What is the FTSE 100 Index?

Owned by the London Stock Exchange Group, the FTSE 100 Index is the United Kingdom’’s most prominent stock market index, comprising the 100 largest companies by market capitalization listed on the London Stock Exchange.

Managed by the FTSE Group, its prices are updated every 15 seconds from 8 a.m. to 4:30 p.m. UK time. The UK FTSE 100 Index functions similarly to major US stock indices such as the Dow Jones Industrial Average.

The index value is calculated by weighting all stocks listed on the London Stock Exchange by their market capitalization. The top 100 companies with the highest market caps are included in the index. Key points to consider include:

Stocks with larger market capitalizations have a greater influence on the index, significantly impacting its price movements.

Therefore, when the index rises, it reflects an overall increase in the combined market value of its constituent companies.

However, an increase in the index does not imply that all companies within it have rising market capitalizations.

How to Trade the FTSE 100 Index

Open an account with a reputable trading platform. Platforms such as TMGM offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5), where traders can monitor the FTSE 100 Index’s performance, invest in exchange-traded funds (ETFs), or trade contracts for difference (CFDs) on the FTSE 100 Index.

For those new to trading, consider using a demo account to practice risk-free trading.

Select your preferred trading instrument.

With CFDs, you can trade the FTSE 100 Index, global stock indices, forex pairs, and shares of over 200 of the UK’’s largest companies.

ETFs track the FTSE 100 Index’s performance and allow you to invest in over 300 of the UK’’s largest companies.

Start trading. To add the FTSE 100 Index to your portfolio, click here to open an account.

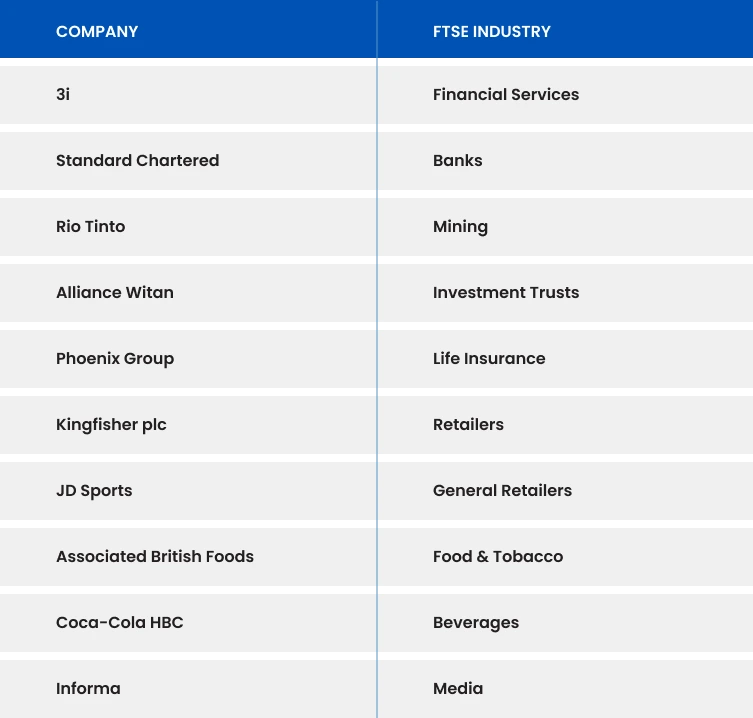

FTSE 100 Companies

Established in 1984 by the Stock Exchange to replace the Financial Times’’ FT 30 Index, the FTSE 100 Index provides a more accurate reflection of market activity. Over time, the composition of companies has evolved due to changes in market capitalization and corporate mergers. Not all 100 companies are UK-based, as the index does not require this; however, many constituents are headquartered abroad.

Here are some of the FTSE 100 companies included in the index:

To view the full list, visit the London Stock Exchange website.

Getting started with a FTSE 100 Trading Strategy

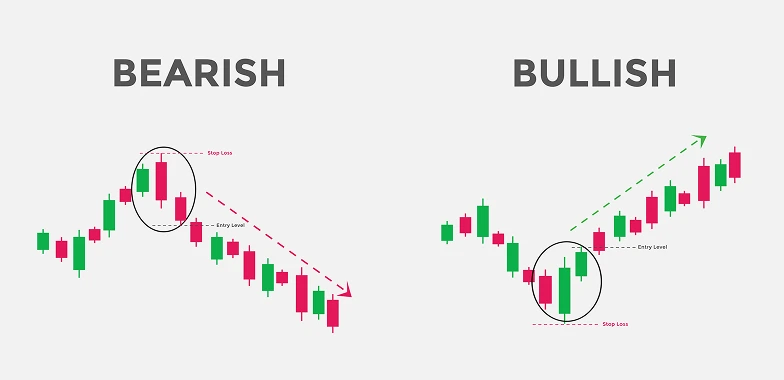

Traders often employ technical analysis and price action patterns as part of their strategy for trading the FTSE 100. These help identify optimal entry and exit points. One commonly used price action pattern is the engulfing candlestick pattern:

Bearish engulfing candlestick pattern

This candlestick formation occurs when the body of the current candlestick completely engulfs the body of the previous one. This pattern signals a potential reversal in an upward price trend, indicating that the prior bullish momentum is weakening and a downward reversal may be imminent.

Bullish engulfing candlestick pattern

This pattern is characterized by a white candlestick that closes above the previous day’s open after opening below the previous day’s close. It is a reversal pattern indicating a possible shift from a downtrend to an uptrend.

However, as with all technical analysis, this pattern does not guarantee outcomes. Traders should combine it with other indicators and implement sound risk management.

What moves the FTSE 100 Index?

Economic and political factors are the primary drivers of the FTSE 100 Index. During periods of economic growth, stock markets generally trend upward, supported by higher employment rates, increased consumer spending, and greater corporate profitability. When companies generate higher profits, they attract more investors, which can further boost the stock market. Investors monitor a variety of factors, including:

Inflation rates

Employment levels

Interest rates

Consumer spending data

Currency fluctuations

Traders often keep up to date with UK-specific financial news and breaking developments. Trading around unexpected news events can be challenging, so having the right trading tools is essential. TMGM offers a transparent trading environment and access to hundreds of instruments across six asset classes. To learn more, click here.