Why is Gold Valuable?

Despite the transition to a fiat currency system, where currency is government-issued, gold continues to hold significant value and remains highly sought after as both a commodity and an investment asset. For example, central banks retain gold reserves as part of their liquidity management strategies.

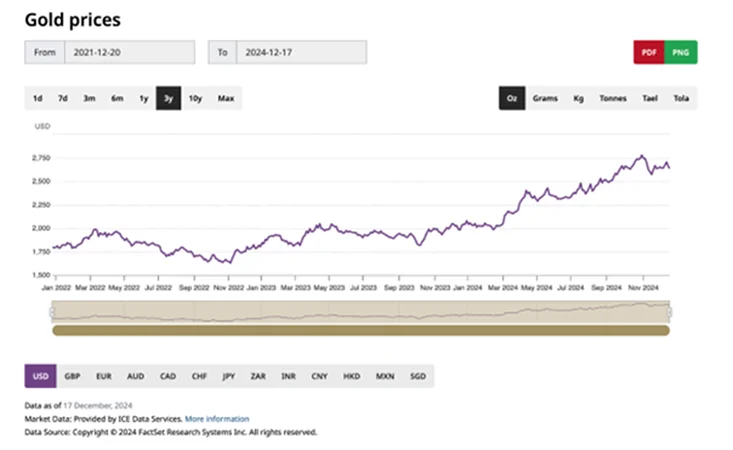

Since 2021, corporations have been acquiring gold at record levels. Gold spot prices in 2024 have shown a steady upward trend, reaching a peak around late October.

Is Gold a Good Investment?

Although it can add diversification and stability to an investment portfolio, gold has historically demonstrated inconsistent performance as a standalone investment asset.

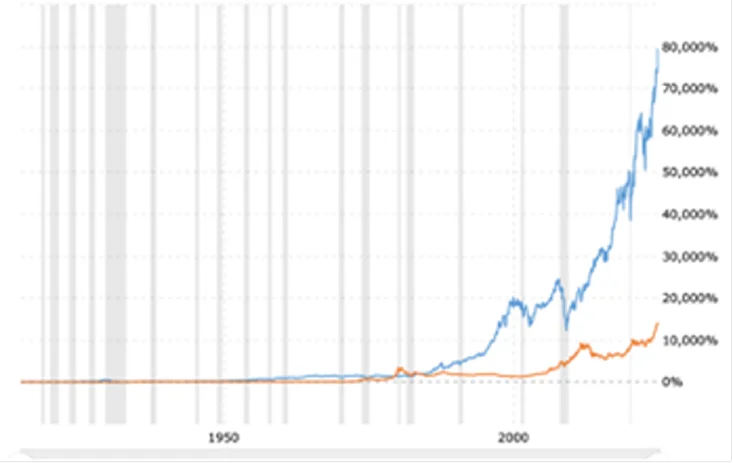

(Chart via Macrotrends)

The chart above spans 100 years, comparing the historical percentage returns of the Dow Jones Industrial Average (blue line) against gold price returns (orange line). The grey bars indicate periods of economic recession.

In terms of total returns, the Dow Jones Industrial Average has outperformed, appreciating over 900%, whereas gold increased by over 500%. Therefore, investors with a heavier allocation to Dow Jones equities would have realized greater profits than those invested exclusively in gold.

Nonetheless, holding gold (XAUUSD) within a diversified portfolio still offers strategic advantages. As illustrated, gold tends to outperform equities during recessionary periods. This underscores gold's distinctive role as an asset class and suggests a low or even negative correlation with stock markets.

Given its intrinsic value, gold is a valuable addition to any trader’s portfolio, serving as a hedge against market volatility and inflationary pressures.

Why Do Investors Favor Gold?

Liquidity

Liquidity refers to how quickly and easily an asset can be bought or sold in the secondary market. Equities typically exhibit high liquidity, enabling rapid transactions, whereas real estate is less liquid, often requiring weeks or months to complete a sale.

Gold is among the most liquid markets globally. Physical gold holdings are estimated at approximately $5.1 trillion, with an additional $1 trillion in open interest via derivatives. This substantial liquidity provides traders with flexibility in executing trades, allowing swift entry and exit from positions, which facilitates effective risk management.

Diversification

Portfolio diversification mitigates risk. By allocating investments across multiple asset classes, investors can reduce exposure to market volatility.

Gold’s low correlation with equity markets makes it an attractive investment choice. During the 2008 Global Financial Crisis, hedge funds, real estate, and equities declined sharply, whereas gold preserved its value and appreciated by 21%.

Store of Value

Gold’s demand is driven by its limited supply, making it a scarce resource influenced by supply and demand dynamics.

Gold has demonstrated resilience over time, maintaining its purchasing power throughout history. Investors can safeguard their capital by allocating funds to gold.

Returns

Gold also tends to appreciate steadily over the long term. While other asset classes, such as equities, exhibit higher volatility, gold remains one of the most reliable investments for preserving wealth.

How to Invest in Gold for Beginners?

Gold IRA

By rolling over a portion of their Individual Retirement Account (IRA) into a gold-backed IRA, investors can diversify their portfolios and gain exposure to this asset class.

Owning Physical Gold

Holding physical gold in the form of bullion, bars, or coins is a viable investment option. Traders can acquire gold from authorized dealers, jewelry retailers, or pawnshops.

However, storing physical gold can be cumbersome, and investment-grade gold must have a minimum purity of 99.5%. Additionally, producing jewelry at such high purity levels is challenging; therefore, if investors include gold jewelry in their portfolios, they should be aware that it typically carries a lower intrinsic value.

Gold CFDs

Contracts for Difference (CFDs) provide an alternative investment method, allowing traders to speculate on gold price movements without owning the physical metal. This enables investors to profit from both rising and falling prices while avoiding the complexities of physical storage.

Gold Futures

Gold futures are standardized contracts obligating the buyer and seller to transact a specified quantity of gold at a predetermined price on a future date, regardless of market fluctuations.

Futures contracts serve as effective tools for hedging against market volatility and can also be utilized to anticipate price trends.

Gold ETFs and Gold Mining Stocks

Gold Exchange-Traded Funds (ETFs) and gold mining equities offer alternative exposure to gold without requiring physical ownership. Gold ETFs provide diversified access to various sectors and companies within the gold industry. If uncertain about which ETF to select,’ opt for gold ETFs with strong historical performance records.