2024 Performance Overview

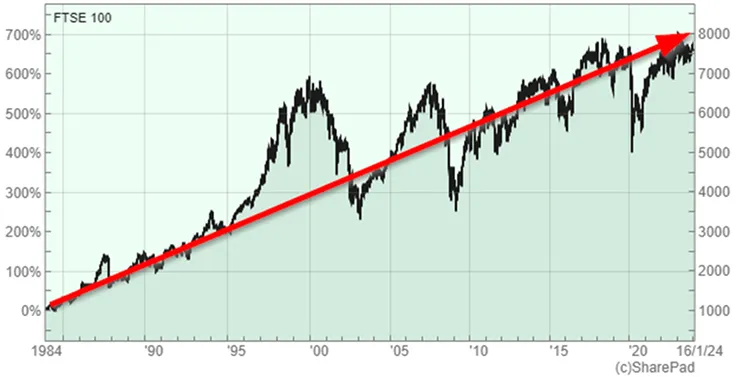

Strong annual return: The FTSE 100 Index closed 2024 with an impressive 5.7% annual gain, finishing at 8,173 points by year-end. This growth reflected resilience amid a challenging global economic environment.

Record high reached: In May 2024, the index reached a record high of 8,474 points, supported by robust energy and financial sector performance.

Sector contributions: The financial sector led gains, driven by strong merger and acquisition activity. Defensive stocks also provided stability amid market volatility.

The FTSE 100’s robust performance last year sets a positive foundation for 2025, though challenges and opportunities lie ahead.

Key Economic Indicators to Monitor in 2025

GDP growth: The UK economy expanded modestly with 0.1% growth in November 2024. Although slightly below forecasts, this highlights the economy’s resilience amid global uncertainties.

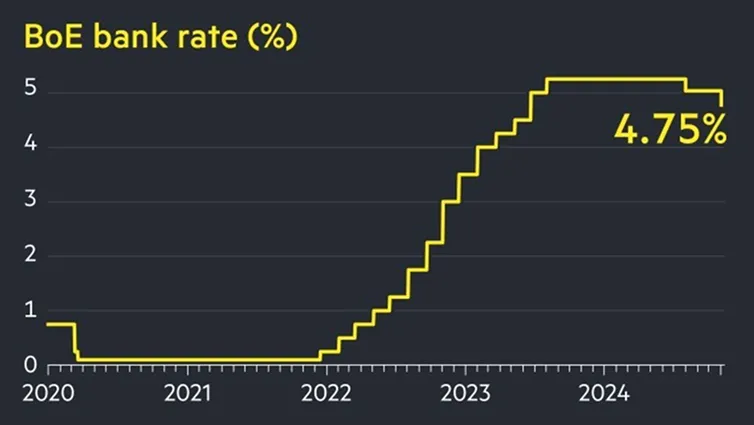

Inflation trends: Inflation fell to 2.5% year-on-year in December 2024, prompting speculation about potential interest rate cuts by the Bank of England. Lower rates could stimulate consumer spending and business investment in 2025.

Fiscal policy: Increased government expenditure is expected in 2025, potentially supporting economic growth. However, uncertainties around trade policies and tax reforms may present risks.

Economic stability and supportive fiscal conditions could significantly impact the FTSE 100’s performance this year.

Sectoral Trends Driving the FTSE 100 Index

Financial sector rebound: Banks and financial institutions, including Barclays and Lloyds Banking Group, are projected to maintain strong performance, supported by improved credit conditions and rising loan demand.

Energy sector growth: With oil prices stabilizing and energy firms such as BP and Shell capitalizing on global demand, the sector remains a key driver for the FTSE 100 Index.

Healthcare and pharmaceuticals: Led by companies like AstraZeneca and GSK, this sector continues to benefit from innovation and strong global demand for advanced therapies.

Chemical sector recovery: The chemicals industry, represented by firms such as Croda International, shows growth potential as global manufacturing activity accelerates.

Diverse sector contributions make the FTSE 100 a resilient index, well-positioned to withstand economic shifts and market volatility.

Investor Sentiment and Market Outlook

Positive fund manager sentiment: Many fund managers remain confident in UK equities for 2025, citing attractive valuations and growth prospects across key sectors.

Impact of political stability’: Following the UK’s smooth post-election transition in late 2024, political stability is expected to enhance market confidence.

Global market factors: Despite ongoing global economic uncertainty, the FTSE 100’s balanced mix of defensive and cyclical stocks positions it well to manage potential headwinds.

Investor sentiment points to a cautiously optimistic outlook for 2025, with the FTSE 100 expected to attract both domestic and international capital.

Opportunities and Risks for Traders

Upside potential: Should inflation remain subdued and the Bank of England reduce interest rates, sectors dependent on consumer spending and credit could outperform.

Geopolitical risks: Trade tensions, currency volatility, and shifting international relations may increase market fluctuations, creating opportunities for traders skilled in navigating rapid price movements.

Sector-specific risks: Energy companies face regulatory pressure from green policies, while financial institutions remain vulnerable to changes in compliance requirements.

Traders should closely monitor these factors to leverage opportunities and manage risks effectively.

A Promising Outlook for the FTSE 100 Index

The FTSE 100 Index is poised to remain a significant player in global financial markets, combining growth-oriented sectors with defensive stocks that provide both stability and opportunity. Economic indicators, sector trends, and investor sentiment suggest a favorable year ahead, though potential risks require vigilant management.

Staying informed on these developments will be crucial for investors and traders engaging with the UK equity market. With appropriate strategies and tools, the FTSE 100 Index offers substantial profit potential in 2025.

Take Action: Trade Stock Indices with TMGM

Ready to seize the FTSE 100 Index’s opportunities in 2025? TMGM’’s platform enables you to trade stock indices via CFDs (Contracts for Difference), allowing you to profit from both rising and falling markets. Open an MT4 or MT5 trading account today by visiting TMGM’’s platform and access advanced trading tools and leverage for smarter trading.