Gold Silver Ratio Guide: Chart, Calculation & Example

The Gold to Silver Ratio (GSR) is a key indicator used by traders to assess the relative valuation of gold compared to silver. Monitoring this ratio enables traders to identify potential trading opportunities, particularly when the ratio diverges notably from its historical norm. Whether leveraging a high GSR by increasing exposure to silver or benefiting from a low GSR through long gold positions, comprehending the intrinsic relationship between these two metals allows traders to effectively capitalize on market trend reversals.

What is the Gold-Silver Ratio?

The Gold-Silver Ratio (GSR) indicates how many ounces of silver are required to purchase one ounce of gold. This ratio has varied over centuries, reflecting the changing relative values of these two precious metals. Below are key factors influencing the GSR.

Market participants closely monitor the GSR as it reveals different market dynamics within the precious metals sector.

Inflation and Deflation: During inflationary periods, investors typically seek gold as an inflation hedge, driving gold prices higher and increasing the GSR. Conversely, during deflationary phases, silver’s industrial demand may enhance its appeal, potentially compressing the GSR.

Market Sentiment: Gold is widely regarded as a “safe-haven” asset, prompting investors to increase gold exposure amid economic or geopolitical uncertainty, which tends to elevate the GSR.

Industrial Demand: Silver’s extensive industrial applications—from electronics to renewable energy—mean that during periods of robust economic growth, silver prices may appreciate relative to gold, narrowing the GSR. Conversely, a slowdown in industrial demand can weaken silver prices, resulting in a higher GSR.

Central Bank Policy: Monetary policy, particularly interest rate adjustments, also influences the GSR. Low interest rates enhance gold’s appeal as a store of value, pushing its price up and increasing the GSR.

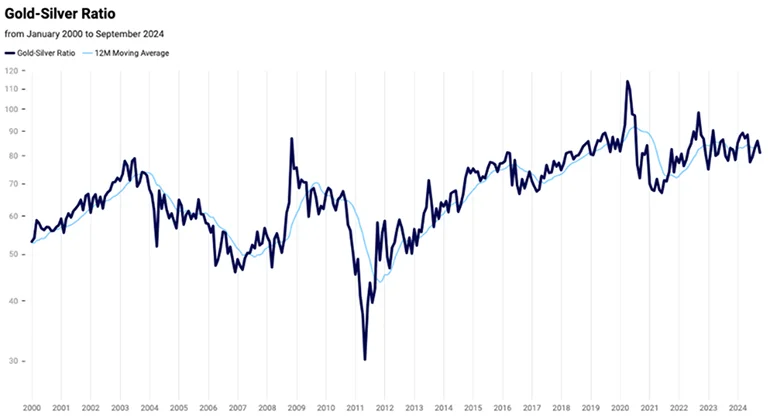

Historical Gold-Silver Ratio Chart

How to Calculate the Gold-Silver Ratio

Calculating the Gold-Silver Ratio is straightforward and offers a quick assessment of the relative valuation between gold and silver.

For example, if gold is priced at $2,752 per ounce and silver at $34 per ounce:

[Equation]

This implies that purchasing one ounce of gold requires 81 ounces of silver.

Trading with the Gold-Silver Ratio

The Gold-Silver Ratio is widely used by precious metals traders who adjust their positions based on significant shifts in the GSR trend. Typically, traders seek to optimize their portfolios by capitalizing on cyclical movements between gold and silver.

High Ratio Example

Market Context: At the onset of the COVID-19 pandemic, the GSR surged to 114.28 as investors sought gold’s safety. Gold reached approximately $1,591.93 per ounce, while silver was priced at $13.93.

Trade: At this elevated ratio, a trader could have exchanged one ounce of gold for about 114 ounces of silver, anticipating a decline in the ratio as market conditions normalized.

Low Ratio Example

Market Context: In February 1980, amid high inflation and strong silver demand, the ratio dropped to 15.69, with gold at $557.39 and silver at $35.52.

Trade: At this low ratio, a trader could exchange 15 ounces of silver for one ounce of gold, leveraging silver’s relative strength during this timeframe.'

Using Long-Term Averages

Market Context: If the GSR significantly exceeds its long-term average, it may signal that gold is overvalued relative to silver, and vice versa.

Trade: Traders might sell gold and buy silver or take a short position on gold while going long on silver, anticipating a reversion to a lower GSR.

Overall Average GSR

Since December 1999, the average Gold-Silver Ratio has been approximately 67.2*. This benchmark helps traders identify when the GSR deviates markedly from historical norms.

*Data as of September 2024

Why Trade Precious Metals with TMGM

Trading precious metals such as gold and silver with TMGM offers numerous advantages that enable traders to seize market opportunities with confidence and flexibility. Here’s why TMGM is the premier platform for precious metals trading:

Advanced Trading Tools: TMGM delivers robust analytical tools, including live price charts, customizable technical indicators, and real-time market data, empowering you to make well-informed trading decisions.

Flexible Leverage Options: Leverage your trading strategy by opening larger positions with smaller capital requirements. This flexibility can amplify potential returns while enabling effective risk management.

Competitive Spreads and Low Fees: TMGM offers tight spreads on gold and silver CFDs, ensuring that a greater portion of your capital is allocated to trading rather than costs.

24/5 Market Access: Access precious metals markets around the clock during trading days, providing the flexibility to respond promptly to market movements.

Security and Reliability: TMGM is a regulated and reputable broker committed to safeguarding client assets and ensuring a secure trading environment.—Trade with confidence at TMGM.

Ready to Get Started?

Sign up now and access global markets in under 3 minutes.

Trade Smarter Today

Account

Account

Instantly