POPULAR ARTICLES

- XRP falls for four consecutive days as a bearish wave weighs on the broader cryptocurrency market.

- The cross-border remittance token's supply in profit holds near its one-year low amid risk-off sentiment.

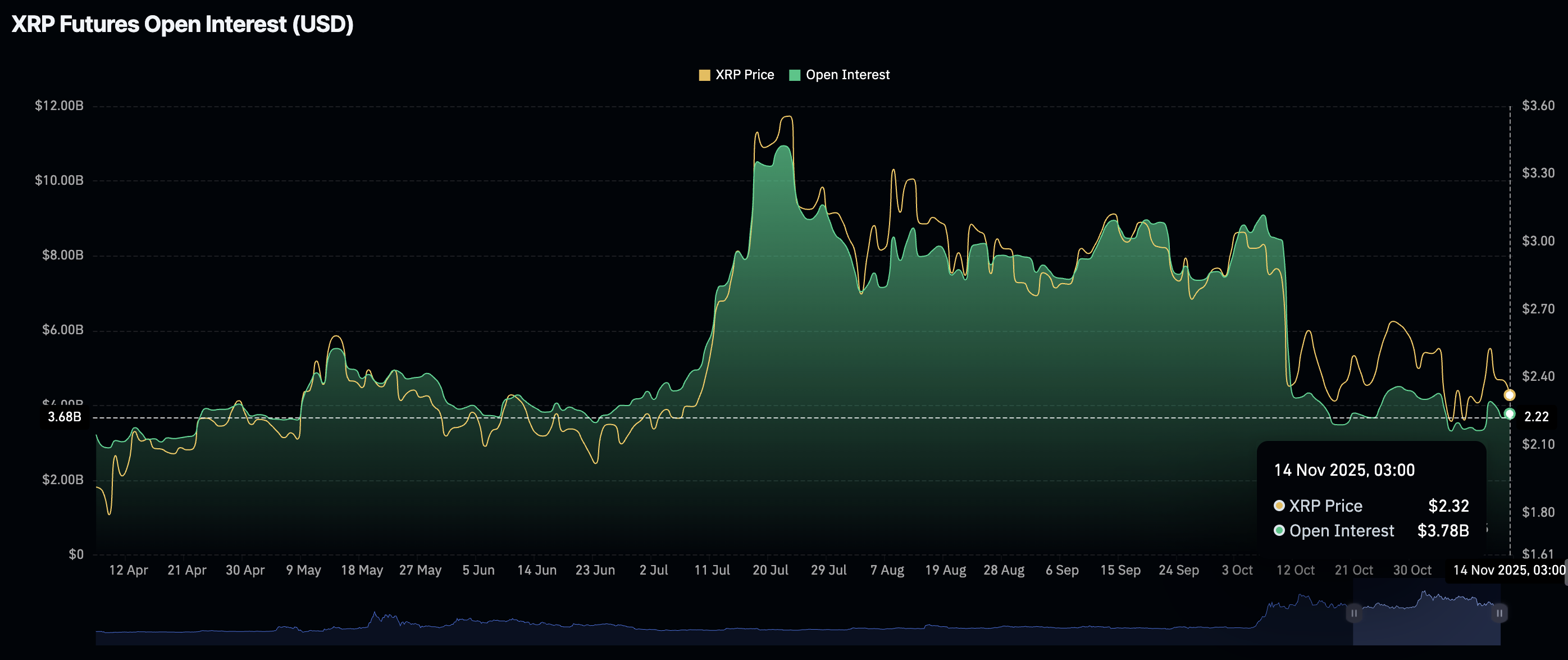

- XRP retail demand steadies, with the futures Open Interest rising slightly to $3.78 billion.

Ripple (XRP) edges lower, trading above $2.25 at the time of writing on Friday. The token's short-term outlook reflects a sticky risk-off sentiment in the broader cryptocurrency market.

Low retail demand continues to weigh on the token, shrugging off the launch of the first XRP spot Exchange Traded Fund (ETF) in the United States. XRPC ETF debuted on Thursday, clocking $59 million in volume on the first day of trading.

XRP supply in profit shrinks as risk-off sentiment prolongs

The Supply in Profit metric from Glassnode shows the absolute volume of XRP's circulating supply currently held at an unrealized profit. According to the chart below, this volume averages 44 million XRP on Friday, down from a peak of 64 million XRP in mid-July. XRP's supply in profit reached this level in early November 2024, highlighting a one-year low.

The steady decline from mid-July points to a broadening wave of unrealized losses among holders, affecting other factors such as sentiment, liquidity, and price performance.

Still, the decline could signal a turnaround, as the supply available for sale diminishes, suggesting sentiment is bottoming. Moreover, investors could begin seeking new opportunities, increasing demand for XRP and paving the way for a short to medium-term recovery.

Meanwhile, retail demand for XRP has not recovered since mid-October, characterised by a weak derivatives market. CoinGlass data shows the futures Open Interest (OI) averaging $3.78 billion on Friday, slightly up from $3.67 the previous day but down from $4.17 billion posted on November 1.

A steady increase in OI is required to support XRP's short-term recovery, indicating that investors have confidence in the token and the ecosystem and are willing to increase their risk exposure.

Technical outlook: XRP bulls defend key support

XRP is trading above $2.25 at the time of writing on Friday as bearish sentiment remains sticky across the cryptocurrency market. The token's position below key moving averages, including the 50-day Exponential Moving Average (EMA) at $2.53, the 200-day EMA at $2.57 and the 100-day EMA at $2.63, reinforces the bearish grip.

Sellers have the upper hand with the Relative Strength Index (RSI) at 43 and extending its decline. Lower RSI readings suggest that bearish momentum is building, increasing the odds of a prolonged downtrend.

A short-term support lies at $2.24, which was tested earlier in the day. If the decline extends, XRP will seek liquidity at $2.07 and $1.09, tested on November 4 and in mid-June, respectively. Still, a recovery could ensue if investors buy the dip, building a tailwind for XRP and eyeing highs above the 50-, 200-, and 100-day EMAs.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.