Key Takeaways

- Scalpers capitalize on numerous small intraday price fluctuations to accumulate incremental profits, requiring rapid order execution, disciplined trading rules, and an understanding that transaction costs and slippage can quickly erode gains.

- Scalping involves holding positions for minutes or less to “recover the bid-ask spread plus a modest profit,” where profitability depends on trade frequency and volume, but so do risk and costs.

- Common entry techniques include Stochastic oscillator crossovers, SMA/EMA crossovers, RSI extremes, and support– and resistance level bounces, all implemented with predefined stop-loss orders and conservative leverage to limit downside exposure.

- A regulated broker offering MT4/MT5 platforms, tight spreads, deep liquidity, and low-latency execution (e.g., NY4 data center routing) enables scalpers to consistently apply strategies and practice risk-free on demo accounts.

What is Scalping in Trading? Is There an Optimal Scalping Strategy?

Scalping trading is a very short-term trading approach focused on capturing small profits frequently. Unlike position traders who hold trades for days or weeks, scalpers typically maintain positions for minutes or less. The objective of scalping trading is to recoup the spread cost incurred entering the trade, plus a small incremental gain — and to repeat this process multiple times.

Individually, these scalping trades yield minimal profit. However, scalpers execute a high volume of trades daily, compounding gains over the trading session.

Some scalpers hold positions for as little as fifteen seconds, while others may hold for a few minutes — but generally avoid holding positions overnight.

So, how should a trader approach scalping?

How to Execute Scalping Trading?

Small Account Example:

Buy: You open a long position of 0.1 lot on EUR/USD at 1.1000. With 1:10 leverage, your required margin is $1,000 (controlling $10,000).

Price Movement: The price increases to 1.1050 (+50 pips).

Sell: You close your position at 1.1050.

Profit Calculation:

Each pip for 0.1 lot equals $1

Total pips gained = 50

Gross Profit: $1 × × 50 = $50

Net Profit (after $5 round-trip commission): $50 – − $5 = $45

Large Account Example:

Buy: You open a long position of 10 lots on EUR/USD at 1.1000. With 1:10 leverage, your required margin is $100,000 (controlling $1,000,000).

Price Movement: The price rises to 1.1050 (+50 pips).

Sell: You close your position at 1.1050.

Profit Calculation:

Each pip for 10 lots equals $100

Total pips gained = 50

Gross Profit: $100 × × 50 = $5,000

Net Profit (after $100 round-trip commission): $5,000 – − $100 = $4,900

Both small and large traders can capitalize on short-term price movements through scalping, but profits correlate directly with position size and leverage. Trading costs and risk also increase proportionally with trade size.

However, when trading CFDs with leverage, both gains and losses are magnified. While leverage enables traders to control larger positions with smaller capital outlay, it also elevates risk—losses can exceed your initial margin, particularly in volatile markets. CFDs are complex instruments and may not be suitable for all investors.

Ensure you fully understand how CFDs and leverage operate and assess your risk tolerance before engaging in trading.

So, what is the optimal scalping trading strategy?

Best Scalping Strategy for Beginners Trading CFDs

The best scalping strategy depends on the specific financial markets you trade, the technical analysis tools and price action patterns you employ, and your risk appetite. To assist you in selecting the most suitable approach, let’s review some effective scalping strategies.

Scalping Trading Strategy: The Stochastic Oscillator

The Stochastic Oscillator strategy utilizes the stochastic indicator, available on MT4 for forex trading. The stochastic indicator is a short-term momentum oscillator (similar to Moving Average Convergence Divergence (MACD)) calculated based on the closing price of a prior period.

The indicator comprises two lines — the faster, more sensitive %K line and the slower, smoother %D line. Scalpers focus on the interaction between these lines, as each reflects market momentum over slightly different timeframes.

As an oscillator, its values range between 0 and 100. It is commonly used to identify “oversold” conditions (below 30) and “overbought” conditions (above 70). However, scalpers use the oscillator differently.

A scalper holds a position until the lines cross in the opposite direction and stabilize, signaling a new trade opportunity. A long position is initiated when the fast line crosses above the slow line and held until the fast line crosses below the slow line. Conversely, a short position is opened when the fast line crosses below the slow line and closed when it crosses back above.

Simple Moving Averages: A Potential Best Scalping Strategy

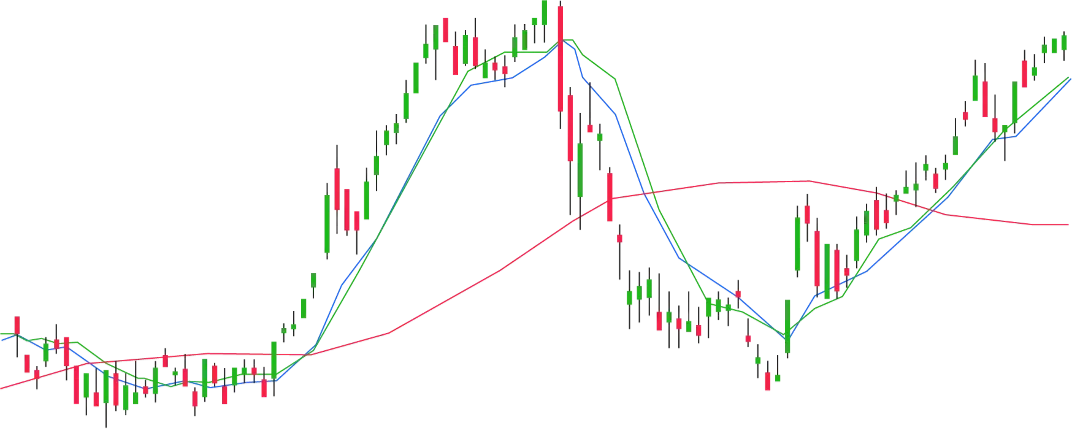

Many scalpers, including numerous swing traders, rely on Simple Moving Averages (SMAs), which measure market trend momentum by averaging prices over a specified number of periods (e.g., a 5-day SMA, which corresponds to one trading week for stock traders since markets are closed on weekends). Traders often use two or three SMAs; for example, a short-term SMA averaging five periods alongside a 10-period or 20-period SMA.

A bullish signal occurs when the short-term SMA crosses above the longer-term SMA, prompting scalpers to enter the market for quick gains. Conversely, when the longer-term SMA crosses below the short-term SMA, traders may consider short positions to capitalize on downward price movements.

You can use either SMAs or Exponential Moving Averages (EMAs), which assign greater weight to recent price data. EMAs are more responsive, making them popular among scalpers who seek earlier entry signals.

Relative Strength Index (RSI) in CFD Scalping

The Relative Strength Index (RSI) is another momentum indicator measuring market supply and demand. Like the Stochastic Oscillator, it ranges from 0 to 100. Some traders find RSI easier to interpret due to its smoother line. The market is considered overbought when RSI exceeds 70 and oversold when it falls below 30.

Similar to the stochastic approach, scalpers aim to exit trades as soon as the RSI reaches the opposite extreme.

Support and Resistance Levels in Scalping

Scalping strategies often incorporate established support and resistance levels, where price reversals commonly occur. Scalpers add these levels to their charts and look for confirming signals from other indicators or candlestick patterns as price approaches these zones.

TMGM – Specialists in Scalping Trading for Beginners

Before starting scalping trading, traders should select a regulated, reputable broker offering advanced tools. At TMGM, we provide access to MetaTrader 4 and MetaTrader 5, platforms equipped with comprehensive charting capabilities and fast execution essential for scalping.

We also connect to over 10 liquidity providers and utilize NY4 data centers to ensure low-latency trade execution.

If you are interested in scalping trading, visit TMGM to open an account today.