What Are CFDs?

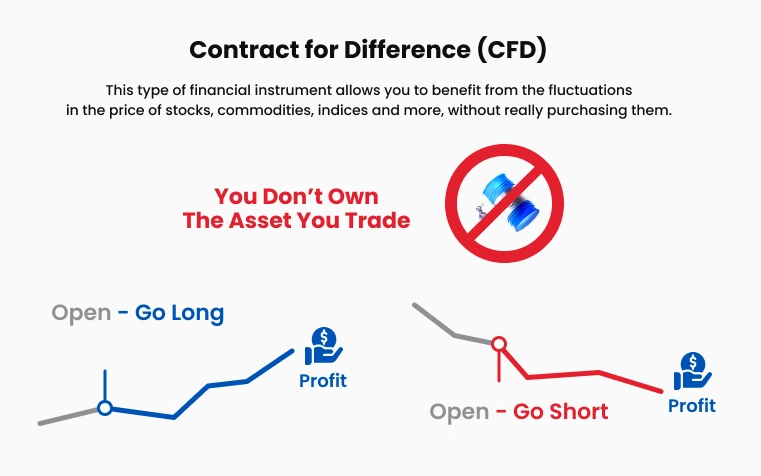

Contracts for Difference (CFDs) enable traders to speculate on the price movements of various financial instruments without owning the underlying assets.

Diverse Instruments: Trade across indices, commodities, equities, cryptocurrencies, and more.

Flexibility: Take long or short positions, allowing you to profit from both rising and falling markets.

Leverage: CFDs typically involve margin trading, which can amplify both potential profits and losses.

No Ownership: Traders do not own the underlying asset; the contract reflects only the price change.

What Is Forex Trading?

Forex trading involves buying and selling currency pairs to capitalize on fluctuations in exchange rates.

Largest Financial Market: The forex market operates 24 hours a day, five days a week, with a daily turnover exceeding $7 trillion.

Currency Pairs: Trading involves major, minor, and exotic currency pairs, such as EUR/USD or USD/JPY.

Liquidity: High liquidity in forex ensures rapid execution and tight spreads, particularly for major pairs.

Focus: Unlike CFDs, forex trading exclusively involves currency pairs.

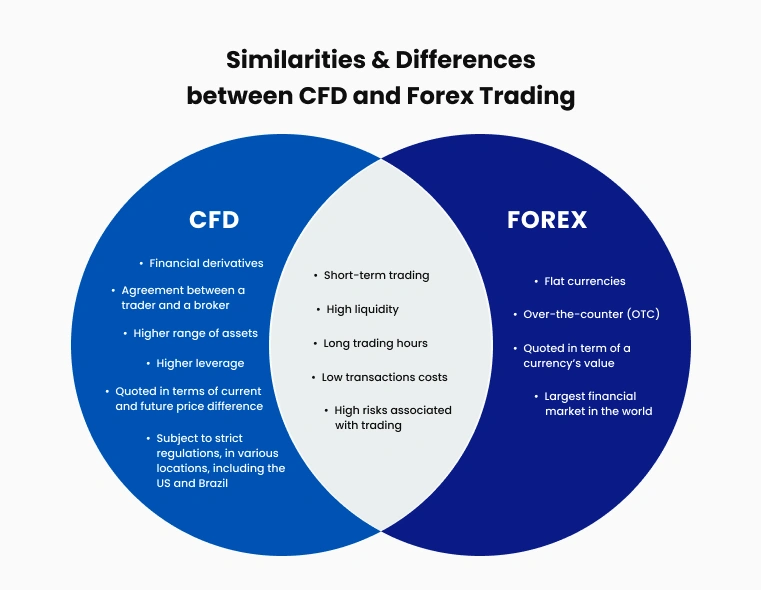

Similarities Between CFD and Forex Trading

Although they target different markets, CFD and forex trading share several key features:

Leverage: Both markets offer margin trading, allowing traders to control larger positions with a smaller capital outlay.

Short and Long Positions: Traders can profit from both upward and downward price movements in either market.

Online Trading Platforms: Both are primarily accessed via advanced online platforms equipped with technical analysis tools.

Risk Management Tools: Both markets commonly utilize stop-loss and take-profit orders to effectively manage risk.

Key Differences Between CFD and Forex Trading

Understanding the distinctions between CFD and forex trading is crucial to selecting the market that aligns best with your trading strategy.

Market Scope: CFDs provide access to a broad range of asset classes, whereas forex trading is limited exclusively to currency pairs.

Trading Hours: Forex markets operate continuously during weekdays, while CFD trading hours vary depending on the underlying asset.

Underlying Drivers: Forex prices are influenced by macroeconomic indicators, central bank policies, and geopolitical events, whereas CFD prices depend on the specific asset traded, such as a company’’s stock performance or a commodity’’s supply and demand dynamics.

Volatility: Both markets can exhibit volatility, but the factors affecting CFD and forex price movements differ, necessitating tailored risk assessment approaches.

Risks in CFD vs Forex Trading

Trading CFDs and forex involves substantial risks due to leverage and market volatility.

Leverage Risks: While leverage can increase potential profits, it also magnifies losses, making effective risk management essential.

Market Volatility: Sudden price swings in either market can lead to significant losses if positions are not carefully managed.

Lack of Asset Ownership: With CFDs, traders do not own the underlying asses, which may limit certain long-term investment strategies.

Knowledge Requirements: Success in both markets demands a strong grasp of trading methodologies, technical analysis, and market behavior.

CFD vs Forex: Which Should You Choose?

Choosing between CFDs and forex depends on your trading preferences, objectives, and risk appetite.

For Diversification: CFDs are suitable for traders seeking exposure across multiple asset classes.

For Focused Trading: Forex trading is ideal for those who prefer to specialize in currency markets.

Risk Management: Both markets require comprehensive risk management strategies due to the inherent risks associated with leveraged trading.

Start Trading with TMGM

Navigating the complexities of CFD and forex trading can be challenging, but selecting the right platform is crucial. TMGM provides an advanced trading environment with state-of-the-art tools, competitive spreads, and comprehensive educational materials designed to support trader success.

Whether you want to explore CFDs, forex, or both, TMGM offers the expertise and tools necessary to enhance your trading strategies.

Ready to advance your trading journey? Visit TMGM'’s website to access advanced trading insights and begin your path toward success in the dynamic markets of CFDs and forex.