Key Takeaways

Trade the right hours and pairs. Focus on peak liquidity, especially the London and New York overlap from 8 am to 12 pm EST. Prioritize liquid majors like EUR/USD, GBP/USD, USD/JPY, and USD/CHF for tighter spreads.

Pick timeframes with intent. Use 1 to 5 minute charts for scalps and 5 to 15 minute charts for most intraday work. Confirm bias on 30 minute to 1 hour charts.

Simple, repeatable setups. Keep a small playbook such as 8 and 21 EMA crossover, support and resistance bounces, and clean breakouts. Wait for price action confirmation and avoid over trading.

Indicators that add value. Trend and momentum with EMAs and MACD. Conditions and turning points with RSI or Stochastics and watch for divergence. Volatility and targets with ATR or Bollinger Bands.

Risk, discipline, and tools. Risk no more than 1 percent per trade with ATR based or structure based stops and aim for at least 1 to 2 reward. Journal every trade. Use regulated platforms such as MT4 or MT5 with fast execution and low latency since cost and slippage matter for scalps.

What is Forex Day Trading?

Forex day trading is a short-term strategy where traders buy and sell currency pairs within the same trading day. Positions are opened and closed within minutes or hours to capture small price movements without holding trades overnight. This approach relies on high market liquidity, quick decision-making, and often uses technical analysis to find short-lived opportunities in forex price action.

Market Structure and Best Timeframe for Forex Day Trading

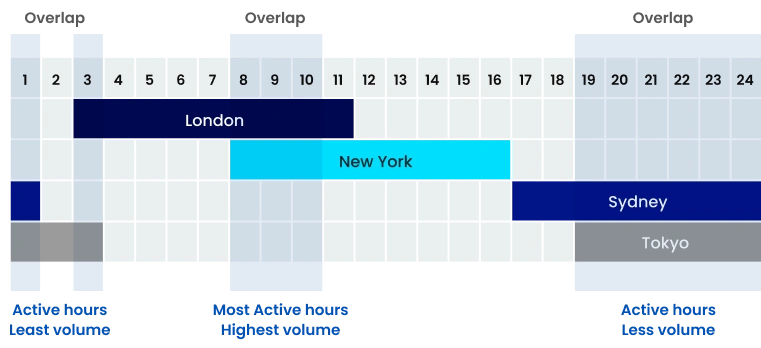

Figure 1: Forex trading hours overlap

Figure 1: Forex trading hours overlap

Forex Market Opening Times

Forex trading operates 24 hours a day across major financial centers worldwide, with three primary sessions: the Asian (Tokyo), European (London), and North American (New York) sessions.

The most significant market activity occurs during session overlaps, particularly between London and New York, offering high liquidity and volatility for traders. Successful forex day trading strategies consider the optimal trading hours when implementing trades:

Tokyo Session Forex Time: 7 PM to 4 AM EST

London Session Forex Time: 3 AM to 12 PM EST

New York Session Time: 8 AM to 5 PM EST

For beginners implementing forex day trading strategies, the overlaps between these sessions often provide the best opportunities:

London/New York overlap (8 AM to 12 PM EST) typically offers the highest volatility and liquidity.

Tokyo/London overlap (3 AM to 4 AM EST) can provide unique trading opportunities for certain currency pairs.

How to Choose the Best Currency Pair to Trade

A currency pair in forex day trading represents the exchange rate between two currencies, where one is bought while the other is sold, with price fluctuations creating trading opportunities. When developing forex day trading strategies, pair selection is critical:

Figure 2: Forex currency pairs

Major Pairs

Major currency pairs typically offer the tightest spreads and highest liquidity, making them ideal for day trading strategies for beginners:

EUR/USD (Euro/US Dollar)

GBP/USD (British Pound/US Dollar)

USD/JPY (US Dollar/Japanese Yen)

USD/CHF (US Dollar/Swiss Franc)

Cross Pairs

Cross pairs (those not involving USD) can offer additional opportunities for forex day trading strategies but often have wider spreads:

EUR/GBP (Euro/British Pound)

EUR/JPY (Euro/Japanese Yen)

GBP/JPY (British Pound/Japanese Yen)

Exotic Pairs

Day trading strategies for beginners typically avoid exotic pairs due to higher spreads and lower liquidity:

USD/TRY (US Dollar/Turkish Lira)

USD/ZAR (US Dollar/South African Rand)

Forex Day Trading Technical Analysis

What are some of the technical analysis tools that you, the forex day trader, need to be aware of most?

Figure 3: Forex technical analysis

How to Read Forex Chart

Different forex chart serve various purposes in forex day trading strategies:

Candlestick charts reveal market psychology and are preferred in most day trading strategies for beginners due to their visual representation of price action

Bar charts provide similar information in a more condensed format

Line charts simplify price action and help identify overall trends

Renko charts filter out market noise by focusing purely on price movement

Best Timeframe for Forex Day Trading

The timeframe selection is crucial when implementing forex day trading strategies. Timeframe charts represent price movements over specific periods, such as 1-minute, 5-minute, or 15-minute intervals, helping traders analyze market trends and make informed trading decisions.

1-minute charts: Used in scalping strategies but can generate significant noise

5-minute charts: Popular for most intraday forex day trading strategies

15-minute charts: Provide clearer signals with less noise

30-minute and 1-hour charts: Often used for confirmation in day trading strategies for beginners.

Best Indicators for Forex Day Trading

Technical indicators are mathematical calculations based on price, volume, or open interest that help traders analyze market trends, identify entry and exit points, and make informed trading decisions.

Effective forex day trading strategies incorporate various technical indicators:

Trend Indicators

Moving Averages: Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) help identify trend direction

MACD (Moving Average Convergence Divergence): Signals momentum changes

Parabolic SAR: Provides potential reversal points

Momentum Indicators

RSI (Relative Strength Index): Identifies overbought/oversold conditions

Stochastic Oscillator: Compares closing price to price range over a specific period

CCI (Commodity Channel Index): Identifies cyclical trends

Volatility Indicators

Bollinger Bands: Measure market volatility and potential price targets

ATR (Average True Range): Quantifies market volatility

Keltner Channels: Similar to Bollinger Bands but uses ATR for band calculation

Forex Day Trading Strategies

Moving Average Crossover Strategy

One of the simplest forex day trading strategies, the moving average crossover helps identify potential trend shifts. When a fast EMA (8-period) crosses above a slow EMA (21-period), it signals a buy opportunity, whereas a fast EMA crossing below a slow EMA indicates a potential sell signal.

To implement, apply 8 and 21-period EMAs to a 15-minute chart, enter long when the fast EMA crosses above the slow EMA, and place a stop-loss below the recent swing low. Profits can be taken at a 1:2 risk-reward ratio or when the EMAs cross again.

Support and Resistance Trading

Support and resistance levels provide structured entry and exit points for traders. Support is a price level where downtrends pause due to buying pressure, while resistance is where uptrends slow due to selling pressure.

To apply this strategy, identify key support/resistance levels on a daily chart, then monitor price action on 5- or 15-minute charts for confirmation. Enter long trades at support and short trades at resistance, using candlestick patterns as confirmation. Place stop-loss orders beyond support or resistance levels to minimize risk.

Breakout Trading Strategy

Breakout trading focuses on price movement following a breakout from consolidation patterns such as triangles, rectangles, and flags. Traders monitor volume for confirmation and enter a trade when the price breaks through support or resistance with increasing volume.

A stop-loss is placed inside the pattern, while the take-profit level is equal to the pattern’s height, allowing traders to capitalize on momentum.

Fibonacci Retracement Strategy

Fibonacci retracement levels are used to identify potential trend reversal points. This strategy involves drawing Fibonacci retracements from swing low to high (uptrends) or swing high to low (downtrends) and looking for price reactions at key levels such as 38.2%, 50%, and 61.8% retracements.

Trades are confirmed with candlestick patterns or additional indicators, and stop-losses are placed beyond the next Fibonacci level. Once mastered, this approach becomes a valuable tool in forex day trading strategies.

RSI Divergence Strategy

RSI divergence helps traders identify potential trend reversals. A bearish divergence occurs when the price makes higher highs, but the RSI forms lower highs, signaling a potential downtrend.

Bullish divergence happens when the price makes lower lows, but RSI forms higher lows, indicating a possible uptrend. Trades are confirmed using candlestick patterns or other technical indicators, with stop-loss orders placed beyond recent swing points. This more advanced technique is useful for traders once they have mastered basic strategies.

Order Flow Trading

Order flow trading focuses on the balance between buyers and sellers. Traders analyze time and sales data to identify large institutional orders and monitor limit order books where available. They look for the absorption of buying or selling pressure and enter trades when order imbalances occur in the direction of absorption.

While this method requires a deeper understanding of market mechanics, it can enhance day trading strategies once fundamental techniques are mastered.

Each strategy provides a structured approach to forex day trading, helping traders refine their techniques and build a disciplined, risk-managed market approach.

Risk Management for Forex Day Trading

Figure 4: A risk gauge meter with a semi-circular scale indicating risk levels

Position Sizing

Proper position sizing is critical for all forex day trading strategies. Position sizing helps manage risk effectively by determining the appropriate trade volume or lot size based on account size, risk tolerance, and stop-loss distance.

The 1% rule is recommended for day trading strategies for beginners:

Never risk more than 1% of your trading capital on a single trade

Calculate position size using the formula: Position Size = (Account Size × Risk Percentage) ÷ Stop - Loss in Pips

Setting Stop-Losses

Effective stop-loss placement is essential in forex day trading strategies. Stop-loss is a predefined price level at which a trade is automatically closed to limit potential losses and manage risk.

Volatility-based stops: Place stops based on ATR multiplier (e.g., 1.5× ATR)

Structure-based stops: Place stops beyond support/resistance levels or swing points

Time-based stops: Exit trades that don't move in your favor within a specified timeframe

Day trading strategies for beginners should always incorporate predefined stop-losses before entry.

Take-Profit Strategies

Profitable forex day trading strategies require clear profit-taking rules:

Fixed risk-reward: Set take-profit at multiples of risk (1:2, 1:3)

Technical levels: Take profits at support/resistance levels

Partial profits: Scale-out of positions at different levels

Trailing stops: Move stop-loss to lock in profits as trade moves favorably

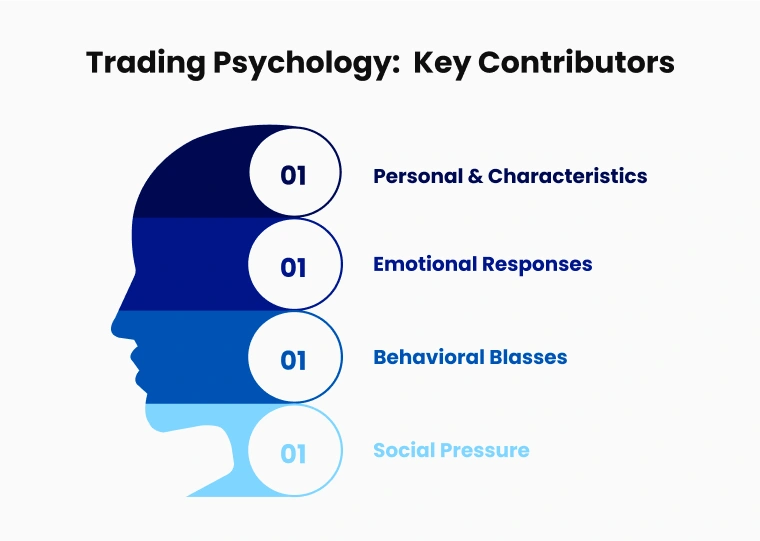

Psychological Aspects of Forex Day Trading

Figure 5: Forex trading psychology

Maintaining Discipline

Mental discipline is the foundation of successful forex day trading. Beginners must develop strategies to manage psychological challenges, such as sticking to a well-defined trading plan, adhering to predefined risk parameters, and avoiding revenge trading after losses.

Regular breaks help maintain mental clarity while keeping a detailed trading journal allows traders to analyze performance objectively and refine their approach.

Dealing with Losses

Losses are inevitable in forex trading, and a healthy mindset toward them is essential for long-term success.

Traders should accept losses as a normal part of the process, analyze losing trades objectively for improvement, and maintain consistent position sizing regardless of recent results. Implementing stop-trading rules after consecutive losses can prevent emotional decision-making while focusing on trading execution rather than short-term outcomes ensures steady progress.

Practical Implementation for Beginners

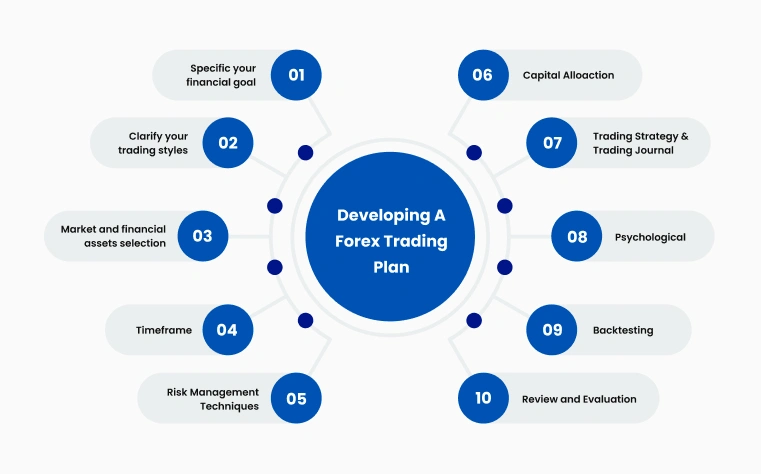

Figure 6: Forex trading plan.

A well-structured trading plan is essential for success in forex day trading. To maintain consistency, beginners should define their trading goals, timeframes, entry and exit criteria, and risk management rules. A clear trading schedule and routine help ensure discipline while tracking performance metrics allows traders to refine their strategies over time.

Before committing real capital, traders should test their strategies under different conditions. Backtesting with historical data helps identify potential performance trends, while forward testing through demo accounts allows traders to validate their approach in real-time market conditions. When transitioning to live trading, starting with small positions and gradually increasing trade size ensures smoother adaptation and risk control.

Maintaining detailed trading records is crucial for long-term success. Traders should capture screenshots of charts before entering trades, document trade parameters (entry, exit, risk, reward), and note market conditions and trade rationale. Weekly reviews of trading records help identify strengths, weaknesses, and areas for improvement. By following this disciplined, data-driven approach, traders can enhance decision-making and long-term profitability in forex day trading.

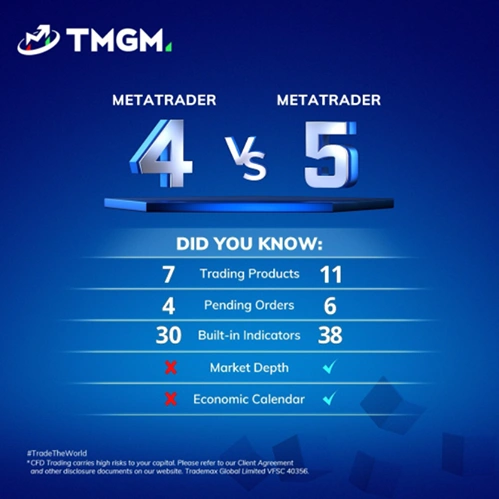

Figure 7: MetaTrader 4 Vs MetaTrader 5

Technology Requirement for Forex Day Trading

Implementing forex day trading strategies requires appropriate technology:

Trading Platforms

Popular platforms for day trading strategies for beginners include:

MetaTrader 4/MetaTrader 5 Industry standard with extensive indicator libraries

cTrader: Advanced platform with depth of market features

TradingView: Excellent charting with social features

NinjaTrader: Advanced platform with extensive customization options

Execution Tools

Some forex day trading strategies benefit from specialized tools:

One-click trading functionality

Automated trade management (trailing stops, partial exits)

Risk calculators for precise position sizing

Trade journaling software

Regulatory Considerations

Understanding regulatory aspects is important for forex day trading strategies:

Day trading strategies for beginners should consider broker regulation (FCA, ASIC, CFTC/NFA)

Understand the tax implications of frequent trading

Be aware of pattern day trader rules in certain jurisdictions

Consider account structure (individual, corporate, proprietary)

Developing a Learning Path

Mastering forex day trading strategies requires ongoing education and refinement, depending on one's appetite, market conditions, and risk management controls.

A progressive approach to day trading begins with mastering one strategy before adding complexity, ensuring a strong foundation. Risk management should prioritize profit maximization, as preserving capital is key to long-term success. As skills develop, traders can gradually introduce more advanced strategies while maintaining discipline.

Seeking mentorship or joining trading communities provides valuable insights and feedback, accelerating growth. Additionally, regularly reviewing and refining strategies helps traders adapt to evolving market conditions and improve performance.

Figure 8: Forex Technology

The Future of Forex Day Trading

Evolving technologies are changing how we view and make the most of forex day trading strategies:

Algorithmic trading is becoming more accessible to retail traders

Big data analysis provides new insights

Machine learning applications for pattern recognition

Social trading and copy trading platforms for forex day trading strategies for beginners

Developing effective forex day trading strategies requires technical knowledge, psychological discipline, and practical experience. For newcomers exploring day trading strategies for beginners, the journey should begin with education, move through structured practice, and culminate in inconsistent application of well-tested methods.

Remember that successful forex day trading strategies focus on consistency rather than exceptional gains. By managing risk appropriately, maintaining emotional discipline, and continuously refining your approach, you can develop day trading strategies for beginners that evolve into sophisticated methods for navigating the complex but rewarding world of currency trading.

Free Forex Trading Courses and Resources

Becoming a successful forex trader requires skill, knowledge, and practice. TMGM provides everything you need with free trading courses, webinars, and expert insights. With US$100,000 in virtual funds, our free demo account allows you to refine your strategies in a risk-free environment.

Stay ahead with market analysis, trading strategy insights, and real-time news—whether you're a beginner or an experienced trader, TMGM equips you with the tools for success.