What is Crypto Day Trading?

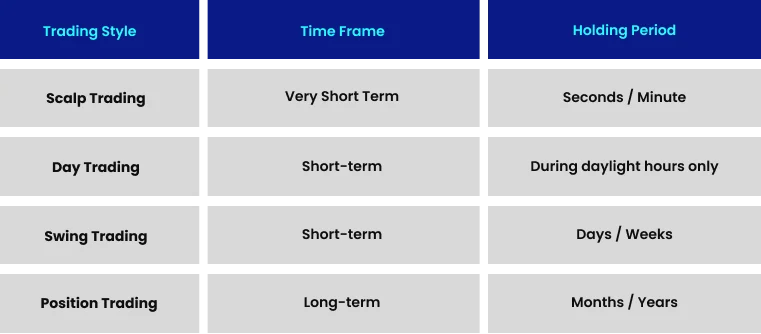

Crypto day trading refers to opening and closing positions within the same 24-hour period—, commonly known as intraday trading. This differentiates it from other trading styles such as spot trading, swing trading, or position trading, where trades are held for longer durations. Day traders usually operate on centralized exchanges, executing multiple trades rapidly—, sometimes twenty or more within a single day—, aiming to profit from small, short-term price movements.

It’’s important to understand that day trading is not a single strategy but a time-based trading methodology. Traders employ techniques such as scalping or utilize tools from technical analysis, but what defines a trade as a "day trade" is its timeframe——both entry and exit occur within the same trading day.

Here'’s how day trading compares to other prevalent trading styles:

Figure 1: Illustrates day trading versus alternative trading approaches

Cryptocurrency markets operate continuously, unlike traditional stock markets with regional sessions and weekend closures. Therefore, a crypto day trade is any position opened and closed within 24 hours. Many traders use Coordinated Universal Time (UTC) as the standard reference for defining the trading day’s start and end.

How to Select Cryptocurrencies for Day Trading

Choosing cryptocurrency assets for day trading should be a deliberate process. Successful day traders typically focus on assets that satisfy specific criteria:

Comprehensive Knowledge: Select cryptocurrencies you have thoroughly researched over time, including backtesting your trading strategies to assess their effectiveness for your approach.

Alignment with Personality and Trading Plan: Opt for assets that suit your trading style and risk tolerance. Some cryptocurrencies exhibit high volatility and substantial volume, while others trend more gradually. Your asset choice should reflect your individual trading profile.

Platform Compatibility: Confirm that your selected cryptocurrencies are supported by your preferred trading platform and possess sufficient liquidity to accommodate your trade sizes.

Top-performing day traders often develop deep expertise in a limited set of cryptocurrency pairs rather than diversifying too broadly. This focused specialization enables a more nuanced understanding of specific market dynamics.

Crypto Day Trading Example: Step-by-Step

To demonstrate crypto day trading in practice, consider this scenario:

After analyzing various crypto markets for opportunities, a trader identifies a promising setup on the five-minute Bitcoin chart. Bitcoin is in a downtrend approaching the psychologically significant $50,000 support level.

Figure 2: Five-minute Bitcoin chart showing downtrend nearing the $50,000 psychological support level.

The trader formulates a trade idea with historically positive expectancy based on extensive backtesting, statistical analysis, and trading journal insights. Their analysis indicates a high probability of a price rebound at $50,000.

The trader decides to:

Place a limit buy order for 1 Bitcoin at $50,000

Set a stop-loss at $49,900 to limit downside risk if the price continues to decline

Place a take-profit order at $50,200

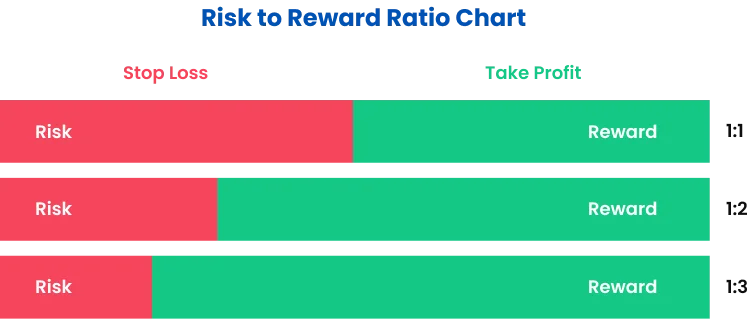

After evaluating potential outcomes, the trader establishes a risk-reward ratio of 2:1——the target profit ($200) is twice the potential loss ($100), excluding transaction costs.

Figure 3: Visual showing stop-loss, take-profit levels, and risk-reward ratio.

As expected, Bitcoin’s price drops to $50,000, triggering the trader’s limit buy order. However, contrary to expectations, the market continues downward. When the price falls below $49,900, the stop-loss order executes, resulting in a $100 loss.

Despite the loss, the trader acknowledges correct execution of their plan and understands that losses are an inherent part of trading. Statistically, losses occur frequently, and individual losing trades do not negate the trader’s' edge"—their ability to identify and capitalize on non-random market events.

Is Crypto Day Trading Suitable for Beginners?

Most professional traders strongly caution beginners against day trading, supported by compelling evidence:

The stark reality is that the vast majority of day traders incur losses, with failure rates often cited at 95% or higher. Research indicates the actual rate may be even more discouraging.

Key findings from studies of day traders in traditional markets include:

80% of traders quit within their first two years

Over 90% of day traders ultimately lose their invested capital across multiple studies

One study found only 1% of day traders remain profitable after accounting for trading fees

Another study concluded that "it is virtually impossible for an individual to sustain a living solely from day trading, contrary to claims by some brokers and educators."

These statistics should give pause to anyone considering crypto day trading, especially novices with limited experience and capital.

Why Is Crypto Day Trading Considered Difficult?

Several factors contribute to the exceptional challenges of day trading cryptocurrencies, making it significantly harder than trading on higher timeframes or adopting long-term investment strategies:

Extreme Market Volatility: Crypto markets exhibit rapid and large price swings over short intervals, presenting both opportunities and substantial risks.

Real-Time Decision Making: Day trading requires exceptional cognitive agility to make swift decisions under pressure—, a skill many traders find difficult to develop consistently.

Fee Impact: The high frequency of trades leads to increased cumulative transaction costs, which can erode profits or exacerbate losses.

Psychological Demands: Among all trading approaches, day trading imposes the greatest psychological strain. Successful day traders must quickly accept losses and move on without emotional interference—, a psychological discipline many beginners struggle to master.

A key question: Would you invest in a company without analyzing its profitability or expected ROI? If not, why approach day trading differently? Before risking capital, you should have evidence supporting your profitability potential under day trading conditions.

Achieving consistent profitability often requires years of dedication and resilience—, as exemplified by many successful traders featured in Jack Schwager’s renowned "Market Wizards" series.

Essential Skills for Crypto Day Trading

While no single formula guarantees success in crypto day trading, the markets offer vast freedom and creativity——a double-edged sword presenting both opportunities and risks.

In his influential book "Trading in the Zone," Mark Douglas explains that markets provide a level of creative freedom rarely found elsewhere. This freedom enables traders to take significant risks with potentially severe consequences.

This dynamic explains why traders may experience dramatic short-term gains and losses while struggling to maintain long-term profitability.

Many experienced traders agree that successful crypto day trading requires:

Self-awareness to develop strategies aligned with your personality

Mastery of trading fundamentals, including technical analysis, backtesting, and risk management

Let'’s explore these core skills in detail.

Chart Reading and Technical Indicators

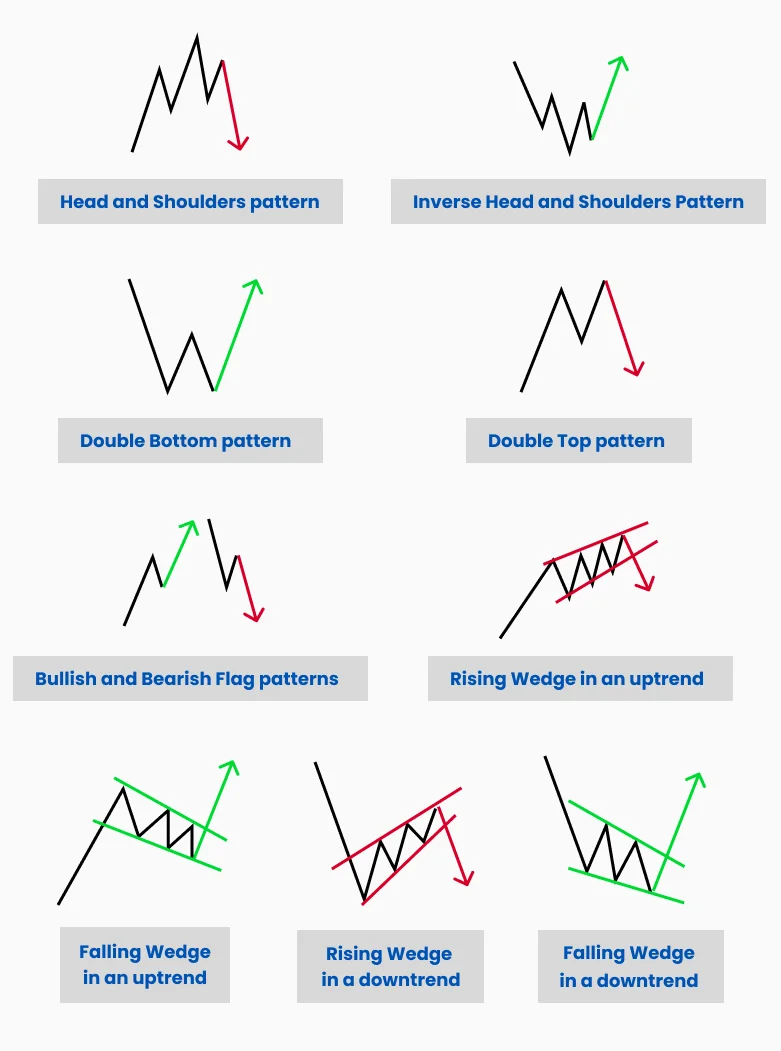

While academic debate continues over market randomness (see "Random Walk Theory"), many traders operate under the assumption that markets exhibit repeatable, tradable patterns.

Chart analysis encompasses numerous methods, with thousands of indicators, algorithms, and strategies available. Experienced traders often analyze price action—price movement over time—using candlestick charts, which visually depict price fluctuations within defined intervals.

Figure 4: Common candlestick patterns used by day traders to identify potential reversals and continuations.

Technical analysis aids traders in detecting trends and chart patterns in cryptocurrencies, potentially revealing market sentiment and supporting informed decisions.

Figure 5: Example of technical analysis on a cryptocurrency chart, showing moving averages, RSI, and volume indicators.

Selecting Appropriate Trading Timeframes

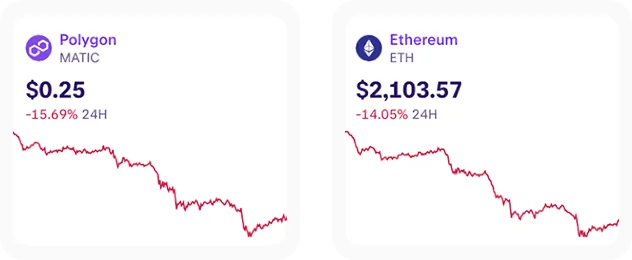

Crypto day traders typically focus on lower timeframes, such as hourly charts (capturing up to one hour of price data) or even 1-minute candlesticks. This enables capturing minor price movements over short periods.

Many traders also reference higher timeframes, such as daily or weekly charts, to contextualize their lower timeframe trades. For example, if Polygon (MATIC) or Ethereum (ETH) is trending upward on the daily chart, aligning lower timeframe trades with this trend may increase success probability.

Mastering Order Execution

Financial markets offer various order types, but crypto day traders primarily use two on centralized exchanges:

Limit Orders: Passive or "resting" orders executed at a specified price. For instance, a trader may place a limit buy order for 1 Bitcoin at $50,000, which executes only if the price reaches that level and a seller accepts. Limit orders add liquidity by making assets available for trading. The order book aggregates all limit orders for a market.

Market Orders: Active orders that "take" liquidity from the order book. For example, a trader wanting immediate Bitcoin purchase near $50,000 might use a market order at $50,500, filled by the closest sell orders. This may lead to a less favorable price due to "slippage".

This explains why stop-loss orders (market orders triggered at predetermined levels) may execute at prices different from intended levels, or not at all. No exchange guarantees execution at your desired price.

Risk Management in Crypto Day Trading

Risk management——deciding how much capital to risk per trade to minimize the "risk of ruin" (losing all trading capital)——is arguably the most critical component of successful trading.

Risk of ruin quantifies the probability of losing sufficient capital to prevent recovery or force cessation of trading. In crypto communities, this catastrophic event is colloquially termed "getting rekt."

Many free online calculators help traders estimate risk of ruin based on their parameters.

To mitigate risk, traders often:

Use stop-loss orders on all trades to cap losses

Never risk more capital than they can afford to lose

Conduct thorough due diligence on cryptocurrencies before investing

Figure 6: Technical analysis example on a cryptocurrency chart, showing moving averages, RSI, and volume indicators.

Top 5 Crypto Day Trading Strategies for Beginners

While applicable across timeframes, these strategies are popular among day traders seeking short-term opportunities.

1. Range Trading Strategy

Markets typically exhibit two behaviors: trending (up or down) or rangebound (sideways). Strong trends often transition into ranges or consolidations.

Many traders specialize in trading these consolidations by entering near the range boundaries——the upper or lower limits.

Crypto prices often "sweep" or "overshoot" range boundaries' before reversing. This occurs as traders holding losing positions are caught off guard. Range traders target these deviations for entry.

Figure 7: Range trading example showing consolidation between support and resistance, with entries at range edges.

2. Fibonacci Retracement for Crypto Day Trading

Many traders use Fibonacci retracement tools to identify potential reversal zones by marking significant highs and lows on price charts.

Common retracement levels include 23.6%, 38.2%, 61.8%, and 78.6%, with particular focus on the "golden ratio" at 61.8%.

Figure 8: Fibonacci retracement levels on a Bitcoin chart highlighting potential reversal zones.

3. Crypto Arbitrage Opportunities

Arbitrage exploits price discrepancies of the same asset across different exchanges. Unlike price action strategies, arbitrage requires monitoring prices across multiple venues.

For example, if Solana (SOL) trades at $100 on Exchange A and $120 on Exchange B, a trader could buy on Exchange A, transfer to Exchange B, and sell there—, potentially profiting after fees.

However, successful arbitrage demands overcoming challenges like transfer delays, withdrawal limits, and rapidly changing spreads.

4. Support and Resistance Flip Strategy

A common trading principle states "former resistance becomes future support," meaning once price breaks a key resistance, that level often acts as support thereafter— until sentiment shifts.

This creates trading opportunities. Price may test a level multiple times before breaking out, then retest the breakout level as new support, forming a reversal. This pattern is called an "S/R Flip".

Many traders regard S/R flip zones as high-probability setups in crypto markets.

Figure 9: Support and resistance flip example on an Ethereum chart showing resistance becoming support post-breakout.

5. Trendline and Momentum-Based Trading

Trend trading aims to capture significant directional moves by following established trends. Traders use trendlines and price action to define risk and reward for setups.

The adage "the trend is your friend" reflects the higher probability of success when trading with the prevailing market direction.

Figure 10: Trend trading example showing Bitcoin uptrend with multiple entries along ascending trendline.

Advantages and Disadvantages of Crypto Day Trading

Advantages of Crypto Day Trading

Structured Schedule: Day trading allows focusing trading activities within defined hours, resembling conventional work schedules. This can suit individuals with family or other commitments.

Potential for Rapid Account Growth: Skilled day traders can accelerate account growth through multiple daily trades. Combined with compounding, this high-frequency approach can yield exponential growth when executed effectively.

Disadvantages of Crypto Day Trading

Psychological Stress: Managing multiple trades within a day can be highly stressful, leading to decision fatigue and burnout.

Mental and Physical Demands: Day trading requires intense, sustained focus on numerous variables, often across multiple screens, causing significant mental and physical strain.

High Failure Rate: The difficulty of maintaining consistent profitability means many day traders lose money. Such traders might achieve better outcomes via long-term investing or higher timeframe strategies.

Conclusion: Should You Begin Crypto Day Trading?

Crypto day trading is among the most challenging methods to profit from cryptocurrency markets, as reflected by high failure rates in both traditional and digital asset trading.

Understanding the risks is essential before adopting this style. Extensive practice using demo accounts can help assess if day trading suits your skills, personality, and financial goals.

While successful day trading offers substantial rewards, the path to consistent profitability is arduous and not suitable for everyone. Many successful crypto investors prefer longer-term strategies that require less time, reduce stress, and limit exposure to short-term volatility.

Whatever your approach, education, practice, and disciplined risk management are the cornerstones of a successful trading career.

Advancing Your Crypto Trading Journey

Figure 11: TMGM cryptocurrency trading interface displaying opportunities for five major pairs: BTC/USD, ETH/USD, BNB/USD, DOGE/USD, and DOT/USD.

Experience TMGM'’s advanced trading platform featuring comprehensive charting tools and real-time market data.

Access Bitcoin, Ethereum, and other major cryptocurrencies via CFD trading with competitive spreads, leverage, and live market data. TMGM provides professional-grade trading conditions, advanced charting, and robust risk management to support your crypto strategies.

Open an account today and discover the TMGM advantage:

Award-winning trading platform

24/7 dedicated customer support

Educational resources for traders at all levels

Competitive spreads and low transaction fees