熱門文章

- Bittensor recovers 2% on Monday from a 5% loss on the previous day, extending the decline below $300.

- Bittensor halving on Monday will reduce the daily TAO token emission to 3,600, from 7,200.

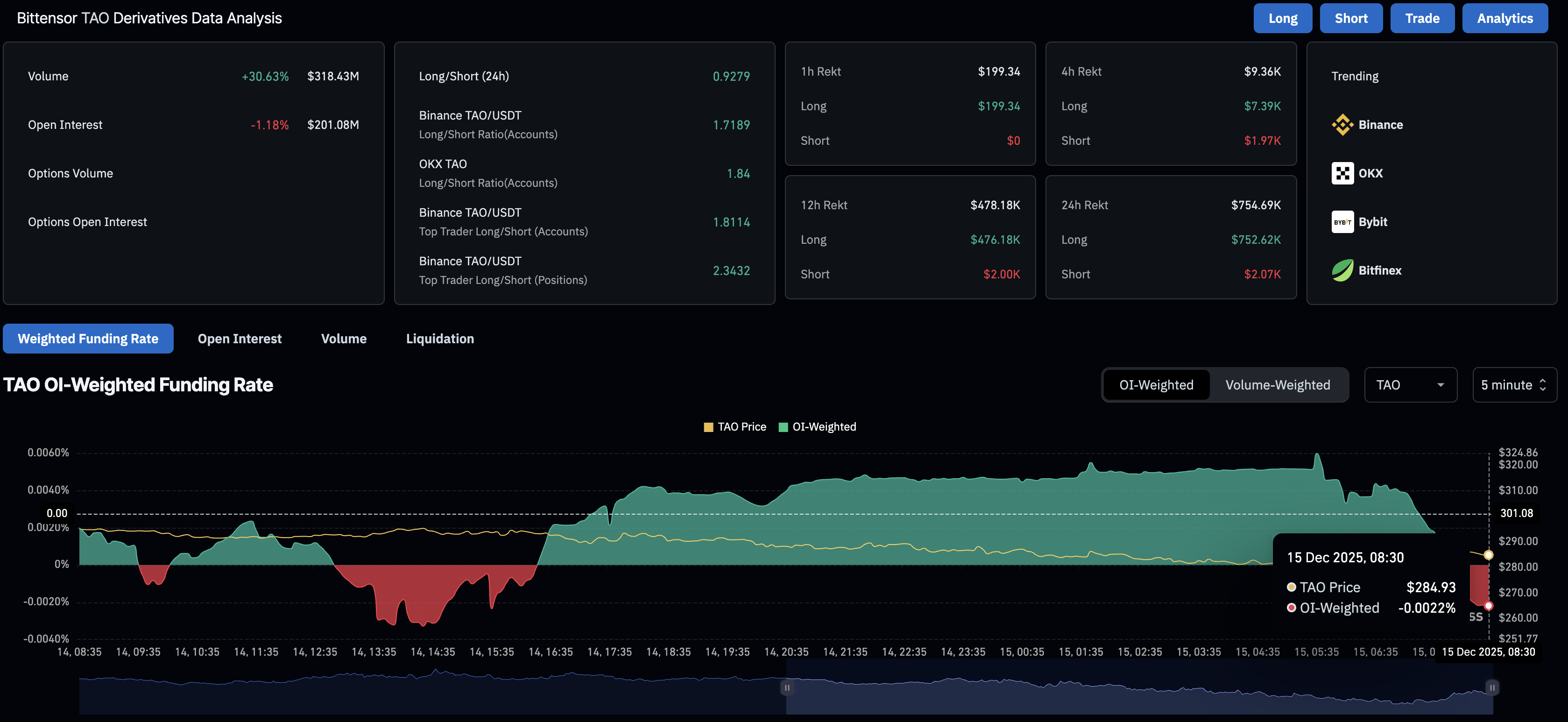

- Derivatives market data shows an increase in bearish sentiment amid risk-off sentiment.

Bittensor (TAO) edges higher by over 2% at press time on Monday, recovering from a 5% loss on Sunday. Bittensor’s recovery is underpinned by its halving event scheduled for Monday, which would reduce daily supply emissions by 50% to 3,600 TAO tokens. Still, the derivatives market shows lukewarm sentiment, with futures Open Interest declining and the funding rate turning negative.

The technical outlook for TAO remains bearish as it breaks below a short-term support trendline on the 4-hour chart, targeting the S1 Pivot Point at $286.

Bittensor halving struggles to ignite demand

Bittensor will record its first halving event on Monday, reducing the emission rate of TAO by 50% to 0.5 TAO per block. This will halve the daily emission to 3,600 TAO from the current rate of 7,200 TAO.

Reduced emissions make TAO more valuable, if demand remains stable or increases. At the same time, the Alpha rewards, which are TAO tokens distributed at the subnet level to miners, validators, and subnet owners, will remain unaffected.

However, on the derivatives side, retail interest remains dull, as TAO futures Open Interest (OI) dropped 1.18% over the last 24 hours to $201.08 million. This indicates a reduced number of active positions, as traders limit their risk exposure.

Still, the OI-weighted funding rate has dropped to -0.0022% from 0.0060% earlier on Monday, signaling a sharp increase in bearish confidence.

Bittensor’s triangle pattern fallout risks further decline to $265

Bittensor breaks below a symmetrical triangle pattern on the 4-hour price chart formed by connecting two converging trendlines. The intraday recovery in the decentralized AI network token marks a retest of the broken support trendline connecting the December 1 and 7 lows, near the 50-period Exponential Moving Average (EMA) at $291.

A potential post-retest reversal could extend the decline to the S1 Pivot Point at $265, followed by the S2 Pivot Point at $250.

The momentum indicators on the daily chart suggest a bearish bias amid rising selling pressure. The Relative Strength Index (RSI) at 42 remains below the halfway line, extending a prevailing downward trend. At the same time, the Moving Average Convergence Divergence (MACD) and the signal line keep a steady decline into the negative territory, indicating a bearish momentum buildup.

Looking up, a potential rebound above the 50-period EMA at $291 could extend the recovery to the R1 Pivot Point at $305.