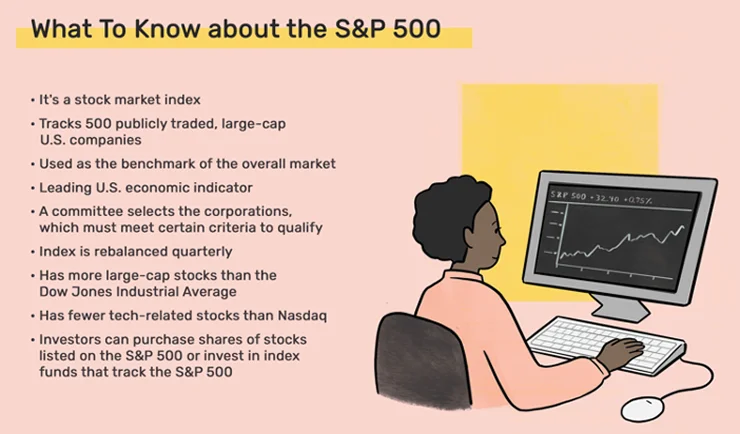

Why Trade the S&P 500 Index?

Global Market Indicator: The S&P 500 reflects the health of the U.S. economy, making it a critical indicator for global markets.

Diverse Exposure: It covers sectors ranging from technology to healthcare, offering built-in diversification.

Liquidity and Volatility: High trading volumes ensure excellent liquidity, while consistent price movements create ample trading opportunities.

Key Strategies for S&P 500 Index Trading

Trend Following: Ride the Market Waves

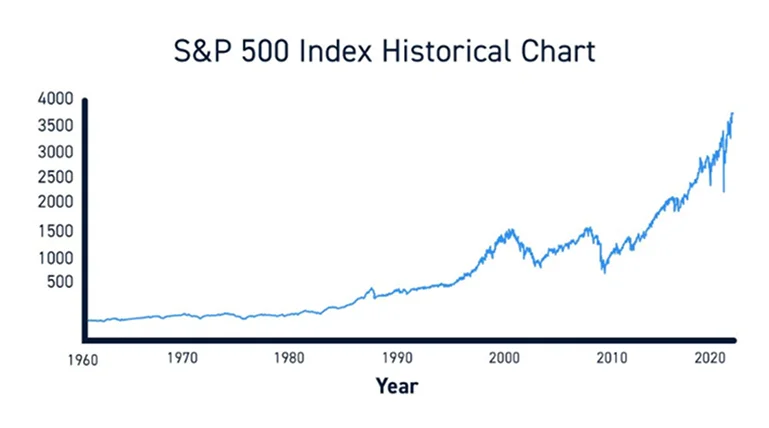

Identify Long-Term Trends: Use moving averages (e.g., 50-day and 200-day) to spot upward or downward market momentum.

Confirm with Indicators: Enhance your analysis with tools like MACD or RSI to validate trends before entering a trade.

Avoid Overtrading: Focus on quality trades by sticking to well-established trends.

Range Trading: Profit in Sideways Markets

Define Support and Resistance: Use chart patterns to pinpoint levels where prices repeatedly bounce or retrace.

Deploy Oscillators: Tools like Stochastic Oscillators can help identify overbought or oversold zones.

Set Stop-Loss Orders: Protect against unexpected price movements by placing stop-loss levels below support or above resistance zones.

Breakout Trading: Capitalize on Major Moves

Monitor Key Levels: Breakouts often occur around psychological price points, such as 4000 or 4500 on the S&P 500.

Confirm with Volume: Ensure higher trading volume accompanies the breakout for reliability.

Trade Quickly: Enter positions promptly to benefit from the initial momentum.

Day Trading: Short-Term Opportunities

Follow Economic News: Monitor events like Federal Reserve announcements or employment reports that can impact intraday prices.

Stick to High-Volume Times: For more liquidity, focus on peak hours, such as the U.S. market's opening and closing times.

Use Tight Risk Controls: Limit losses with strict stop-loss and take-profit levels.

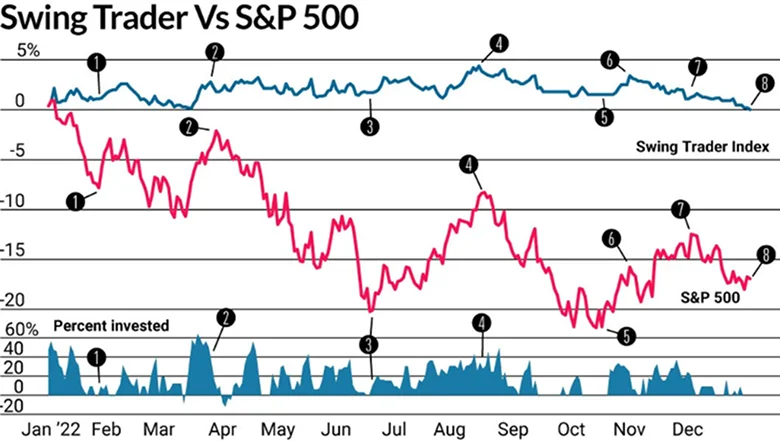

Swing Trading: Capture Medium-Term Swings

Combine Technical and Fundamental Analysis: Identify potential moves using chart patterns and economic data.

Target Clear Price Objectives: Look for 3-10% swings within established trends.

Adjust to Market Sentiment: React to news, earnings reports, or geopolitical events that could influence the index.

Tools for Effective S&P 500 Index Trading

Economic Calendars: Track important dates and announcements.

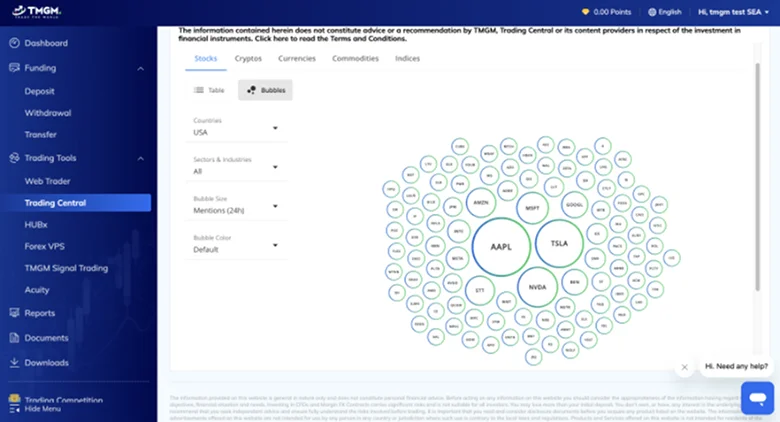

Technical Analysis Software: Platforms like MetaTrader 4 or MetaTrader 5 provide advanced charting tools.

Risk Management Tools: Utilize position-sizing calculators and volatility indicators to minimize risks.

Tips for Beginners

Start Small: Begin with micro-lots or a demo account to practice strategies without significant financial exposure.

Focus on Education: Learn index traidng basics through resources and courses.

Stay Updated: Monitor market trends, geopolitical events, and central bank policies influencing the S&P 500.

The Role of CFDs in S&P 500 Index Trading

Leverage for Higher Exposure: CFDs allow traders to magnify positions using a smaller capital outlay.

Go Long or Short: Take advantage of both rising and falling markets.

Lower Entry Barriers: Trade fractional units of the index, making it accessible to retail traders.

Elevate Your S&P 500 Index Trading Game

Mastering S&P 500 index trading requires combining strategies, tools, and market knowledge. By understanding the index's dynamics and employing the right techniques, traders can tap into its immense potential for profit.

For more in-depth educational resources and practical trading tips, hop on TMGM and start your journey to becoming a confident S&P 500 trader today!