What is the Risk-Reward Ratio (RRR)

The Risk-Reward Ratio (RRR) is a fundamental trading metric that assists in evaluating potential gains against potential losses. This ratio is essential for effective risk management, helping traders determine if a position is justified based on its expected reward compared to the associated risk. Utilizing the RRR in trade analysis allows traders to establish precise profit targets, manage risk exposure efficiently, and execute more informed trading strategies.

What is the Risk-Reward Ratio (RRR)?

The Risk-Reward Ratio (RRR) quantifies the proportional relationship between the anticipated profit from a trade and the amount at risk if the trade results in a loss.

It enables traders to establish realistic profit targets, set stop-loss orders, and is a fundamental component of effective risk management.

Understanding Reward

In trading, a reward represents the expected profit from an investment. This potential gain incentivizes traders to enter positions, but rewards constitute only one side of the equation. The reward is calculated based on target prices or the potential profit traders aim to realize.

Assessing rewards involves technical analysis tools, such as exit signals, and evaluating market conditions to identify attainable profit objectives.

Understanding Risk

Risk in trading refers to the possibility that a trade may not yield the expected result: when price moves unfavorably, causing a financial loss. This potential loss, also known as a “drawdown", can be significant, particularly in volatile markets characterized by rapid price fluctuations. Risks encompass various factors, including market volatility, liquidity constraints, and leverage exposure. Effective risk management requires traders to identify risk sources and implement measures to mitigate exposure.

Risk calculation in Forex trading involves multiple metrics, from the probability of adverse outcomes to the scale of potential loss. Typically, risk assessment in Forex focuses on the maximum potential loss per trade, accounting for leverage and margin requirements.

For instance, if a trader executes a leveraged position with a stop-loss set at a specific price, the risk equals the difference between the entry and stop-loss levels.

Example of RRR Calculation

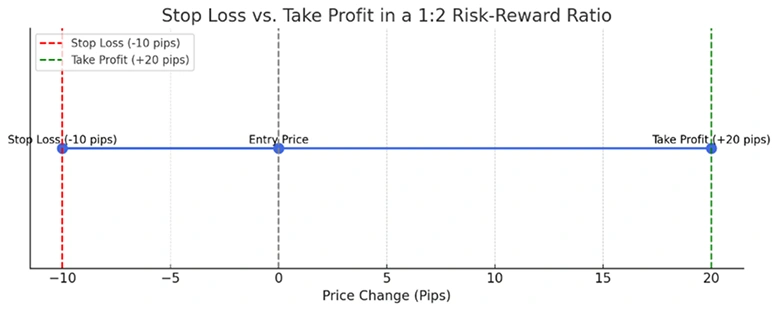

The chart below demonstrates a stop-loss versus take-profit strategy with a 1:2 RRR configuration. The maximum risk is set at -10 pips, while the maximum reward is +20 pips.

To calculate the RRR, follow these straightforward steps:

1) Determine the Risk: Calculate the difference between the entry price and the stop-loss level.

2) Determine the Reward: Calculate the difference between the target price and the entry price.

3) Calculate the Ratio: Divide the reward by the risk to obtain the RRR.

Example Calculation:

Entry Price: 1.2000

Target Price: 1.2200 (Reward of 200 pips)

Stop-Loss Price: 1.1900 (Risk of 100 pips)

In this example, the RRR is 200 pips (reward) / 100 pips (risk) = 2:1. The trader aims to earn $2 for every $1 risked.

How Are Risk and Reward Related?

There’ is a fundamental principle in trading: higher potential rewards typically entail higher risks. This correlation is evident across asset classes, where “low-risk” instruments such as government bonds generally yield lower returns, while higher-risk assets like equities or alternative investments offer the possibility of greater gains.

Examples of Asset Classes by Risk Level:

Low Risk: Treasuries, Cash

Moderate Risk: Government Bonds, Corporate Bonds

Higher Risk: Junk Bonds, Large-Cap Equities

High Risk & Volatile: Small-Cap Equities, Alternative Investments (such as commodities and cryptocurrencies)

With TMGM as your trusted broker, you gain access to a broad spectrum of markets and asset classes , enabling you to trade instruments that align with your risk appetite.

What is Considered a Good RRR?

An optimal RRR varies among traders and depends on factors such as risk tolerance, trading methodology, and prevailing market conditions.

An RRR of 2:1 or greater is preferred by aggressive traders, indicating the potential profit is twice the potential loss.

For more conservative traders, a lower RRR may be suitable to prioritize steady gains and capital preservation.

The RRR should be aligned with the trader’s overall strategy. Maintaining consistent ratios tailored to one’s trading style and objectives is often advantageous. Regardless of the chosen ratio, adhering to a disciplined RRR framework supports effective risk management.

When to Use the RRR While Trading?

Set Specific RRR Targets: Before entering a trade, establish an RRR based on your risk preferences and market analysis. Defining targets facilitates evaluating whether a trade aligns with your risk management objectives.

Analyze Trades Based on the RRR: Evaluate if the RRR justifies the trade. Even trades with high probability may not be advisable if the reward does not adequately compensate for the risk.

Understand RRR Limitations: While RRR is a useful metric, it does not incorporate probabilities or win rates. Traders should integrate RRR analysis with win/loss ratios, technical indicators, and comprehensive research to fully assess trade viability.

Common Sources of Risk in Forex Trading

Although drawdown and risk can be quantified, many risk factors may not be fully priced in. Awareness of these risks is crucial for developing a robust trading strategy. Common risk sources in Forex trading include, but are not limited to:

Market Risk

Liquidity Risk

Leverage Risk

Currency (Forex) Risk

Interest Rate Risk

Counterparty Risk

Behavioral Risk

Event Risk

Learn more with TMGM

Enhance your risk management expertise with TMGM’’s comprehensive educational resources, including trading guides, market analysis, and professional insights. Explore the extensive range of tradable markets, and learn more about Contracts for Difference (CFDs). All available at TMGM.com.

Begin building a resilient trading strategy with TMGM as your reliable partner!

Register now and access global markets in under 3 minutes.

Trade Smarter Today

Account

Account

Instantly