What Is a Pip? The Complete Guide to Mastering Forex Pips with TMGM

In India’s fast-growing forex market, understanding pips is absolutely essential. What is pips in forex? A pip (short for “percentage in point”) is the smallest unit of price movement in currency pairs. For Indian traders using US Dollar-based accounts, mastering pips in forex helps you calculate profits, manage risks, and design trading strategies. In this guide, we will explore what is pips in trading and what is pips in forex, its historical roots, and how the pips meaning in trading shapes modern forex operations in India. With TMGM’s advanced trading tools, you can efficiently track and manage pips, optimise your performance, and navigate forex moves in INR-pairs or global currencies with confidence.

What is a Pip in Forex Trading

In forex trading, pips are the building blocks of how traders measure market movement. What is pips in forex? A pip, short for “percentage in point,” is the smallest standardized change in the price of a currency pair. For most major and minor pairs, one pip equals 0.0001, while for pairs involving the Japanese Yen, one pip equals 0.01. For Indian traders, understanding pips meaning in trading is crucial because it directly affects how profits and losses are calculated. Though you are unlikely to trade USD/INR and instead would more likely trade global pairs like EUR/USD, pips in forex show you exactly how much the exchange rate has moved, making it easier to plan entries, exits, and risk management.

Where did Pips Originate in Forex

The concept of pips was created to standardize price movements across different currency pairs, making forex trading clearer and more consistent for traders worldwide. Before electronic platforms became common, price changes were often quoted in fractions like 1/16th of a point. With the move to decimal pricing, pips in forex became the universal way to measure and compare shifts in exchange rates. For Indian traders learning what is pips in trading, this history highlights why pips meaning in trading remains important even today. Moreso, it ensures every price movement is measured in the same way, no matter which currency pair you trade.

Why are Pips Important in Forex Trading

Measure price movements

Calculate profits and losses

Set stop-loss and take-profit orders

Determine position sizes

Compare volatility across different currency pairs

TMGM Insight: Understanding pips is crucial for using TMGM's trading platforms effectively. The MetaTrader 4 interface prominently displays pip movements, allowing for precise trade tracking.

What is the Value of Pip in Forex?

Standard Pip Measurement

A pip is the fourth decimal place in the exchange rate for most currency pairs. For example, in EUR/USD, a move from 1.1200 to 1.1201 is one pip.

Exceptions and Special Cases

Japanese Yen (JPY) pairs: A pip is the second decimal place. For example, in USD/JPY, a move from 110.50 to 110.51 is one pip.

Pipettes or Fractional Pips: Some brokers quote to the fifth decimal place. Example: A move from 1.12000 to 1.12001 is one pipette (1/10th of a pip).

Exotic Currency Pairs: May have different pip conventions. Example: USD/THB (US Dollar/Thai Baht) is often quoted with two decimal places.

Cryptocurrency Pairs: Often use different decimal conventions. Example: BTC/USD might consider a pip to be $1 or $0.1, depending on the exchange.

TMGM Feature: TMGM offers fractional pip pricing on many currency pairs, providing more precise pricing and potentially tighter spreads. This is particularly beneficial for scalpers and high-frequency forex traders.

The Psychology of Pips

Understanding how other forex traders perceive pips can give you an edge:

Round Numbers: Many traders place orders at round pip numbers (e.g., 1.2000 for EUR/USD), creating potential support/resistance levels

Pip Milestones: Large round-number pip moves (e.g., 100 pips) can influence market sentiment

TMGM Tool: Use TMGM's advanced charting tools like trend line in MetaTrader 4 to identify these psychological levels and anticipate market movements.

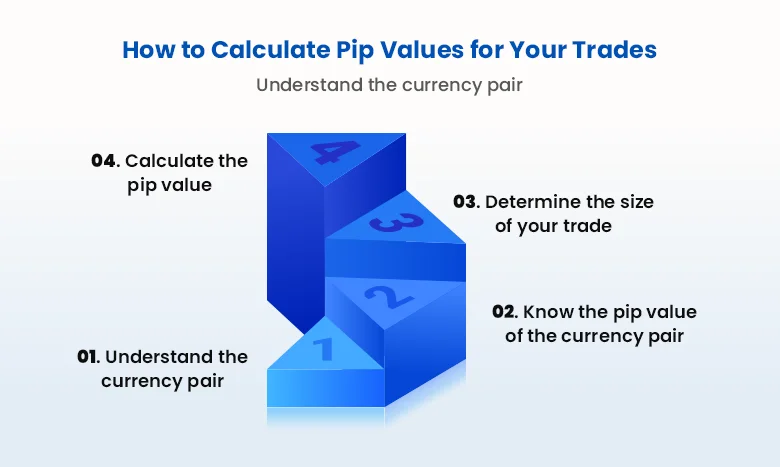

How to Calculate Pip Value in Forex?

Basic Formula to Calculate Pips

Pip Value = (1 pip / Exchange Rate) * Lot Size

Detailed Examples

EUR/USD trading 1 standard lot (100,000 units)

If EUR/USD is at 1.1200

Pip Value = (0.0001 / 1.1200) * 100,000 = $8.93 per pip

USD/JPY trading 1 mini lot (10,000 units)

If USD/JPY is at 110.50

Pip Value = (0.01 / 110.50) * 10,000 = $0.90 per pip

GBP/AUD trading 0.5 lot (50,000 units)

If GBP/AUD is at 1.8500

Pip Value = (0.0001 / 1.8500) * 50,000 = AUD 2.70 per pip

To convert to USD, multiply by the AUD/USD rate

Pip Value in Different Account Currencies

If your trading account is denominated in a currency different from the quote currency, an additional conversion is needed:

Example: Trading USD/CAD with a EUR account

Calculate the pip value in CAD

Convert the CAD value to EUR using the current EUR/CAD rate

TMGM Advantage: TMGM's pip value calculator automatically adjusts for your account currency, saving you time and reducing the risk of calculation errors.

How Does Leverage Affect Pip Value

Leverage doesn't change the pip value itself, but it does affect the impact of each pip on your account balance.

Example: With 1:100 leverage on a $1,000 account

You can control a $100,000 position (1 standard lot)

A 10-pip movement represents a $100 change in your account balance (10% of your initial deposit)

TMGM Risk Management: TMGM offers flexible leverage options and educational resources to help you understand and manage the risks of leveraged trading.

What are Advanced Pip-Based Trading Strategies?

Pip-Based Momentum Trading

Identify strong momentum using pip-based indicators like the Average Directional Index (ADX)

Enter trades when pip movement exceeds a certain threshold within a specified timeframe

Example Strategy:

If EUR/USD moves more than 20 pips in 15 minutes

And ADX is above 25 (indicating a strong trend)

Enter a trade in the direction of the movement

TMGM Tool: Use the ADX indicator in TMGM’s MetaTrader 4 platform to identify strong trends.

Pip Reversal Strategy

Identify overbought or oversold conditions using pip-based oscillators

Look for price reversals after significant pip movements

Example Strategy:

If GBP/USD has moved 100 pips in a day

And Relative Strength Index (RSI) is above 70 (overbought) or below 30 (oversold)

Consider a counter-trend trade

TMGM Feature: TMGM’s MT4 platform includes various oscillators and indicators to support this strategy.

Multi-Timeframe Pip Analysis

Compare pip movements across different timeframes to identify potential trend changes

Use pip-based moving averages on multiple timeframes for confirmation

Example Strategy:

If 50-pip MA crosses above 200-pip MA on a 1-hour chart

And 10-pip MA crosses above 50-pip MA on the 15-minute chart`

Consider entering a long position

TMGM Advantage: TMGM’s platforms allow for easy switching between multiple timeframes, facilitating this type of analysis.

How to Use Pips for Risk Management in Forex

Position Sizing Based on Pips

Determine the maximum amount you're willing to risk per trade (e.g., 2% of account balance)

Calculate position size based on your stop-loss in pips

Example:

Account Balance: $10,000

Risk per trade: 2% ($200)

Stop-loss: 40 pips

Pip Value: $1 per pip

Position Size = Risk / (Stop-loss in pips * Pip Value) = $200 / (40 * $1) = 5 mini lots

TMGM Tool: Use TMGM’s position size calculator to automate this process and ensure accurate risk management.

Trailing Stops in Pips

Set an initial stop-loss

Move the stop-loss as the trade moves in your favor, maintaining the same pip distance

Example:

Enter long EUR/USD at 1.1200 with 30-pip stop-loss at 1.1170

If the price moves to 1.1230, move the stop-loss to 1.1200 (maintaining 30-pip distance)

TMGM Feature: TMGM's MT4 platform makes it easy to implement trailing stops, helping you lock in profits while managing risk.

Risk-Reward Ratios Using Pips

Aim for a positive risk-reward ratio, typically 1:2 or higher.

Example:

Stop-loss: 30 pips

Take-profit: 60 pips

Risk-Reward Ratio: 1:2

TMGM Tip: Use TMGM's educational resources to learn more about effective risk-reward strategies in forex trading.

What is Pip Spread in Forex and How Do They Affect Trading Cost?

Understanding What are Pip Spreads

The spread is the difference between the bid and ask price, measured in pips. It represents the cost of entering a trade.

Example:

EUR/USD Bid: 1.1200

EUR/USD Ask: 1.1202

Spread = 2 pips

Types of Pip Spreads

Fixed Spreads: Remain constant regardless of market conditions

Variable Spreads: Fluctuate based on market liquidity and volatility

Impact of Pips Spreads on Trading Strategies

Scalping: Requires very tight spreads to be profitable

Long-term trading: Less affected by spreads

TMGM Advantage: TMGM offers competitive spreads, with some as low as 0 pips, making it suitable for various trading strategies, including scalping.

Calculating Total Trading Costs in Pips

Total Cost = Spread + Commission (if applicable)

Example:

Spread: 1.5 pips

Commission: 0.5 pips (round turn)

Total Cost = 2 pips per round turn

TMGM Transparency: TMGM provides clear information on spreads and any applicable commissions, allowing you to calculate your trading costs accurately.

Advanced Pip Concepts

Correlation and Pips

Understanding how pip movements in one currency pair might affect another.

Example: A 100-pip move in EUR/USD might correlate with a similar move in GBP/USD due to the shared USD component.

TMGM Tool: use TMGM’s correlation matrix to identify these relationships and potentially diversify your trading.

Pip Value Fluctuations

Pip values can change as exchange rates move, especially for pairs not quoted against your account currency.

Example: As USD/JPY rises, the pip value in USD terms for USD/JPY trades decreases slightly.

What is Slippage in Pips?

The difference between the expected entry/exit and execution prices often occurs during high volatility or low liquidity.

Example: You place a market order to buy EUR/USD at 1.1200, which executes at 1.1202, resulting in 2 pips of slippage.

TMGM Feature: TMGM's advanced execution technology aims to minimize slippage, especially during high-volatility periods.

Pip-Based Market Analysis

Measuring Volatility in Pips

Average True Range (ATR): Measures market volatility in pips

Bollinger Band Width: Another pip-based volatility measure

Example: An ATR of 100 pips for EUR/USD indicates high volatility, while an ATR of 30 indivates lower volatility.

Support and Resistance Levels in Pips

Identify key levels where price has repeatedly reversed, measured in pips from a reference point.

Example: EUR/USD might consistently reverse within a 50-pip range, indicating strong support and resistance levels.

Fibonacci Retracements in Pips

Use Fibonacci levels to identify potential reversal points, measured in pips.

Example: After a 200-pip move up, look for potential reversals at the 38.2% (76 pips) and 61.8% (124 pips) retracement levels.

TMGM Platform: TMGM's MetaTrader 4 platform includes all these analytical tools, allowing for comprehensive pip-based market analysis.

Pip Targets for Different Trading Styles

Scalping

Aim: 5-10 pips per trade

Timeframe: Minutes to hours

High frequency of trades

Requires very tight spreads and fast execution

TMGM Suitability: TMGM's low spreads and fast execution make it suitable for scalping strategies.

Day Trading

Aim: 10-20 pips per trade

Timeframe: Hours to one day

Moderate frequency of trades

Focuses on intraday price movements

TMGM Tool: Use TMGM's economic calendar to identify potential intraday trading opportunities based on economic releases.

Swing Trading

Aim: 50-100 pips per trade

Timeframe: Days to weeks

Lower frequency of trades

Captures larger market swings

TMGM Feature: TMGM's MT4 platform allows for setting wider stop-losses and take-profits, which is suitable for swing trading.

Position Trading

Aim: 100+ pips per trade

Timeframe: Weeks to months

Low frequency of trades

Focuses on long-term trends and fundamental factors

TMGM Resource: Utilize TMGM's long-term market analysis and fundamental research to support position trading strategies.

Practical Tips for Pip-Based Trading with TMGM

Start with a Demo Account: Open a TMGM demo account to practice pip calculations and try out strategies without risking your capital. This is especially useful if you’re new and still learning pips meaning in trading.

Use TMGM’s Educational Resources: TMGM’s guides and webinars help Indian traders understand how pips in forex work in real-world scenarios, making it easier to calculate profits and losses.

Leverage TMGM’s Analysis Tools: On platforms like MT4 and MT5, TMGM provides built-in indicators that make pip-based analysis simpler, whether you’re trading USD/INR or other global currency pairs.

Track Your Pip Performance: Maintain a trading journal that records your wins and losses in pips. This habit helps identify strengths and weaknesses in your strategies.

Stay Informed: TMGM’s daily market insights can help Indian traders anticipate potential pip movements, especially during major RBI announcements or global economic events.

Gradual Progression: Begin by setting broader pip targets, and as you gain confidence, fine-tune your strategies with smaller pip goals for more precise trading.

Commit to Continuous Learning: Forex markets evolve constantly. By staying updated with TMGM’s educational tools and research, you can refine your approach and better apply what is pips in trading in different market conditions.

Get started today - Begin Your Forex Trading Journey with TMGM!

Start exploring the world of forex trading in India and take the first step towards building your financial future with TMGM. Whether you’re just discovering what is pips in forex or looking to diversify your portfolio, TMGM’s platform provides the tools, guidance, and resources you need to trade with confidence. By learning what is pips in trading and applying it effectively, Indian traders can unlock new opportunities in both INR-based pairs and global markets.

Remember, while mastering pips meaning in trading is essential, it’s only one part of a complete trading strategy. TMGM supports you with webinars, guides, and advanced analysis tools designed to help you refine your forex skills.

To trade responsibly, always practice sound risk management. Consider starting with a TMGM demo account, where you can test pip calculations and strategies in real-time conditions before moving on to live trading.

Trade Smarter Today

Account

Account

Instantly