Best Gold ETFs in India (2026)

Ranking logic used: Liquidity first, then expense ratio, then AUM, then consistency, then one year returns. This aligns with how ETF trading costs show up in real execution, because higher volume tends to mean a tighter bid ask spread.

Top 5 list (based on your dataset and weighted score)

While the weighted list highlights balanced performers, specific investor needs dictate different choices:

Highest Liquidity (Scalping/Intraday): Tata Gold ETF. With a volume of 259,442,713, it vastly outperforms peers in execution capability, ensuring tight bid-ask spreads. It also boasts the best consistency with a Standard Deviation of 12.71.

Lowest Cost (Long-Term Holding): Zerodha Gold ETF (GOLDCASE). The 0.30% expense ratio minimizes the "cost drag" on your portfolio over multi-year horizons.

Pro Tip: Do not strictly chase the highest "1 Yr Returns." Since all gold ETFs track physical gold prices, slight deviations in returns often indicate higher Tracking Error rather than superior fund management.

How to Use Our 2026 Gold ETF Analysis Table

Do not read the table like a popularity list. Treat it as a decision matrix that maps your execution needs to the right gold ETF.

1. Weighted Score

The Weighted Score is a composite metric derived from our proprietary algorithm. It balances Liquidity (40% weight), Expense Ratio (30%), and Consistency (30%).

How to read it: If you want a low maintenance choice and you do not want to think about spreads, costs, or tracking quality, pick an ETF with a strong overall score profile (e.g., HDFC or ICICI Prudential). These tend to be the most balanced on liquidity, expenses, and tracking stability.

2. Volume vs. AUM (The ‘Size’ Trap)

Novice investors look at AUM; professional traders look at Volume.

The Trap: A fund can have massive AUM (assets) but low daily volume if most holders are inactive.

The Read: If you plan to deploy capital exceeding ₹5 Lakhs in a single trade, ignore the "Rank" and look strictly at the Volume column. You need deep order books (like Nippon or Tata) to ensure your buy order doesn't artificially spike the price (Slippage).

3. Consistency (Standard Deviation)

This column reveals the "nervousness" of the ETF.

The Read: Lower standard deviation usually means steadier tracking with less noise. Higher values can indicate more tracking variation from cash drag, creation redemption frictions, or less stable liquidity.

Your Action Plan: Execution Strategy

Once you have analyzed the table, choose your ETF based on your holding period.

Note: Do not mix these strategies.

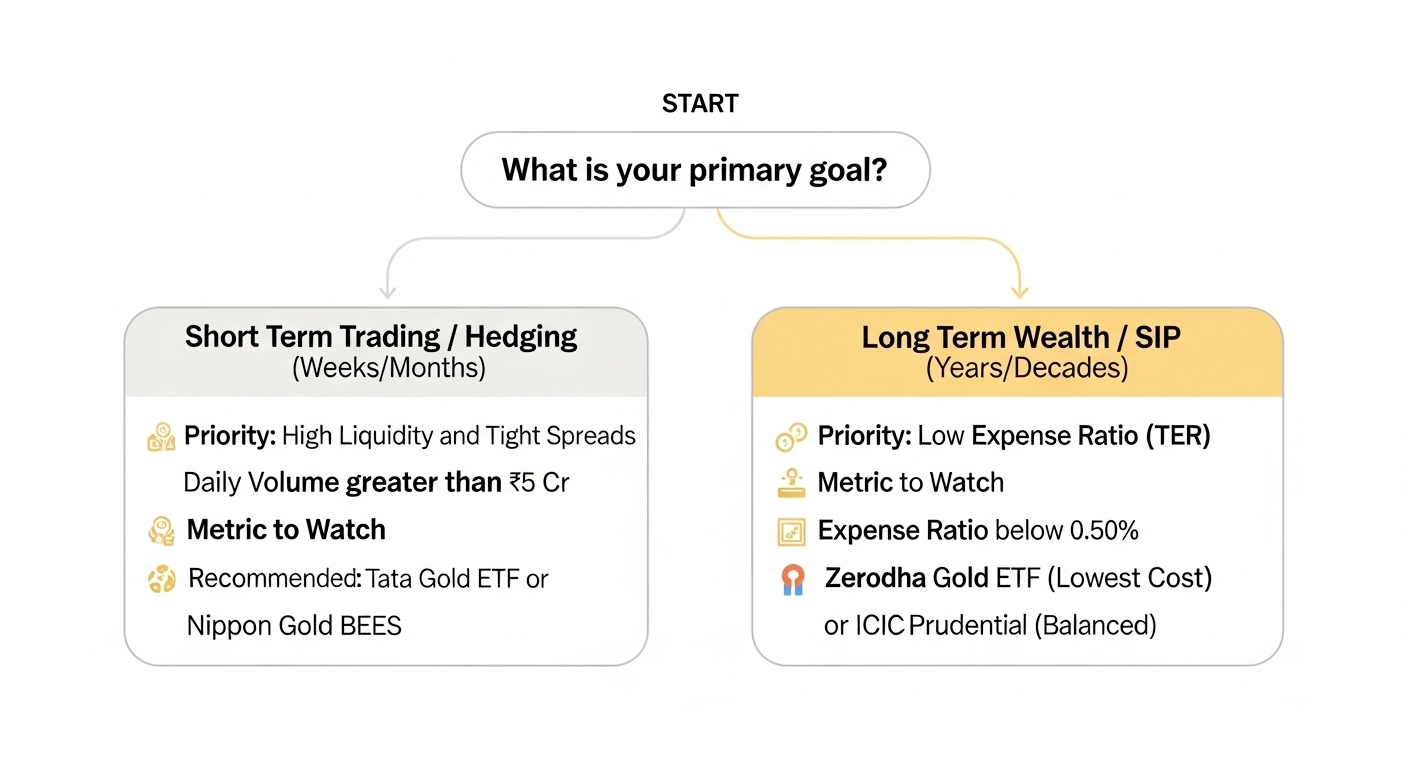

Figure 1: Goal based framework for choosing a gold ETF using two screening metrics, liquidity via daily trading volume and cost via expense ratio, with example funds for each use case.

Path A: The Tactical Trader (Weeks to Months)

Goal: Capture short-term gold price rallies or hedge equity portfolio volatility.

Priority: Liquidity. You need to enter and exit instantly without losing 0.5% to wide bid-ask spreads.

The Pick: Nippon Gold ETF (GOLDBEES) or Tata Gold ETF.

More Explanation: These 2 ETFs have the largest trading volume, so that when you need to sell quickly, your order will get filled fast with the large number of participants in the market.

The Move: Execute orders during peak market hours (11:00 AM – 2:00 PM) to ensure maximum liquidity overlap.

Path B: The Strategic Accumulator (Years to Decades)

Goal: Wealth preservation and compounding.

Priority: Expense Ratio. You are marrying the fund; divorce costs (exit loads) and maintenance (expense ratios) matter most.

The Pick: Zerodha Gold ETF (for lowest cost) or ICICI Prudential (for balanced performance).

The Move: Ignore daily volume fluctuations. Use a Systematic Investment Plan (SIP) or buy on dips. The 0.30% - 0.50% annual savings will compound significantly over 10+ years.

Important: Never use a "Market Order" when buying ETFs with lower volumes (Rank 3-5). Always use a "Limit Order" placed slightly above the best bid to avoid getting filled at a bad price due to momentary illiquidity.

How to Choose the Best Gold ETF? Important Considerations

Determining which gold scheme is best requires a fundamental understanding of what a gold etf is, how it works and its risks to make an informed decision before investing. The following factors are ranked by order of importance for a sophisticated investor.

1. Liquidity (Trading Volume)

Liquidity is the paramount metric. It dictates your ability to enter or exit a position at the current NAV (Net Asset Value) without slippage.

The Metric: Daily Average Trading Volume.

Why it matters: In volatile markets, low-volume ETFs suffer from wide bid-ask spreads. You might see a price of ₹6000 but only find buyers at ₹5980. Nippon Gold ETF and Tata Gold ETF have large liquidity pockets (huge trading volume), hence providing sufficient depth to absorb large orders without price distortion.

2. Expense Ratio (Total Expense Ratio - TER)

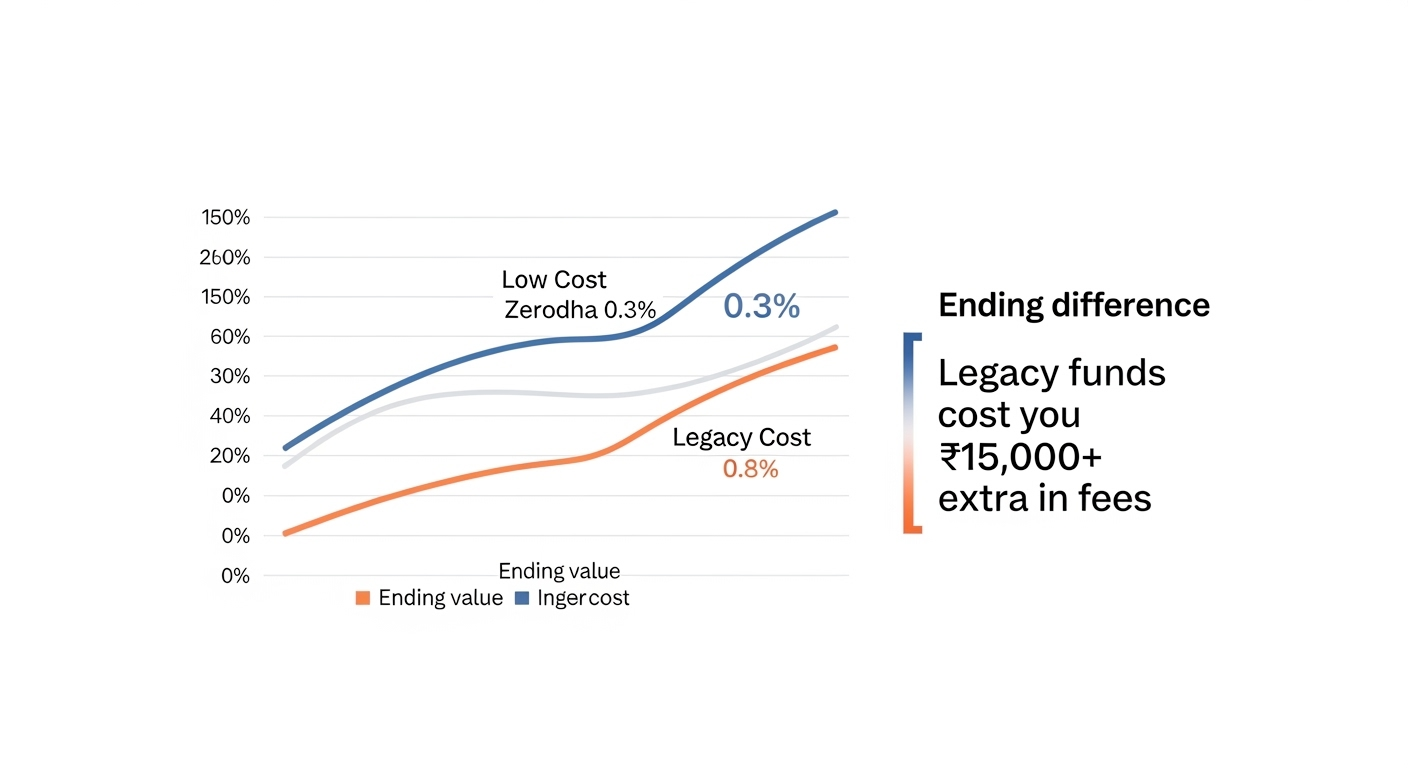

Figure 2: Cost drag illustration showing how a lower expense ratio can compound to a higher ending value, with the final gap highlighting the estimated extra fees from higher cost funds.

The TER is the annual fee deducted from the fund’s assets.

The Metric: Percentage per annum.

Analysis: Over a 10-year period, a 0.5% difference in TER can erode significant capital due to compounding. Zerodha (0.30%) and ICICI (0.5%) are superior to legacy funds charging 0.8% or more.

3. Assets Under Management (AUM)

While not a direct performance metric, AUM indicates survivability.

The Threshold: Funds with AUM > ₹1,000 Cr are generally safe from closure or merger risks. High AUM also typically correlates with better liquidity with Authorized Participants (APs).

4. Consistency (Tracking Fidelity)

This measures how closely the ETF follows the benchmark spot gold price.

The Metric: Standard Deviation of Returns.

Analysis: A lower standard deviation (like Tata’s 12.71) implies the fund manager is efficiently managing cash drag and inflows/outflows, resulting in precise tracking.

5) One year returns (lowest priority)

One year returns mainly reflect the gold price regime, so it is easy to overfit on a hot year. Use it as context, not the deciding factor, unless two ETFs are near identical on liquidity and cost.

6) Tracking Error (The Hidden Cost)

While Expense Ratio is explicit, Tracking Error is an implicit cost that can erode capital. It measures the standard deviation of the difference between the ETF's returns and the actual domestic spot price of gold.

The Reality: No ETF tracks the benchmark perfectly due to cash holdings (for redemptions) and accrued expenses.

The Strategy: Do not just look for "high returns." A Gold ETF outperforming physical gold is just as alarming as one underperforming it, as it indicates a breakdown in the fund's replication strategy. Always prioritize the lowest tracking error, as this proves the fund manager is efficiently managing inflows and outflows without cash drag.

Pro Tip: High volume often solves high tracking error. ETFs with deep liquidity allow Authorized Participants to arbitrage price differences faster, keeping the ETF price glued to the spot price.

Fees and Tax Reality for Gold ETFs in India

Fees you actually pay

Your total cost is Expense Ratio + Trading Friction. Trading friction is mostly the bid ask spread and market impact, which tends to be lower in high volume ETFs.

The Purity Standard: According to SEBI's regulations for Gold ETFs, funds must value their underlying gold based on 0.995 fineness (99.5% purity). This ensures that the asset quality is identical across all schemes, leaving tracking error as the only differentiator.

Tax treatment

Tax Reality Post-July 2024: As per the Finance (No. 2) Act, 2024, listed Gold ETFs held for more than 12 months are now classified as Long Term Capital Assets taxed at 12.5% (flat), replacing the old 36-month requirement.

Across recent explainers, gold ETF gains are commonly presented as short term taxed at your slab if sold within 12 months, and long term taxed at a flat rate after 12 months, without indexation in those summaries. Always check the latest rule set before publishing hard numbers.

Gold CFDs as a simpler trading alternative for active traders

For short to medium term traders/investors, Gold CFDs are often superior to ETFs. They remove management fees, allow you to trade price movements in either direction, and provide easy access to leverage.

Gold CFD Cost

With a gold CFD, you do not pay an ETF expense ratio. Your costs are usually priced directly into the trade:

• Spread and slippage: The cost shows up as the bid ask spread and slippage, but with TMGM’s Tier 1 Liquidity Provider and NY4 Servers, we guarantee 0.0 pip spread, and the best possible pricing in the whole CFD industry.

• Commission: Many brokers charge a separate commission, however, TMGM’s Classic Account guarantees 0 commission on your trades, and we have specially curated Islamic Account for Shariah Compliance as well.

• Overnight financing: If you hold positions overnight, you typically pay (or receive) a daily financing charge, which can become the main cost for longer holding periods.

Why some traders prefer CFDs over ETFs

• Profit in both directions: You can go long if you expect gold to rise, or short if you expect it to fall, without borrowing units.

• Lower entry barrier with leverage: You can control a larger notional position with a smaller margin deposit. This can amplify gains, but it also amplifies losses.

• Fast execution: You can open and close positions quickly without needing to compare multiple ETF schemes, tracking differences, or fund level fee structures.

Bottom Line

If you are trading for weeks or months, a gold CFD can be a strong alternative because it is built for active execution, supports both long and short positions, and makes your costs easier to see at the trade level rather than embedded in fund expenses. If you are investing for years, gold ETFs reward simplicity: pick high liquidity and a low expense ratio to reduce hidden spread costs and long run tracking drag.

Use this rule of thumb:

Trading or tactical hedging (weeks to months): prioritise volume first and use Nippon Gold ETF (GOLDBEES) or the highest liquidity option in your dataset like Tata Gold ETF, then execute with limit orders during peak hours.

Long term allocation (years): prioritise expense ratio first and consider Zerodha GOLDCASE for lowest cost, or ICICI Prudential Gold ETF if you want a more balanced profile.

Whatever you choose, treat any ETF that wins mainly because of “high 1 year returns” with suspicion. In gold ETFs, unusual return gaps often point to tracking frictions, not superior management.