What is Scalping in Trading & How Does It Work

Scalping in trading is a fast-paced, short-term day trading strategy designed to capitalize on numerous small price movements across financial markets. This comprehensive article offers readers a thorough understanding of scalping, including its historical background and core principles. The guide explores various detailed scalping strategies, key technical indicators, and essential tools necessary for effective execution. Furthermore, readers will gain insights into critical risk management techniques tailored to scalping and dispel common myths associated with this popular trading approach. Whether you are a novice or an experienced trader exploring scalping, this guide provides a clear framework to help assess whether scalping fits your trading objectives and style.

Key Takeaways:

- Scalping is a high-frequency trading style focused on capturing numerous small intraday profits by leveraging speed, tight bid-ask spreads, and disciplined trade execution to compound incremental gains.

- This involves executing dozens of rapid trades on minute or tick charts, where swift entries and exits combined with low latency aim to exploit brief price differentials.

- The mechanics of scalping depend on narrow bid-ask spreads, high market liquidity, and fast order routing, as delays or wide spreads can erode expected profits into losses.

- Primary scalping approaches include market-making, large-position scalping to capture a few ticks, and signal-based strategies, each tailored to liquidity conditions, volatility, and defined exit criteria.

- Commonly used indicators include moving average ribbons, MACD, short-period RSI, Bollinger Bands, Fibonacci retracements, VWAP, and order book depth for precise timing.

- Successful scalping typically requires Direct Market Access (DMA) or ultra-low latency brokers such as TMGM, stable and responsive trading platforms, Level 2 market data, and reliable hardware and software supporting rapid order management.

- Risk management focuses on minimal risk per trade (typically 0.5% to 1% of capital), strict stop-loss orders, modest profit targets around 1:1 to 1.5:1 risk-reward ratios, daily loss limits, and avoiding correlated positions.

- Common misconceptions, such as scalping being “easy money” or that higher volatility always benefits scalpers, overlook transaction costs, slippage, broker restrictions, and the necessity for disciplined processes and consistent edges.

- A beginner’s roadmap includes education, 1–3 months of simulated trading, starting with small live positions, documenting every trade, iterating strategy rules, and scaling only after statistically consistent results.

- Scalping suits traders with fast decision-making skills, strong emotional control, availability during peak market sessions, and sufficient capital and technology; otherwise, slower trading styles may be more appropriate.

What Is Scalping?

Scalping is a rapid-execution trading strategy involving dozens or even hundreds of trades within a single day to exploit small price movements. Unlike swing trading, which is more accessible for beginners and common in stock markets, scalping is predominantly used in CFDs, forex, and cryptocurrency markets, where traders aim to accumulate frequent small profits by swiftly responding to intraday volatility. This method demands strict discipline, low-latency execution, and a thorough understanding of market microstructure.

Traders employing scalping techniques—scalpers—execute numerous day trades throughout a single session, sometimes opening and closing hundreds of positions within hours.

The core principle of scalping is straightforward yet effective: repeatedly secure small profits while minimizing market exposure. Instead of waiting for large price moves that may take days or weeks, scalpers capitalize on constant minor fluctuations occurring within seconds or minutes.

Historical Context of Scalping Trading

Scalping has evolved considerably over decades. Prior to electronic trading, scalpers operated on physical trading floors, relying on hand signals and verbal cues to execute rapid trades, leveraging proximity to information and order flow for advantage.

With the rise of electronic trading platforms in the late 20th century, scalping transformed dramatically. Market access democratized via online brokers like TMGM and advanced trading software has made scalping accessible to retail traders, though institutional players still dominate high-frequency trading—the institutional counterpart to scalping.

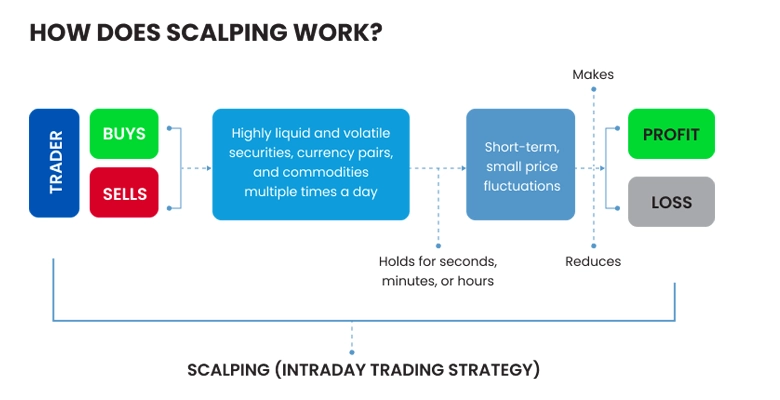

Figure 1: How Does Scalping Work?

How does Scalping Work?

How Scalping Works in Modern Markets

Practically, successful scalping depends on several key factors.

Scalping demands rapid execution, with entries and exits occurring within seconds. Execution delays can convert potential profits into losses. Scalpers analyze price action on one-minute or tick charts to make swift decisions based on minor price changes.

Unlike long-term traders who incorporate fundamental analysis, scalpers rely almost exclusively on technical analysis, employing indicators, trend lines, and price action to identify short-term market trends and patterns rather than macroeconomic factors. Technical Analysis such as technical indicators, trend lines and price action. Their strategies focus on short-term market movements rather than broader economic influences.

Because individual trade profits are small, scalpers execute high volumes of trades to accumulate meaningful gains, making trading frequency a critical component.

Scalpers also target securities with minimal bid-ask spreads to minimize transaction costs. Tight spreads enable efficient entry and exit with minimal slippage, maximizing the capture of small price moves.

Algorithmic trading systems have revolutionized modern scalping by analyzing market conditions and executing trades based on predefined parameters at speeds unattainable by human traders.

Figure 2: Bid-ask spread on TMGM.

The Role of Bid-Ask Spread in Scalping Trading

The bid-ask spread—the difference between the highest bid price and lowest ask price—is critical in scalping.

Scalpers seek to capture all or part of this spread through:

Market Making: Posting simultaneous buy and sell orders at slightly different prices to profit from the spread.

Momentum Scalping: Entering trades aligned with short-term price momentum and exiting quickly as momentum fades.

Range Scalping: Trading price bounces between established support and resistance within a narrow range.

Market data from 2024 indicates that average bid-ask spreads for highly liquid stocks on major exchanges range from approximately 0.01% to 0.05%, whereas less liquid securities may have spreads from 0.1% to 0.5% or more. These variations significantly affect scalping profitability, as wider spreads increase trading costs.

In-Depth Scalping Trading Strategies

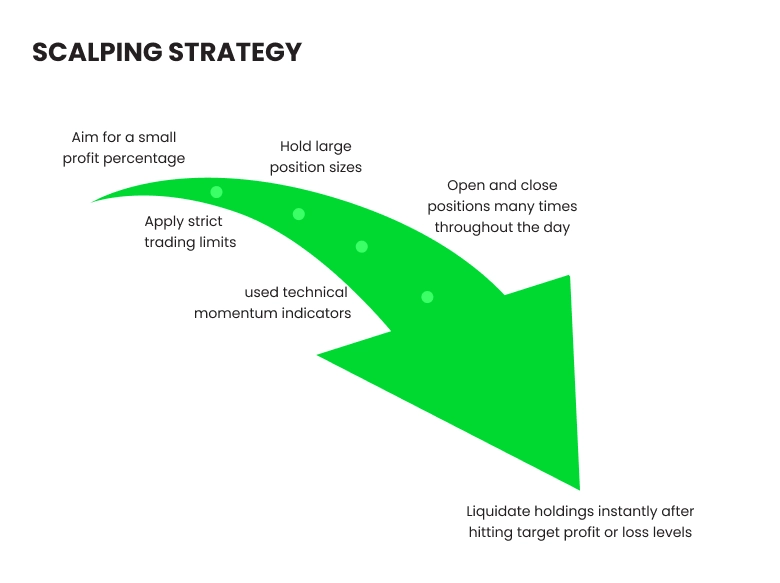

Primary Scalping Approaches

Scalping strategies vary depending on market conditions. Traders typically use three main approaches:

Figure 3: Scalping indicator

1. Market-Making Scalping Approach

This classic method involves placing simultaneous buy and sell orders for the same asset at slightly different prices, profiting from the spread by acting as a market maker.

Example: A scalper bids to buy 1,000 shares of Stock XYZ at $20.00 and offers to sell 1,000 shares at $20.02. If both orders fill, the scalper earns $0.02 per share, totaling $20 (excluding commissions).

This approach works best with high-volume, low-volatility securities trading in large quantities without sharp price swings. However, retail traders face challenges competing against institutional market makers and high-frequency trading firms.'

Figure 4: Scalping Strategy

2. Large-Position Scalping Strategy

This strategy involves acquiring large quantities of an asset (often thousands of shares) and quickly selling after a small favorable price move.

Example: A trader buys 5,000 shares of Stock ABC at $15.00 and sells at $15.03, earning $0.03 per share or $150 total (before transaction costs).

This method requires highly liquid stocks to facilitate large trades without significantly impacting market prices. Stocks with average daily volumes exceeding one million shares typically provide sufficient liquidity for this approach.

Figure 5: Swing trade signal scalping indicator.

3. Signal-Based Scalping Strategy

This approach aligns with conventional technical trading but operates on compressed timeframes. Traders enter positions based on technical signals and exit upon counter-signals or when reaching predefined profit targets, often at a 1:1 risk-reward ratio.

Example: Observing a bullish engulfing pattern on a one-minute chart for Stock DEF priced at $45.20, a trader enters long with a stop-loss at $45.15 (risking $0.05 per share). Upon reaching $45.25 (a 1:1 risk-reward ratio), the trader exits with a $0.05 profit per share.

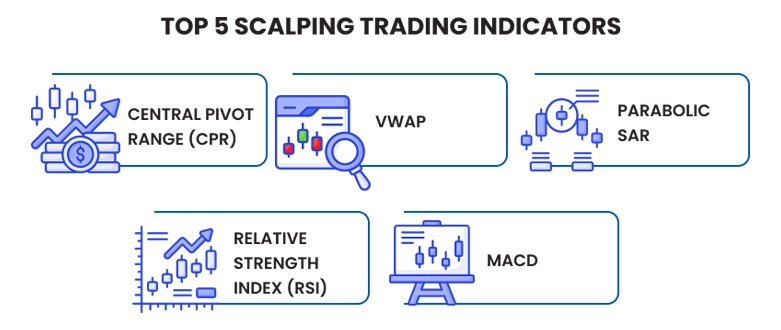

Figure 6: Top 5 Scalping Trading Indicators

Figure 6: Top 5 Scalping Trading Indicators

Key Technical Indicators for Scalping Strategy

Effective scalping utilizes technical tools optimized for ultra-short timeframes. The Moving Average, especially when multiple averages create a ribbon effect, provides clear crossover signals for entries and exits. MACD, an oscillator depicting the relationship between two moving averages, is effective for momentum detection in scalping.

Fibonacci Retracement levels, drawn from recent swing highs and lows on ultra-short timeframes (e.g., 1- or 5-minute charts), assist in pinpointing potential support, resistance, or reversal zones, aiding scalpers in timing quick trades.

The Volume-Weighted Average Price (VWAP) is crucial for intraday scalping, indicating whether prices are trading above or below the average volume-weighted price, clarifying market trend direction. Market Depth Charts reveal current limit orders, enabling scalpers to identify support and resistance based on real-time order flow.

Analysis of 2023–2024 trading data shows that combining VWAP with a 2-period RSI correlates strongly with successful scalping trades across multiple asset classes, achieving win rates over 60% among experienced traders.

Tools and Requirements for Successful Scalping Trading

Essential Trading Infrastructure for Scalping

Scalping demands not only strategy but also robust infrastructure for efficient trade execution. Direct Market Access (DMA) is vital, enabling orders to be routed directly to exchanges without intermediaries, minimizing latency and ensuring rapid order placement.

Level 2 Market Data, which displays the full order book with multiple bid and ask levels, provides critical insight into market depth, helping scalpers anticipate price movements and make informed decisions.

Low-latency internet connections are essential, as even millisecond delays can impact scalping outcomes. Professional scalpers often invest in dedicated connections or co-locate their trading systems within exchange data centers to minimize lag.

High-performance hardware is necessary, including multi-core CPUs, ample RAM, and multiple monitors, to process large volumes of market data and manage multiple charts and orders simultaneously without delays.

Specialized trading software enhances scalping efficiency by offering advanced charting, customizable indicators, and automated order execution features to improve speed and accuracy.

Industry surveys indicate professional scalpers typically invest between $5,000 and $20,000 in trading infrastructure, excluding brokerage deposits and ongoing data subscriptions.

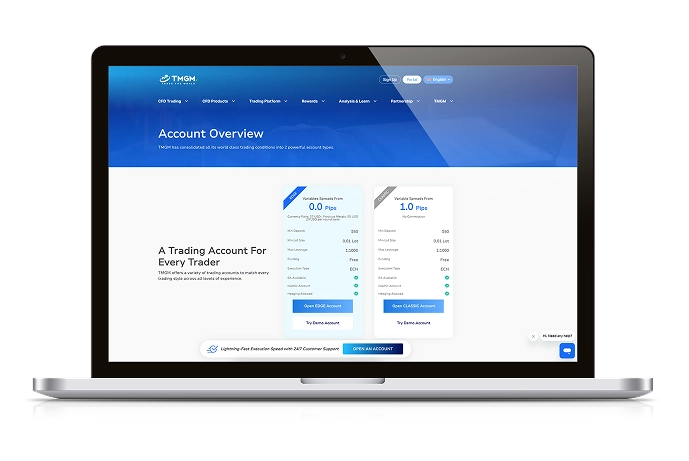

Figure 7: TMGM’s Accounts

Broker Selection for Scalping Traders

Selecting an appropriate CFD broker is critical for scalpers, as broker policies and costs directly affect profitability and execution quality. Commission structures are a primary consideration. Since scalping involves high trade volumes, fixed-fee commissions often provide more predictable and cost-effective pricing than percentage-based fees.

Execution speed is equally important, as even a one-second delay can turn a profitable trade into a loss. Brokers with consistently fast order execution minimize slippage and support scalping strategies.

Platform stability is crucial; outages or slowdowns during volatile periods can be disastrous for scalpers who rely on split-second decisions. A reliable and responsive trading platform is essential.

Margin requirements influence scalping strategies. Higher leverage amplifies profits and risks, and brokers offer varying margin rates. Scalpers must balance leverage use with effective risk management.

Traders must confirm their broker permits scalping, as some explicitly prohibit or restrict this style, especially in forex markets. Understanding broker scalping policies before account opening prevents conflicts and ensures strategic alignment.’

Recent trends show a rise in commission-free brokers; however, scalpers should be cautious of hidden costs via wider spreads or payment-for-order-flow arrangements that may degrade execution quality.

Best Markets for Scalping Trading

Which Markets Are Best for Scalping?

While scalping can be applied across various asset classes, certain markets offer more favorable conditions.

Stock Markets

Equities provide numerous scalping opportunities, especially in:

High-volume, large-cap stocks: Companies like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) trade millions of shares daily with tight spreads, ideal for scalping.

ETFs: Exchange-traded funds such as SPY (S&P 500 ETF) and QQQ (Nasdaq-100 ETF) combine high liquidity with moderate volatility, offering frequent scalping setups.

In 2023–2024, the top 10 most liquid stocks on NYSE and NASDAQ averaged daily volumes exceeding 20 million shares, providing ample scalping opportunities throughout trading sessions.

Forex Markets

The forex market, with approximately $7.5 trillion in daily volume (2023) and 24-hour trading, is highly popular for scalping. Suitable currency pairs include:

Major pairs: EUR/USD, USD/JPY, GBP/USD, and USD/CHF offer the tightest spreads and highest liquidity.

Cross pairs: EUR/GBP, EUR/JPY, and GBP/JPY provide greater volatility but with slightly wider spreads.

Forex broker data from 2024 shows average EUR/USD spreads during peak hours of approximately 0.1 to 0.3 pips, enabling profitable scalping with disciplined risk management.

Futures Markets

Futures contracts with high volume and standardized sizes also attract scalpers:

E-mini S&P 500 futures (ES): Among the most liquid futures globally, featuring tight spreads and steady volatility.

Treasury futures: Contracts such as 10-Year T-Note futures (ZN) offer sufficient intraday price movement for scalping.

Commodity futures: Gold (GC) and Crude Oil (CL) futures provide volatile conditions suitable for experienced scalpers.

Recent data shows the E-mini S&P 500 futures trade about 1.5 million contracts daily, with average intraday price moves of 0.5–1%, offering numerous scalping opportunities.

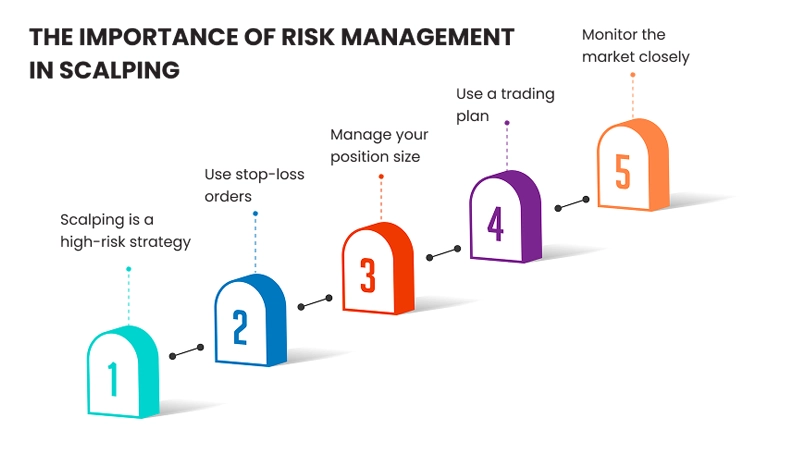

Figure 8: The Importance of Risk Management in Scalping

Risk Management Principles for Scalping Trading

Crucial Risk Controls for Scalping Traders

Due to scalping’s high trade frequency and slim profit margins, rigorous risk management is essential. Without it, scalping equates to gambling.

1. Fixed Position Sizing

Successful scalpers maintain consistent position sizes, avoiding increasing size after wins or doubling down after losses. A common rule is risking no more than 0.5% to 1% of total capital per trade.

Example: With a $50,000 account, a scalper risks $250–$500 per trade, adjusting position size based on stop-loss placement.

2. Predefined Stop-Loss Orders

Hard stop-loss orders should be set immediately upon trade entry. For stock scalping, stops are typically 2–5 cents from entry, depending on volatility and price.

Data from professional trading firms shows scalpers using predefined stops have survival rates 3–4 times higher than those relying on mental or no stops.

3. Profit Targets in Scalping

Most scalpers set predetermined profit targets, often at 1:1 or 1.5:1 reward-to-risk ratios. For example, with a 5-cent stop, the target would be 5–7.5 cents from entry.

4. Daily Loss Limits

To avoid severe drawdowns, scalpers implement daily loss limits, typically 3–5% of account equity. Trading stops once this limit is reached.—

5. Trade Correlation Awareness

Scalpers avoid multiple correlated positions that could amplify losses during adverse moves. For instance, scalping several technology stocks simultaneously may increase sector concentration risk.

Professional scalpers typically maintain win rates of 65–75% with reward-to-risk ratios between 0.8:1 and 1.2:1, generating modest but steady returns.

Common Misconceptions About Scalping Trading

Debunking Scalping Trading Myths

Common myths about scalping include:

Myth 1: Scalping Is Easy Money

Reality: Scalping can be profitable but requires extensive knowledge, advanced tools, significant capital, and intense focus. Brokerage data shows over 90% of novice scalpers fail.

Myth 2: Quick-Close Trades Guarantee WinsReality

Reality: Closing positions quickly limits individual losses but does not ensure overall profitability. Transaction costs, slippage, and the need for a high win rate pose challenges.

Myth 3: Scalping Works Best in Volatile Markets

Reality: Extreme volatility often widens bid-ask spreads and causes unpredictable price jumps that can bypass stops, resulting in larger losses. Moderate volatility generally offers optimal scalping conditions.

Myth 4: Scalping Is Illegal or Unethical

Reality: Legitimate scalping strategies are legal and contribute to market liquidity. However, manipulative practices like spoofing or layering, which mimic scalping, are prohibited.

Myth 5: Any Broker Is Suitable for Scalping

Reality: Many retail brokers restrict or prohibit scalping, especially in forex. Specialized brokers offering DMA and scalping-friendly policies are typically required.

Scalping Trading 101: A Roadmap for Beginners

Developing Scalping Skills

Traders interested in scalping should follow a structured approach:

Education First: Gain comprehensive knowledge of market mechanics, order types, technical analysis, and specific market characteristics before risking capital.

Platform Mastery: Develop proficiency with your trading platform’s order entry and management tools. In scalping, hesitation of even seconds can turn profitable trades into losses.

Simulated vs. Live Scalping: Practice your strategy in simulation for 1–3 months, focusing on process over results.

Small-Scale Live Trading: Begin live trading with small position sizes—no more than 10–20% of your target scale—to gain real-market experience with limited risk.—

Performance Analysis: Record and analyze every trade to identify patterns and refine your strategy.

Incremental Scaling: Increase position sizes gradually only after demonstrating consistent profitability over statistically significant samples (typically 100+ trades).

Continuous Education: Stay updated on market developments and new techniques, dedicating regular time to learning.

Specialized educational resources for scalping, including online courses, simulators, and mentorships, have grown, ranging from free content to premium programs costing $2,000–$5,000 or more.

Figure 9: What is Scalping?

Is Scalping Right for You?

Personal Suitability Assessment

Not all traders are suited for scalping. Consider:

Attention Span: Can you maintain intense focus for extended periods?

Decision Speed: Are you comfortable making rapid decisions with incomplete information?

Emotional Resilience: Can you stay emotionally detached through winning and losing streaks?

Analytical Mindset: Can you quickly identify patterns and anomalies in market data?

Technological Comfort: Are you adept with complex trading platforms and willing to troubleshoot technical issues?

Time Commitment: Can you dedicate consistent trading hours during optimal market periods?

Financial Resources: Do you have sufficient capital, infrastructure, and data feeds?

Psychological assessments used by proprietary trading firms indicate successful scalpers score highly on working memory, visual processing speed, and emotional stability under pressure.

Does Scalping Fit Your Overall Strategy?

Evaluate final criteria:

- Capital Adequacy: Do you have sufficient capital (recommended minimum $25,000–$50,000) to endure drawdowns and cover technology costs?

- Time Availability : Can you allocate focused trading hours during optimal market sessions, often 4-6 hours of uninterrupted concentration?

- Technical Resources&: Do you have access to reliable high-speed internet, professional-grade platforms, and quality market data?

- Learning Commitment: Will you invest hundreds of hours in education, simulation, and small-scale live trading before expecting consistent profits?

- Psychological Profile: Do you possess the emotional discipline, rapid decision-making, and stress tolerance required for high-frequency trading?

- Performance Expectations: Are your profit goals realistic, understanding that successful scalpers typically target 1–3% monthly returns rather than large gains?

If you answer "yes" to most questions, scalping may be a viable strategy to explore. Otherwise, consider trading styles better aligned with your profile and resources.

Trade Smarter Today

Account

Account

Instantly