POPULAR ARTICLES

- New Bitcoin whales realized over $1.3 billion in losses last week.

- The purge of excessive and speculative leverage can lay the foundation for a structural recovery.

- Bitcoin's ability to withstand the intense deleveraging suggests underlying accumulation from strong-conviction whales.

Bitcoin is down 2% on Tuesday as the market decline over the past few days has triggered massive loss realization from new whales.

New Bitcoin whales offload positions as prices slip below their cost basis

Following Bitcoin's decline and consolidation below $110,000 over the past few weeks, short-term holders with large balances — also known as new whales — have been under intense pressure.

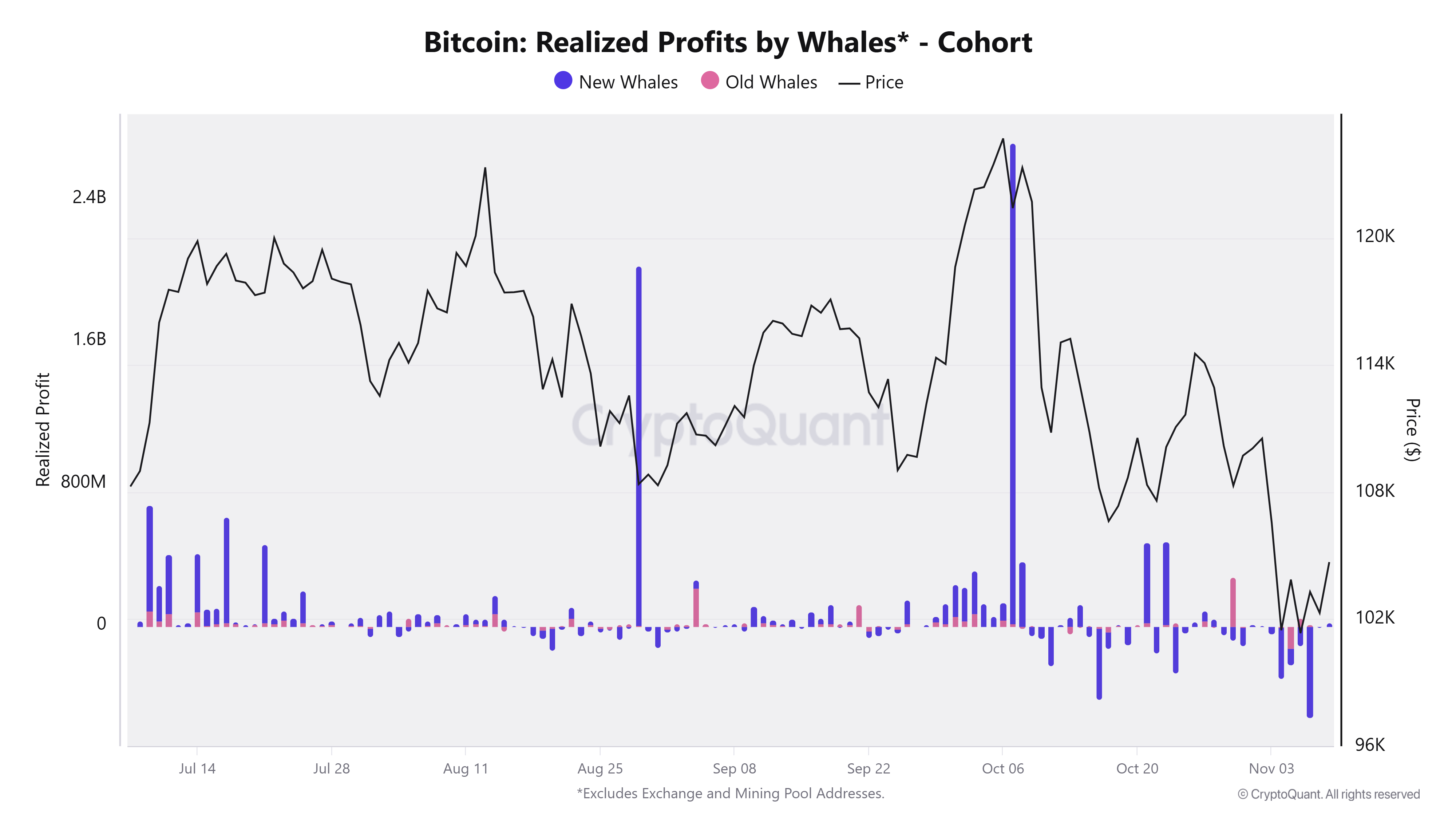

This cohort has accelerated their selling pressure as prices have failed to sustain above their average cost basis of $110,000, resulting in heavy losses. Between November 4 and 9, new whales booked more than $1.3 billion in losses. This is one of the most aggressive selling streaks of 2025, according to CryptoQuant analyst MorenoDV in a Sunday note.

"Sustained losses of this magnitude suggest forced selling or panic-driven exits, typically driven by leveraged positions being unwound or loss aversion among late entrants," wrote MorenoDV.

This is evident in the 11.3% drop in Bitcoin's open interest (OI) over the past 7 days. While such a decline triggers increased fear, uncertainty and doubt (FUD), it presents a buying opportunity. The purge of excessive and speculative leverage could help lay the foundation for a structural recovery, another CryptoQuant analyst noted in a Tuesday report.

However, "the coming days will reveal whether this was a final shakeout or a prelude to deeper structural stress," MorenoDV added.

High conviction whales buy the dip as medium-sized holders' interest wanes

For now, Bitcoin's ability to withstand the intense deleveraging and loss realization without prices crashing heavily shows underlying accumulation from strong-conviction whales.

In the past week, "while Dolphins (100–1K BTC) drastically reduced their accumulation from 173.9828K BTC to 81.4535K BTC, Great Whales (>10K BTC) more than doubled their holdings, rising from 26.8767K BTC to 62.8957K BTC (+36.019K BTC)," analyst GugaOnChain wrote in a Sunday CryptoQuant report.

.png)

Bitcoin trades around $103,000, down 2% on Tuesday, as investors eye the $100,000 key level.