Key Takeaways

Scalping = ultra-short-term trading. Dozens of trades held for seconds–minutes, targeting small price movements (often ~5–20 pips) and relying on tight spreads and rapid execution.

Core setups & timing. Focus on one or two repeatable patterns (trend pullback, range fade, breakout retest) and trade exclusively during high-liquidity periods (session openings, London–New York overlap) with strict, predefined entry and exit criteria.

Risk and costs can erode the edge. High-frequency trading amplifies spreads, commissions, slippage, and errors; leverage magnifies both profits and losses, so use strict stop-losses and small position sizes (≈1–2% risk per trade).

Right tools are essential. Low-latency platforms (preferably ECN), real-time news feeds, advanced charting, and precise risk management tools. Focus on liquid major currency pairs during peak liquidity.

Mindset & suitability. Success depends on quick decision-making, discipline, intense focus, adaptability, and stress management—ideal for traders who can monitor markets closely without overtrading.

What is Scalping in Forex?

Forex scalping is a short-term trading technique where traders aim to capture small price changes in currency pairs. Positions are opened and closed rapidly, often within seconds or minutes, with high trade frequency throughout the session. The objective is to accumulate small, consistent gains rather than holding positions for extended periods. Scalping requires tight spreads, fast execution, and disciplined risk and timing management.

Key Characteristics of Forex Scalping

High Frequency

In forex trading, scalpers execute a very high volume of trades daily—often dozens or even hundreds—capitalizing on numerous small price fluctuations. This trading frequency offers many profit opportunities but requires constant vigilance, rapid responses, and consistent performance throughout the session.

Small Profits

Each scalping trade targets modest gains, typically between 5 to 20 pips. Scalpers depend on volume, consistently accumulating small profits throughout the day to generate significant overall returns. The strategy's success lies in consistency rather than the size of individual trades.

Short Timeframes

Scalping trades are held for very short durations, usually from a few seconds to a few minutes. These brief holding periods minimize exposure to market uncertainty and large price swings, enabling traders to quickly capitalize on transient price movements and adjust strategies promptly if market conditions change.

Leverage

Scalpers often utilize higher leverage to amplify potential profits from small price movements. While leverage can significantly increase returns, it also magnifies losses. Therefore, prudent leverage management is vital for risk control and account sustainability.

Discipline

Successful forex scalping requires strict discipline and adherence to predefined entry and exit rules. Scalpers must rigorously follow their trading plans and risk management protocols to avoid impulsive decisions that can lead to significant losses. Emotional control, systematic planning, and consistent execution are essential for sustained scalping success.

Popular Forex Scalping Strategies

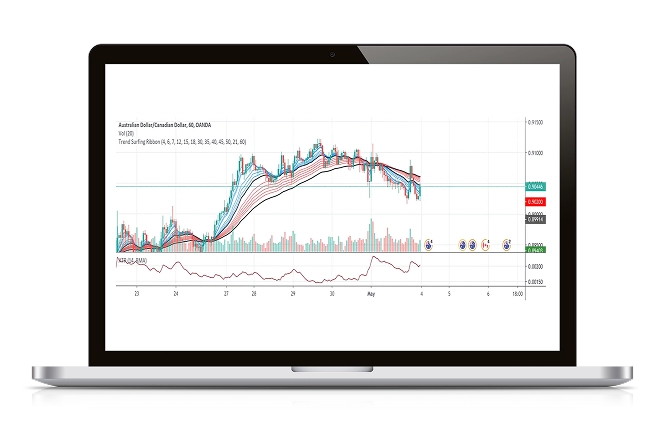

Trend Surfing

This trend-following strategy involves identifying a strong trend and entering multiple small trades aligned with that trend. Scalpers look for minor pullbacks as entry points and exit quickly after reaching small profit targets.

Indicators Used: 50-period EMA (Exponential Moving Average) or similar trend indicators.

Entry Signal: Enter on a minor pullback towards the EMA line within a clear trend.

Exit Strategy: Close positions promptly when a profit of 5-10 pips is achieved.

Ideal Currency Pairs: EUR/USD, GBP/USD, USD/JPY.

Best Timeframes: 1-minute and 5-minute charts.

Practical Tip: Confirm trends using higher timeframes (15-minute or hourly charts) for greater reliability.

Range Trading

In range-bound markets, scalpers buy near support levels and sell near resistance levels, profiting from predictable oscillations within the range.

Indicators Used: Support and resistance lines, Bollinger Bands.

Entry Signal: Buy near support; sell near resistance.

Exit Strategy: Close positions as price approaches the opposite side of the range, targeting quick profits (5-15 pips).

Ideal Currency Pairs: EUR/GBP, AUD/USD, USD/CAD.

Best Timeframes: 5-minute and 15-minute charts.

Practical Tip: Verify range stability by ensuring no major news events are imminent.

News Spike Trading

News spike trading capitalizes on sudden volatility caused by major economic announcements, exploiting rapid price moves immediately after news releases.

Indicators Used: Economic calendar, real-time news feeds.

Entry Signal: Enter trades instantly as volatility surges following key economic data (interest rates, employment figures, GDP).

Exit Strategy: Exit quickly, usually within seconds to minutes, locking in profits as volatility declines.

Ideal Currency Pairs: EUR/USD, USD/JPY, GBP/USD.

Best Timeframes: 1-minute charts.

Practical Tip: Always use tight stop-losses to manage rapid reversals and consult a news calendar to plan trades.

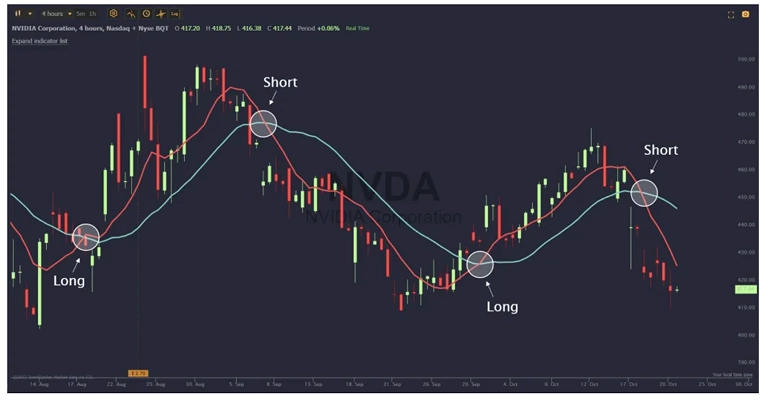

Moving Average Crossovers

This approach uses short-term moving averages (e.g., 5-period and 10-period) to identify quick entry and exit points when the faster moving average crosses above or below the slower one.

Indicators Used: Short-term EMAs (e.g., 5-period and 10-period).

Entry Signal: Enter long when the 5-period EMA crosses above the 10-period EMA; enter short when it crosses below.

Exit Strategy: Exit promptly after reaching small profit targets (5-10 pips) or upon reversal signals.

Ideal Currency Pairs: EUR/USD, USD/JPY.

Best Timeframes: 1-minute and 5-minute charts.

Practical Tip: Improve accuracy by combining moving average crossovers with momentum indicators like RSI or MACD.

Risks and Challenges of Forex Scalping

While scalping can be profitable, it carries specific risks:

Transaction Costs: High trade frequency results in increased cumulative spreads and commissions.

Overtrading: Excessive trading may lead to poor decisions and elevated risk exposure.

Emotional Stress: The fast pace can be mentally and emotionally demanding.

Technical Failures: Dependence on technology means technical issues can cause losses.

Slippage: In volatile markets, order execution may occur at prices different from expected.

Essential Tools for Forex Scalping

Low-Latency Trading Platform: Speed is critical for scalpers.

Real-Time News Feed: Stay updated on market-moving events.

Advanced Charting Software: For rapid technical analysis.

Risk Management Tools: To implement strict stop-loss and take-profit orders.

Top Tips for Successful Forex Scalping

Practice with a Demo Account: Perfect your strategy before risking real funds.

Start Small: Use smaller position sizes initially as you build experience.

Use Appropriate Leverage: Leverage can boost profits but also increases risk.

Implement Strict Risk Management: Never risk more than 1-2% of your account balance on a single trade.

Choose Liquid Currency Pairs: Major pairs like EUR/USD, GBP/USD, and USD/JPY are preferred by scalpers.

Monitor Market Conditions: Stay aware of upcoming news and overall market sentiment.

The Psychology of Forex Scalping

Forex scalping is not only about technical proficiency; psychological resilience and discipline are equally crucial. Successful scalpers cultivate a mental framework that enables them to thrive in the fast-paced trading environment. Key psychological factors include:

Rapid Decision-Making

Scalping requires making multiple trading decisions within seconds. Traders must swiftly interpret market signals, evaluate potential outcomes, and execute trades decisively. Hesitation or delayed reactions can result in missed opportunities or losses. Developing this skill involves regular practice in simulated environments to enhance reflexes and confidence in rapid decision-making.

Emotional Control and Discipline

Maintaining emotional stability is vital, as scalping’s pace can provoke stress, anxiety, or frustration. Emotional responses may lead to impulsive actions like revenge trading or neglecting risk controls. Successful scalpers manage emotions by strictly following trading plans, adhering to clear entry and exit rules, and accepting losses as part of the process. Establishing routines and mindfulness practices can strengthen emotional resilience.

Intense Focus and Concentration

Scalpers must maintain high levels of focus and alertness throughout trading sessions, monitoring market movements without distraction. Even brief lapses can cause missed opportunities or costly errors. To sustain concentration, traders often schedule short breaks, manage time efficiently, and create distraction-free workspaces to preserve mental clarity.

Adaptability

Markets can change suddenly, requiring scalpers to adjust strategies quickly. The ability to stay flexible, reassess situations promptly, and adapt to new conditions—such as unexpected volatility spikes or breaking news—is essential. Skilled scalpers continuously monitor market context and maintain contingency plans, ready to pivot as needed. This adaptive mindset helps exploit new opportunities while mitigating risks during market disruptions.

Stress Management and Resilience

Given scalping’s demanding pace, effective stress management is critical. Traders must handle losses and setbacks without emotional interference. Techniques such as breathing exercises, meditation, regular physical activity, or journaling can support stress reduction, building resilience and mental stamina over time.

Developing these psychological skills requires deliberate practice, self-awareness, and ongoing improvement. Recognizing the importance of mindset and actively cultivating these traits will greatly enhance a trader's success in forex scalping.

Is Forex Scalping Right for You?

Scalping is not suitable for everyone. It is best suited for traders who:

Enjoy fast-paced trading and manage stress effectively.

Have the time to monitor markets closely for extended periods.

Possess strong analytical skills and can make rapid decisions.

Have access to low-cost trading and advanced technology.

TMGM: Your Partner in Forex Scalping

For traders interested in forex scalping, TMGM offers a range of features designed to meet scalpers’ specific needs:

Ultra-Fast Execution: TMGM'’s advanced forex trading infrastructure ensures rapid order execution, critical for capturing small price movements.

Competitive Spreads: Tight spreads on major currency pairs, helping minimize transaction costs for high-frequency traders.

Advanced Trading Platforms: Access to MetaTrader 4 and MetaTrader 5, equipped with essential tools and indicators for scalping strategies.

ECN Account Option: Electronic Communication Network accounts provide direct market access, ideal for scalping.

Robust Risk Management Tools: Set precise stop-loss and take-profit levels to manage risk effectively.

High Leverage Options: While leverage should be used cautiously, TMGM offers flexible leverage options for experienced scalpers.

24/5 Customer Support: Receive assistance whenever needed during market hours.

Educational Resources: Access webinars, tutorials, and market analysis to refine scalping techniques.

Mobile Trading Apps: Stay connected to markets with TMGM APP and execute trades on the go.

Demo Account: Practice scalping strategies risk-free before committing real capital.

Remember, while TMGM provides the tools and conditions conducive to scalping, ultimate success depends on your forex trading strategy, discipline, and risk management. Always trade responsibly and within your means.

Forex scalping offers a distinct trading approach, enabling potentially frequent profits but also carrying significant risks. Traders can explore this dynamic style by understanding scalping strategies, tools, and psychological demands, leveraging a suitable platform like TMGM.

Whether you're an experienced trader seeking to diversify or a newcomer intrigued by high-frequency trading, scalping presents an exciting opportunity in the forex market. As with any strategy, education, practice, and prudent risk management are essential for long-term success.