Day Trading Crypto: A Beginner’s Guide to Getting Started

In the fast-moving world of cryptocurrency, where prices can rise or crash within minutes, day trading crypto has become a popular day trading strategy among both seasoned traders and ambitious beginners. Unlike traditional markets that close each day, crypto markets run 24/7, offering continuous opportunities—and risks—for those ready to act fast. Crypto day trading is one of the most demanding trading styles. It requires sharp decision-making, disciplined risk management, and a solid grasp of tools like MACD and RSI indicators. While the potential for short-term profit is real, so are the challenges—from volatility to emotional pressure. This guide breaks down how to trade cryptocurrency effectively. We'll explore the core principles, day trading strategies, tools, and risks involved—equipping you with a clear understanding of what it takes to operate in this high-intensity space.

What is Crypto Day Trading?

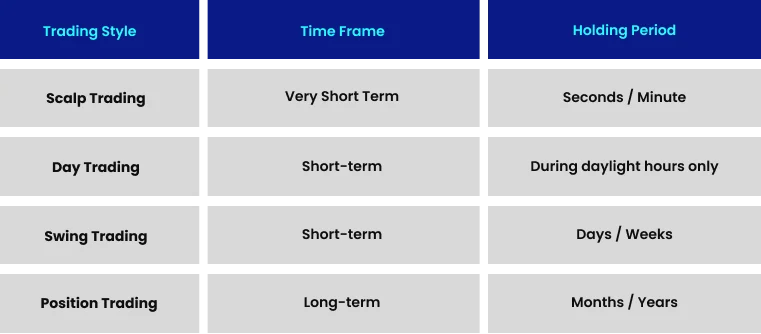

Crypto day trading involves opening and closing trades within the same 24-hour period—commonly referred to as intraday trading. This distinguishes it from other trading styles like spot trading, swing trading, or position trading, where positions are held longer. Day traders typically operate on centralized exchanges, executing multiple trades in quick succession—sometimes twenty or more in a single day—to profit from small, short-term price fluctuations.

It’s important to understand that day trading is not a single strategy but a time-based trading approach. Traders apply techniques like scalping or use tools from technical analysis, but what classifies a trade as a "day trade" is its duration—entry and exit occur within the same day.

Here's how day trading compares to other common trading styles:

Figure 1: Depicts day trading versus other trading styles

Cryptocurrency markets operate continuously unlike traditional stock markets with regional sessions and weekend closures. Therefore, a crypto day trade is considered any trade concluded within 24 hours. Many traders use Coordinated Universal Time (UTC) as their reference point for the opening and closing of a trading day.

Why Day Trade Cryptocurrencies?

Day trading means buying and selling cryptocurrency within a single day. The goal is to make small profits that add up over time. Here are the main reasons people choose this style of trading.

The Benefits

Quick Profits: You don’t have to wait months or years to see a return. You try to make money on small price changes throughout the day.

Always Open: The stock market closes at night, but crypto is open 24/7. You can trade whenever it fits your schedule.

Moving Prices: Crypto prices go up and down a lot. These frequent jumps give traders more chances to make a profit.

Easy to Buy and Sell: Popular coins like Bitcoin are always in demand. This makes it easy to enter or exit a trade instantly.

No Overnight Stress: You sell everything before you go to sleep. This means you don't have to worry about the price crashing overnight.

Make Money When Prices Drop: You can make money even when the market is going down. This is called "shorting."

Freedom: You can trade from anywhere with internet access. You are your own boss.

A Warning:

Day trading can be very risky. Most beginners lose money. It takes a lot of time, practice, and self-control to be successful. Never trade with money you cannot afford to lose.

Is Day Trading Crypto Suitable for Beginners?

Most professional traders strongly advise against day trading for beginners, and their concerns are supported by compelling evidence:

The harsh reality is that the overwhelming majority of day traders lose money, with frequently cited failure rates of 95% or higher. Research suggests that the actual figure may be even more discouraging.

Key findings from studies of day traders in traditional markets reveal:

80% of traders abandon the practice within their first two years

Across multiple studies, more than 90% of day traders ultimately lose their invested capital

One study found that only 1% of day traders remain profitable after accounting for trading fees

Another study concluded that "it is virtually impossible for an individual to day trade for a living, contrary to what brokerage specialists and course providers often claim."

These statistics should pause anyone considering crypto day trading, especially beginners with limited market experience and capital reserves.

Why Crypto Day Trading Is Considered Difficult?

Several factors contribute to the exceptional difficulty of day trading cryptocurrency assets, making it substantially more challenging than trading on higher timeframes or pursuing long-term investment strategies:

Extreme Market Volatility: Cryptocurrency markets experience dramatic price fluctuations over short periods, creating opportunities and significant risks.

Real-Time Decision Making: Day trading demands exceptional mental agility for making rapid decisions under pressure—a cognitive skill many traders struggle to consistently develop.

Fee Impact: The frequency of trades in day trading leads to higher cumulative transaction fees. These costs can be the difference between marginal profitability and consistent losses.

Psychological Demands: Of all approaches to financial market participation, day trading places the most intense demands on a trader's psychology. Successful day traders must be extremely adept at accepting losses quickly and moving forward without emotional baggage—a psychological skill that many novice traders find nearly impossible to master.

A crucial question: Would you invest in a company without investigating its profitability or expected return on investment? If you wouldn't, why would you approach day trading any differently? Before risking capital, you should have evidence of your profitability potential in day trading conditions.

Becoming consistently profitable can require years of persistence and determination—as demonstrated by many successful traders profiled in Jack Schwager's renowned "Market Wizards" series.

How to Pick Cryptocurrencies for Day Trading

The selection of cryptocurrency assets for day trading should not be random. Successful day traders typically focus on assets that meet specific criteria:

Thorough Knowledge: Choose cryptocurrencies you have studied extensively over a significant period, including backtesting your strategies to determine their suitability for your trading approach.

Personality and Trading Plan Alignment: Select assets that match your trading personality and plan. Some cryptocurrencies exhibit extreme volatility with substantial trading volume, while others trade in longer, slower trends. Your selection should reflect your risk tolerance and trading style.

Platform Support: Ensure your chosen cryptocurrencies are supported by your preferred trading platform and have adequate liquidity for your intended trade sizes.

The most successful day traders develop deep expertise in a limited number of cryptocurrency pairs rather than spreading their attention too thin across many different assets. This focused approach allows for a more nuanced understanding of specific market behaviors.

Day Trading Crypto: Spot vs. CFDs

For day traders who need to move quickly in volatile markets, choosing the right trading method is crucial. You essentially have two options: buying actual coins on a Spot Exchange or trading price movements with a CFD Broker.

While spot trading is excellent for long-term investors, day traders often prefer CFDs because of the flexibility to profit in both rising and falling markets.

Here is a comparison of how they differ for a day trader:

Why Day Traders Prefer CFDs:

Short Selling: In crypto, prices crash fast. CFDs allow you to open a "sell" position to potentially profit from these drops, whereas spot traders are often stuck holding a losing asset.

Capital Efficiency: With leverage, you do not need to deposit the full value of a Bitcoin to trade it. A small margin deposit allows you to control a full position. Note: Leverage increases both potential profits and potential losses.

Crypto Day Trading Example: Step-by-Step Guide on How to Place Your First Trade

Step 1: Fund Your Account

First, deposit money into your crypto exchange account. If you plan to borrow money from the exchange to make larger trades (using leverage), you need to pay close attention to margin requirements for your broker. This is simply the minimum amount of your own cash you must keep in your account as a security deposit.

Step 2: Check the Trend Look at the price chart for the coin you want to trade. You need to see which direction the market is moving.

Bullish: The price is going up. Traders usually look to buy here.

Bearish: The price is going down. Traders usually avoid buying or look to "short" (bet against) the coin.

To illustrate how crypto day trading works in practice, consider the following scenario:

After analyzing various cryptocurrency markets for potential opportunities, Henry identifies a promising setup on the five-minute Bitcoin price chart. Bitcoin is currently in a downtrend approaching the psychologically significant $50,000 level.

Figure 2: Five-minute Bitcoin chart showing the downtrend approaching the $50,000 psychological support level.

Henry develops a day trade idea with historically positive expectations based on extensive backtesting, statistical analysis, and trading journal data. Their analysis suggests a high probability that Bitcoin prices will bounce once reaching the $50,000 level.

Step 3: Pick a Strategy & Set Targets

Never guess. Have a very specific plan before you start. For example, you might decide to buy only when the price breaks through a specific low point then sell higher. Decide on three specific numbers before you trade:

Entry: The price where you will buy the coin.

Take Profit: The price where you will sell to lock in your winnings.

Stop Loss: The most important number. This is an automatic safety trigger. If the price drops to this level, the system sells your coin to stop you from losing too much money.

Stick to your plan. You should never make decisions based on feelings or stress.

Back to the scenario: Henry

Henry decides to:

Place a limit order to buy one Bitcoin at $50,000

Set a stop-loss order at $49,900 to cap potential losses should prices continue falling

Place a take-profit order at $50,200

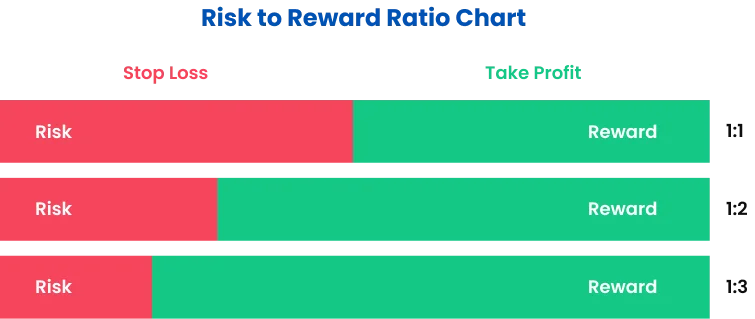

After calculating potential gains and losses, Henry determined a risk-reward ratio of 2:1—the intended profit ($200) is twice the potential loss ($100), before accounting for transaction fees. Now you trade.

Figure 3: Visual representation showing stop-loss, take-profit levels, and risk-reward ratio.

Step 4: Place the Order Now you are ready to click the buy button. You usually have two choices:

Market Order: You buy immediately at the current price. This is fast, but the price might change slightly by the time the trade finishes.

Limit Order: You set the exact price you want to pay. The trade will only happen if the market hits your price. This gives you control, but you might miss the trade if the price never hits your target.

As Henry anticipated, Bitcoin's price dips to $50,000, and Henry's limit buy order is executed. However, contrary to his expectation, the market falls instead of bouncing. When prices drop below $49,900, the stop-loss order triggers a $100 loss.

Despite the unsuccessful outcome, Henry recognizes that he executed his plan correctly and understands that losses are an inevitable part of the trading process. Statistically, losses occur a significant percentage of the time, and individual losing trades do not invalidate Henry's "edge"— His ability to identify and exploit non-random market events.

Essential Skills Needed for Crypto Day Trading

While there is no single formula for successfully day trading cryptocurrency, the markets offer unlimited freedom and creativity—a characteristic that presents both opportunities and dangers.

In his influential book "Trading in the Zone," Mark Douglas explains that markets afford creative freedom rarely experienced in other areas of life. This freedom allows traders to take enormous risks with potentially devastating consequences.

This dynamic explains why traders can experience dramatic short-term wins and losses while finding it exceedingly difficult to preserve long-term gains.

Many experienced traders believe that successful crypto day trading requires the following:

Self-awareness to develop strategies aligned with your personality

Mastery of trading fundamentals, including technical analysis, backtesting, and risk management

Let's examine these essential skills in greater detail.

Reading Charts and Technical Indicators

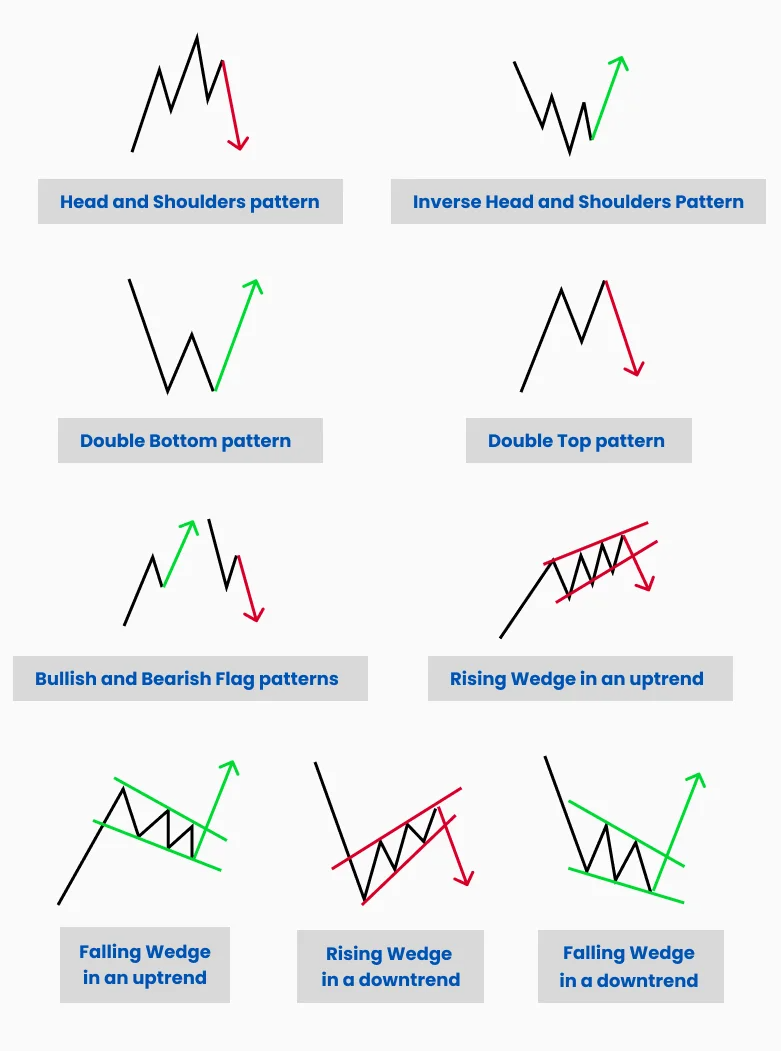

While academics have long debated the random nature of markets (see "Random Walk Theory"), many traders operate on the premise that markets display repeatable, tradable patterns.

Chart analysis offers countless approaches, with thousands of indicators, algorithms, and strategies available. Many experienced traders analyze price action (the movement of price over time) using candlestick charts, which visually represent price movements within specific periods.

Figure 4: Common candlestick patterns day traders use to identify potential market reversals and continuations.

Technical analysis helps traders identify trends and patterns on cryptocurrency charts, potentially revealing broader market sentiment and enabling more informed decision-making.

Figure 5: Example of technical analysis applied to a cryptocurrency chart, showing moving averages, RSI, and volume indicators.

Example: Fibonacci Retracement for Day Trading Crypto

Many crypto traders employ the Fibonacci retracement tool (derived from the Fibonacci sequence) to identify potential reversal zones on price charts. By marking significant highs and lows, traders can overlay Fibonacci retracement levels to highlight areas where the market might reverse direction.

The most commonly used retracement levels are 23.6%, 38.2%, 61.8%, and 78.6%, with many traders paying particular attention to the "golden ratio" level of 61.8%.

Figure 6: Fibonacci retracement levels applied to a Bitcoin chart, showing potential reversal zones at key Fibonacci levels.

Choosing the Right Trading Timeframes

Crypto day traders typically focus on lower timeframes, such as hourly charts (representing up to one hour of price action) or timeframes as short as 1-minute candlesticks. This approach allows traders to capitalize on minor market fluctuations over brief periods potentially.

Many traders also incorporate data from higher timeframes, such as daily or weekly charts, to support their lower timeframe decisions. For example, if Polygon (MATIC) or Ethereum (ETH) is trending upward on the daily timeframe, trades aligned with this bias on lower timeframes may have a higher probability of success.

Mastering Order Placement

Financial markets utilize various order types, but crypto day traders typically rely on two primary order categories available on centralized exchanges:

Limit Orders: These passive or "resting" orders wait to be filled at a specific price. For example, a trader might order a limit to buy 1 Bitcoin at $50,000. This trade executes only when Bitcoin reaches that price, and a seller accepts the order. Limit orders add liquidity to markets by making assets available for trading. The order book represents all limit orders that constitute a particular market.

Market Orders: These active orders "take" existing orders from the order book. Using the previous scenario, if a trader wants to quickly buy Bitcoin around $50,000 without waiting for the exact price, they might use a market order to purchase immediately at $50,500. The exchange will fill this order using the closest available sell orders, which may result in a less favorable entry price—a phenomenon known as "slippage."

This concept explains why stop-loss orders (market orders at predetermined levels to close positions) may execute at prices significantly different from intended levels, if at all. No exchange can guarantee a successful position exit at your desired price.

Top 5 Day Trading Crypto Strategies for Beginners

While the following strategies can apply to any timeframe, they are particularly popular among day traders seeking short-term opportunities.

1. Range-Based Trading Strategy

Markets typically exhibit two behavioral patterns: trending (moving up or down) or rangebound (moving sideways). Strong trends often decelerate into ranges or consolidations.

Many traders specialize in trading these consolidations by waiting for prices to reach either extreme of the range—the upper or lower boundary.

Cryptocurrency prices frequently "sweep" or "deviate" beyond a range's boundaries before pivoting back inside. This price action sequence often occurs because traders are caught off-guard, holding underwater positions after prices briefly exit the range. Many range traders specifically target these deviation patterns for entry opportunities.

Figure 7: Range trading example showing price consolidation between support and resistance levels, with entry points at range boundaries.

2. Arbitrage Opportunities in Crypto Markets

Crypto arbitrage exploits price differences of the same digital asset across different cryptocurrency exchanges. Unlike strategies based on price action, arbitrage requires monitoring an asset's price across multiple trading venues.

For example, if Solana (SOL) trades at $100 on Exchange A but $120 on Exchange B, a trader with funds on Exchange A could purchase Solana, transfer it to Exchange B, and sell it there—potentially profiting after accounting for transfer and transaction fees.

While conceptually simple, successful arbitrage requires overcoming numerous practical challenges, including transfer times, withdrawal restrictions, and rapidly changing price differentials.

3. Support and Resistance Flip Strategy

A common trading maxim states that "former resistance becomes future support," meaning once cryptocurrency prices break through a key level, that level can subsequently act as support—at least until market sentiment shifts again.

This phenomenon creates opportunities for day traders. Price will often test a level repeatedly before breaking through it. Following a breakout, the price frequently returns to retest the former resistance as new support, producing a reversal. This pattern is known as an "S/R Flip" due to the transformation from resistance to support.

Many traders consider these S/R flip zones among the highest-probability trading setups available in cryptocurrency markets.

Figure 8: Support and resistance flip example on an Ethereum chart, demonstrating how previous resistance becomes support after a breakout.

4. Trendline and Momentum-Based Trading

Trend trading strategies aim to capitalize on established market trends, typically capturing significant portions of directional price movements. A common application uses trendlines on price charts and price action to define risk and reward parameters for trading setups.

Trend traders often use the phrase "the trend is your friend," recognizing that trading in alignment with prevailing market direction typically offers higher probability opportunities than counter-trend approaches.

Figure 9: Trend trading example showing an uptrend in Bitcoin with multiple entry points along the ascending trendline.

Pros and Cons of Day Trading Crypto Assets

Pros of Crypto Day Trading

Structured Schedule: Day trading allows practitioners to focus their trading activities during specific hours, similar to conventional work schedules. This structure may particularly appeal to individuals with family or other commitments.

Rapid Account Growth Potential: Skilled day traders can grow their accounts quickly through multiple daily trades. Combined with compounding effects, this high-frequency approach enables exponential account growth when executed successfully.

Cons of Crypto Day Trading

Psychological Stress: Many individuals find executing and managing multiple trades within a single day extremely stressful, leading to decision fatigue and potential burnout.

Mental and Physical Demands: Day trading requires intense, sustained concentration on multiple variables (often across multiple screens), which can create significant mental and physical strain over time.

High Failure Rate: The extraordinary difficulty of maintaining consistent profitability over extended periods means many day traders ultimately lose money. These individuals might achieve better results through long-term investing or strategies executed on higher timeframes.

Day Trading in Australia: Rules & Taxes

Navigating the Australian market requires more than just a strategy; it requires understanding the regulatory landscape. Australia maintains one of the strictest financial environments globally, designed to protect retail participants.

Is Day Trading Legal in Australia?

Yes, day trading is 100% legal in Australia.

However, it is heavily regulated by the Australian Securities and Investments Commission (ASIC). For a secure experience, traders should strictly operate with brokers that hold a valid Australian Financial Services Licence (AFSL).

Why this matters: ASIC imposes strict rules on leverage (e.g., capping crypto leverage to protect consumers) and requires brokers to segregate client funds.

The Risk: Trading with offshore, unlicensed brokers exposes traders to significant risk. If an offshore broker collapses, Australian dispute resolution schemes cannot help recover the funds.

Tax Implications (Trader vs. Investor Status)

This is the most critical "hidden" aspect of trading in Australia. The Australian Taxation Office (ATO) does not treat everyone with a trading account the same way. There is a distinct legal difference between being classified as a "Share Investor" versus carrying on a "Business of Trading."

Understanding this distinction determines how profits are taxed:

The Investor (Capital Gains Tax):

Most casual participants fall here.

Profits are subject to Capital Gains Tax (CGT).

The Downside: Day traders rarely qualify for the 50% CGT discount, as this generally requires holding an asset for more than 12 months.

Losses: Capital losses can only offset capital gains, not ordinary income (like a salary).

The Trader (Business Income):

If trading is conducted with a business-like structure (high volume, regular frequency, organized records), the ATO may classify the individual as a "Trader."

Profits are treated as ordinary personal income.

The Upside: "Traders" can often deduct trading expenses (courses, hardware, data subscriptions) against their income.

Losses: Revenue losses may potentially offset other income types, providing a different tax outcome compared to investors.

> Note: Tax laws are complex. The ATO assesses each case individually based on volume and intent. It is strongly recommended to consult a qualified Australian tax accountant to determine the correct classification.

Conclusion: Should You Start Crypto Day Trading?

Crypto day trading represents one of the most challenging approaches to generating profit from cryptocurrency markets, as evidenced by remarkably high failure rates across traditional and digital asset markets.

Awareness of the associated risks is essential for those considering this trading style. Before committing significant capital, extensive practice using demo accounts can help determine whether day trading aligns with your skills, personality, and financial objectives.

While the potential rewards of successful day trading are substantial, the path to consistent profitability is arduous and unsuitable for everyone. Many accomplished cryptocurrency investors achieve impressive results through longer-term approaches that demand less time, reduce stress, and minimize exposure to short-term market noise.

Whatever approach you choose, remember that education, practice, and disciplined risk management form the foundation of any successful trading journey.

Managing Risk when Day Trading Crypto

Risk management—determining how much capital to risk per trade to minimize the "risk of ruin" (losing all trading capital)—is arguably the most critical aspect of successful trading.

The risk of ruin represents the probability of losing enough capital to make recovery impossible or force trading activities to be abandoned. In cryptocurrency communities, this catastrophic outcome is colloquially known as "getting rekt."

Numerous free online tools allow traders to calculate their risk of ruin based on their trading parameters.

To reduce risk, many traders:

Set stop-loss orders on all trades to limit potential losses

Never invest more capital than they can afford to lose

Conduct thorough due diligence on all cryptocurrencies before committing capital

Mastering Position Sizing (The 1% Rule)

While setting a stop-loss is essential, determining how much of your portfolio to risk on a single trade is equally important. This is known as position sizing.

The 1% Rule: A widely accepted standard among professional day traders is to never risk more than 1% of your total account balance on a single trade.

How it works: If you have a $10,000 trading account, your risk per trade should be capped at $100. This does not mean you only buy $100 worth of crypto; it means that if your stop-loss is hit, your loss will not exceed $100.

The Survival Math: By adhering to this rule, you would need to suffer 100 consecutive losing trades to wipe out your account. This statistical buffer is what keeps you in the game during inevitable losing streaks.

Understanding Risk-to-Reward Ratio

Successful risk management is not just about defense; it is about ensuring your winners outweigh your losers. This is calculated using the Risk-to-Reward (R:R) ratio.

The Concept: Before entering a trade, measure your potential profit against your potential loss.

The Target: Most day traders aim for a minimum ratio of 1:2. This means if you are risking $50 (your stop-loss distance), your take-profit target must be at least $100 away.

Why it Matters: With a 1:2 ratio, you can be wrong on 50% of your trades and still remain profitable. If you risk $1 to make $0.50, you need an incredibly high win rate just to break even, which is unsustainable for beginners.

The Dangers of Leverage

In crypto day trading, leverage (borrowing funds to increase position size) is a double-edged sword that directly impacts your risk of ruin.

Amplified Losses: While leverage can multiply gains, it also multiplies losses. A 10% price drop on a 10x leveraged position results in a 100% loss of your margin (liquidation).

Risk Management Adjustments: If you use high leverage, you must reduce your position size tightly to maintain the 1% risk rule mentioned above. Beginners are often advised to start with spot trading or very low leverage (e.g., 2x) until they have a proven track record of profitability.

Trading Psychology: The 80/20 Rule

Trading is 20% strategy and 80% psychology. You can have a perfect chart setup, but if your mind breaks, your account will too.

In crypto, volatility is high, and emotions spike fast. Here is how to survive the "mind game" that beginners usually fail:

Kill FOMO (Fear Of Missing Out): If you see a coin spike 10% in five minutes, the trade is already over. Chasing massive green candles is how beginners buy the top. Let it go.

Avoid Revenge Trading: Taking a loss hurts. But jumping back in immediately to "win it back" is gambling, not trading. If you hit your daily loss limit (e.g., 2% of your account), walk away. The market will be there tomorrow.

Patience is a Position: Beginners feel they need to be in a trade constantly to make money. Pros know that sitting on your hands and waiting for the perfect setup is a skill. Sometimes, the best trade is no trade.

The Golden Rule: Treat this like a business, not a casino. Never enter a trade without a pre-planned exit for both winning and losing. If you trade on feelings, the market will charge you an expensive tuition fee.

Taking the Next Step in Your Crypto Trading Journey

Figure 10: TMGM cryptocurrency trading interface showcasing trading opportunities for five major cryptocurrency pairs: BTC/USD, ETH/USD, BNB/USD, DOGE/USD, and DOT/USD.

Experience TMGM's advanced trading platform with comprehensive charting tools and real-time market data.

Gain access to Bitcoin, Ethereum, and other major cryptocurrencies through CFD trading with competitive spreads, leverage, and real-time market data. TMGM offers professional trading conditions, advanced charting tools, and robust risk management features to support crypto trading strategies.

Open an account today and experience the TMGM difference:

Award-winning trading platform

24/7 dedicated customer support

Educational resources for traders at all levels

Competitive spreads and low transaction fees

Trade Smarter Today

Frequently Asked Questions (FAQ) about Day Trading Cryptocurrency

What is the minimum amount to start crypto day trading?

Can you make a living day trading cryptocurrency?

Do I pay tax on crypto day trading in Australia?

Which crypto pairs are best for day trading?

Account

Account

Instantly