What Is a Bull and Bear Market?

In the dynamic world of financial markets, two powerful forces continually shape the landscape: the charging bull and the swiping bear. These iconic animals have come to symbolize the ebb and flow of market trends, influencing investment strategies and trading decisions worldwide. But what lies beneath these metaphors, and how can traders harness their power to navigate the complex waters of financial markets? Join us as we embark on a comprehensive journey through the bull and bear markets, uncovering strategies, insights, and expert knowledge that can elevate your trading game.

The Anatomy of a Bull Market: Definition, Phases, and Optimism

Picture a bull, its muscular form poised for action; horns pointed skyward in a gesture of unstoppable upward momentum. This powerful image encapsulates the essence of a bull market – a period of sustained price increases brimming with optimism and opportunity.

Defining Characteristics of Bull Markets

Sustained Price Appreciation: The hallmark of a bull market is a prolonged period of rising asset prices, typically defined as an increase of 20% or more from recent lows.

Investor Confidence: Bullish markets are fueled by optimism. Investors believe in future growth and are willing to take on more risk.

Increased Trading Volume: As confidence grows, more investors enter the market, increasing trading volume and liquidity.

Economic Expansion: Bull markets often coincide with periods of economic growth characterized by rising GDP, low unemployment, and robust corporate earnings.

The Anatomy of a Bull Run

Understanding the phases of a bull market can help traders identify opportunities and potential turning points:

Accumulation Phase: This initial stage occurs when informed investors start buying assets at relatively low prices, often against prevailing market sentiment.

Public Participation Phase: As positive sentiment grows, more investors enter the market, increasing prices and generating media attention.

Excess Phase: In the final stage, speculation may run rampant, potentially leading to asset bubbles and overvaluation.

Case Study: The 2009-2020 Bull Market

The longest bull market in U.S. history, lasting from March 2009 to March 2020, is a fascinating case study. Sparked by the recovery from the 2008 financial crisis, this bull run was characterized by:

Unprecedented monetary policy, including near-zero interest rates and quantitative easing

Technological innovation driving growth in sectors like tech and e-commerce

A surge in stock buybacks, boosting earnings per share

The rise of passive investing and ETFs, changing market dynamics

This historic bull market reshaped investment strategies and challenged traditional market theories, highlighting the importance of adaptability in trading.

Navigating the Bear Market: Strategies for Turbulent Times

Now, envision a bear, its powerful paws swiping downward in a motion that mirrors falling asset prices. Bear markets, characterized by sustained price declines and pessimism, present unique challenges and opportunities for savvy traders.

Key Features of Bear Markets

Prolonged Price Declines: Bear markets are typically defined by a drop of 20% or more from recent highs across a broad market index.

Pessimistic Sentiment: Investor confidence wanes, leading to risk aversion and a flight to perceived safety.

Reduced Trading Volume: As investors retreat, trading volume and market liquidity often decrease.

Economic Contraction: Bear markets frequently coincide with economic recessions, marked by falling GDP, rising unemployment, and declining corporate profits.

The Life Cycle of a Bear Market

Bear markets typically unfold in several stages:

Distribution Phase: Smart money begins to exit as valuations peak and early warning signs emerge.

Panic Phase: A catalyst event triggers widespread selling, leading to sharp price declines.

Capitulation: In this final stage, even long-term investors throw in the towel, often marking the point of maximum pessimism and potential opportunity.

Historical Bear Markets: Lessons for Modern Traders

Examining past bear markets offers valuable insights:

The Great Depression (1929-1932):

Lesson: The importance of diversification and the risks of margin trading.

The Dot-com Bubble (2000-2002):

Lesson: Beware of irrational exuberance and the dangers of overvaluation.

The Global Financial Crisis (2007-2009):

Lesson: The interconnectedness of global markets and the systemic risks of complex financial instruments.

The COVID-19 Crash (2020):

Lesson: The unpredictability of black swan events and the potential for rapid market recoveries.

Market Corrections: The Middle Ground

Market corrections lie between the extremes of raging bulls and fierce bears – short-term declines that serve as reality checks in bullish and bearish environments.

Understanding Corrections

Typically defined as a 10% drop from recent highs

Can occur in both bull and bear markets

Often seen as healthy adjustments, preventing excessive speculation

Types of Corrections

Technical Corrections: Driven by chart patterns and technical indicators

Fundamental Corrections: Sparked by changes in underlying economic or company-specific factors

Sentiment-Driven Corrections: Caused by shifts in investor psychology or external events

Understanding the nature of a correction can help traders distinguish between temporary setbacks and potential trend reversals.

Trading Strategies for Bulls, Bears, and Everything in Between

Successful trading requires a diverse toolkit of strategies, adaptable to various market conditions. Let's explore some key approaches for different market environments:

Bull Market Strategies

Trend Following: Riding the upward momentum of strong performers. Four keys to trend trading offer a simple framework to stay aligned with the main move.

Growth Investing: Focusing on companies with high growth potential. Signals can be complemented with momentum tools like RSI and MACD.

Momentum Trading: Capitalizing on assets with strong recent performance. You can refine entries with advanced RSI techniques.

Breakout Trading: Entering positions as prices break above resistance levels. For structure, see trading with trend lines and Fibonacci levels for targets.

Bear Market Strategies

Short Selling: Profiting from falling prices by borrowing and selling assets.

Put Options: Using options for downside protection or speculative gains.

Defensive Sector Rotation: Moving into sectors that typically outperform in downturns.

Pair Trading: Going long on stronger assets while shorting weaker ones in the same sector.

Strategies for Choppy Markets

Range Trading: Buying at support and selling at resistance. The RSI indicator helps identify overbought and oversold zones.

Options Straddles: Profiting from volatility regardless of direction.

Mean Reversion: Betting on a return to average after extremes. For timing aids, see MACD basics.

Remember, no strategy is foolproof. Successful trading requires continuous learning, adaptation, and rigorous risk management. Explore core trading strategies and leverage & margin before deploying capital.

The Global Perspective: Bulls and Bears Across Asset Classes

While often associated with equity markets, bull and bear dynamics play out across various asset classes, each with its unique characteristics:

Bonds

Often move inversely to stocks, with increased demand during equity bear markets

Influenced by interest rates, inflation expectations, and credit quality

Example: U.S. Treasury bonds as a haven during stock market downturns

Forex (Foreign Exchange)

Currency charts can show their own bull and bear trends across pairs.

Influenced by factors like interest rate differentials, economic strength, and geopolitical events

Example: The concept of "risk-on" versus "risk-off" in different market environments

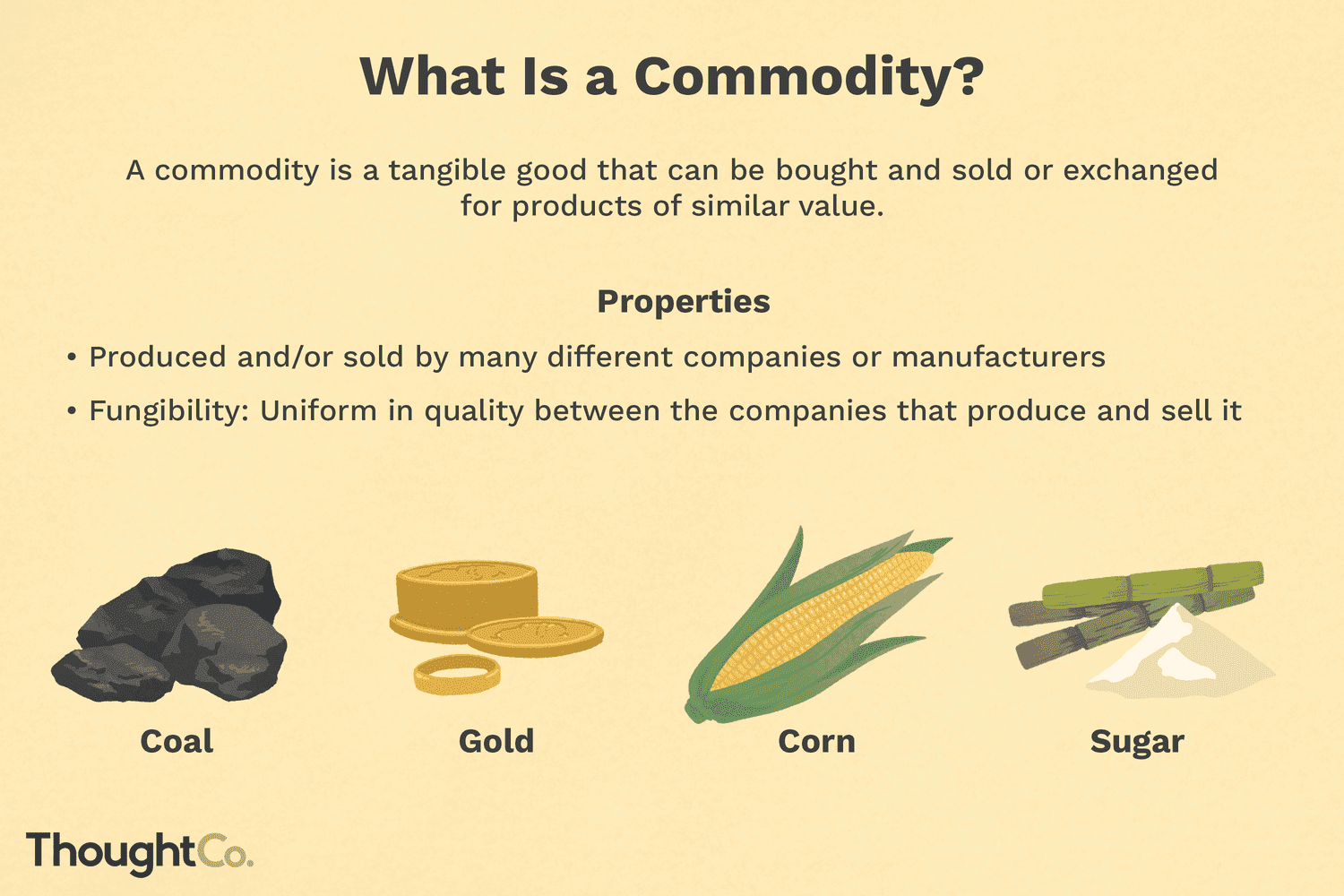

Commodities

Can have bull and bear markets independent of other asset classes

Driven by supply and demand dynamics, geopolitical events, and currency movements

Example: The oil price crash of 2014-2016 occurring during a bull market in stocks.

Cryptocurrencies

Known for volatility and often shorter bull and bear cycles

Influenced by adoption, regulation, and technology developments

Example: The Bitcoin bull run of 2020–2021 followed by a sharp bear market in 2022

Understanding these cross-asset dynamics can give traders a more holistic view of market conditions and potential opportunities.

The Psychology of Markets: Mastering the Mental Game

Behind charts, indicators, and news headlines lies human psychology. Understanding and mastering the psychological aspects of trading can be the difference between success and failure. For news-driven approaches, the NewsIQ feed and Economic Calendar can help frame sentiment objectively.

Common Psychological Pitfalls

Fear of Missing Out (FOMO): Chasing trends without proper analysis

Mitigation: Develop and stick to a well-defined trading plan

Confirmation Bias: Seeking information that confirms existing beliefs

Mitigation: Actively seek out opposing viewpoints and challenge your assumptions

Loss Aversion: Holding onto losing positions too long

Mitigation: Use stop-loss orders and predetermine exit points

Overconfidence: Taking on excessive risk after a string of successes

Mitigation: Maintain consistent position sizing and risk management

Emotional Intelligence in Trading

Developing emotional intelligence can help traders navigate the psychological challenges of the market. TMGM platforms like MetaTrader 5 and MetaTrader 4 provide tools to manage trades with discipline.

Building Mental Resilience

Mindfulness and Meditation: Practicing techniques to stay present and focused

Journaling: Recording trades, emotions, and lessons learned to identify patterns

Scenario Planning: Mentally preparing for various market outcomes to reduce stress

Continuous Learning: Staying curious and open to new ideas and strategies. Start with Forex for beginners.

Risk Management: The Cornerstone of Trading Success

In the unpredictable world of financial markets, effective risk management is essential. Whether facing a charging bull or a swiping bear, good risk practices protect capital and support long-term success.

Key Risk Management Techniques

Position Sizing: Determine how much to allocate per trade. Try the Trading Calculator or Margin & Profit Calculator.

Stop-Loss Orders: Automatically closing positions at predetermined price levels.

Diversification: Spread risk across assets, sectors, or strategies. Assess setups with an appropriate risk-reward ratio.

Hedging: Using offsetting positions to reduce risk exposure.

Risk-Reward Ratio: Ensuring potential profits justify the risk taken.

Scenario Analysis: Evaluating potential outcomes and their impact on your portfolio.

The Role of Technology in Risk Management

Modern trading platforms and tools offer sophisticated capabilities. Access analytics and signals through Trading Central.

While these tools can enhance risk management, they should complement, not replace, a trader's judgment and experience.

The Future of Trading: Emerging Trends and Technologies

As we look to the horizon, several trends are shaping the future of trading in bull and bear markets alike:

Artificial Intelligence and Machine Learning

Advanced pattern recognition in market data

Natural language processing for news and sentiment analysis

Predictive analytics for market movements

Blockchain and Decentralized Finance (DeFi)

New asset classes and trading opportunities

Increased transparency and reduced counterparty risk

Potential for 24/7 trading across all asset classes

Environmental, Social, and Governance (ESG) Factors

Growing importance of sustainable investing

Impact of climate change on long-term market trends

Integration of ESG metrics into traditional financial analysis

Quantum Computing

Potential for ultra-fast trading and risk calculations

Complex portfolio optimization beyond current capabilities

New approaches to encryption and security in trading

Augmented and Virtual Reality

Immersive data visualization for market analysis

Virtual trading floors and collaborative environments

Enhanced training and simulation for traders

While these technologies offer exciting possibilities, they also present new challenges and potential risks. Staying informed and adaptable will be key for traders navigating this evolving landscape.

Embracing the Market Beasts

As we conclude our journey through the realms of bulls and bears, one thing becomes clear: success in trading is not about predicting the future but about being prepared for whatever the market may bring. You can confidently navigate the financial jungle by understanding the characteristics of different market conditions, mastering a diverse set of strategies, managing risk effectively, and staying attuned to the psychological aspects of trading.

Remember, every market condition – whether a raging bull, a fierce bear, or something in between – presents opportunities for prepared and disciplined people. Continuous learning, adaptability, and a commitment to excellence will serve you well as you face the market beasts.

Ready to put your bull and bear market knowledge into practice? TMGM offers a comprehensive suite of trading tools, educational resources, and expert support to help you navigate market conditions. Enhance your toolkit with HUBx and Forex VPS.

Visit TMGM to explore our trading platforms, open a demo account to practice your skills, or speak with one of our experienced market analysts to take your trading to the next level. Whether you're facing bulls, bears, or anything in between, TMGM is your partner in trading success.

今日更明智地进行交易

Frequently Asked Questions (FAQs) about Bull Market and Bear Market

What Is a Bull and Bear Market?

Is a bear or bull market better?

Why do they call it a bear market?

How long does a bull market last?

What if I invested $1000 in S&P 500 10 years ago?

交易账户

入金

交易