POPULAR ARTICLES

- Dogecoin price hovers around its 200-day EMA at $0.211, a firm close below signals further correction ahead.

- Derivatives markets indicate a bearish outlook as the DOGE funding rate turns negative and bearish bets rise.

- Santiment data indicate that holders are offloading DOGE tokens, adding to downside pressure.

Dogecoin (DOGE) is trading cautiously around its key level at $0.211 at the time of writing on Tuesday, a level that could determine DOGE’s next directional move. While the dog-based meme coin attempts to hold ground, derivatives data and on-chain metrics suggest growing bearish sentiment, raising the risk of further downside if selling pressure intensifies.

Dogecoin’s derivatives and on-chain metrics raise the risk of further downside

CoinGlass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of Dogecoin will slide further is higher than that anticipating a price increase.

The metric flipped to a negative rate on Tuesday, reading 0.0010%, indicating that shorts are paying longs. Historically, as shown in the chart below, when the funding rates have flipped from positive to negative, DOGE’s price has fallen.

DOGE funding rate chart. Source: Coinglass

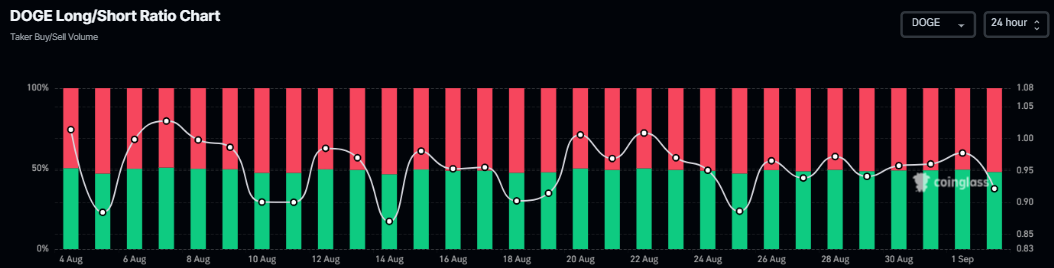

Apart from the negative funding rates, the long-to-short ratio for DOGE also suggests a bearish sentiment as short bets are rising among the traders.

Dogecoin long-to-short ratio chart. Source: Coinglass

Santiment’s Supply Distribution data points to a bearish outlook for the dog-based meme coin, as holders are offloading DOGE tokens.

The metric shows that whales holding between 100,000 and 1 million DOGE tokens (red line), 1 million and 10 million (yellow line), and 10 million and 100 million (blue line) have shed a total of 250 million DOGE tokens since August 25, supporting the bearish view.

[07-1756783770770-1756783770772.45.52, 02 Sep, 2025].png)

Dogecoin supply distribution chart. Source: Santiment

Dogecoin Price Forecast: A close below the 200-day EMA hints at further correction

Dogecoin price found rejection from its previously broken ascending trendline (drawn by connecting multiple lows since June 22) on Sunday and declined by nearly 3% the following day. At the time of writing on Tuesday, it hovers around its 200-day EMA at $0.211.

If DOGE closes below the $0.211 level on a daily basis, it could extend the correction to retest its weekly support at $0.181.

The Relative Strength Index (RSI) on the daily chart reads 46, still trading below its neutral level of 50, suggesting a bearish momentum. The Moving Average Convergence Divergence (MACD) continues to display a bearish crossover, further reinforcing the bearish outlook.

DOGE/USDT daily chart

However, if the 200-day EMA at $0.211 holds as support, DOGE could extend the recovery toward its daily resistance level at $0.247.