How to Use the MACD Indicator & Implement MACD Trading Strategies

You utilize the MACD indicator by examining its three elements—the MACD line, the signal line, and the histogram—to detect buy and sell signals via crossovers, divergences, and zero-line crossings.

Key Takeaways:

The MACD (Moving Average Convergence Divergence) is a trend and momentum indicator that compares short-term and long-term exponential moving averages to generate crossover, divergence, and histogram signals. Traders can combine these signals with moving averages, RSI, volume, Fibonacci retracements, and trendlines across various timeframes to confirm entry and exit points, manage risk, and refine strategies on a demo account.

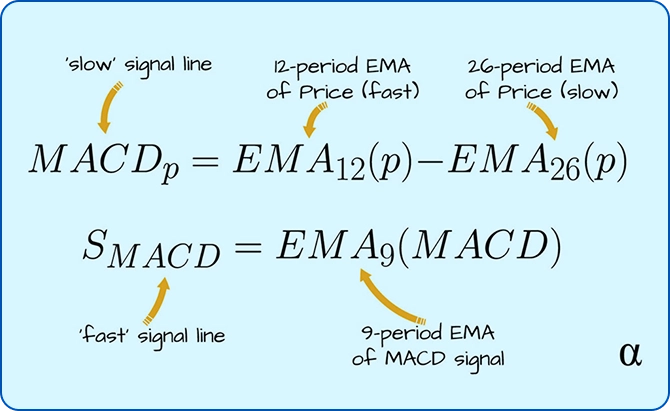

MACD is calculated by subtracting the 26-period EMA from the 12-period EMA to form the MACD line, then applying a 9-period EMA to this line as the signal line, and finally plotting the histogram as the difference between the MACD and signal lines. This allows traders to visualize trend shifts and momentum strength through these three components.

Traders often use MACD in conjunction with other tools such as moving averages, RSI, volume analysis, Fibonacci retracements, and trendline strategies to validate trends, momentum, and potential reversals.

To maximize effectiveness, traders should treat MACD as a supplementary tool by selecting timeframes aligned with their strategy, combining it with other indicators, avoiding sideways markets, applying strict risk management, and testing setups first on a demo account before live trading.

You can practice MACD strategies without risking real capital by using a demo account and experimenting with different indicator combinations and timeframes until you gain confidence.

Practice MACD strategies risk-free through paper trading or demo accounts, testing setups with virtual funds in real time, and backtesting your rules on historical price data. This approach enables you to optimize MACD settings, familiarize yourself with the trading platform, and evaluate performance metrics such as win rate, risk-reward ratio, and drawdown across various market conditions without risking actual funds.

What is the MACD Indicator?

The MACD (Moving Average Convergence Divergence) is a technical analysis indicator that highlights changes in the strength, direction, and momentum of a security'’s price trend. It is calculated by subtracting a longer-term exponential moving average (EMA) from a shorter-term EMA, typically the 12-period and 26-period EMAs by default. A third line, the 9-period EMA of the MACD line (Signal Line), is plotted to help identify potential buy and sell signals through crossovers.

How is MACD Calculated?

MACD calculation involves three steps: first, subtract the 26-period EMA from the 12-period EMA to obtain the MACD line. Second, compute the 9-period EMA of the MACD line to derive the signal line. Third, subtract the signal line from the MACD line to generate the histogram.

The Three Key Components of MACD:

MACD Line: The difference between the short-term and long-term EMAs, indicating trend changes.

Signal Line: A 9-period EMA of the MACD line that generates buy or sell signals.

Histogram/Price Chart: A graphical representation of the difference between the MACD and signal lines, reflecting momentum strength.

Histogram: The difference between the MACD and signal lines.

How to Identify MACD Crossovers and& MACD Divergence?

1. MACD Crossovers:

MACD crossovers occur when the MACD line crosses its signal line, signaling a potential momentum shift. A bullish crossover happens when the MACD line crosses above the signal line, indicating a possible uptrend, while a bearish crossover occurs when it crosses below, indicating a potential downtrend.

Bullish Crossover: The MACD line crossing above the signal line — suggests upward momentum.

Bearish Crossover: The MACD line crossing below the signal line — indicates downward momentum.

2. MACD Divergence:

MACD divergence is a trading signal that arises when the price of an asset and the MACD indicator move in opposite directions. This divergence suggests a potential reversal in the asset'’s price trend, as momentum diverges from price action.

Positive Divergence: Price forms lower lows while the MACD forms higher lows —, potentially signaling a bullish reversal.

Negative Divergence: Price forms higher highs while the MACD forms lower highs —, possibly indicating a bearish reversal.

How to Use the MACD Indicator with Other Indicators?

How to Combine MACD with Moving Averages

To combine MACD with moving averages, use the moving average to determine the primary trend and the MACD to confirm entry points and momentum.

Buy Signal –: Wait for the price to be above the moving average and for the MACD line to cross above its signal line, ideally accompanied by the histogram turning green and rising above zero.

Sell Signal –: The price should be below the moving average, and the MACD line should cross below its signal line, with the histogram turning red and falling below zero.

How to Use MACD and RSI (Relative Strength Index) Together

Use the MACD to confirm the trend'’s strength and direction, while the RSI (Relative Strength Index) identifies overbought or oversold conditions to pinpoint potential entry and exit points.

A bullish trade is confirmed when the MACD shows upward momentum and the RSI moves out of the oversold zone (below 30).

A bearish trade is suggested when the MACD indicates downward momentum and the RSI exits the overbought zone (above 70).

How to Use MACD with Volume Analysis

Volume can help confirm breakouts and validate MACD divergences, which may signal trend changes. To use MACD with volume analysis, combine MACD signals with volume trends to confirm momentum and identify potential reversals:

Look for increasing volume during a bullish MACD crossover to confirm a stronger uptrend.

Look for decreasing volume during a bearish crossover to confirm a weakening trend.

Combining MACD with Fibonacci Retracement

To combine MACD with Fibonacci retracement, apply the Fibonacci tool to a clear price trend to identify potential support and resistance levels. Then look for a MACD crossover at these Fibonacci retracement levels to confirm trade entries aligned with the trend.

Identify Key Levels: Focus on key retracement levels such as 38.2%, 50%, and 61.8% as potential support (in an uptrend) or resistance (in a downtrend) zones.

Use MACD for Confirmation: Wait for price to retrace to a key Fibonacci level (38.2%, 50%, or 61.8%) and confirm a potential long entry with a bullish MACD crossover (MACD line crossing above the signal line).

How to Use MACD with Trendline Trading Strategy?

To apply MACD alongside trendline trading, first identify the trend and draw trendlines on the price chart. Then use MACD signals for confirmation: look for a bullish MACD crossover (MACD line crossing above the signal or zero line) during an uptrend, or a bearish crossover during a downtrend.

A MACD crossover that coincides with a trendline breakout or trading signal enhances confidence in trade entries.

Trendline breaks combined with MACD divergence may indicate early signs of trend reversal.

Important Notes & Limitations of MACD

Choose the Right Timeframe: TMGM’ offers flexible charting options to select timeframes that suit your trading style, whether short-term or long-term.

Combine Indicators: To validate MACD signals, use TMGM’’s comprehensive technical tools such as Bollinger Bands or Fibonacci retracements.

Avoid Sideways Markets: TMGM’ provides real-time market data to help identify clear trends, reducing unreliable MACD signals in choppy or range-bound markets.

Implement Risk Management: Utilize TMGM’’s stop-loss and take-profit features to safeguard your capital and lock in profits.

Practice with a Demo Account: Test MACD strategies risk-free on TMGM’’s demo account before applying them to live markets.

How to Practice MACD Strategies Risk-Free?

You can practice MACD strategies risk-free using demo accounts (paper trading) and backtesting. These methods allow you to apply your strategies to real-time or historical market data without risking actual capital.

1. Paper Trading (Demo Accounts)

Paper trading, or simulated trading, is the most common way to practice in a risk-free environment. Most brokers and trading platforms provide free demo accounts funded with virtual capital.

How It Works: You gain access to full platform features, including real-time market data and advanced charting tools, but trade with virtual funds. This replicates the live trading experience without financial risk.

Benefits: It helps you become familiar with the trading platform, test various MACD configurations, and understand indicator behavior under current market conditions. It also aids in managing the psychological aspects of trading, although emotional responses may differ from trading with real money.

2. Backtesting

Backtesting involves applying your MACD strategy to historical price data to evaluate its past performance.

How It Works: You use specialized software or manual analysis on historical charts to identify past trade signals and track hypothetical profits and losses.

Benefits: This method enables you to assess the strategy’s effectiveness and reliability across different market environments (trending, ranging, volatile) over extended periods. It helps uncover strategy weaknesses and determine key performance metrics such as win rate, average win/loss ratio, and maximum drawdown.

Why Trade with TMGM?

TMGM provides a comprehensive suite of tools and resources to enhance your trading strategies:

Advanced Charting Tools: Customize your MACD analysis with detailed charts and overlays.

Diverse Asset Selection: Trade forex, indices, commodities, and more, including leading cryptocurrencies.

Fast Execution: Benefit from lightning-fast order execution for optimal trade entries and exits.

Educational Resources: Access webinars, tutorials, and guides to enhance your trading expertise.

Trade Smarter Today

Account

Account

Instantly