起得益於與IBM等關鍵合作,以及MS-DOS、Windows和Internet Explorer等突破性創新。多年來,微軟擴展產品組合,涵蓋生產力軟體、個人娛樂及企業解決方案,成為全球最具價值的公司之一。

如今,微軟的業務涵蓋人工智慧、雲端運算及前沿應用如LinkedIn與Microsoft Azure。其股票成為眾多投資者的基石,持股結構反映多元化:機構投資者佔71.46%、內部人士6%、散戶24%。

前五大機構股東

#1 Vanguard集團

- 概覽:成立於1975年,Vanguard是全球最大的投資管理公司之一,以低成本指數基金及ETF聞名。Vanguard服務機構及個人投資者,管理資產規模達數兆美元。

- 持股比例:8.7%

- 持股數量:6.492億股

- 總價值:2,680億美元

- 重要性:Vanguard影響力遍及多家大型企業,是全球最具權力的機構投資者之一。

#2 BlackRock公司

概覽:成立於1988年,BlackRock是領先的投資管理及金融服務公司,為多元客戶管理資產,涵蓋退休基金及政府機構。BlackRock亦管理業界領先的風險管理平台Aladdin。

持股比例:7.25%

持股數量:5.389億股

總價值:2,140億美元

重要性:BlackRock以積極參與公司治理著稱,常透過持股影響大型企業決策。

#3 State Street公司

- 概覽:成立於1792年,State Street是一家擁有悠久歷史的金融服務及投資管理公司,提供資產管理、研究及交易解決方案。

- 持股比例:4.01%

- 持股數量:2.976億股

- 總價值:1,180億美元

- 重要性:State Street、Vanguard及BlackRock被稱為「三大」指數基金管理公司,合計對美國企業具有重大影響力。

#4 Fidelity(FMR LLC)

概覽:由Edward C. Johnson II於1946年創立,Fidelity Investments提供多元金融服務,包括個人理財規劃及資產管理,客戶涵蓋個人及大型機構。

持股比例:2.9%

持股數量:2.1587億股

總價值:893.8億美元

重要性:Fidelity以積極管理策略及其共同基金系列聞名,是投資界的重要角色。

#5 T. Rowe Price Associates

概覽:成立於1937年,T. Rowe Price是一家獨立投資管理公司,服務全球客戶,包括個人及機構,以嚴謹的長期投資策略著稱。

持股比例:2%

持股數量:1.5192億股

總價值:629億美元

重要性:T. Rowe Price以紮實的研究能力及致力於透過多元投資策略為客戶創造績效聞名。

前五大個人股東

#1 Steve Ballmer

背景:微軟前任執行長Ballmer於1980年加入,擔任公司首位業務經理,促成與IBM的合作並推動軟體擴張。2000年接替Gates成為CEO,領導公司直到2014年退休。

持股比例:4.48%

持股數量:3.332億股

總價值:1,158億美元

重要性:Ballmer持有大量股份,是最大個人股東,對微軟未來發展擁有重要影響力。

#2 Bill Gates

背景:微軟共同創辦人,曾任CEO至2000年,2020年卸任董事會專注慈善。Gates是Windows及Office等產品的推手,深刻塑造數位時代。

持股比例:0.53%

持股數量:3,920萬股

總價值:137億美元

重要性:儘管多年來減持股份,Gates作為微軟遠見者的影響力依然根基深厚。

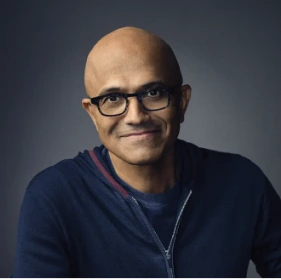

#3 Satya Nadella

背景:1992年加入微軟,推動公司雲端運算發展,包括Microsoft Azure。2014年出任CEO,將公司重心轉向人工智慧、雲端服務及業務轉型。

持股比例:0.01%

持股數量:80萬股

總價值:2.716億美元

重要性:Nadella的領導推動微軟復興,鞏固其全球科技領導地位。

#4 Bradford L. Smith

背景:1993年加入微軟,負責法律及企業事務,包括反壟斷議題及公司社會責任計畫。

持股比例:0.008%

持股數量:57萬零826股

總價值:2億美元

重要性:作為副董事長兼總裁,Smith代表微軟處理關鍵議題,包括網路安全、人權及人工智慧倫理。

#5 Amy E. Hood

背景:2002年加入微軟,2013年起任首席財務官,負責全球財務運營,助力公司財務表現及策略成長。

持股比例:0.007%

持股數量:52萬股

總價值:1.7億美元

重要性:Hood是微軟領導團隊的重要成員,指導公司財務策略及投資優先項目。

如何透過TMGM參與科技與市場趨勢

雖然 TMGM 不提供微軟等公司股票的直接購買,投資者仍可透過TMGM平台上的差價合約(CFDs)參與主要企業的市場波動。

差價合約(CFDs) 允許您在不持有標的資產的情況下,對股票、指數及商品等資產的價格變動進行投機。

透過TMGM,您可以:

開設 TMGM帳戶:首先在TMGM開設交易帳戶。

登入TMGM網頁交易平台:帳戶設立完成後,登入平台享受完整交易體驗。

設定交易:根據您的策略調整交易規模,設置停損及獲利點。