What is Position Sizing in Trading and How to Calculate it?

The forex market is one of the most dynamic financial markets, with trillions of dollars traded daily. As a result, traders face immense opportunities and risks. Success in forex trading often hinges on a critical yet frequently overlooked factor: position sizing. Position sizing is the process of deciding how much to invest or trade in each position to control risk and protect your trading account.

What is Position Sizing?

Position sizing in trading is the process of determining how large or small your trade should be. It determines how many units, contracts, or lot sizes you should trade based on your account balance, strategy, and risk tolerance. When used correctly, position sizing helps traders protect their capital, balance emotional decision-making, and stay consistent over the long term.

Many new traders focus heavily on technical indicators and market predictions. However, ignoring position sizing in trading can result in considerable losses even when the strategy itself is correct. Position sizing is the foundation of sound risk management, especially when you plan your risk-reward ratio , and it plays a key role in maintaining long-term trading consistency.

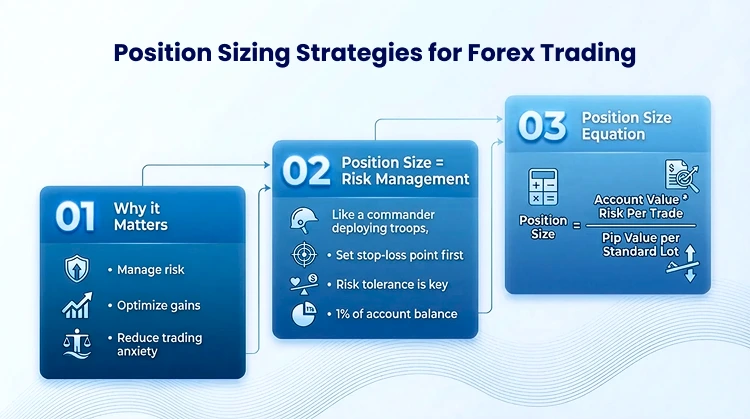

Why is Position Sizing Important?

Position sizing is not only about how much money you use for a trade. It influences your mindset, risk exposure, and trading outcomes.

Protection of Capital

One reason for its importance is that it protects your trading capital. Even skilled forex traders experience losses. Position sizing prevents a single trade from causing severe damage to your account.

Streamlines Decision-Making

Beyond that, position sizing helps control emotions. Trading a position that is too large can cause stress, fear, and impulsive reactions. A well-sized position helps traders remain calm and focused.

Adjustability Based on Goals

Position sizing is also important, as it depends on your goals and aligns with your trading strategy and risk tolerance. Every trader has different goals. Position sizing lets you adjust your trade size to your comfort level and trading style.

Performance-Based

Besides that, position sizing also supports consistent performance. That is because it makes it easier to grow your account steadily over time, rather than relying on luck or high-risk decisions.

Whether you are using a forex scalping strategy for short-term movements or holding a trade for a more extended period, position sizing helps ensure your approach remains controlled and measurable.

How to Calculate Position Size in Trading?

New traders want to know exactly how to calculate position size for each trade. The calculation typically involves three key components, which is how much balance you have in your account, the percentage of risk you are willing to take per trade, and the stop-loss distance (measured in pips or price units).

A common approach beginners use is the 1% to 2% rule. This means you risk only 1% to 2% of your account balance per trade.

For example, let’s say your account balance is $5,000.00. You choose to risk 2% of that per trade, and your maximum loss for that trade is $100. Therefore, this $100 limit is the basis for calculating your position size.

Next, look at your stop-loss distance. If your stop-loss is 20 pips away, you divide your risk amount by the pip cost to find the correct trade size. You can also use a forex margin and profit calculator to automate this step.

Even without manual calculation, most brokers provide position-size tools such as a trading calculator on their trading platforms. TMGM, for example, allows traders to automatically compute position sizing based on their risk percentage and stop-loss levels, helping beginners make accurate decisions with ease.

Position Sizing Formula

As previously mentioned, the common position sizing formula used by traders is:

Position size = (Account balance × Risk percentage) ÷ Stop-loss distance

This formula makes sure that, regardless of market conditions, you never risk more than your chosen amount.

To illustrate this formula with an example, a trader’s account balance is $10,000.00. The trader's risk percentage is 2%, and the stop-loss distance is 50 pips. Below are the steps to take to calculate position sizing. In leveraged markets such as forex, understanding how position sizing interacts with forex leverage is essential. It also connects directly to how your forex margin is calculated.

Step 1: Calculate the Risk Amount

$10,000 × 0.02 = $200 risk per trade

Step 2: Divide by stop-loss distance

$200 ÷ 50 pips = $4 per pip

This means your position size should be chosen so that each pip movement equals $4. The exact lot size depends on the currency pair traded, but the formula guides the trade sizing.

This method removes guessing. It turns risk management into a precise and repeatable process.

Position Sizing Strategies

There are several standard position sizing strategies used, depending on traders’ style, market conditions, and level of experience, and they apply across markets from forex trading to indices and commodities. Some of the most common approaches include: These strategies can also be combined with technical tools such as moving averages in forex trading to refine entries and exits.

Fixed Percentage Method

This is one of the most widely used strategies. Traders risk the same percentage of their account balance on every trade. As your account grows, your trade size naturally increases. If your account decreases, your trade size reduces, helping protect your capital.

Dollar Amount Risk Per Trade

Instead of using a percentage, this strategy sets a fixed dollar amount per trade, such as $50 or $200. It provides simplicity and consistency, especially for new traders.

Volatility-Based Position Sizing

Some traders adjust their position sizes based on a currency pair's volatility. When volatility increases, they trade smaller sizes to reduce the risk of sudden losses. This can be measured using tools like the Average True Range (ATR).

Equal Allocation Strategy

Here, the trader divides their account balance evenly across multiple positions. This is useful for traders who prefer a diversified approach and want to avoid concentrating too much risk in any single trade. It can also serve as a simple way of hedging forex exposure across different instruments.

Start Practicing Smart Position Sizing

If you want to trade more confidently, start applying position sizing to every trade, whether you focus on spot forex, CFDs, or FX options . TMGM offers tools, educational guides, and trading platforms that help beginners and experienced traders calculate position sizes accurately and manage risk more effectively.

Negocie de Forma Mais Inteligente Hoje

Frequently Asked Questions

What is the position sizing in trading?

How do you calculate position size?

What is the best position sizing strategy?

How much is 1 pip in forex?

How much is 1 pip in 0.01 lot size?

Real

Conta

Instantaneamente