Key Takeaways:

- Scalping is a high-frequency trading style that targets numerous small intraday profits, leveraging speed, tight spreads, and disciplined execution to compound incremental advantages.

- This involves executing dozens of rapid trades on minute or tick charts, where swift entries and exits combined with low latency aim to capture brief price differentials.

- The mechanics of scalping depend on narrow bid-ask spreads, high liquidity, and fast order routing, as delays or wide spreads can erode expected gains into losses.

- Core strategies include market-making, large-position scalping to capture a few ticks, and signal-based setups, each tailored to liquidity, volatility, and well-defined exit criteria.

- Key technical indicators include moving average ribbons, MACD, short-period RSI, Bollinger Bands, Fibonacci retracements, VWAP, and order book depth cues for precise timing.

- Successful scalping typically requires Direct Market Access (DMA) or ultra-low latency brokers such as TMGM, stable platforms with Level 2 market data, and reliable hardware and software supporting rapid order management.

- Risk management focuses on minimal per-trade risk (0.5% to 1% of capital), strict stop-loss orders, modest 1:1 to 1.5:1 reward-to-risk targets, daily loss limits, and avoiding correlated positions.

- Common misconceptions—such as scalping being “easy money” or that higher volatility is always better—overlook transaction costs, slippage, broker restrictions, and the necessity for a consistent edge and disciplined process.

- A beginner’s roadmap involves education, 1–3 months of simulation, starting small in live trading, documenting every trade, iterating rules, and scaling only after consistent statistical performance.

- Scalping suits traders with fast decision-making, strong emotional control, availability during peak market sessions, and sufficient capital and technology; otherwise, slower trading styles may be more appropriate.

What Is Scalping?

Scalping is a rapid-fire trading strategy involving the execution of dozens—or even hundreds—of trades within a single trading day to exploit small price movements. Unlike swing trading, which is more accessible for beginners and prevalent in equities markets, scalping is commonly applied in CFDs, forex, and cryptocurrency markets, where traders seek to accumulate frequent small profits by reacting swiftly to intraday volatility. This approach demands strict discipline, low-latency execution, and a thorough understanding of market microstructure.

Scalpers execute numerous day trades, sometimes hundreds within hours, aiming to repeatedly capture small profits while minimizing market exposure.—

The core principle is to accumulate small gains frequently, avoiding the need to wait for large price moves that may take days or weeks, instead capitalizing on minor price fluctuations occurring within seconds or minutes.

Historical Context of Scalping Trading

Historically, scalping evolved from floor trading, where traders used hand signals and verbal cues to execute rapid trades, relying on proximity to order flow and information.

With the rise of electronic trading platforms in the late 20th century, scalping transformed significantly. Online brokerages like TMGM and advanced trading software democratized access, enabling retail traders to scalp. Nevertheless, institutional players dominate high-frequency trading, the institutional counterpart to scalping.

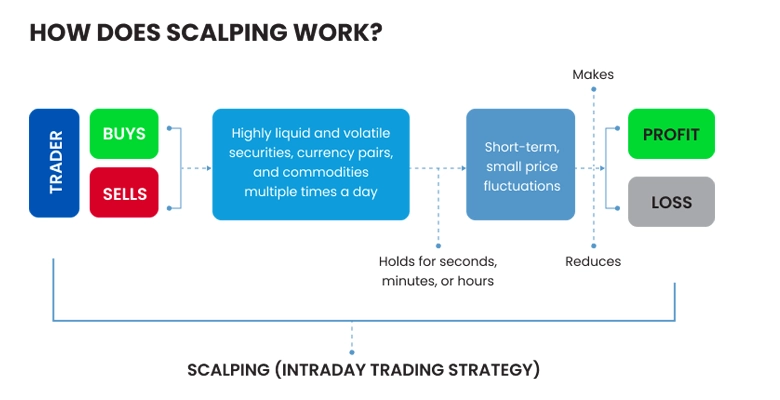

Figure 1: How Does Scalping Work?

How does Scalping Work?

How Scalping Works in Modern Markets

Practically, successful scalping depends on several critical elements.

Scalping requires rapid order execution, with entries and exits occurring within seconds. Execution delays can erode potential profits. Scalpers analyze price movements using one-minute or tick charts to make swift decisions based on minor price changes.

Unlike longer-term traders who incorporate fundamental analysis, scalpers rely almost exclusively on technical analysis—using indicators, trend lines, and price action—to identify short-term market patterns. Their strategies focus on brief market trends rather than macroeconomic factors. Since individual trade profits are small, scalpers execute high volumes of trades to accumulate meaningful returns.

Scalpers prefer instruments with tight bid-ask spreads to minimize transaction costs and slippage, enabling efficient capture of small price movements.

Tight bid-ask spreads are essential for scalping profitability. The bid-ask spread represents the difference between the highest buyer price and lowest seller price. Narrow spreads reduce costs and slippage, maximizing scalpers’ ability to capture small price differentials efficiently.

Algorithmic trading has revolutionized scalping, enabling automated systems to analyze market conditions and execute trades at speeds unattainable by humans.

Figure 2: Bid-ask spread on TMGM.

The Role of Bid-Ask Spread in Scalping Trading

The bid-ask spread—the difference between the highest bid and lowest ask price—is a critical factor in scalping.

Scalpers aim to capture all or part of this spread through:

Market Making: Placing simultaneous buy and sell orders at slightly different prices to profit from the spread.

Momentum Scalping: Entering trades in the direction of short-term price momentum and exiting quickly as momentum fades.

Range Scalping: Trading price bounces within established support and resistance levels in a narrow range.

Market data from 2024 shows average bid-ask spreads for highly liquid stocks on major exchanges range from 0.01% to 0.05%, while less liquid securities have wider spreads of 0.1% to 0.5% or more. These differences significantly affect scalping profitability.

In-Depth Scalping Trading Strategies

Primary Scalping Approaches

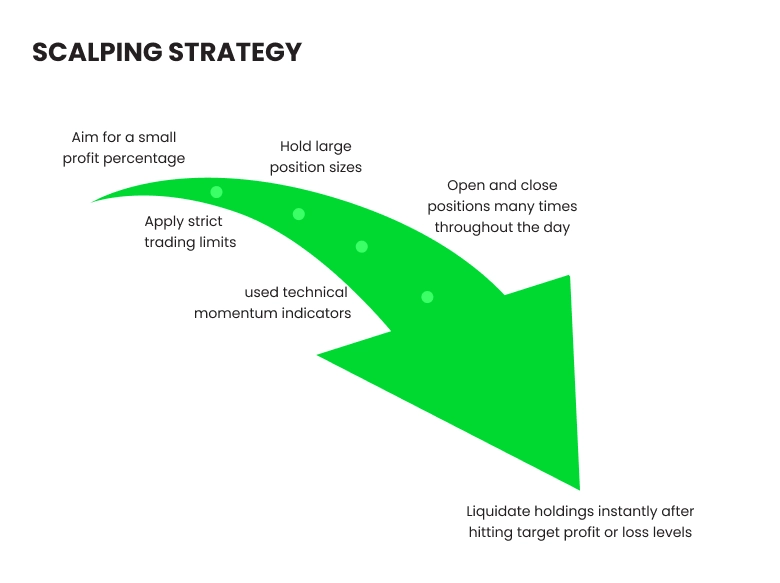

Scalping strategies typically fall into three main categories:

Figure 3: Scalping indicator

1. Market-Making Scalping Approach

This traditional method involves posting simultaneous buy and sell orders for a security, profiting from the spread as a de facto market maker.

Example: A scalper bids to buy 1,000 shares of Stock XYZ at $20.00 and offers to sell 1,000 shares at $20.02. If both orders fill, the scalper earns $0.02 per share, or $20 gross (excluding commissions).

This strategy is most effective with high-volume, low-volatility securities that trade large quantities without sharp price swings. However, retail traders face challenges competing against institutional market makers and high-frequency trading firms.'

Figure 4: Scalping Strategy

2. Large-Position Scalping Strategy

This approach involves purchasing large quantities of a security and quickly selling after a small favorable price move.

Example: A trader buys 5,000 shares of Stock ABC at $15.00 and sells at $15.03, realizing a $0.03 per share profit or $150 gross (before fees).

This strategy requires highly liquid stocks to facilitate large entries and exits without significantly moving the market. Stocks with average daily volumes exceeding 1 million shares typically provide sufficient liquidity.

Figure 5: Swing trade signal scalping indicator.

3. Signal-Based Scalping Strategy

This method uses traditional technical trading signals on compressed timeframes. Traders enter positions based on indicators and exit upon counter-signals or when reaching predefined profit targets, often at a 1:1 risk-reward ratio.'

Example: A trader spots a bullish engulfing pattern on a one-minute chart for Stock DEF at $45.20, enters long with a stop-loss at $45.15 (risking $0.05 per share), and exits at $45.25, achieving a 1:1 risk-reward with a $0.05 profit per share.

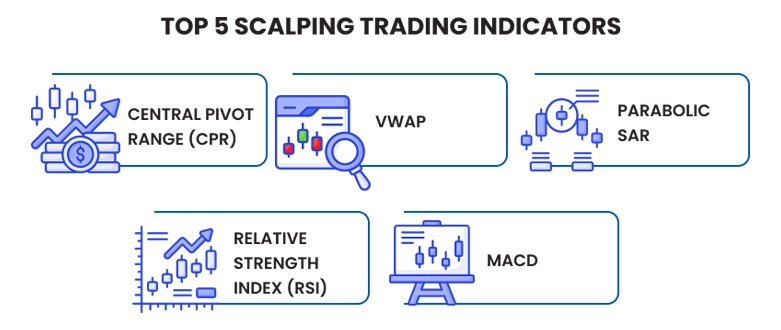

Figure 6: Top 5 Scalping Trading Indicators

Figure 6: Top 5 Scalping Trading Indicators

Key Technical Indicators for Scalping Strategy

Effective scalping relies on technical tools optimized for ultra-short timeframes. The Moving Average, especially when multiple are layered to form a ribbon effect, provides clear crossover signals for entries and exits.—MACD, an oscillator illustrating the relationship between two moving averages, is effective for momentum detection in scalping.

For precise entry and exit timing on rapid price moves, Fibonacci Retracement levels drawn from recent swing highs and lows on 1- or 5-minute charts help identify potential support and resistance zones, such as 38.2%, 50%, and 61.8%, where price may pause or reverse.

The Volume-Weighted Average Price (VWAP) is crucial for intraday scalping, indicating whether prices are trading above or below the average price weighted by volume, clarifying market trend context. Market Depth Charts reveal the order book’s limit orders, enabling scalpers to identify support and resistance based on actual pending orders.

Analysis of 2023–2024 trading data shows that combining VWAP with a 2-period RSI correlates strongly with successful scalping trades across asset classes, yielding win rates above 60% for experienced traders. Tools and Requirements for Successful Scalping TradingSuccessful scalping demands robust infrastructure:

Direct Market Access (DMA) is essential, allowing scalpers to route orders directly to exchanges, minimizing latency and execution delays.

Level 2 Market Data provides full order book visibility beyond best bid and ask, enabling anticipation of price moves and informed decision-making.

Low-latency internet connections are critical, as milliseconds impact scalping profitability. Professional scalpers often co-locate servers near exchange data centers to reduce lag.

Powerful hardware with multi-core CPUs, ample RAM, and multiple monitors supports processing large data volumes and managing multiple charts simultaneously.

Specialized trading software offers advanced charting, customizable indicators, and automated order execution to enhance speed and accuracy.

Industry surveys indicate professional scalpers invest $5,000 to $20,000 in infrastructure, excluding brokerage deposits and data subscriptions.

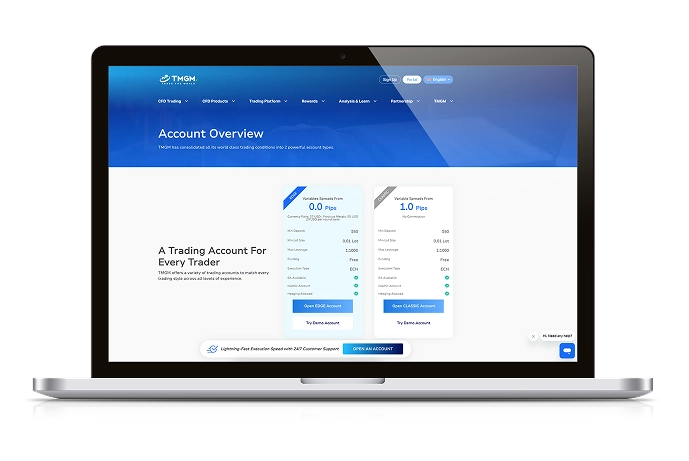

Figure 7: TMGM’s Accounts

Broker Selection for Scalping Traders

Selecting the appropriate CFD broker is critical for scalpers, as broker features directly affect profitability and execution efficiency. Commission structures matter: fixed fees often benefit high-frequency scalpers more than percentage-based commissions by providing predictable costs per trade.

Execution speed is vital; even a one-second delay can turn a winning trade into a loss. Brokers with fast, consistent execution minimize slippage and support scalping strategies.

Platform reliability is equally important, as outages or slowdowns during volatile periods can be detrimental. Stable, responsive platforms ensure uninterrupted trading.

Margin requirements influence scalping strategies; higher leverage amplifies profits and risks. Scalpers must balance leverage use with effective risk management.’

Confirm that the broker permits scalping, as some restrict or prohibit this style, especially in forex. Understanding broker policies beforehand prevents conflicts and ensures strategy compatibility.’

Recent trends favor commission-free brokers, but scalpers should beware of hidden costs like wider spreads or payment-for-order-flow arrangements that can degrade execution quality.

Best Markets for Scalping Trading

Which Markets Are Best for Scalping?

Scalping can be applied across various markets, but some are more suitable due to liquidity, volatility, and spread characteristics.

Stock Markets

Equity markets offer ample scalping opportunities, especially in:

High-volume, large-cap stocks: Companies like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) trade millions of shares daily with tight spreads, ideal for scalping.

Exchange-Traded Funds (ETFs): ETFs such as SPY (S&P 500 ETF) and QQQ (Nasdaq-100 ETF) combine high liquidity with moderate volatility, providing frequent scalping setups.

In 2023–2024, the top 10 most liquid stocks on NYSE and NASDAQ averaged over 20 million shares traded daily, offering abundant scalping opportunities.

Forex Markets

With a daily turnover around $7.5 trillion (2023) and 24-hour trading, forex is highly favored for scalping. Optimal pairs include:

Major pairs: EUR/USD, USD/JPY, GBP/USD, and USD/CHF offer the tightest spreads and deepest liquidity.

Cross pairs: EUR/GBP, EUR/JPY, and GBP/JPY provide higher volatility with slightly wider spreads.

Forex broker data from 2024 shows EUR/USD spreads averaging 0.1 to 0.3 pips during peak hours, enabling profitable scalping with sound risk management.

Futures Markets

Futures contracts with high volume and standardized sizes attract scalpers:

E-mini S&P 500 futures (ES): Among the most liquid futures globally, offering tight spreads and steady volatility.

Treasury futures: Contracts like the 10-Year T-Note futures (ZN) provide sufficient intraday movement for scalping.

Commodity futures: Gold (GC) and Crude Oil (CL) futures offer volatility suitable for experienced scalpers.

Recent data shows E-mini S&P 500 futures trade about 1.5 million contracts daily, with intraday price moves of 0.5–1%, creating numerous scalping opportunities.

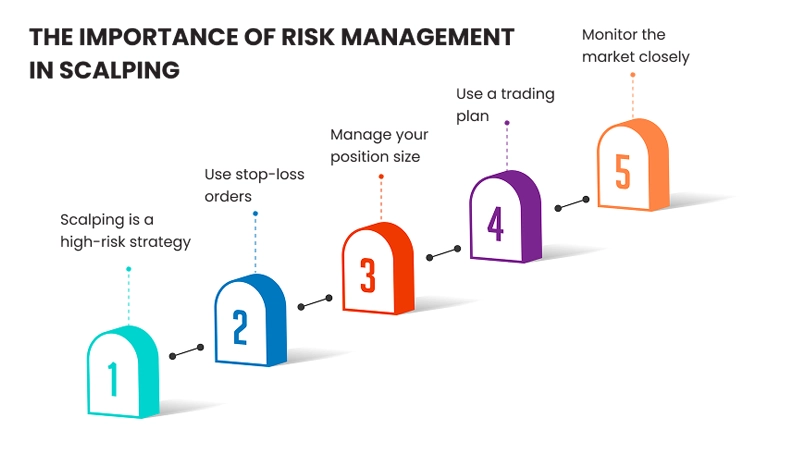

Figure 8: The Importance of Risk Management in Scalping

Risk Management Principles for Scalping Trading

Critical Risk Controls for Scalpers

Due to its high-frequency nature and slim profit margins, scalping demands rigorous risk management. Without it, scalping equates to gambling.

1. Fixed Position Sizing

Successful scalpers maintain consistent position sizes, avoiding size increases after wins or “doubling down” after losses. Typically, risk per trade is limited to 0.5%–1% of total capital."

Example: With a $50,000 account, risk per trade is capped at $250–$500, with position sizes adjusted accordingly based on stop-loss placement.

2. Predefined Stop-Loss Orders

Hard stop-loss orders should be placed immediately upon entry. For stock scalping, stops are typically 2–5 cents from entry, depending on volatility and price.'

Data from professional trading firms shows scalpers using predefined stops have 3–4 times higher survival rates than those relying on mental stops or none.

3. Profit Targets

Most scalpers set profit targets at 1:1 or 1.5:1 reward-to-risk ratios. For example, with a 5-cent stop, the target is 5–7.5 cents.

4. Daily Loss Limits

To avoid severe drawdowns, scalpers impose daily loss limits, typically 3%–5% of account equity, ceasing trading once reached.—

5. Trade Correlation Awareness

Scalpers avoid multiple correlated positions that could amplify losses during adverse moves, e.g., scalping several tech stocks simultaneously increases sector risk.

Professional scalpers typically maintain win rates of 65%–75% with reward-to-risk ratios between 0.8:1 and 1.2:1, generating modest but consistent returns.

Common Misconceptions About Scalping Trading

Debunking Scalping Myths

Several myths persist about scalping:

Myth 1: Scalping Is Easy Money

Reality: Scalping requires extensive knowledge, advanced tools, significant capital, and intense focus. Brokerage data shows over 90% failure rates among novice scalpers.

Myth 2: Quick Closures Guarantee Profits

Reality: Rapid trade exits limit individual losses but do not ensure overall profitability. Costs, slippage, and the need for a high win rate pose challenges.

Myth 3: Scalping Performs Best in Volatile Markets

Reality: Extreme volatility often widens spreads and causes erratic price jumps that can bypass stops, increasing risk. Moderate volatility is preferable.

Myth 4: Scalping Is Illegal or Unethical

Reality: Legitimate scalping is legal and contributes to market liquidity. However, manipulative practices like spoofing or layering are prohibited.

Myth 5: Any Broker Supports Scalping

Reality: Many retail brokers restrict or prohibit scalping, especially in forex. Specialized brokers with DMA are typically required.

Scalping Trading 101: A Roadmap for Beginners

Developing Scalping Skills

A structured approach is essential for learning scalping:

Education: Master market mechanics, order types, technical analysis, and market-specific features before risking capital.

Platform Mastery: Develop proficiency with your trading platform’s order entry and management to minimize hesitation.'

Simulation: Paper trade your strategy for 1–3 months, focusing on process over outcomes.

Small-Scale Live Trading: Start with minimal position sizes (10–20% of target size) to experience real market conditions with limited risk.—

Performance Analysis: Document every trade and analyze patterns to refine your approach.

Scaling: Increase position sizes only after consistent profitability over statistically significant samples (100+ trades).

Continuous Education: Regularly update skills and knowledge to adapt to evolving markets.

Educational resources range from free online content to premium courses costing $2,000–$5,000.

Figure 9: What is Scalping?

Is Scalping Right for You?

Personal Suitability Assessment

Consider:

Attention Span: Can you maintain intense focus for extended periods?

Decision Speed: Are you comfortable making rapid decisions with incomplete data?

Emotional Resilience: Can you remain emotionally detached through winning and losing streaks?

Analytical Mindset: Can you quickly identify patterns and anomalies?

Technological Comfort: Are you adept with complex trading platforms and troubleshooting?

Time Commitment: Can you dedicate consistent trading hours during peak market sessions?

Financial Resources: Do you have sufficient capital, infrastructure, and data access?

Psychological assessments indicate successful scalpers score highly on working memory, visual processing speed, and emotional stability under pressure.

Does Scalping Fit Your Overall Strategy?

Evaluate:

Capital Adequacy: Do you have $25,000–$50,000 minimum capital to endure drawdowns and tech costs?

Time Availability : Can you commit 4–6 hours of focused trading during optimal market hours?Technical Resources&: Do you have reliable high-speed internet, professional platforms, and quality market data?

Learning Commitment: Will you invest hundreds of hours in education, simulation, and small-scale live trading before expecting consistent profits?

Psychological Profile: Do you possess the emotional discipline, rapid decision-making, and stress tolerance needed for high-frequency trading?

Performance Expectations: Are your profit goals realistic, understanding that scalpers typically target 1%–3% monthly returns rather than large gains?

If you answer “yes” to most of these, scalping may be a viable strategy to explore. Otherwise, consider trading styles better aligned with your profile.