What is an FX Calculator?

An FX calculator is a multifunctional tool designed to assist traders in making informed decisions by computing essential trading metrics.

It streamlines the calculation of profit, margin, pip value, and other key figures, saving time and minimizing the risk of errors.

By inputting parameters such as trade size, currency pair, leverage, and market price, traders can quickly gain insights into potential trade outcomes.

Why Use a Forex Profit Calculator?

- A forex profit calculator allows traders to estimate the potential profit or loss of a trade before execution.'

- It provides clarity on the financial impact of various trade scenarios, enhancing decision-making.

- With a forex profit calculator, traders can better align their strategies with their risk tolerance and objectives.

Key Metrics Calculated by an FX Calculator

1. Profit and Loss

Calculates the expected profit or loss for a trade based on entry and exit prices.

Assists traders in evaluating whether the trade justifies the risk.

The formula for Profit and Loss:

Profit/Loss = (Exit Price - Entry Price) × Trade Size × Pip Value

2. Margin Requirement

Calculates the minimum margin required to open a position.

Essential for managing leverage and preventing margin calls.

The formula for Margin:

Margin = (Trade Size × Contract Size) ÷ Leverage

3. Pip Value

Displays the monetary value of a single pip movement for a given trade size and currency pair.

Vital for setting stop-loss and take-profit orders.

4. Swap Fees

Estimates the cost or credit of holding a position overnight.

Important for traders employing swing or long-term strategies.

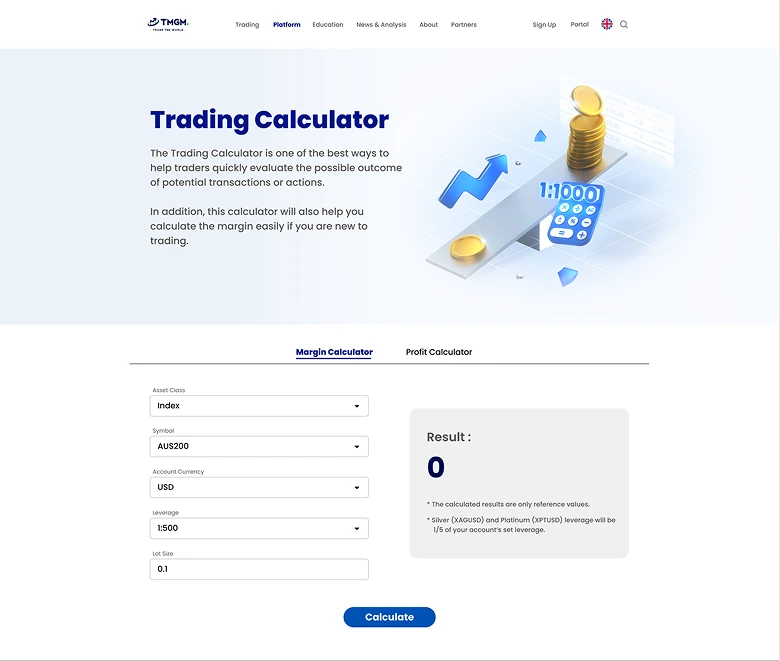

How to Use a Forex Profit Calculator

1. Enter Trade Details

Input the currency pair you intend to trade.

Specify the trade size in lots.

Enter the entry price and target price (or stop-loss level).

2. Choose Leverage and Account Currency

Select the leverage ratio you plan to use.

Specify your account’’s base currency for precise calculations.

3. Review Results

The forex profit calculator will immediately display profit/loss, margin requirement, and pip value.

Use this data to assess the trade’’s potential.

Benefits of Using an FX Calculator

- Enhanced Risk Management: Understand the capital at risk before entering a trade.

- Time Efficiency: Rapidly calculate multiple scenarios without manual effort.

- Improved Accuracy: Reduce errors in complex computations, especially when trading across multiple currency pairs.

- Better Planning: Optimize your strategies by testing various trade configurations.

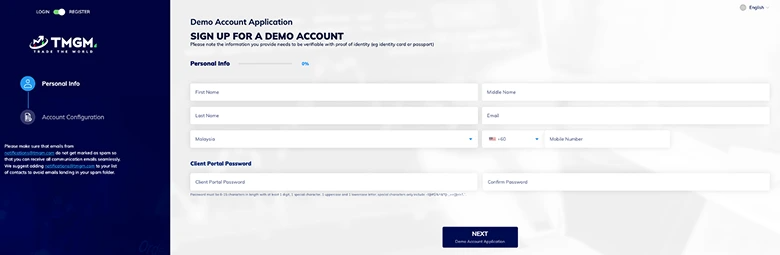

Opening a TMGM Demo Trading Account

- Register for a demo account on TMGM’’s platform.

- Practice using TMGM’’s Trading Calculator in a risk-free environment.

- Experiment with different trade sizes, leverage levels, and currency pairs to understand how the forex profit calculator functions.

- Gain practical experience to refine your trading strategies without risking real capital.

Maximize Foreign Currency Potential with TMGM’’s Forex Tools

TMGM’’s platform offers a comprehensive suite of tools, including a user-friendly trading calculator, to empower traders to make smarter decisions. Visit TMGM’’s trading calculator page to explore its features and enhance your trading performance.

Additionally, leverage TMGM’’s educational resources to improve your skills and develop effective growth strategies. Begin your journey to becoming a more knowledgeable and well-equipped forex trader by registering with TMGM today.