Key Takeaways:

- Microsoft’s ownership is widely distributed among major asset managers and a broad base of retail investors, resulting in corporate governance heavily influenced by large index funds and long-term institutional investors.

- The company’s free float is primarily held by institutional investors (≈71.46%), with insiders (~6%) and retail investors (~24%) providing liquidity and alignment, reflecting diversified oversight and stable capital structure.

- Vanguard, BlackRock, State Street, Fidelity, and T. Rowe Price collectively maintain significant stakes, impacting proxy voting, board accountability, and long-term strategic direction.

- Among individual shareholders, Steve Ballmer holds the largest position, followed by Bill Gates, with Satya Nadella, Brad Smith, and Amy Hood holding smaller executive stakes that align management interests with shareholders.

- Through TMGM, investors can access Microsoft exposure via CFDs, enabling speculation on Microsoft-related price movements without owning the underlying shares; however, leverage magnifies both profits and losses, necessitating disciplined risk management.

Microsoft Ownership: Shareholder Structure

Founded in 1975 by Bill Gates and Paul Allen, Microsoft rapidly established itself as a technology sector leader. The company’s rapid growth was driven by key partnerships, such as with IBM, and pioneering products including MS-DOS, Windows, and Internet Explorer. Over time, Microsoft expanded its portfolio to encompass productivity software, consumer entertainment, and enterprise solutions, becoming one of the world’s most valuable corporations.

Today, Microsoft’s offerings include artificial intelligence, cloud computing, and advanced platforms like LinkedIn and Microsoft Azure. Its stock is a core holding for many investors, with ownership distributed as 71.46% institutional investors, 6% insiders, and 24% retail investors.

Top 5 Institutional Shareholders

#1 Vanguard Group

- Overview: Founded in 1975, Vanguard is among the world’s largest asset management firms, renowned for its low-cost index funds and ETFs. It serves both institutional and retail clients, managing trillions in assets.

- Relative Stake: 8.7%

- Shares Held: 649.2 million

- Market Value: $268 billion

- Notable: Vanguard’s extensive holdings grant it significant influence over many major corporations, positioning it as one of the most powerful institutional investors globally.

#2 BlackRock Inc

Overview: Founded in 1988, BlackRock is a leading investment management and financial services firm managing assets for a wide range of clients, including pension funds and government entities. BlackRock also operates Aladdin, a sophisticated risk management platform widely used across the industry.

Relative Stake: 7.25%

Shares Held: 538.9 million

Market Value: $214 billion

Notable: BlackRock actively engages in corporate governance, frequently influencing major companies through its investment positions.

#3 State Street Corporation

- Overview: Established in 1792, State Street is a financial services and asset management firm with a long-standing history, offering asset management, research, and trading solutions.

- Relative Stake: 4.01%

- Shares Held: 297.6 million

- Market Value: $118 billion

- Notable: State Street, Vanguard, and BlackRock are collectively known as the “Big Three” index fund managers, wielding substantial influence over corporate governance in the US.

#4 Fidelity (FMR LLC)

Overview: Founded in 1946 by Edward C. Johnson II, Fidelity Investments provides a broad range of financial services including personal financial planning and asset management. Its client base spans individuals and large institutions.

Relative Stake: 2.9%

Shares Held: 215.87 million

Market Value: $89.38 billion

Notable: Fidelity is well-known for its active management and mutual fund offerings, making it a key player in the investment management industry.

#5 T. Rowe Price Associates

Overview: Founded in 1937, T. Rowe Price is an independent investment management firm serving global clients, including retail and institutional investors. The firm is recognized for its disciplined, long-term investment philosophy.

Relative Stake: 2%

Shares Held: 151.92 million

Market Value: $62.9 billion

Notable: T. Rowe Price is respected for its rigorous research and commitment to delivering consistent client outcomes through diversified investment strategies.

Top 5 Individual Shareholders

#1 Steve Ballmer

Background: Former Microsoft CEO Steve Ballmer joined the company in 1980 as its first business manager. He played a key role in securing the IBM partnership and expanding Microsoft’s software business. Ballmer succeeded Bill Gates as CEO in 2000 and led the company until his retirement in 2014.

Relative Stake: 4.48%

Shares Held: 333.2 million

Market Value: $115.8 billion

Notable: Ballmer’s significant holdings make him the largest individual shareholder, providing substantial influence over Microsoft’s strategic direction.

#2 Bill Gates

Background: Microsoft co-founder Bill Gates served as CEO until 2000 and stepped down from the board in 2020 to focus on philanthropy. He was instrumental in developing foundational products such as Windows and Office, shaping the modern digital era.

Relative Stake: 0.53%

Shares Held: 39.2 million

Market Value: $13.7 billion

Notable: Although Gates has reduced his holdings over time, his legacy as Microsoft’s visionary founder remains foundational.

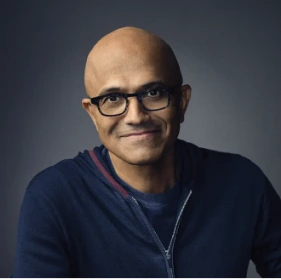

#3 Satya Nadella

Background: Joining Microsoft in 1992, Satya Nadella was pivotal in building the company’s cloud computing platform, including Microsoft Azure. He became CEO in 2014, steering Microsoft’s focus toward AI, cloud services, and digital transformation.

Relative Stake: 0.01%

Shares Held: 800,000

Market Value: $271.6 million

Notable: Nadella’s leadership has revitalized Microsoft, solidifying its position as a global technology powerhouse.

#4 Bradford L. Smith

Background: Joining Microsoft in 1993, Brad Smith oversees the company’s legal, regulatory, and corporate affairs, including antitrust issues and social responsibility initiatives.

Relative Stake: 0.008%

Shares Held: 570,826

Market Value: $200 million

Notable: As Vice Chair and President, Smith represents Microsoft on critical issues including cybersecurity, human rights, and AI ethics.

#5 Amy E. Hood

Background: Amy Hood joined Microsoft in 2002 and became CFO in 2013. She manages Microsoft’s global financial operations and is credited with driving the company’s financial performance and strategic growth.

Relative Stake: 0.007%

Shares Held: 520,000

Market Value: $170 million

Notable: Hood is a key executive, guiding Microsoft’s financial strategy and capital allocation priorities.

Accessing Technology and Market Trends via TMGM

While TMGM does not provide direct equity purchases for companies like Microsoft, investors can gain exposure through Contracts for Difference (CFDs) available on the TMGM platform.

CFDs enable speculation on price fluctuations of assets such as stocks, indices, and commodities without owning the underlying securities.

With TMGM, you can:

Open a TMGM Account: Begin by opening an account with TMGM.

Access the TMGM Web Platform: After setup, log in to the platform for a full-featured trading experience.

Configure Your Trade: Adjust trade size, set stop-loss and take-profit orders according to your trading plan.