What is Crypto Day Trading?

Crypto day trading involves opening and closing positions within the same 24-hour period—, commonly known as intraday trading. This differentiates it from other trading styles such as spot trading, swing trading, or position trading, where positions are held for longer durations. Day traders usually operate on centralized exchanges, executing multiple trades rapidly—, sometimes twenty or more within a single day—, aiming to profit from small, short-term price movements.

It’’s important to understand that day trading is not a single strategy but a time-based trading approach. Traders employ techniques like scalping or utilize tools from technical analysis, but what defines a trade as a "day trade" is its duration—— entry and exit occur within the same trading day.

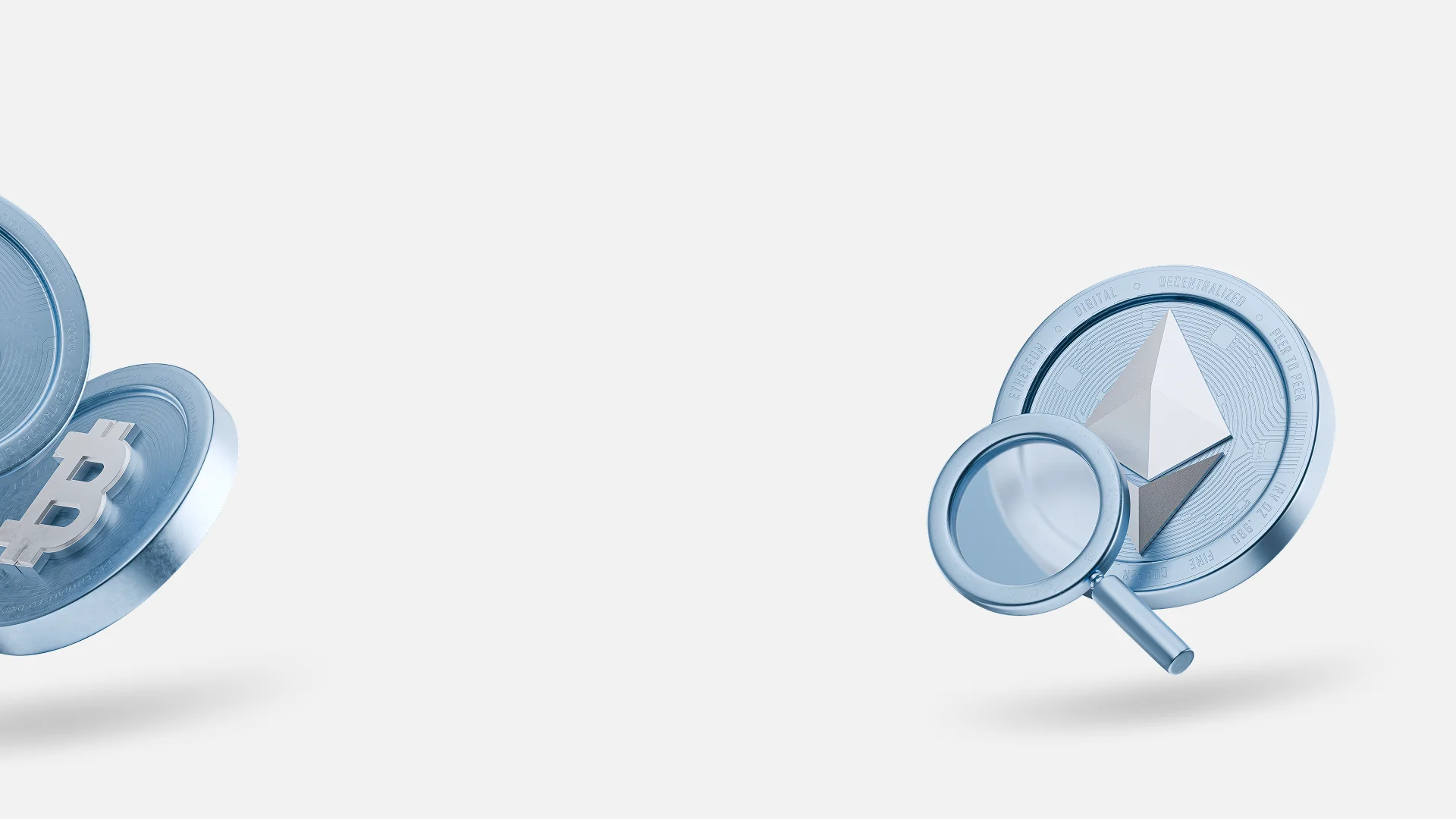

Here'’s how day trading compares to other common trading styles:

Figure 1: Illustrates day trading versus other trading styles

Cryptocurrency markets operate continuously, unlike traditional stock markets which have regional sessions and close on weekends. Therefore, a crypto day trade is any position opened and closed within 24 hours. Many traders use Coordinated Universal Time (UTC) as the standard reference for defining the trading day’s start and end.

How to Select Cryptocurrencies for Day Trading

Choosing cryptocurrency assets for day trading should be deliberate. Successful day traders generally focus on assets that meet specific criteria:

In-depth Knowledge: Select cryptocurrencies you have thoroughly researched over time, including backtesting your trading strategies to assess their effectiveness for your approach.

Alignment with Personality and Trading Plan: Choose assets that fit your trading style and risk tolerance. Some cryptocurrencies exhibit high volatility and trading volume, while others trend more steadily over longer periods. Your asset selection should reflect your individual preferences.

Platform Compatibility: Confirm that your preferred trading platform supports your chosen cryptocurrencies and that sufficient liquidity exists for your intended trade sizes.

Top day traders develop specialized expertise in a limited number of cryptocurrency pairs rather than diversifying too broadly. This focused approach enables a deeper understanding of specific market dynamics.

Crypto Day Trading Example: Step-by-Step

To demonstrate crypto day trading in practice, consider this scenario:

After analyzing various cryptocurrency markets, a trader spots a promising setup on the five-minute Bitcoin chart. Bitcoin is in a downtrend approaching the psychologically significant $50,000 support level.

Figure 2: Five-minute Bitcoin chart showing downtrend nearing the $50,000 psychological support level.

The trader formulates a trade idea based on extensive backtesting, statistical analysis, and journal records, indicating a high probability of a price rebound at $50,000.

The trader decides to:

Place a limit buy order for one Bitcoin at $50,000

Set a stop-loss order at $49,900 to limit potential losses if the price continues to decline

Place a take-profit order at $50,200

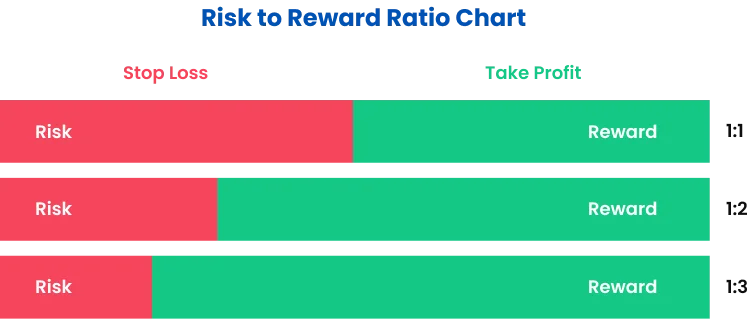

After calculating potential outcomes, the trader establishes a risk-reward ratio of 2:1—— the expected profit ($200) is twice the potential loss ($100), excluding transaction costs.

Figure 3: Diagram illustrating stop-loss, take-profit levels, and risk-reward ratio.

As expected, Bitcoin’s price drops to $50,000, triggering the trader’s limit buy order. However, instead of rebounding, the market continues downward. When the price falls below $49,900, the stop-loss order activates, resulting in a $100 loss.

Despite the loss, the trader acknowledges proper execution of their plan and understands that losses are an inherent part of trading. Statistically, losses occur frequently, and individual losing trades do not negate the trader’s "edge"—— their ability to identify and capitalize on non-random market movements.

Is Crypto Day Trading Suitable for Beginners?

Most professional traders strongly caution against day trading for novices, supported by substantial evidence:

The reality is that the vast majority of day traders incur losses, with failure rates commonly cited at 95% or higher. Some research suggests the actual rates may be even more discouraging.

Key insights from studies on day traders in traditional markets include:

80% of traders quit within their first two years

Over 90% of day traders lose their invested capital across multiple studies

One study found only 1% of day traders remain profitable after fees

Another concluded that "it is virtually impossible for an individual to sustain a living solely from day trading, contrary to claims by some brokers and educators."

These statistics serve as a warning for anyone considering crypto day trading, especially beginners with limited experience and capital.

Why Is Crypto Day Trading Considered Difficult?

Several factors contribute to the exceptional challenges of day trading cryptocurrencies, making it significantly harder than trading on higher timeframes or pursuing long-term investing:

Extreme Volatility: Crypto markets exhibit rapid and substantial price swings over short periods, creating both opportunities and risks.

Real-Time Decision Making: Day trading requires swift, accurate decisions under pressure—, a cognitive skill many traders find difficult to master consistently.

Transaction Costs: High trade frequency leads to increased cumulative fees, which can erode profits or exacerbate losses.

Psychological Pressure: Among all trading styles, day trading imposes the greatest psychological demands. Successful day traders must quickly accept losses and move on without emotional interference—, a skill many novices struggle to develop.

Consider this: Would you invest in a company without evaluating its profitability or expected returns? If not, why approach day trading differently? Before risking capital, you should have evidence supporting your potential profitability in day trading conditions.

Achieving consistent profitability often requires years of dedication and resilience—, as illustrated by many successful traders featured in Jack Schwager’s acclaimed "Market Wizards" series.

Essential Skills for Crypto Day Trading

There is no universal formula for successful crypto day trading, but the markets offer vast freedom and creativity—, which can be both advantageous and risky.

In his influential book "Trading in the Zone," Mark Douglas explains that markets provide a level of creative freedom rarely found elsewhere, allowing traders to take significant risks with potentially severe consequences.

This dynamic explains why traders can experience dramatic short-term gains and losses while struggling to maintain long-term profitability.

Many seasoned traders agree that successful crypto day trading requires:

Self-awareness to develop strategies that suit your personality

Mastery of trading fundamentals, including technical analysis, backtesting, and risk management

Let'’s explore these skills in detail.

Chart Reading and Technical Indicators

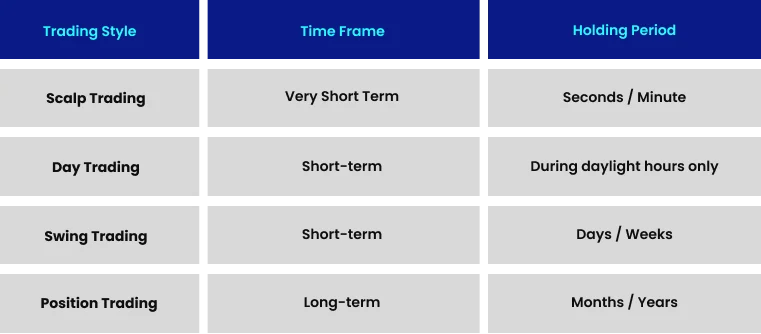

While academic debate continues over market randomness (see "Random Walk Theory"), many traders operate under the assumption that markets exhibit repeatable, tradable patterns.

Chart analysis offers numerous methods, with thousands of indicators and strategies available. Many experienced traders analyze price action using candlestick charts, which visually depict price movements within defined time intervals.

Figure 4: Common candlestick patterns used by day traders to identify potential market reversals and continuations.

Technical analysis assists traders in recognizing trends and patterns on cryptocurrency charts, potentially revealing broader market sentiment and supporting informed decision-making.

Figure 5: Example of technical analysis on a cryptocurrency chart, displaying moving averages, RSI, and volume indicators.

Selecting Appropriate Trading Timeframes

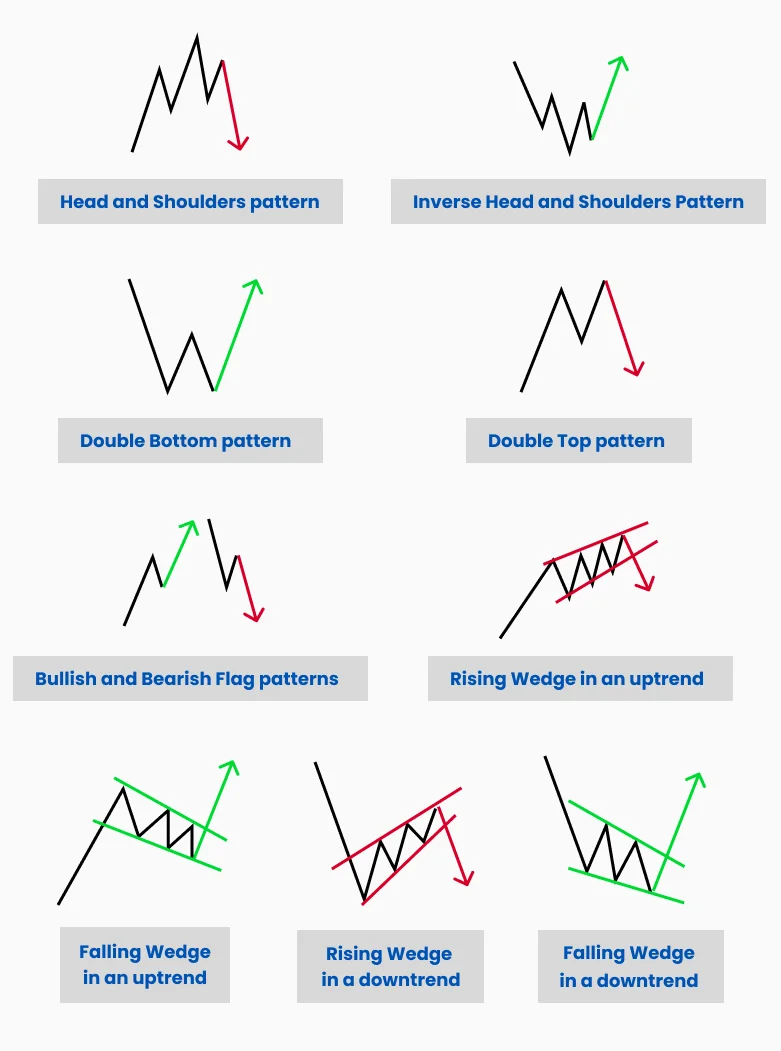

Crypto day traders generally focus on lower timeframes, such as hourly charts (covering up to one hour of price data) or even 1-minute candlesticks. This enables them to capitalize on minor price fluctuations over short periods.

Many traders also reference higher timeframes, like daily or weekly charts, to contextualize their lower timeframe trades. For example, if Polygon (MATIC) or Ethereum (ETH) is trending upward on the daily chart, trades aligned with this trend on shorter timeframes may have a higher chance of success.

Order Placement Mastery

Financial markets offer various order types, but crypto day traders primarily use two main types on centralized exchanges:

Limit Orders: These passive or "resting" orders execute only at a specified price. For example, a trader might place a limit buy order for 1 Bitcoin at $50,000, which executes only when the market reaches that price and a seller matches the order. Limit orders add liquidity by making assets available for trading. The order book aggregates all limit orders for a market.

Market Orders: These active orders "take" liquidity from the order book. For instance, if a trader wants to buy Bitcoin immediately near $50,000 without waiting for a specific price, they use a market order, which fills at the best available sell orders, possibly resulting in a less favorable price—— a phenomenon called "slippage."

This explains why stop-loss orders (market orders triggered at predetermined levels to close positions) may execute at prices significantly different from intended levels, or sometimes not at all. No exchange can guarantee exit at your desired price.

Risk Management in Crypto Day Trading

Risk management—— deciding how much capital to risk per trade to minimize the "risk of ruin" (total loss of trading capital)—— is arguably the most crucial factor for trading success.

Risk of ruin refers to the probability of losing so much capital that recovery becomes impossible or trading must cease. In crypto circles, this catastrophic event is colloquially called "getting rekt."

Many free online calculators help traders estimate their risk of ruin based on their trading parameters.

To mitigate risk, traders often:

Use stop-loss orders on all trades to limit losses

Never risk more capital than they can afford to lose

Perform thorough due diligence on cryptocurrencies before investing

Figure 5: Example of technical analysis applied to a cryptocurrency chart, showing moving averages, RSI, and volume indicators.

Top 5 Crypto Day Trading Strategies for Beginners

While applicable across timeframes, these strategies are especially popular among day traders seeking short-term opportunities.

1. Range Trading Strategy

Markets typically display two behaviors: trending (up or down) or rangebound (sideways). Strong trends often transition into ranges or consolidations.

Many traders specialize in trading these consolidations by entering positions near the range boundaries—— the upper or lower limits.

Crypto prices often "sweep" or "overshoot" range boundaries before reversing. This occurs because traders get caught in losing positions when prices briefly exit the range. Range traders target these deviations as entry points.

Figure 6: Range trading example showing price consolidation between support and resistance, with entries at range edges.

2. Fibonacci Retracement for Crypto Day Trading

Many traders use Fibonacci retracement tools, based on the Fibonacci sequence, to identify potential reversal zones. By marking significant highs and lows, traders overlay retracement levels to highlight areas where price may reverse.

Common retracement levels include 23.6%, 38.2%, 61.8%, and 78.6%, with particular attention to the "golden ratio" at 61.8%.

Figure 7: Fibonacci retracement levels on a Bitcoin chart indicating potential reversal zones.

3. Crypto Arbitrage Opportunities

Crypto arbitrage exploits price discrepancies of the same asset across different exchanges. Unlike price action strategies, arbitrage requires monitoring prices across multiple venues.

For example, if Solana (SOL) trades at $100 on Exchange A but $120 on Exchange B, a trader could buy SOL on Exchange A, transfer it to Exchange B, and sell it there—, potentially profiting after fees.

Though conceptually straightforward, successful arbitrage requires overcoming challenges like transfer delays, withdrawal limits, and rapidly changing price gaps.

4. Support and Resistance Flip Strategy

A common trading principle states "former resistance becomes future support"— once prices break a key resistance level, that level often acts as support subsequently—, until market sentiment changes.

This creates trading opportunities. Price often tests a level multiple times before breaking through. After a breakout, price frequently retests the former resistance as new support, causing a reversal. This is known as an "S/R Flip".

Many traders regard S/R flip zones as high-probability setups in crypto markets.

Figure 8: Support and resistance flip example on an Ethereum chart, showing previous resistance becoming support after breakout.

5. Trendline and Momentum Trading

Trend trading seeks to capture large moves by following established trends. Traders use trendlines and price action to define risk and reward for setups.

The saying "the trend is your friend" reflects that trading with the prevailing trend generally offers higher probability trades than counter-trend approaches.

Figure 9: Trend trading example showing Bitcoin uptrend with multiple entries along ascending trendline.

Advantages and Disadvantages of Crypto Day Trading

Advantages of Crypto Day Trading

Structured Schedule: Day trading allows traders to concentrate trading activities within defined hours, similar to a traditional workday. This can appeal to those with family or other commitments.

Potential for Rapid Account Growth: Skilled day traders can grow accounts quickly through multiple daily trades. When combined with compounding, this high-frequency approach can lead to exponential growth if executed well.

Disadvantages of Crypto Day Trading

Psychological Stress: Managing multiple trades within a day can be highly stressful, causing decision fatigue and burnout.

Mental and Physical Strain: Day trading demands intense focus on numerous factors, often across multiple screens, leading to significant mental and physical fatigue.

High Failure Rate: Maintaining consistent profitability over time is extremely difficult, and many day traders ultimately incur losses. Such traders might achieve better outcomes through long-term investing or higher timeframe strategies.

Conclusion: Should You Begin Crypto Day Trading?

Crypto day trading is among the most demanding methods to profit from cryptocurrency markets, as evidenced by very high failure rates in both traditional and digital asset markets.

Understanding the risks is vital for those considering this style. Extensive practice on demo accounts is recommended before committing significant capital, to assess alignment with your skills, personality, and financial goals.

While successful day trading can be rewarding, the journey to consistent profitability is difficult and not suited for everyone. Many successful crypto investors achieve strong results through longer-term strategies that require less time, reduce stress, and avoid short-term market noise.

Whatever path you choose, education, practice, and disciplined risk management are the foundation of a successful trading career.

Advancing Your Crypto Trading Journey

Figure 10: TMGM cryptocurrency trading interface displaying opportunities for five major pairs: BTC/USD, ETH/USD, BNB/USD, DOGE/USD, and DOT/USD.

Experience TMGM'’s advanced trading platform featuring comprehensive charting tools and real-time market data.

Access Bitcoin, Ethereum, and other leading cryptocurrencies via CFD trading with competitive spreads, leverage, and live data. TMGM provides professional trading conditions, advanced charting, and robust risk management to support your crypto strategies.

Open an account today and experience the TMGM advantage:

Award-winning trading platform

24/7 dedicated customer support

Educational resources for traders at all levels

Competitive spreads and low transaction fees