POPULAR ARTICLES

- Pi Network's outlook remains bearish as overhead selling pressure neutralizes attempts of a reversal.

- Pi Network recognises Onramp. money, Transfi, and Banxa as official partners on Thursday.

- Four out of the five largest transactions in the last 24 hours indicate that large-wallet investors acquired PI tokens.

Pi Network (PI) edges higher by 1% at press time on Thursday as the declining trend appears to have found a floor above the $0.3200 level.

While the downtrend remains firm, the largest transactions on the network over the last 24 hours reflect that large-wallet investors are acquiring PI tokens from the OKX exchange amid the core team’s announcement of its on-ramp services to help users directly buy Pi coins.

Pi Network officially partners with Onramper

Pi Network has officially announced the integration of the on-ramp feature via multiple partners and Onramper as the official aggregator. The service has been available on the network for the last month, possibly for testing without an official announcement.

The launch of such services fulfills the commitment pledged in the Pi2Day announcement. Despite the news, no significant price movement is seen in the 10 hours following the announcement. The official partners are Onramp. money, Transfi, and Banxa after the Know Your Business (KYB) verification.

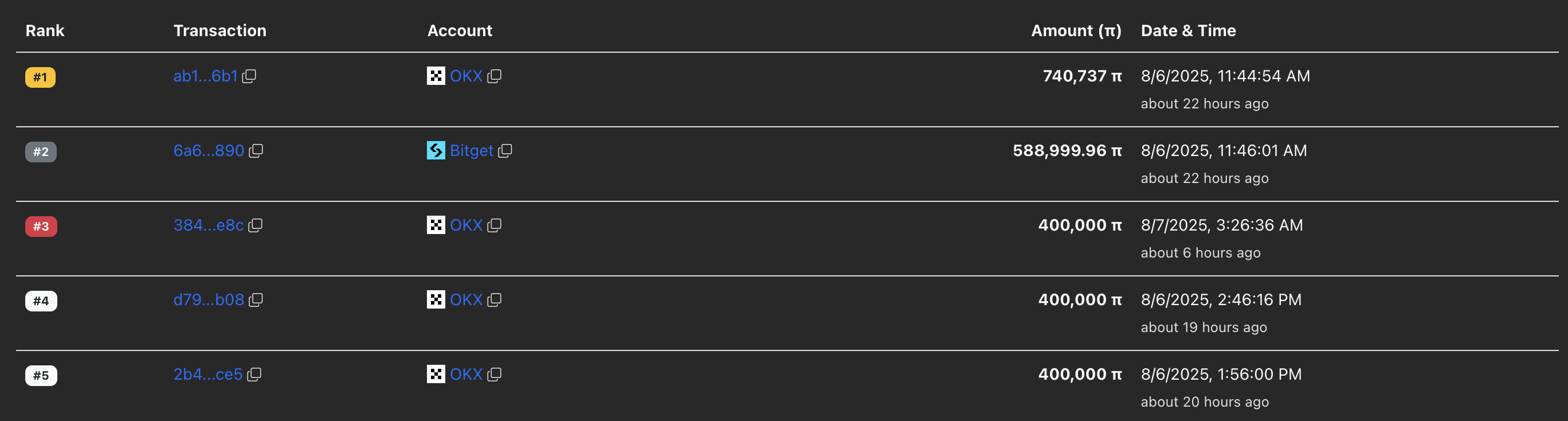

Large investors accumulate nearly 2 million PI tokens

PiScan data shows that, out of the five largest transactions on the Pi Network in the last 24 hours, four occurred on the OKX exchange. Notably, the transaction reflects investors withdrawing PI tokens from the exchange, a sign of accumulation reflecting confidence.

In total, the group of large investors accumulated 1.94 million PI tokens in the last 24 hours.

Large transaction data. Source: Piscan

Pi Network flashes bullish reversal chances

Pi Network appreciates over 1% so far in the day, extending the sideways trend between the S1 and S2 pivot levels at $0.3642 and $0.3191, respectively. The path of least resistance for PI tokens in the short term targets the S1 pivot level.

A potential close above this level could extend the reversal run to the centre pivot level at $0.4461.

Adding credence to a potential reversal, the Relative Strength Index (RSI) reads 26 on the daily chart, indicating oversold conditions. Typically, at saturated buying or selling pressure limits, trends reverse due to profit booking or investors buying the dip.

The Moving Average Convergence Divergence (MACD) line gradually approaches its signal line as the red histogram bars decline. This indicates the possibility of a trend reversal as bearish momentum gradually declines.

PI/USDT daily price chart.

On the downside, an extended correction could test the S2 pivot level at $0.3191. In case of a decisive close below this level, the PI token could target the S3 pivot level at $0.2372.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.