What is the RSI, or Relative Strength Index?

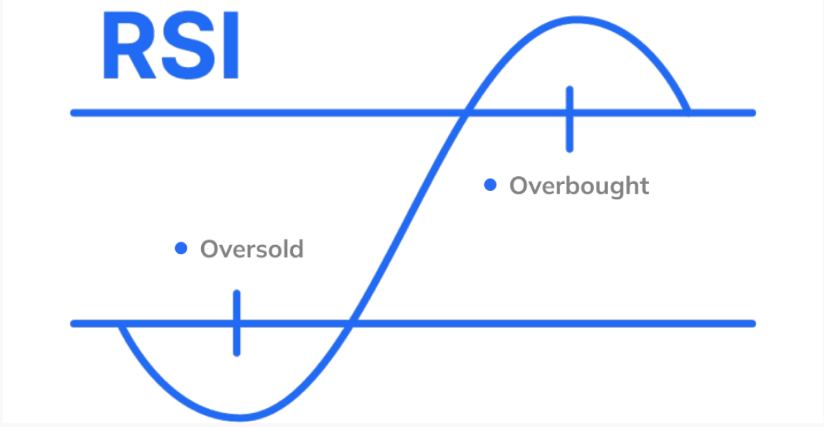

RSI, or Relative Strength Index, is a momentum oscillator utilized in trading to gauge the velocity and extent of recent price movements, helping to identify overbought or oversold conditions in an asset. It is presented as a line chart on a scale ranging from 0 to 100, where readings above 70 typically signal that the asset is overbought, and readings below 30 indicate it is oversold.

Key Takeaways (RSI Indicator)

The RSI is a momentum oscillator that indicates when assets are overbought or oversold.

It assists in identifying reversal points, trend strength, and optimal entry and exit levels.

It is most effective when combined with tools such as moving averages, Fibonacci retracement levels, MACD, and trendlines.

Traders should always consider the overall market context and implement sound risk management practices.

The RSI performs well across forex, equities, and commodities, making it a versatile indicator for all types of traders.

How the RSI Indicator Works

The Relative Strength Index (RSI) is a widely adopted momentum oscillator that quantifies the velocity and magnitude of price changes. It calculates the ratio of recent average gains to average losses over a specified period, typically 14 intervals. This straightforward yet powerful tool helps traders detect overbought and oversold conditions, potential trend reversals, and confirm trend direction.

Here’s the methodology:

RSI Calculation Formula:

RSI = 100 - (100 / (1 + RS))

Where RS (Relative Strength) = Average Gain over N periods / Average Loss over N periods

This formula yields a value between 0 and 100:

Above 70: Signals that the asset may be overbought and could be poised for a price correction.

Below 30: Indicates the asset may be oversold, suggesting a possible upward price adjustment.

Between 30–and 70: Considered a neutral zone where traders often seek additional confirmation before making decisions.

Example: If a stock’’s RSI exceeds 70, it may be regarded as overbought, increasing the probability of a price pullback. Conversely, if the RSI falls below 30, the stock could be oversold and primed for a rebound.

RSI Indicator in Forex, Equities, and Commodities

The RSI indicator is effective across various asset classes:

Forex Trading:

The forex market experiences continuous price fluctuations. RSI helps identify when currency pairs are overbought (above 70) or oversold (below 30).

Example: If the EUR/USD RSI surpasses 70, traders might anticipate a potential reversal or consolidation.

Equity Trading:

RSI helps identify stocks that are overextended or undervalued based on recent price movements.

A stock consistently showing RSI above 70 may indicate overheating, while below 30 could signal undervaluation and buying opportunities.

Commodity Trading:

Commodities such as gold, Brent crude oil, and silver exhibit strong cyclical behavior. RSI helps identify potential cycle shifts.

Example: An RSI above 70 during a gold rally might signal an opportune moment to take profits.

Confirming Trends with the RSI Indicator

The RSI is valuable not only for timing entries and exits but also for confirming trend strength.

In Uptrends: RSI typically remains above 50, supporting bullish momentum.

In Downtrends: RSI often stays below 50, confirming bearish momentum.

Example: During a sustained EUR/USD uptrend, an RSI holding above 50 reinforces the case for maintaining long positions.

RSI Divergence: A Strong Signal

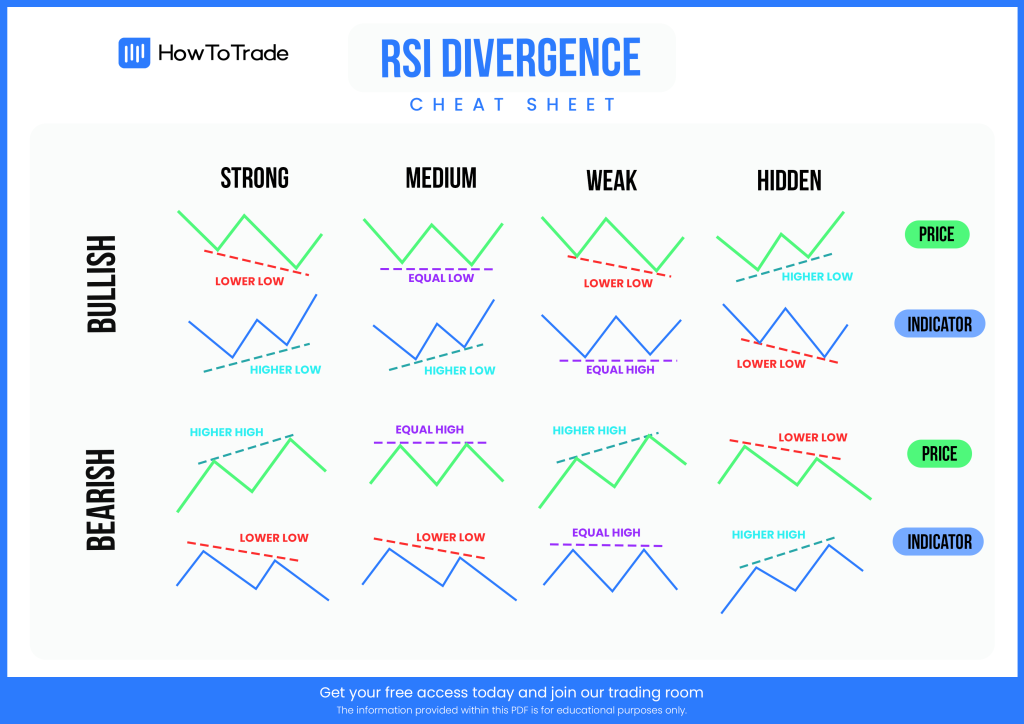

Divergences between price action and RSI can signal weakening trends or impending reversals.

- Bearish Divergence: Price makes higher highs while RSI forms lower highs, indicating diminishing momentum and a potential sell-off.

Bullish Divergence: Price makes lower lows while RSI forms higher lows, suggesting weakening bearish momentum and a possible reversal.

Example: If GBP/USD records a new low but RSI fails to do so, traders may anticipate a bullish reversal setup.

Combining the RSI Indicator with Other Indicators

How to combine the RSI Indicator with other tools?

The RSI’s effectiveness increases when used alongside complementary indicators.

RSI + Moving Averages: An overbought RSI signal near a 200-day moving average resistance can reinforce a short trade setup.

RSI + Fibonacci Retracement: An oversold RSI at the 61.8% Fibonacci retracement level may indicate a high-probability buying opportunity.

RSI + Trendlines: Confirm RSI signals with bounces or breaks of well-established trendlines.

RSI + Bollinger Bands: Identify volatility expansions or contractions in conjunction with RSI readings.

RSI + MACD: Use RSI to gauge momentum strength, while MACD (Moving Average Convergence Divergence) provides crossover confirmation.

Common RSI Indicator Mistakes to Avoid

Overreliance on RSI:

Traders relying solely on RSI risk false signals. RSI should be integrated within a comprehensive strategy including trend analysis, support and resistance levels, and volume confirmation.

Ignoring Market Context:

In strong trending markets, RSI can remain in overbought or oversold territory for prolonged periods. Context is crucial——don’t automatically sell just because RSI crosses 70 in a bullish trend.

Poor Risk Management:

RSI signals are not certainties. Always employ stop-loss orders and proper position sizing. For example, an overbought RSI combined with a short position should include a stop-loss above recent highs.

RSI Indicator in Different Markets: Forex, Equities, and Commodities

The RSI’’s adaptability makes it suitable for various markets beyond forex. Here’’s how to use it effectively in stock and commodity trading:

Equity Trading:

Use RSI to detect exhaustion during earnings-driven rallies or panic selling.

Divergences during earnings seasons can provide early reversal signals.

Commodity Trading:

- RSI assists in navigating volatile commodity price swings driven by supply disruptions or geopolitical events.

Example: RSI divergence during an oil price spike may signal a speculative top

The Relative Strength Index (RSI) is an indispensable tool for traders. It provides a clear and concise method to evaluate market momentum and potential price reversals. Its simplicity and effectiveness across multiple markets, including forex, equities, and commodities, make it especially valuable for novice traders.

Applying the RSI Indicator on TMGM’’s Platform

Trading with TMGM, a leading global CFD provider, offers numerous advantages, particularly for beginners aiming to apply technical indicators like the Relative Strength Index (RSI). TMGM’’s platform is designed for ease of use, delivering a seamless experience whether trading forex, equities, or commodities.

Using the RSI on TMGM’’s Trading Platform:

Setting up the RSI indicator on TMGM is straightforward and efficient. Whether using the web or desktop platform, the RSI can be configured within a few clicks to support any sophisticated trading strategy. Whether employing day trading strategies or swing trading strategies across forex, equities, or commodities, mastering the RSI indicator is highly beneficial.

Here’’s how TMGM enhances RSI-based trading:

Customize RSI Periods: Adjust the RSI timeframe for scalping or extend it for swing trading.—TMGM allows you to tailor settings to your trading style.

Overlay with Other Indicators: Combine RSI with moving averages, Bollinger Bands, or MACD using TMGM’’s advanced charting capabilities.

Real-Time RSI Monitoring: Quickly respond to overbought or oversold signals thanks to TMGM’’s low-latency infrastructure and rapid order execution.

Learn While Trading: TMGM provides tutorials, webinars, and articles to help you master RSI and integrate it into a comprehensive technical strategy.

Educational Resources:

New traders can access step-by-step tutorials, live webinars, and real-time trading examples to learn how to interpret RSI signals and combine them effectively with other technical indicators.

Optimized for Beginners

TMGM’’s platform caters to traders of all experience levels but is especially advantageous for beginners. Its intuitive interface and extensive educational content make it an excellent choice for those new to trading. By leveraging RSI on TMGM, beginners can build a solid foundation in technical analysis while benefiting from a supportive and efficient trading environment.

Ready to start trading with a platform that offers powerful tools like RSI and much more? Visit TMGM today to explore their platform and elevate your trading. Whether you’’re just beginning or aiming to refine your strategy, TMGM provides the tools and support necessary for success in the markets.

Trade Smarter Today

Account

Account

Instantly