Why Do Gold Pips Matter?

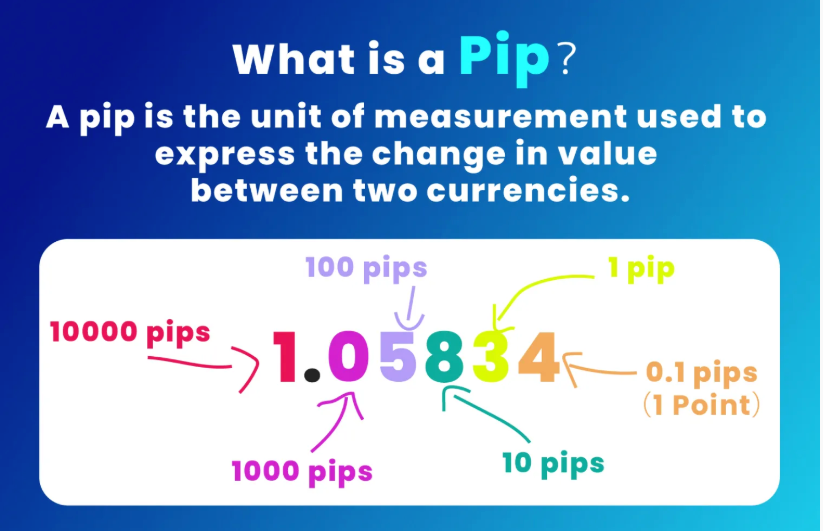

Defining Gold Pips: In gold trading, a pip represents the smallest price movement recorded, usually the fourth decimal place, but can vary depending on broker settings.

Getting Started with Gold Pip Calculation

Price Point Basics: Gold is typically quoted in USD, with a standard lot of 100 ounces.

Understanding Lots: Most forex brokers use standard lots for trading gold, with each lot corresponding to 100 troy ounces.

Impact of Broker Platforms: The number of decimal points in pip calculation varies by broker, and this difference influences pip value.

Calculating Pip Value in Gold

Formula for Pip Value: The standard formula is:

Pip Value = (One Pip / Current Price) × Lot Size × Contract Size

For instance, if gold trades at $1,800 per ounce, a 0.01 price movement on a 100-ounce lot would have a pip value of $1.

Using Leverage: Many traders use leverage to amplify their positions, magnifying profits and losses.

Tips for Tracking Gold Pips Effectively

Real-Time Tracking: Gold prices fluctuate frequently throughout the trading day.

Set Up Alerts: Many platforms allow you to set pip alerts for quick reactions.

Use Chart Tools: Gold traders frequently use RSI and Fibonacci tools to spot pip movements and trend opportunities.

Use Gold/Silver Ratio: Some traders might wonder if Silver is still a good investment in 2026 after breaking record high, by using Gold/Silver Ratio, you can easily navigate Silver Trading like many professional precious metal traders.

Key Factors Influencing Gold Pip Movements

Economic Indicators: Gold reacts to inflation, interest rates, and Fed decisions.

Market Sentiment: As a safe-haven asset, demand rises during instability.

Currency Strength: Gold’s price in USD means dollar moves affect pip value.

Gold Pip Strategies to Consider

Scalping for Small Gains: Short-term traders, known as scalpers, benefit from minor pip movements. This strategy involves frequent trades throughout the day to capture small pip changes.

Swing Trading for Trends: Swing traders look for broader market trends.

Long-Term Holding: Some view gold as a long-term investment, guided by pip data.

Common Mistakes When Counting Gold Pips

Overlooking Broker Specifications: Each broker may differ in pip count.

Ignoring Lot Size: Always verify lot size traded.

Neglecting Risk Management: Ignoring risk-reward ratios can lead to larger losses.

Thoughts on Mastering Gold Pips

Counting gold pips accurately is vital for successful gold trading. By applying proper calculation and monitoring, traders can manage positions precisely.

Ready to enhance your knowledge? Visit TMGM’s Trading Calculator to test gold pip values and better understand your trade impact.