POPULAR ARTICLES

- Bitcoin price steadies around $86,000 on Monday after falling nearly 8% in the previous week.

- Renewed optimism that the Fed will cut interest rates again in December boosts investors' appetite for riskier assets such as BTC.

- US-listed spot ETF recorded an outflow of $1.22 billion last week, making a fourth consecutive week of withdrawals.

Bitcoin (BTC) begins the week on a steadier footing, trading around $86,000 at the time of writing on Monday after last week’s sharp correction. Growing expectations of a potential Federal Reserve (Fed) rate cut in December are boosting risk-on sentiment among BTC traders. However, continued outflows from US spot Bitcoin Exchange Traded Funds (ETFs) highlight lingering caution among institutional investors.

Fed rate cut expectation boosts risk-off sentiment

Bitcoin starts the week on a positive note, stabilizing above $86,000 at the time of writing on Monday after recovering from Friday’s dip to $80,600. This price recovery was boosted by New York Federal Reserve President John Williams describing the current policy as modestly restrictive. He told reporters on Friday that he sees room for the central bank to lower rates in the near term.

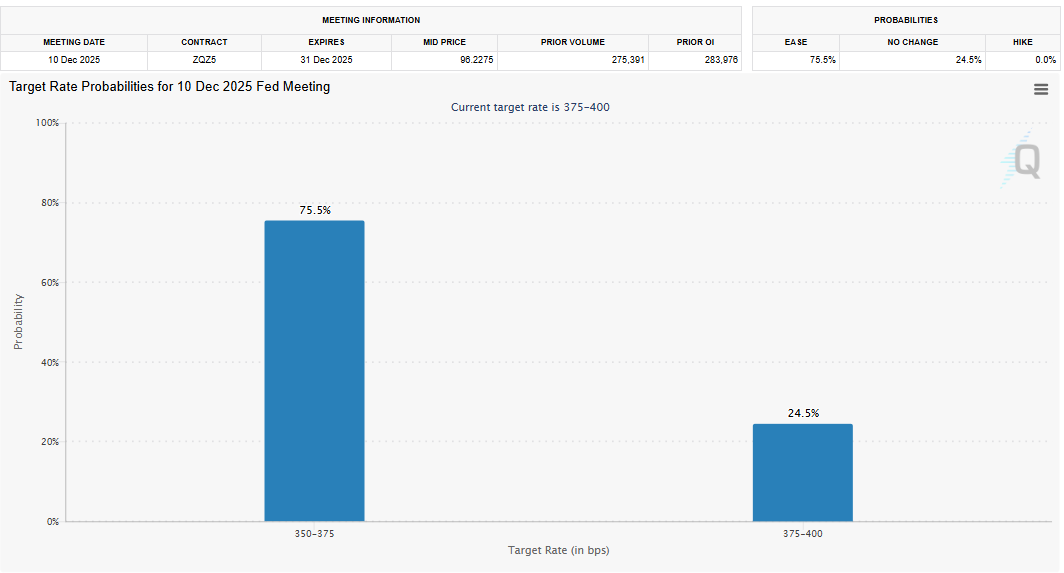

Market participants were quick to react and are now pricing in around a 75% chance that the Fed will lower borrowing costs in December, according to the CME FedWatch tool chart below.

This renewed optimism that the US central bank will cut interest rates again in December boosts investors' appetite for riskier assets such as Bitcoin.

QCP analyst said on Monday, “Thanksgiving week will test whether Friday’s rebound has legs. While the market is eager to call a bottom, weekend bounces have historically been unreliable.

We’ll be watching closely to see if US open selling pressure is abating and whether Friday’s BTC ETF inflows mark the start of a trend reversal after weeks of record outflows.”

Weakening institutional demand

Institutional demand has continued to weaken, weighing on the Bitcoin price. SoSoValue data shows that Bitcoin spot ETFs posted a total outflow of $1.22 billion last week, marking a fourth consecutive week of withdrawals since the end of October. If this trend persists and intensifies, Bitcoin could face a deeper price correction, reflecting waning institutional confidence.

Bitcoin Price Forecast: BTC steadies around $86,000

Bitcoin price has declined more than 20% since it faced rejection at $106,453 on November 11, reaching a low of $80,600 on Friday. BTC managed a mild rebound over the weekend, closing above $86,830 on Sunday. At the time of writing on Monday, BTC hovers around $86,000.

If BTC continues its recovery, it could extend the rally toward the next key resistance at $90,000.

The Relative Strength Index (RSI) on the daily chart reads 27, signaling deeply oversold conditions and suggesting that bearish momentum may be overstretched in the short term.

On the other hand, if BTC faces a correction, it could extend the decline toward the key psychological level at $80,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.