Key Takeaways

- While day trading focuses on capitalizing on intraday price movements and avoiding overnight exposure, sustained success relies on disciplined strategy development and rigorous risk management rather than solely on trading tools.

- Top Day Trading Strategies include trend-following techniques (using Moving Averages and MACD), reversal setups (such as RSI signals and double tops/bottoms), and breakout approaches (range or opening-range breakouts), each incorporating predefined entry points, stop-loss levels, and profit targets.

- Always seek Confluence for Trade Confirmation —Moving Averages, RSI/Stochastics, Bollinger Bands, VWAP, ATR—combined with high-probability chart patterns and volume analysis to time entries and implement adaptive stop placements.

- Consistency in profitable day trading improves when traders control emotional biases like fear, greed, and revenge trading by applying probability-based thinking, focusing on process adherence, strictly following rules, and maintaining detailed trade journaling and review.

- A robust trading system documents market conditions, trade setups, entry and exit criteria, and position sizing rules, then verifies its edge through backtesting and real-time simulated trading before deploying live capital.

- Risk management underpins trading outcomes: limit risk to 1–2% per trade using Position Size = Capital at Risk ÷ Stop-Loss, utilize fixed, ATR-based, or technical stops, cap drawdowns, and target a minimum ≥1:2 risk-to-reward ratio.

Day Trading Strategy Fundamentals for Beginners

Understanding Market Structure in Day Trading

This guide covers profitable CFD trading strategies, technical analysis methods, and risk management techniques employed by experienced traders. It assists both novice and advanced traders in refining their approach for consistent profitability. Prior to implementing any CFD day trading strategy, it's critical to understand the market structure of the instruments you're trading. Different markets—stocks, forex, futures, or cryptocurrencies—each exhibit distinct characteristics:

Stock Markets: Influenced by company fundamentals, sector trends, and overall market sentiment

Forex Markets: Driven by macroeconomic indicators, interest rate differentials, and geopolitical developments

Futures Markets: Affected by supply-demand dynamics, seasonal factors, and underlying spot markets

Cryptocurrency Markets: Impacted by technological innovations, regulatory updates, and adoption rates

Understanding these structural differences helps determine which strategies are most effective under specific market conditions.

Selecting the Appropriate Time Frames for Your Day Trading Strategy

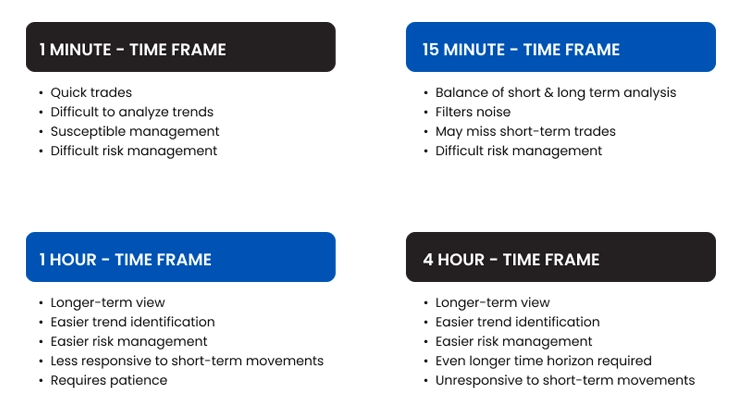

Day traders generally focus on shorter time frames, but successful traders often employ multi-timeframe analysis:

1-minute and 5-minute charts: Used for precise entry and exit timing

15-minute and 30-minute charts: Assist in identifying intraday trends and support/resistance zones

1-hour and 4-hour charts: Provide broader intraday trend context

Daily charts: Offer perspective on key levels and overall market direction

Utilizing multiple time frames delivers a comprehensive market view and helps filter out false signals common in lower time frames.

Figure 1: Informational chart titled "Day Trading Time Frames", outlining various time frames used in day trading and their respective benefits and challenges

Core Risk Management Principles for Traders

Before delving into specific strategies, it's essential to establish sound risk management protocols. A fundamental rule is to never risk more than 1-2% of your trading capital on any single trade, ensuring losses remain controlled. Maintaining a risk-to-reward ratio of at least 1:1.5, ideally 1:2 or higher, helps optimize returns relative to risk.

Implementing hard stop-loss orders is critical to protect against adverse market moves and limit drawdowns. Additionally, monitoring performance metrics enables traders to identify strengths and weaknesses for ongoing improvement. These fundamentals provide the foundation for profitable and sustainable day trading strategies.

Top Profitable Day Trading Strategies

Reliable Trend-Following Strategy

Trend following remains one of the most dependable day trading methods, based on the premise that prices generally continue in their current direction until a significant reversal occurs.

Mastering the Moving Average Trading Strategy

Figure 2: Technical analysis chart displaying the EUR/USD currency pair on a daily timeframe with a 50-day Simple Moving Average (SMA) applied

This strategy utilizes moving averages to determine trend direction and potential trade entries:

Plot two moving averages—commonly a 20-period Exponential Moving Average (EMA) and a 50-period EMA

Enter long positions when the shorter EMA crosses above the longer EMA

Enter short positions when the shorter EMA crosses below the longer EMA

Place stop-loss orders below recent swing lows for longs or above recent swing highs for shorts

Take profits at predefined targets or when moving averages indicate a potential trend reversal

MACD Trend Trading: A Day Trading Tool

Figure 3: Technical chart demonstrating the use of the Moving Average Convergence Divergence (MACD) indicator on the EUR/USD daily chart

The MACD indicator helps identify trend momentum and potential reversals:

Enter long trades when the MACD line crosses above the signal line during an uptrend

Enter short trades when the MACD line crosses below the signal line during a downtrend

Confirm signals with additional indicators such as RSI or volume

Exit positions when the MACD line crosses back in the opposite direction

Reversal Trading Strategy to Capture Market Turning Points

Reversal strategies seek to identify the onset of new trends as the market changes direction.

Oversold/Overbought Reversals

Figure 4: Technical chart illustrating overbought and oversold conditions, commonly identified using momentum oscillators like the Relative Strength Index (RSI) or Stochastic Oscillator.

This strategy employs momentum oscillators such as Relative Strength Index (RSI) to pinpoint potential reversal zones:

Identify extreme overbought conditions (RSI above 70) or oversold conditions (RSI below 30)

Look for divergence between price and oscillator (price making new highs/lows while the indicator does not)'

Wait for confirmation candlestick patterns (engulfing, hammer, shooting star, etc.)

Enter trades with tight stop-losses beyond the extreme price points

Take profits at significant support/resistance levels or when momentum fades

Double-Top and Double-Bottom Formations Explained

This pattern-based strategy targets reversals at critical technical levels:

Identify markets that have tested the same support or resistance level twice

Enter short positions when price breaks below the "neckline" following a double top

Enter long positions when price breaks above the "neckline" following a double bottom

Place stop-loss orders above/below the pattern extremes

Set profit targets equal to the height of the pattern

Breakout Trading Strategies: Ideal for High Alpha Returns

Figure 5: Depicts a resistance breakout, a fundamental concept in technical analysis used to identify potential trend continuations or reversals

Breakout strategies exploit strong price moves when the market breaches established support or resistance levels.

Range-Breakout Strategy: Capturing Early Momentum

Identify assets trading within a defined range (bounded by clear support and resistance)

Monitor for price approaching range boundaries accompanied by rising volume

Enter long trades on a breakout above resistance or short trades on a breakdown below support

Place stop-loss orders just inside the broken range

Set profit targets equal to the range height

Opening-Range Breakout for Intraday Gains

This approach leverages the initial trading range established during market open:

Define the high and low of the first 30 minutes (or first hour) of trading

Enter long trades when price breaks above the opening range high

Enter short trades when price breaks below the opening range low

Place stop-loss orders at the opposite end of the range

Take profits at key support/resistance zones or use trailing stops

Scalping Techniques: Rapid Profit Opportunities

Figure 6: Demonstrates a scalping strategy applied to a EUR/USD forex chart on an hourly (H1) timeframe

Scalping involves executing numerous trades daily to capitalize on small price fluctuations.

Bid-Ask Spread Scalping Techniques

This method is particularly effective in forex and futures markets:

Select instruments with tight bid-ask spreads

Enter trades aligned with the immediate short-term trend

Target profits of 5-10 pips or ticks

Use tight stop-losses, typically 2-5 pips or ticks

Exit positions swiftly, often within minutes

Order Flow Scalping: Analyzing Market Depth

This advanced technique leverages order flow data to detect institutional buying and selling activity:

Utilize time and sales data and/or depth of market (DOM) information

Identify large orders or imbalances between buy and sell orders

Trade in the direction of dominant order flow

Exit when order flow imbalance diminishes

Maintain strict risk management with predefined stop-losses

Gap Trading Techniques for Intraday Moves

Gap trading exploits price gaps between the previous day’s close and the next day's open.

Gap-Fill Strategy: Trading Overnight Gaps

Identify stocks or futures opening with significant gaps from the prior close'.

Analyze the gap type (common, breakaway, runaway, or exhaustion gap)

For common gaps, enter trades anticipating gap fill (price returning to previous close)

For breakaway or runaway gaps, trade in the gap’s direction

Place stop-losses beyond key support or resistance levels

Take profits when the gap fills or at predefined price targets

Essential Technical Analysis Tools for Day Trading Strategies

Key Technical Indicators

Successful day traders typically combine the following technical indicators:

Moving Averages (Simple and Exponential): Identify trend direction and potential support/resistance zones

RSI for Overbought/Oversold Conditions: Measure momentum extremes

Stochastic Oscillator for Entry Timing: Identify potential reversal points

Bollinger Bands for Volatility Breakouts: Assess volatility and price targets

VWAP (Volume-Weighted Average Price): Intraday price benchmark

ATR-Based Stops: Volatility-Adjusted Stop Placement: Use Average True Range (ATR) to set dynamic stop-loss distances

The key is to avoid indicator overload and select complementary tools that address different facets of price action.

Chart Patterns Every Day Trader Should Master

Recognizing high-probability chart patterns significantly enhances trading performance by signaling potential price movements. Continuation patterns like flags, pennants, and triangles suggest trend persistence. Reversal patterns such as head and shoulders, double tops/bottoms, and island reversals indicate possible trend changes and critical turning points.

Candlestick patterns—including engulfing, doji, hammer, and shooting star—offer insights into market sentiment and momentum shifts. These patterns help traders identify optimal entry and exit points and provide logical levels for stop-loss and take-profit placement, improving risk management and execution.

Volume Analysis Techniques for Enhanced Entries

Volume confirms price action and delivers critical insights:

Spotting Volume Spikes for Confirmation: Often signal potential reversals or breakouts

Identifying Volume Divergence to Validate Trends: Occurs when price reaches new highs/lows but volume does not confirm'

Leveraging Relative Volume: Comparing current volume to average volume highlights unusual activity

Day traders should always corroborate price signals with volume activity to increase trade probability.

Psychological Aspects of Successful Day Trading Strategies

Managing Emotions During Live Trading

Emotional discipline is a critical differentiator between profitable and unprofitable day traders. Fear can cause premature exits or hesitation to enter valid setups. Greed may lead to overholding positions or increasing size recklessly. Revenge trading—attempting to recover losses with high-risk trades—is especially detrimental. Successful traders develop systematic methods to manage these emotional pitfalls and maintain discipline.

Cultivating a Winning Trading Mindset

A proper trading mindset is essential for long-term success. Probability-based thinking helps traders accept that no single trade guarantees profit. Process orientation shifts focus from immediate P&L to strategy execution. Emotional detachment enables objective decision-making. Continuous learning ensures each trade contributes to skill enhancement.

Building Discipline for Consistent Results

Discipline entails strict adherence to a trading plan and risk management rules without exceptions. Traders should only take setups that meet predefined criteria. Maintaining detailed trade journals facilitates performance tracking and identifies improvement areas. Regular trade reviews help maintain focus and refine strategies.

Figure 7: Psychological components of successful trading outlining seven essential principles traders should master.

Building Your Day Trading Strategy System

A comprehensive trading plan is vital to maintain consistency and structure in day trading. It should specify markets and time frames, define entry and exit criteria for trade setups, establish position sizing rules to control risk, and outline risk management protocols to protect capital. Setting a trading schedule and routine fosters discipline, while a performance review process enables continuous strategy optimization. The plan should be documented clearly enough for another trader to replicate precisely.

How to Backtest Your Day Trading Strategy

Before deploying real capital, traders must backtest strategies to assess performance and reliability. This involves applying strategy rules to historical price data for the target markets.

Logging hypothetical trades and outcomes provides insights into profitability, while key metrics such as win rate, profit factor, and maximum drawdown help evaluate risk and consistency. Based on these findings, traders can refine strategies prior to live trading.

Forward-Testing and Paper Trading Best Practices

After backtesting, traders should conduct real-time paper trading to evaluate execution quality, emotional responses, and practical challenges not evident in backtesting.

Final adjustments can be made before transitioning to live trading, where starting with small position sizes helps manage risk and build confidence.

Risk Management in Day Trading Strategies

Risk management is fundamental to successful day trading. Even the best setups can result in losses without effective controls. Here’s how to manage risk effectively:

Position Sizing Fundamentals

Position sizing determines capital exposure per trade.

Risk per trade: Limit to 1-2% of total account equity per trade.

Position Size Formula: Position Size = Capital at Risk ÷ Stop-Loss Distance in Pips (or Points)

Managing Drawdowns to Sustain Trading: For example, with a $20,000 account risking 1% per trade ($200) and a 20-pip stop-loss, position size equals $200 ÷ 20 pips = $10 per pip.

Leverage Caution – Use Margin Responsibly: Higher leverage increases risk exposure. Always align leverage with your risk tolerance.

Setting Stop-Loss Orders to Protect Capital

A stop-loss order limits losses if the market moves against your position.

Types of Stop-Losses:

Fixed stop-loss: A predetermined percentage (e.g., 1% of capital).

ATR-based stop-loss: Uses the Average True Range (ATR) to adjust stop distance dynamically based on volatility.

Technical stop-loss: Placed at support/resistance levels, trendlines, or moving averages.

Trailing stop-loss: Moves in your favor to lock in profits while limiting downside risk.

Example:

Buying at $100 with a 2% stop-loss→ Stop set at $98.

In forex, if ATR equals 15 pips, the stop-loss could be 1.5 × × ATR = 22.5 pips.

Managing Drawdowns to Stay in the Game

A drawdown represents a decline in account equity following a series of losing trades.

Maximum Drawdown Limit: Cease trading if monthly drawdown reaches 5-10%.

Risk-Reward Ratio: Target at least 1:2 risk-to-reward (risking $1 to gain $2).

Reducing Risk During Losing Streaks:

If losses persist, halve risk per trade.

Reevaluate strategy——are market conditions unfavorable or is execution flawed?

Example:

A trader with $10,000 account loses $1,000 (10% drawdown).

They reduce position sizes and focus on higher-probability setups.

Elevate Your Day Trading Strategies with TMGM

Executing profitable day trading strategies requires expertise and the right trading environment. TMGM offers traders an optimal platform to implement these strategies effectively:Lightning-Fast Execution:

Execute your day trading strategies with minimal slippage

Competitive Spreads for Cost Efficiency: Maximize profit potential with tight spreads across all asset classes

Advanced Trading Platforms: Access professional-grade charting, indicators, and execution tools

Multi-Asset Trading: Apply your strategies across forex, equities, indices, commodities, and cryptocurrencies

Top Risk Management Tools for Day Traders: Utilize guaranteed stop-loss orders and other advanced risk controls

Best Educational Resources for Beginners: Enhance your trading skills with TMGM'’s comprehensive educational content

Benefit from 24/5 Expert Support from TMGM: Receive assistance anytime from experienced trading professionals

Whether employing trend-following, breakout, or scalping strategies, TMGM provides professional-grade infrastructure, advanced trading tools, and our trading academy to execute your day trading plan with precision.

Ready to implement these profitable day trading strategies? Open an account with TMGM today and experience how a professional trading environment can enhance your trading results.