How to Use MT5 on Tablet – A Step-by-Step Guide for iPad and Android Tablets

MetaTrader 5 (MT5) is a next-generation trading platform that builds on the successes of the ever-popular MetaTrader 4 (MT4) platform. MT5 offers enhanced charting tools, expanded timeframes, additional pending order types, and the ability to trade across multiple asset classes. Optimized for tablets, MT5 provides a larger display, allowing for more seamless navigation and more effective market analysis. In this guide, we will explain how to download, install, and use MT5 on your iPad or Android tablet to begin trading with TMGM. Whether you are managing trades, conducting chart analysis, or staying updated with real-time market data, MT5 on your tablet offers superior functionality and flexibility, ensuring you remain connected to the markets, no matter where you are.

How to Install and Log-in to the MetaTrader 5 Tablet App

Step 1: Sign-up and create your TMGM Account

Complete the sign-up process by providing a few basic details about yourself and let us get to know you better. You will also need to complete a quick verification to confirm your identity. Don’t worry, it’s fast and secure, and should you encounter any issues, please reach our friendly customer support team to assist you.

When signing up, consider how much leverage and margin you want as well, as you will need to set your initial leverage ratio here.

Sign Up and Get Started or Log-in to your existing TMGM account

Step 2: Download and install the MT5 Tablet App

For iPad:

Or tap on the App Store icon on your iPhone, search for MetaTrader 5, and tap on Get

For Android Tablet:

Or tap on the Google Play Store icon on your Android tablet, search for MetaTrader 5, and tap on Install

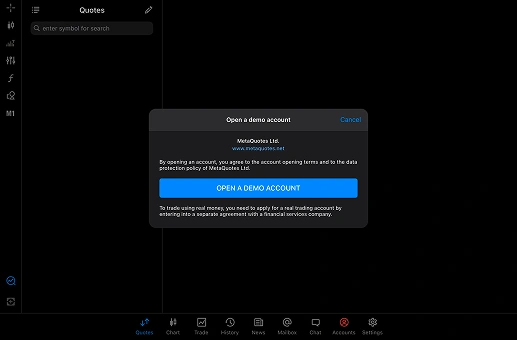

Step 3: Open the MetaTrader 5 App

When prompted, accept the EULA agreement after reviewing it

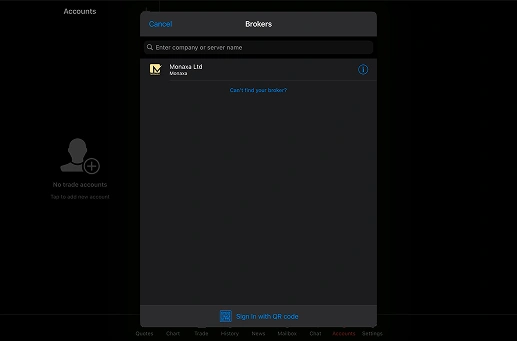

Step 4: Select the Server and Log In to your TMGM Account

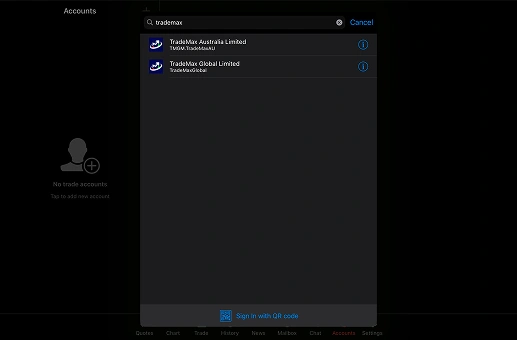

You will then be presented with the Brokers window. Type ‘TradeMax’ into the search bar and select the relevant server.

Enter your login credentials (provided when you sign up through TMGM) and select between a live account or demo account. Your iPad or Android tablet is now ready to trade live with MetaTrader 5, whenever and wherever you are!

Navigating the MetaTrader 5 Tablet App

Once you are logged in, you will be presented with the MT5 main screen which shows the Instruments Watchlist on the left and Charts on the right.

The larger screen of a tablet allows MT5 to display a wealth of useful information. While it may appear daunting at first, we will explain some of the key areas to get you started and give you some useful tips to quickly and intuitively access the information you need on the fly.

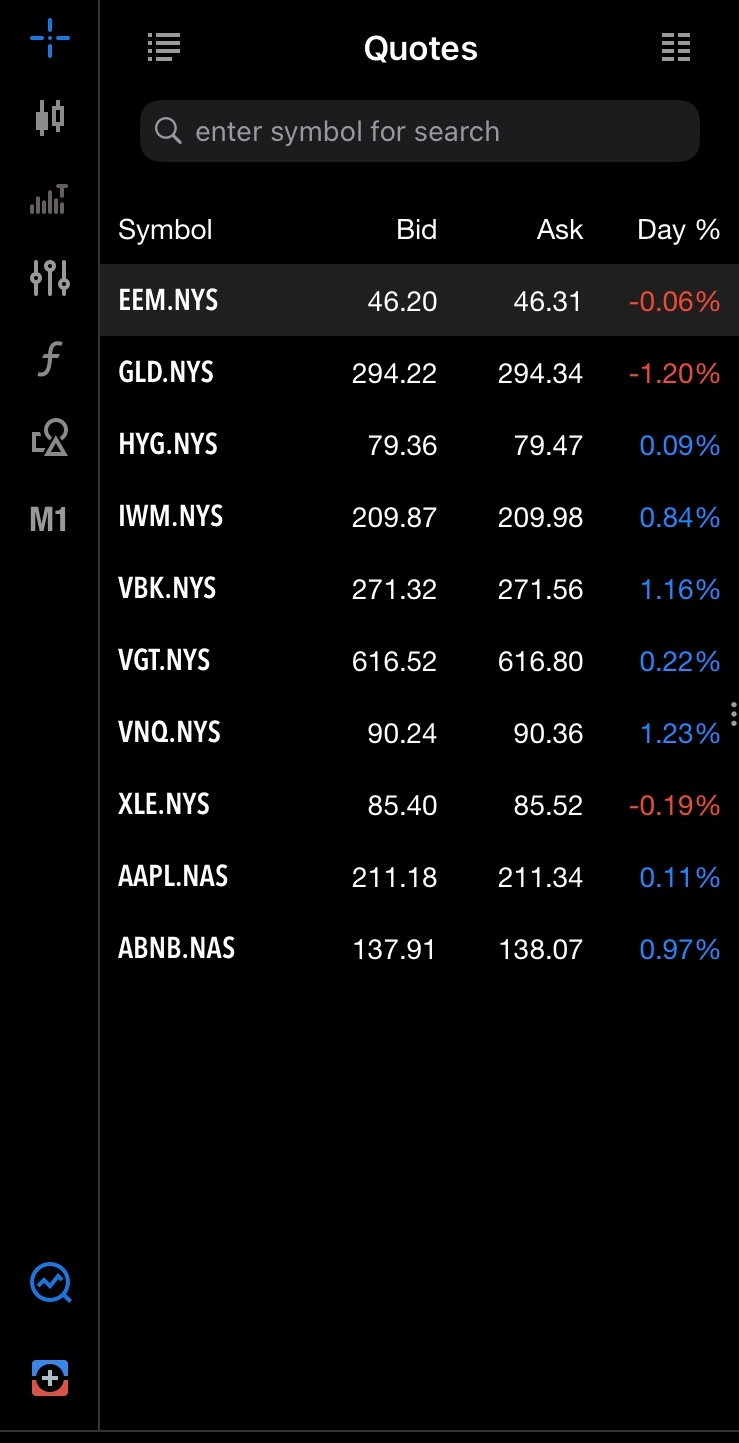

1. Watchlist

Tap on the Quotes (Arrow Up and Down) icon on the bottom left-hand side of the screen to bring up the live bid/ask prices in your watchlist.

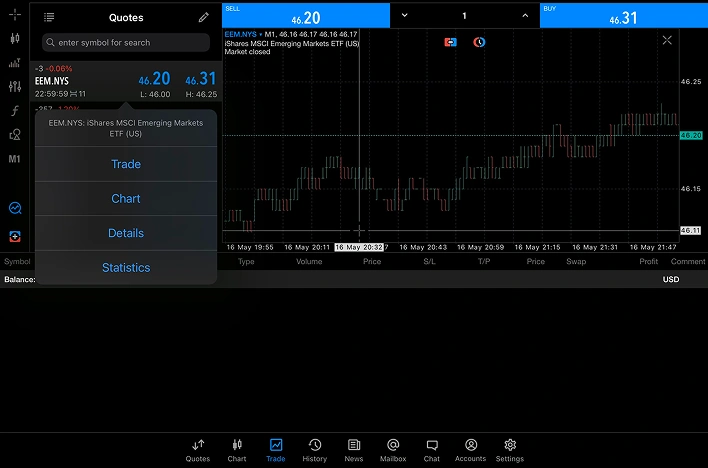

Tap on any instrument for additional choices which includes trading, charts, and more detailed information about that symbol or instrument.

Toggle between Simple and Advanced views to see additional details like spreads, time, or high/low values for each instrument.

To add more instruments or change what symbols are displayed on your watchlist, tap the Symbol search bar. This allows you to add the wide range of markets available with TMGM on MT5 to your watchlist. If you are unsure about what the symbols stand for, you can refer to this list to view the full name and description of each instrument.

Simple View

Advanced View

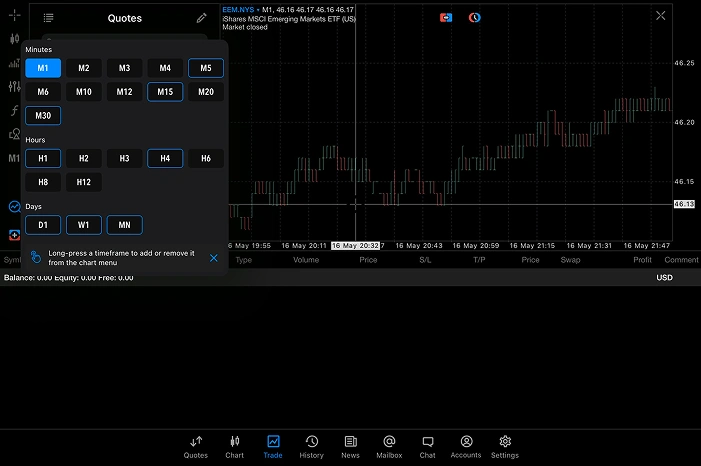

2. Charts Tab

Tap the Charts icon at the bottom of the screen to open a chart for the last selected instrument. You can also open a chart by tapping on an instrument in the Watchlist and selecting Chart.

Charts in MT5 can be customized with 21 different timeframes, offering greater flexibility than MT4. Tap the top left (current timeframe) to easily switch between timeframes. You can also long-press a timeframe to add or remove it from the main chart screen.

You can also MT5 indicators and add-ons like moving averages, relative strength index (RSI), or customize charts further with trendlines, channels, and other objects.

3. Trade Tab

View your open trades, account balance, and free margin through the Trade tab. You can also modify or close positions by tapping on them.

4. History Tab

This tab provides you with a detailed overview of all your past positions and orders. This is a valuable tool for tracking your performance and analyzing your trading decisions over time. With the MT5 app for tablets, you can also sort and filter the list of positions according to your criteria, such as by profit, closing time, or by symbol.

How to Trade with MetaTrader 5 on Your Tablet

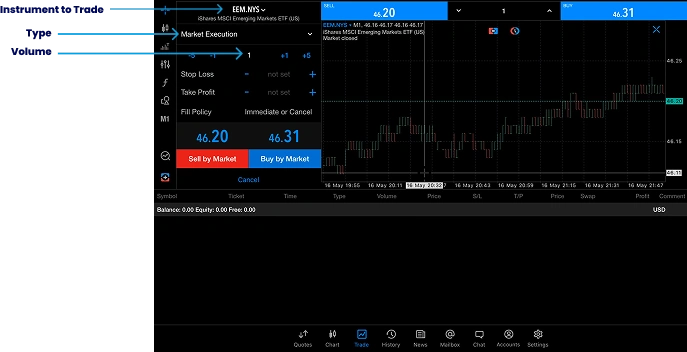

Placing an order on your tablet is straightforward, and the larger screen helps you review trade details more clearly before execution. Follow these steps to place an order on MT5:

Step 1: Choose an Instrument

Go to the Quotes tab and tap on the instrument you want to trade (e.g., EUR/USD), then select Trade.

Step 2: Set Trade Parameters

- Type: You can select between two main order types in MT5

Market Execution: This order type allows you to execute a trade immediately at the current market price.

Pending Order: This option allows you to set an order to be executed at a specific price level in the future. It is ideal for traders who want to enter the market at a precise price.

- Volume: Enter the number of lots you want to trade. This represents the size of your position. You can use the Trading Calculator to estimate margin and pip value.

- Stop Loss: A set amount to automatically close the trade if the market moves against you. For long positions, the stop loss is typically set below the current price, and for short positions, it's placed above the current price.

- Take Profit: A set limit to automatically close the trade once the price reaches a specific profit target. For long positions, the take profit is usually set above the current price; for short positions, below it.

Step 3: Execute the Trade

Market Execution

If you set the trading type to Market Execution, the trade can then be carried out by selecting the ‘Sell by Market’ or ‘Buy by Market’ options.

‘Buy’, to take a long position if you expect that the instrument will rise in value.

‘Sell’ to take a short position if you expect that it will fall in price.

Keep in mind that the actual price may fluctuate slightly, especially during volatile market conditions. If you would like more control over the actual price, you can choose the other option to place your trade.

Pending Order

A pending order allows you to plan your trade at a specific future price level. MT5 offers several types of pending orders for more control:

Limit: A limit order will only be fulfilled when the price reached the specified price, or better.

Stop: A stop order triggers at the specified price and will then be filled at the prevailing market price. This means that the order could be carried out at a significantly different price than the actual stop price.

Stop-Limit: Combines a stop and limit order for better control over price execution. This additional order type is a feature of MT5 and is not available on MT4, and is useful in avoiding slippage, where the actual execution price differs from the requested price, especially when markets are volatile. The downside of a stop-limit order is that it might be harder to fulfil, given the stricter conditions set.

Once you’ve selected the order type, you can then choose whether to ‘Buy’ or ‘Sell’ the order, taking a long or short position respectively.

Expiration: Select a date and time at which the order will expire if the market is unable to reach your specified price.

GTC (Good 'Till Cancelled): The order will stay active until you manually cancel it.

Today: The order will be canceled automatically if not executed by the end of the day.

Specified (Time): Set a specific date and time when the order will expire if not fulfilled.

Specified Day: Set a specific date when the order will expire if not fulfilled.

Once all parameters are set, tap Place to execute the pending order.

How to Monitor and Modify Your Positions on MT5 for Tablets

The Trade tab displays all your active positions, including real-time profit/loss data, margin usage, and current market prices.

Modify Orders: To adjust parameters like Stop Loss or Take Profit, simply tap and hold on any open position. Select the “Modify” option to make the necessary changes.

Close Orders: To close a position, tap and hold on the open trade, then choose “Close Order” from the menu. This lets you exit the trade based on real-time market conditions.

TMGM’s Tips for the MT5 Tablet App

Now that you are familiar with how to monitor and modify positions within the MT5 tablet app, you are well-equipped to capitalize on trading opportunities anytime, anywhere. Below are a few tips and shortcuts to further streamline your experience and maximize the functionality of MT5 on your tablet.

1) Execute On-the-Fly with One-Click Trading

Enable One-Click Trading by tapping on the icon in the Charts tab. The window will then appear above your charts. This feature is especially useful during high-volatility periods when market conditions change rapidly and is one of the main upgrades MT5 has over MT4. See MT4 vs MT5 for a full comparison.

2) Customize Your Workspace with Multiple Chart Windows

MT5 allows you to open and view multiple charts simultaneously. This is especially useful for comparing different instruments or analyzing different timeframes side by side. You can switch between charts easily or arrange them to view multiple charts at once.

3) Use the Depth of Market (DOM) view for Precision Trading

One of the advanced features of MT5 over MT4 is the Depth of Market (DOM) function, which gives traders more insight into liquidity and market orders at different price levels. This feature is particularly valuable for short-term traders who want to assess market depth and price levels.

To open the Depth of Market window of a financial instrument, tap on Depth of Market in its context menu in Quotes.

Trade Smarter Today

FAQ About MT5 on Tablet

Is the MetaTrader 5 Tablet App free to use?

Can I trade the same instruments on MT5 with my tablet as I can on the desktop version?

Can I use automated trading on MT5 for tablets?

How do I use indicators and technical analysis tools in MT5 for tablets?

Can I use MT5 on iPad?

Account

Account

Instantly