Swing Trading Strategies: A Guide to Capturing Short-Term Market Momentum

Swing trading is an active trading strategy aimed at profiting from price movements over several days or weeks. By targeting short-term volatility within broader market trends, swing trading provides a method to generate steady returns while maintaining effective risk management. This detailed guide will cover the fundamentals of swing trading and assist you in crafting strategies that match your financial goals. It will explore various analytical tools to evaluate market momentum and support informed trading decisions—whether through Forex swing trading signals, momentum analysis in equity markets, or applying swing trading techniques to cryptocurrency assets.

Key Takeaways

- Swing trading targets multi-day price movements within broader market trends, providing opportunities for consistent gains with reduced screen time when following a disciplined plan and defined risk parameters.

- Establishing a solid foundation involves mastering essential charting techniques and indicators, defining precise entry and exit points, and employing stop-loss orders alongside real-time profit and loss (P&L) monitoring to ensure decisions are rule-based rather than emotional.

- Effective methodologies include trend-following, support and resistance analysis, price channels such as Bollinger Bands, volatility strategies based on Average True Range (ATR), and Fibonacci retracements, all tailored to the specific instrument and validated by volume analysis.

- Discipline and risk management—through position sizing, favorable risk-to-reward ratios, predefined stop-loss levels, and maintaining a trading journal—are critical to capital preservation and minimizing emotionally driven errors.

- While swing trading can be profitable, results are not guaranteed; success depends on strategy robustness, prevailing market conditions, and effective risk control. Traders should anticipate variability and prioritize ongoing strategy testing and refinement.

What Is Swing Trading? Building Your Swing Trading Strategies Foundation

Before aiming for significant gains, it’s essential to build a strong knowledge base in swing trading. This includes understanding and applying Technical Analysis tools, interpreting chart patterns, and implementing robust risk management techniques. These skills enable you to gauge market momentum and make informed decisions to optimize your trading potential.

Swing trading focuses on identifying medium-term price movements within longer-term trends. Unlike day trading strategies, which focus solely on intraday price action, swing trading aims to capitalize on price retracements and rallies by entering and exiting positions to secure steady, incremental profits. Mastering these fundamentals prepares you to explore advanced swing trading strategies and apply sophisticated technical indicators.

Before proceeding, it’s advisable to learn how to set effective stop-loss orders tailored for swing trading, as these are vital for capital protection and mitigating significant drawdowns over time. Additionally, tracking your trading performance in real time enhances portfolio oversight and decision-making.

Effective Swing Trading Strategies & Techniques

A variety of swing trading strategies exist, each suited to different trading styles, risk tolerances, and market environments. Define your objectives—whether targeting short-term or longer-term holds—and consider your preferred asset classes, as not all indicators perform equally across markets; for example, a Forex-specific indicator may not translate well to equities or indices due to differing market dynamics.

Key strategies to explore include:

Trend-Following Swing Trading Strategy

Trend following seeks to identify prevailing market directions and enter trades aligned with these trends at optimal moments. Utilizing charts and technical indicators such as Moving Average Convergence Divergence (MACD) and trendlines, traders assess market sentiment to determine whether to initiate long or short positions by identifying upward, downward, or sideways price movements. Direction and momentum are critical to maximizing potential returns.

Example: In early 2023, EUR/USD consistently traded above its 50-day moving average, signaling a strong uptrend. Traders who entered long positions during this bullish phase benefited from sustained momentum and realized profits.

Why It Works: Trend following aligns trades with dominant market forces. Markets often display sustained directional trends influenced by macroeconomic data, central bank policies, or geopolitical developments. Trading with the trend reduces exposure to countertrend risks, enhancing the probability of profitable outcomes.

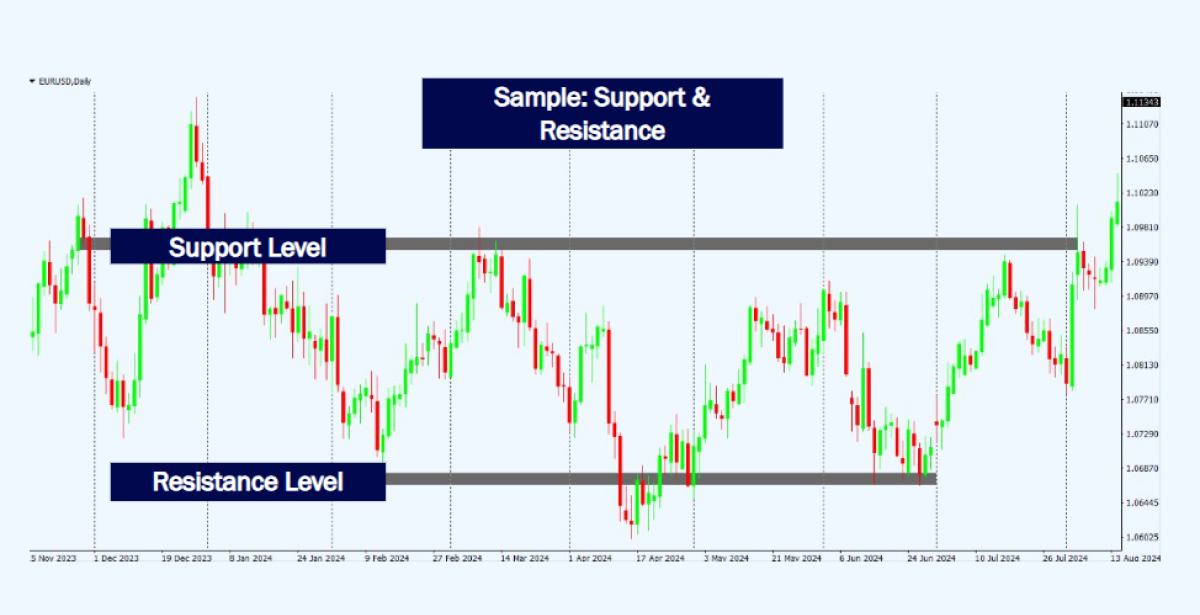

Support & Resistance Levels for Swing Trading Strategies

Also referred to as breakout trading, this strategy centers on identifying critical support and resistance zones and understanding trader psychology. By analyzing market structure, chart formations, and trendlines, traders can act decisively when prices approach key levels, pinpointing optimal entry and exit points. Successfully navigating these zones enables capitalizing on breakouts and potential trend reversals.

Example: In early 2023, gold (XAU/USD) repeatedly encountered resistance near $2,000 per ounce. Traders monitoring this level identified opportunities when the price broke above this barrier, profiting from subsequent sharp price advances.

Why It Works: Support and resistance levels reflect collective market psychology. Repeated price stalls at these levels condition traders to expect similar reactions. A breakout signals a shift in market sentiment, often triggering significant price movements. Recognizing these psychological price points enables traders to anticipate and exploit market dynamics effectively.

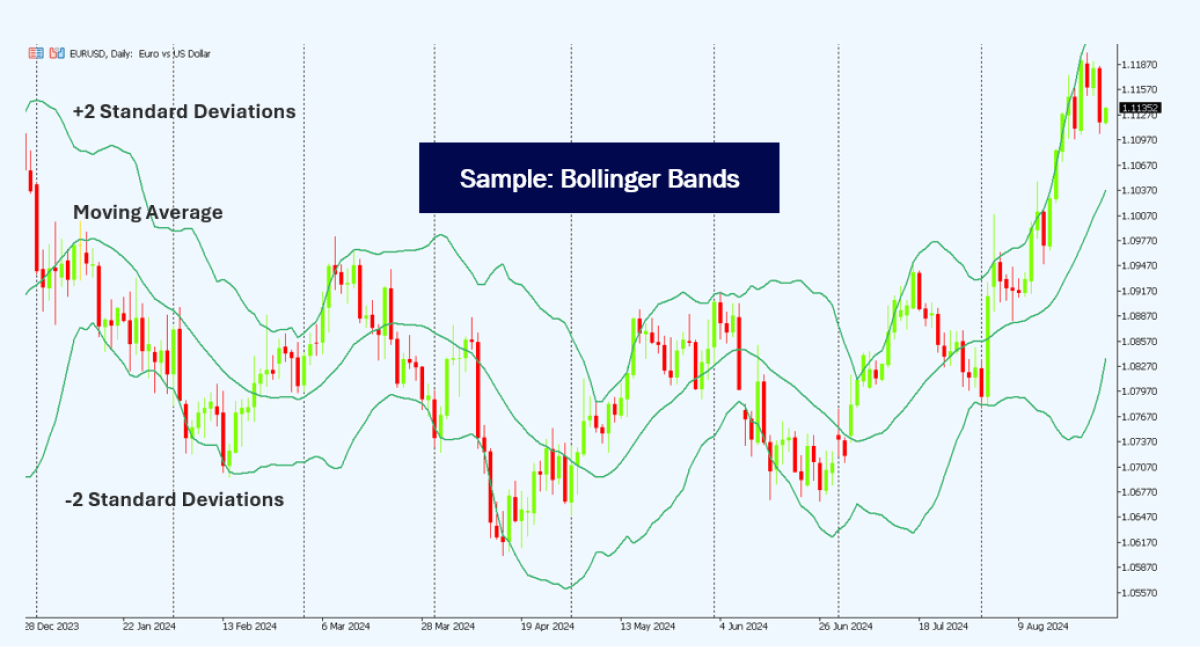

Price Channels: A Key Swing Trading Indicator

Price channels, such as Bollinger Bands, are essential tools for identifying potential entry and exit points on an asset’s price chart. By analyzing price trends within the channel, traders determine trend direction. Typically, price channels are used alongside other technical indicators like chart patterns or MACD to corroborate signals in technical analysis.

Interpreting Bollinger Bands involves recognizing the upper band as resistance linked to recent highs, the lower band as support connected to recent lows, and the middle band representing the moving average.

A common tactic is to buy near the lower band and sell near the upper band, employing stop-loss orders to mitigate risk.

Example: Throughout mid-2022, Ethereum (ETH/USD) traded consistently within defined Bollinger Bands. Traders profited by buying near the lower band, indicating oversold conditions, and selling near the upper band, indicating overbought conditions.

Why It Works: Price channels offer a systematic approach to identifying overbought and oversold market states. By clearly illustrating volatility and typical trading ranges, they enable traders to exploit recurring patterns for predictable gains. These visual tools also reduce emotional bias by providing objective trading criteria.

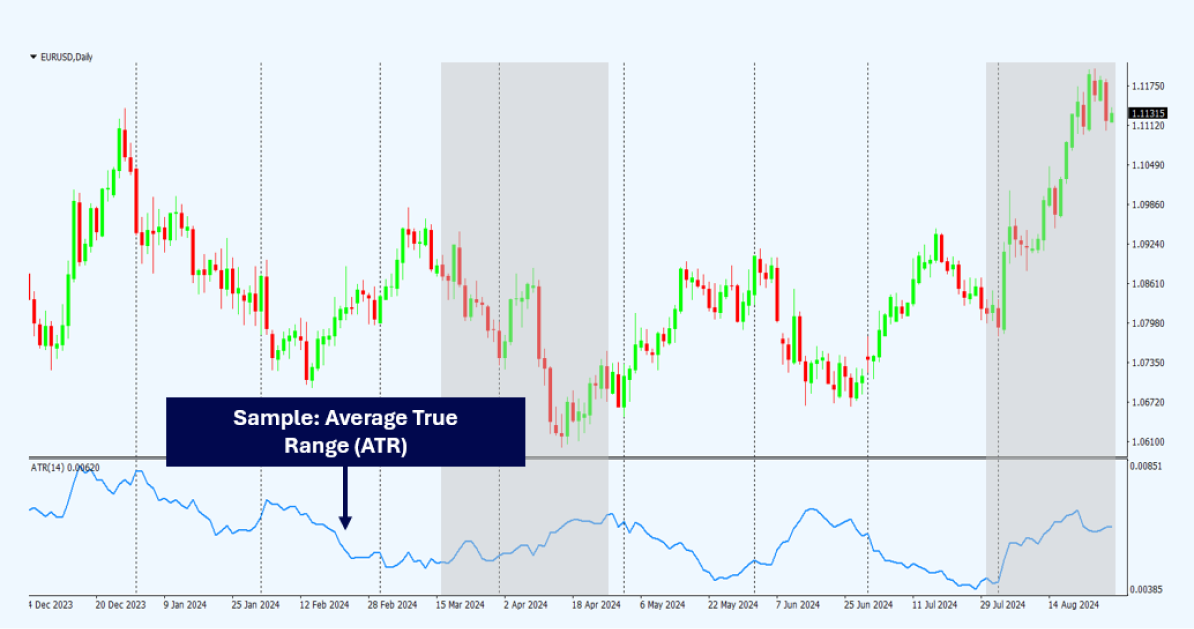

Volatility Trading Strategies with ATR – One of the Best Indicators for Swing Trading

Volatility is a critical consideration in swing trading. Rather than targeting exact highs and lows, traders aim to capitalize on price fluctuations within the asset’s range to lock in profits.

The Average True Range (ATR) is a widely used volatility indicator that measures the average price movement of an asset over a specified period, commonly 14 days, weeks, or months. An ATR rising above its simple moving average often signals strong price momentum and potential breakout opportunities. Traders can adjust ATR periods to suit short-term or long-term volatility assessments aligned with their trading objectives.

Example: Bitcoin (BTC/USD) has exhibited pronounced volatility since 2020——noting how Crypto CFDs amplify exposure to these price swings reflected in ATR values. Traders who monitor ATR fluctuations identify lucrative opportunities during heightened volatility, maximizing profits from rapid price movements.

Why It Works: Volatility trading capitalizes on increased market fluctuations typically occurring during periods of uncertainty, economic data releases, or significant news events. Understanding and quantifying volatility allows traders to strategically position themselves to benefit from dynamic market conditions, making this approach well-suited for short-term trading.

Fibonacci Retracement: A Core Swing Trading Strategy

Fibonacci Retracement is a powerful technical tool used to identify potential support and resistance levels. By analyzing significant price swings and applying Fibonacci ratios, traders can anticipate likely retracement points to optimize trade entries and exits. Common retracement levels include 38.2%, 50%, and 61.8%, which indicate areas where price may reverse or consolidate.

The following chart illustrates a Fibonacci retracement, showing how price changes direction as it approaches resistance and support bands (highlighted in red).

Example: In late 2022, GBP/USD experienced a strong rally followed by a retracement to the 50% Fibonacci level. Traders who initiated long positions at this support level benefited from the subsequent price rebound.

Why It Works: Fibonacci retracements are effective because they reflect common market behaviors and trader psychology. These levels are widely recognized and utilized by market participants globally, creating a self-fulfilling effect that enhances their reliability as key reference points for trade decisions.

Discipline & Risk Management in Swing Trading Strategies

Discipline is fundamental to executing a successful trading plan. Given the relatively short holding periods in swing trading, maintaining a well-defined plan with clear entry and exit criteria is crucial. This focus helps minimize impulsive decisions driven by emotions. Profit and loss potential also depends on asset volatility, underscoring the importance of using risk-to-reward ratios and stop-loss orders to safeguard capital and maintain balanced risk management.

Example: Consider a swing trade in Gold (XAU/USD) targeting a $1,200 profit with a maximum acceptable loss of $300, yielding a favorable Risk-to-Reward Ratio (RRR) of 1:4. By setting an appropriate stop-loss, the trader limits downside risk while aiming for a significantly higher reward..

Why It Works: Effective risk management and discipline support trading longevity and profitability. A structured approach curtails emotional trading and preserves capital during inevitable market downturns. Defining clear risk-to-reward parameters ensures losses are controlled, facilitating consistent profits and sustainable trading over time.

R/R Ratio Illustration

Imagine a trade with a potential profit of $2,000 but a possible loss of $500 if unsuccessful.

- Risk (Potential loss): $500

- Reward (Potential profit): $2,000

- Risk-to-Reward Ratio: 1:4 (risking $1 to potentially gain $4)

In this case, the reward significantly exceeds the risk, making the trade attractive. Conversely, less favorable ratios, such as 1:1 or 2:1, imply higher risk relative to reward, reducing appeal.

Incorporating a risk-to-reward ratio into your strategy supports informed decision-making and effective downside risk management. Pairing this with stop-loss orders ensures automatic trade exits at predetermined levels to protect capital.

Maintaining a trading journal is also recommended to track trades, stay focused, and analyze performance. Recording strategies, outcomes, and insights—whether via traditional methods or digital tools—facilitates continuous improvement and strategy refinement.

Conclusion: Is Swing Trading Profitable?

Swing trading offers a flexible and tailored approach to capturing short-term market momentum. By developing a comprehensive swing trading plan and mastering the techniques outlined in this guide, you can craft a strategy aligned with your trading style and financial objectives.

With discipline and a strategy suited to your goals, swing trading can be effective across various asset classes and technical tools.

As with all trading and investing, ongoing education, research, and experimentation are essential for long-term success. Staying informed and committed enables you to unlock swing trading’s potential and pursue your financial ambitions.

Our team is here to support you at every stage. Whether you’re new to trading or expanding your portfolio, we offer the expertise and assistance needed to help you succeed and thrive.

Remember: Trading CFDs involves risks—learn how margin trading works and implement proper safeguards—so with the right strategies and mindset, trading can be a rewarding experience.

Ready to Get Started?

Sign up now and access global markets in under 3 minutes.

Start Trading, or Try our Demo Account

Trade Smarter Today

Account

Account

Instantly